stinanoraoliver

The map says it all. Price movement is seeking 120. First stop 116 and then a rest before resurging to 118 and beyond.

Get it while you can, or at least till mid-September. Expect some drawdowns after September 17th into October, but for now, things are at a buy on the weekly trades. Peace

I don't really know. I'm targeting 33. Seems likely. For it to go to 40 in the nearest term, would take an equal amount of negative sentiment compared to the last 3 days of mis-priced FED FUNDS + Global Trade Escalation. What could possibly be negative enough to send this thing to 40 in the next week? I'm turning SHORT UVXY once it starts breaching 35. Never...

The all time view for AAPL shows the current major upper and lower trend lines support the idea that AAPL could drop to 190 by October 2019 before resuming the "to-infinity-and-beyond" never-ending march to infinity.

WMT used to trade as a consumer stock, right? I mean, I been charting for a few months now and only recently subscribed to Bloomberg, so I'm not sure if WMT is traditionally considered a defensive stock, or not, but what I do know is that current trading trends implicate a new trading pattern emerging for WMT. One that will see from time to time a divergence, but...

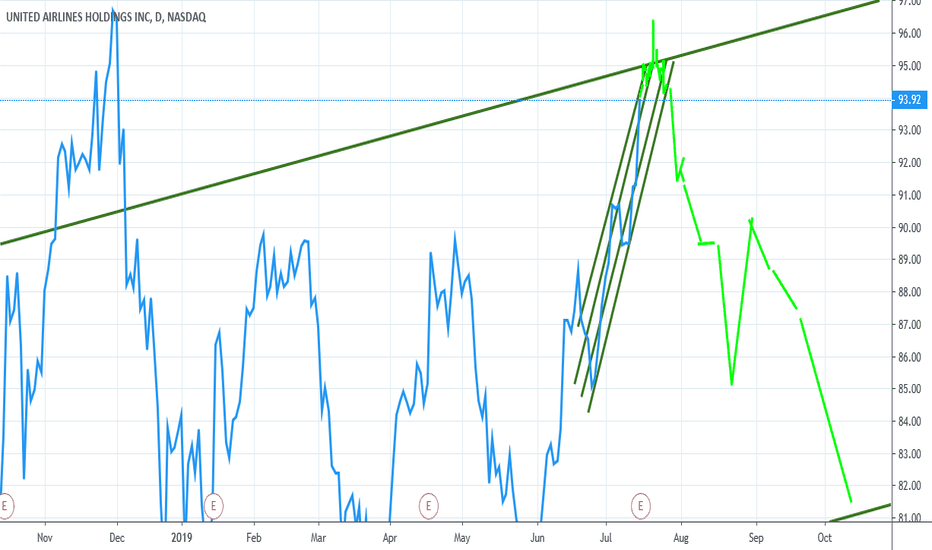

If you saw the previously posted chart and have played it in the last 2 days you should see that the previous post's call for downside after reaching the 95.xx ceiling is playing out to scale. Ciao (Its all about the FED, baby!)

If you're long GLD over the next 3-6 months or until it hits a new ceiling of $1600, why not be short Banks with KBE. If you're long GLD, then why not be long Retail and defensives such as Boeing. And if you go long defensives, you might as well short the S&P and QQQ for the duration of those 3 months.

In order to get "TO THE MOON" this thing would have to get juiced with a HUGE rate CUT from the US Federal Reserve. I'm talking big. Like suddenly the rate is hovering near 1% kinda juiced. The kinda rate hike maneuvering that sends Silver to 20, NASDAQ to 8500, gold to 1600 and oil to 75-80.... Maybe it WAS, all just a dream. A really bad dream.

In so many ways, the upcoming turn/pivot around the first few days of August will seem swift but the unfolding of the action will happen all the way till October. How things unfold will depend in a BIG way on 1) US Federal Reserve Bank and 2) US/China Trade Sentiment. Last Thursday, as we're all aware by now, New York Fed President John Williams inadvertently...

Why chase the momentum when you can just go with the flow? So Boeing has covered some fees, has connections in DC and will payout, what, a few billion at the most in damages to families? Big deal. War is peace and peace is what we all want. So war it will be. Oh, and unless some jokers blow up a few planes in the next few months in a wide-scale blitz, it is...

As MSFT and the broader US markets were rejected again at high levels this past week due to market mispricing of an uber-dovish FED, it looks like MSFT is limited to a 140 ceiling until the beginning of August. SELL 140, baby! Until August anyway. Then BUY, BUY, BUY 132-135.....

Now that we have confirmation MSFT is innovating and keeping pace with revenues with Azure Cloud Management, the next stop for $MSFT is 145 here shortly (next few weeks). But like so many elements subject to gravity 136-137 will be pulling on the price until next earnings, positive news cycle, etc.... Trade Happy!

The chart speaks for itself. It's an inversion of United States broader market index movements (defensive sector rotation). As broader markets trend lower over the next week, UAL will continue a slow path upward and most likely over 95.50 for a moment. But just as the going seems to be good for $UAL, and as everything seems to be nosediving in broader SPY index,...

As the weather turns from rainy to dry so do the markets. Happy Trading

As June rolled into an ATH, BTFD frenzy by the end of the month and even ending the month on a low-volume 1.5% mega rise on the last Friday of June starting from 3:59pm EST until 4:15pm, July will probably do the opposite in terms of pure percentage return. July began predictably by extending June's rally, but with a very BIG twist. Even though trade relations...