stocktwists

EssentialKey Observations: Uptrend Channel: QQQ has been trading within a rising channel. The price respects both the support (lower red trendline) and resistance (upper red trendline) consistently. Recent Price Action: There was a sharp drop that briefly broke below the lower trendline support but quickly rebounded back inside the channel, indicating a false breakdown...

Bottoming signs near $13.20 with today's strong bounce. Still inside a high-risk consolidation zone, but momentum is shifting bullish. Watch for a follow-through move above $16.30–17.00 to confirm potential uptrend. Ideal spot for early positioning, but confirmation is still needed.

Summary of the Chart – Viking Therapeutics, Inc. (VKTX), 1W Chart (NASDAQ): Current Price: ~$33.99 Support Levels: Major Support: ~$23.93 Intermediate Support: ~$33.81 Resistance Levels: Near-Term Resistance: ~$34.66 Major Resistance / Target Zone: ~$60.98 to ~$61.15 Technical Pattern: The chart suggests a bullish reversal setup forming after a prolonged...

🔹 Target: $22.67 🔹 Stop Loss: $9.13 🔹 Entry Zone: Around $15.50 or better on a dip 🔹 Risk/Reward: ~1:1 at CMP, ~2:1 if entry near $13.50 🔹 Bullish momentum intact if it holds above $11.65 📌 Watching for continuation toward 2.0 extension level. Trade safe! #APLD #TradingView #Stocks #Fibonacci #SwingTrade

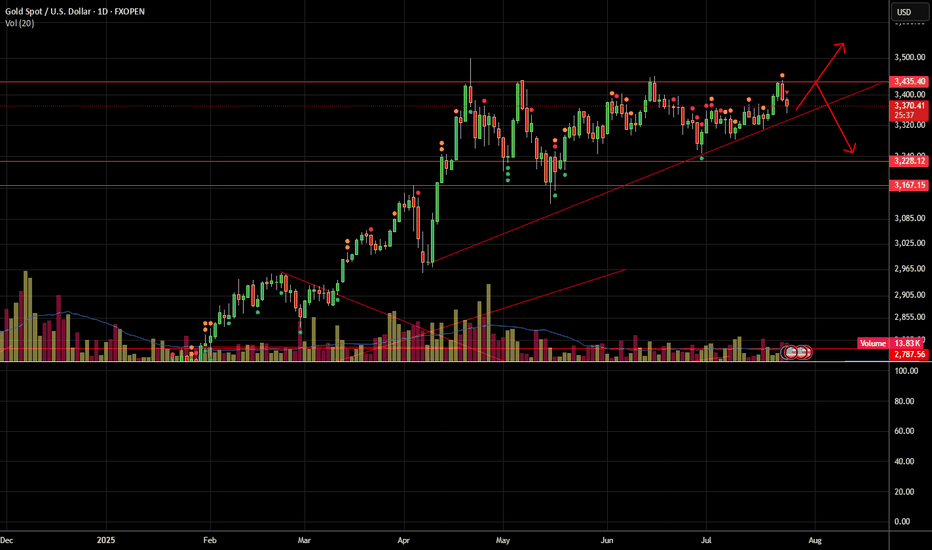

Gold is currently consolidating within a symmetrical triangle pattern, signaling a potential breakout setup as price coils tighter between converging support and resistance trendlines. CMP: Around $ 3370 (adjust based on your exact chart) Lower highs & higher lows = compression zone Volume declining, typical before breakout Break above upper trendline could...

