stingotho

PlusBeen a while but I haven't been posting ideas because I have been scalping and doing smaller time frame trades. I think we have NQ at a nice price level where we might see a bull run soon with the market sentiment slowly "thawing" on the idea of "risk-off" sentiment to "risk-on" sentiment and environment with more uncertainties clearing out of the market scenes....

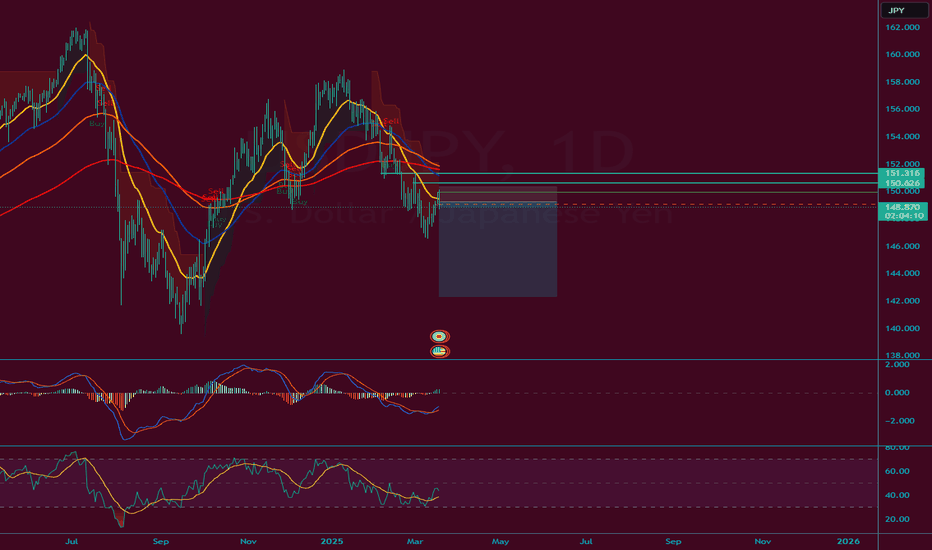

This is a position trade in LEAP competition that I'm happy to take. USDJPY is at an interesting position and environment where the USD wants to see more room for downwards and JPY wants to see strength. BOJ is neutral-hawkish although there were moments where they sounded neutral-dovish but overall I think with time jpy will strengthen this year.

Tokyo CPI came in hot today we have inflation in progress signaling mild-hawkish tone for BOJ. BOJ is known for taking decisions slowly so I do not expect a rate hike to happen soon but we may see it in the very near future. Afterall BOJ Interest rate 0.5 is considered high for its historical data. Aiming for 1.00 interest rate is something huge that few people...

There is a big technical area that has taken the spotlight in NQ and it is around the 50% fib level with a gap opening. US economy has seen some strengthening recently with the FED looking neutral-dovish. A price correction may not even occur here it can keep going up continuously the moment we have a conclusive risk-on environment. Inflation has cooled down...

This is linked to my NAS idea where the market is slowly shifting to a Risk-on environment. I see a nice potential for a bullish BTC price action shift. We may have found the bottom for the new bull run. Technical observation: 1. We recently formed a cup and handle. 2. A visible head and shoulder on the cup and handle. 3. Exit on the bearish trend channel with...

The AUD recent data seems more bearish than the NZD recent data. We are seeing strength in the NZD and weakness in the AUD. NZD CPI -> 2.2% from 2.2% AUD CPI -> 2.4% from 2.8% Interest rate forecast Q2: AUD -> 3.85 from 4.1 NZD -> 3.25 from 3.75

The AUD currency has been seeing some weakness and if we look at the inflation it is relatively weakening. The inflation rate in Australia went from 2.8 to 2.4 and the interest rate for AUD is sitting at 4.1. The Pound has seen some love due to raising inflation narrative we are sitting at 3.0 and it is expected to drop to 2.9 with the interest rate sitting at...

RBNZ looking forward to cut rates to 3.25 meanwhile BOE is looking to HOLD rates at 4.5.

Although Bank Of Japan held rates and sounded neutral-dovish I think the yen has a potential to strengthen against the USD since the FED is sounding dovish and is looking to cut rates twice this year. I think US economy will strengthen and USD will see some weakness.

Stocks are very bearish but I think this is a "buy the news" situation since we are having FOMC next week and their decision on interest rate. We are at the 200 MA on the daily but my theory here is we will have some very small correction(s).

XAUUSD has been seeing a huge massive buy pressure. Gold is an asset that is very tricky to short. When in doubt go long gold. Economically speaking, Gold is notorious for its safe haven status. When economy is struggling and scared, central banks rush towards safe haven assets such as Gold, CHF, JPY and so on. Why do I say the economy is struggling? Well, if...

My bias remains the same with CHFJPY I just saw that there was a Rising Wedge on 4h so I took a new short.

I am long on NQ but with a very small lot size because we have NVIDIA earnings coming up and I don't want to fall a victim to the nasty spike that's about to happen. I am going long on the NQ mainly because US stocks are well known to bounce back up. They are always likely to bounce back up than continue to fall down unless we are entering a recession and we...

This is a very interesting trade and I took it based of BNP Paribas Research trade they are short on EURAUD and their entry is at this level. However, their stop loss is at 1.6850 feel free to adjust your stop loss if you want to. Their TP is at 1.6100 which is interesting. I entered short here because the fundamentals for EUR is weaker than the AUD. In short,...

ETH recently had a major hack incident. I don’t think this will be good for ETH and also I noticed BTC has been slowly declining to the downside. Economy has been shaken recently shifting towards YEN so smart money is probably pulling out of crypto and going towards yen, bonds, and gold.

A lot is happening recently that it is almost hard to keep up with the market BUT! Recently the EURO has finally got 1 good W. Germany election is in favor to the currency and DAX so I expect things to turn out to be bullish.

BTC is just like NASDAQ reacting bearish but there is an important catalyst to it which is the hack incident that happened last week. This is bearish to investors because it is a threat for them to keep their money in crypto since they are susceptible for breach. I think if BTC falls below the support at 88,000$ then we could finally see the appropriate price...

This is a trade I probably missed but if I get any sort of correction or retracement I will be entering long on the GBPNZD. Technical setups are aligned for an upward momentum on the price and when speaking fundamentals the BOE is fighting inflation with a cautious easing unlike RBNZ is on the aggressive easing. I may look at going long GBPCHF aswell.