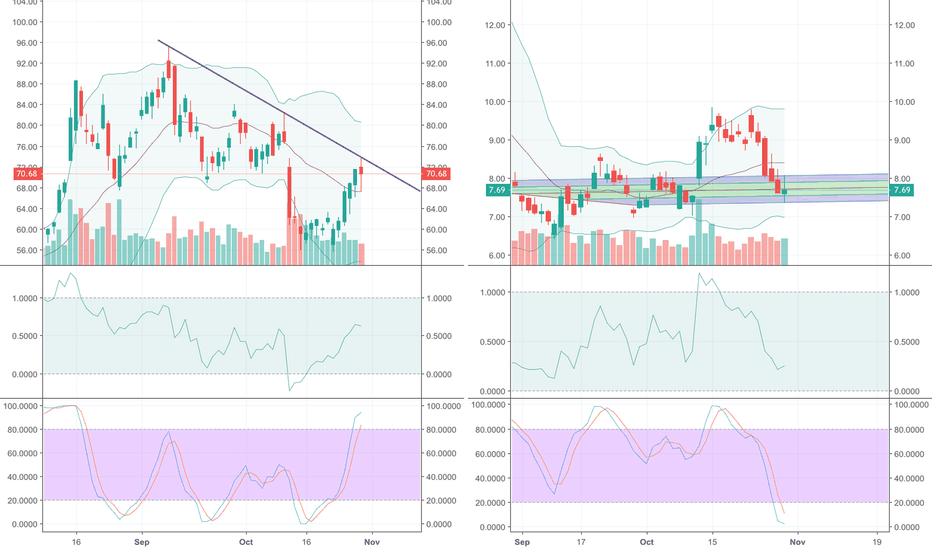

NASDAQ:EYES Currently using 4hr support line to make day trade entries. If we only look at the technical's, this could be a runner. However, market and companies condition do not align with the technicalities. Trade safe!

COINBASE:BTCUSD OTC:GBTC

Many have been questioning MARA has a long term investment, and we are getting close verifying if this will fly or not. Weekly support and downtrend resistance triangle closing towards EOY, we should see a big move soon. I favor the bullish move. We've also seen it's price holding despite the dump in $BTC, there may be another 20% correction in this currency...

$JNUG entry at 7.52, SL will be manual based on break of $JDST resistance.

This is my long-term investment along with BTC. Thus, I have "long" hopes.

Bears broke short-term up-trend at 6500, then broke 6400. Now we see strong support at 6000 (this is our 2018 support line). Given the bearish market moves, money will start moving in this direction IMO 0.09% . We should see a strong recovery next week and hopefully a break of the down-trend at 6700. Good luck! $BTCUSD

GBTC NASDAQ:MARA

COINBASE:BTCUSD September's price closure will define the future of BTC and all others, and all blockchain companies following its price. BTC will need to close September well above $6300 to continue on life support. Fundamentals for its future should be solid, but the future is defined by the market's participants... let's hope bulls have been patiently waiting...

Pretty much self explanatory. COINBASE:BTCUSD

This is where you short $SPX, with 2777 stop loss. $UVXY #VIX - Pretty simple trade for today, will update PT if resistance is not broken.

If you're following the action on WTI, then the title is self-explanatory. Currently holding $DWT with the following plan for the next day or two: - SL after clear close above red line (derived from 4hr chart from 1-13/2018 - Cross green line, will probably be looking at unloading (shy above $62) some of the several entries made in the past week. If the 2nd were...

Short around $62 and cover around $54. Then, buy long to $67.

Aiming at closing half of my current position at 2.75.

AMEX:UGAZ NATGASUSD has tested the support line again. A clear bounce from it would signal the gap-up in the works. UGAZ 1/3 added at $5.76 UGAZ 1/3 added at $5.50 Last 1/3 may be used to average up. Stop loss set at NATGASUSD $2.55 No price target defined yet.

OTC:MJNA Price range is getting tighter and at this point breaking 0.20 will likely cause a breakout. Short-term, buy below 0.10, sell higher. Long-term, hold for 0.40 or more. We will be seeing important price movement towards end of 2018.

On Oct 2nd NG was not able to touch the bottom of triangle, but it did today (perfectly positioned with our daily Bollinger lower band). It's now time to go long and make our first stop somewhere above 2.95's. Keep in mind the triangle is getting narrower and we make have a breakout which is why this may be a multi-stop trip. I started my position in UGAZ at $10.37.

It was announced they wanted oil at $52. We got it and now it's time to take profit. Wait for the dip around low 48's.