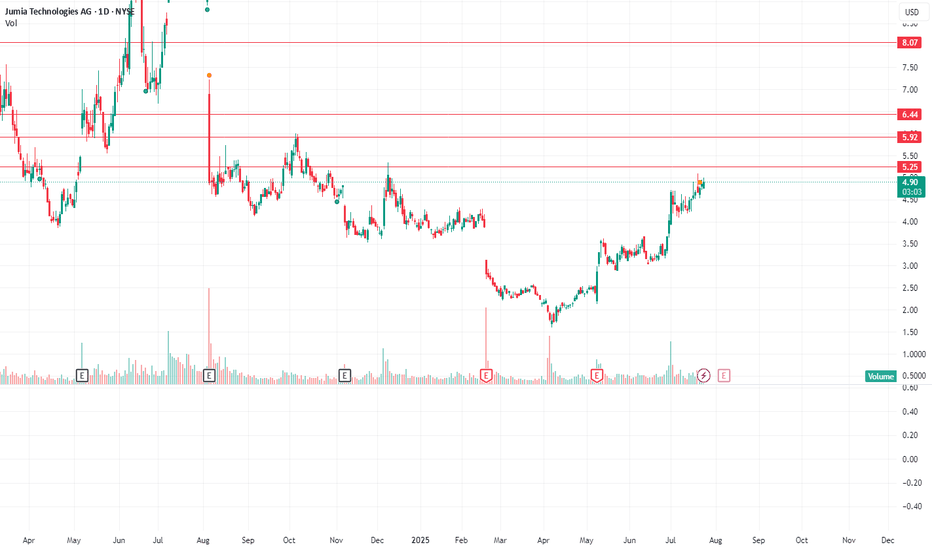

NYSE:JMIA just printed a Golden Cross on the daily chart (50MA > 200MA) — often a signal of trend reversal. ✅ RSI ~62 = momentum building ✅ MACD flipped bullish 📊 Volume rising — breakout setup forming 🔼 Next resistance: $5.50 → $6.20 🛡️ Support: $4.50–$4.60 (MA zone) Chart looks bullish — watching for a push above $5.50 to confirm. #JMIA #GoldenCross...

RCAT looking good at cmp for swing.. it's going to benefit from new Drone policies

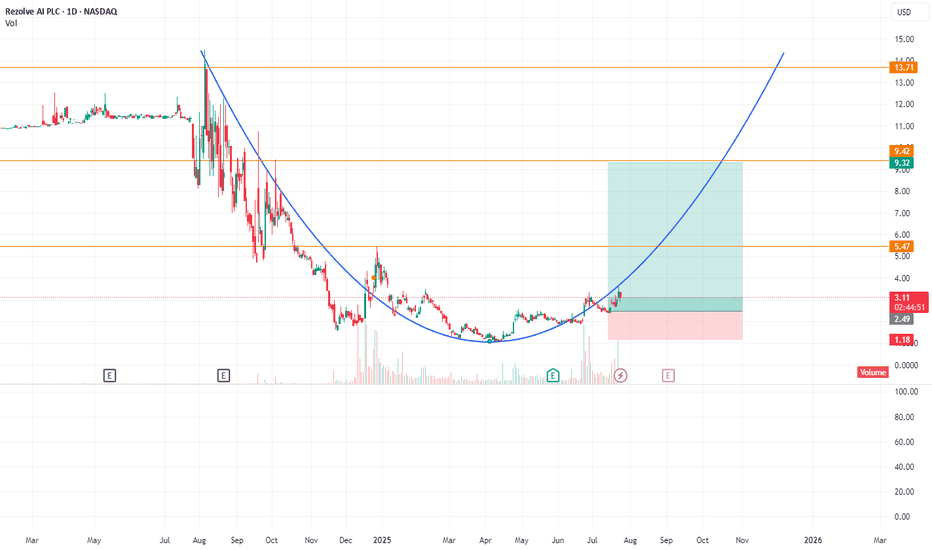

Business Model: AI SaaS for retail—mobile-first, gen‑AI conversational commerce and checkout. Financials: Very low revenue base, heavily loss-making, but building enterprise footprint and usage. Balance Sheet: Strengthened via equity conversions, debt facility, and capital raises; dilution risk remains. Traction: Growing client deployments across major brands;...

1. Company Profile Byrna Technologies Inc., headquartered in Andover, Massachusetts, is a technology company within the Aerospace & Defense sector. Founded in 2005 (originally named Security Devices International), it rebranded to Byrna Technologies in March 2020 It develops, manufactures, and sells less-lethal personal security solutions, serving both...

Onto Innovation, Inc. (NYSE: ONTO) is a mid-cap company in the semiconductor equipment sector, offering metrology, defect inspection, lithography tools, and software for chipmakers It’s been a volatile stock, down ~53% over the past year, with its 52‑week range at about $85.88–$228.42 Average Wall Street target: ≈ $135–142, suggesting ~40–46% upside from the...

Sofi at near trend line if it breaks i am expecting 25 else back to 15-18

Moderna remains in a precarious transition phase—from COVID-revenue dependency toward a diversified vaccine portfolio. Technically, momentum favors upside in the short-term, but fundamentals and macro-regulatory factors suggest caution. If its RSV and flu/COVID combo rollouts succeed and regulatory support stabilizes, it could rebound toward analyst targets near...

Lucid is positioned to enjoy a short-term uplift from the policy change due to its EV-only model and lower volume compared to peers. However, its longer-term success depends on execution—scaling manufacturing, launching key new models, and moving toward profitability in a future without subsidies.

Upside Potential: Expansion plans for TMTG+ streaming and crypto partnership, though still early stage Considerable Risks: Extremely low revenue with heavy losses; profitability is far off Share dilution potential: a Trump family trust controlling ~52% could dump ~$2 billion shares via SEC registration Regulatory and competition uncertainty in social...

Exponent, Inc. is a science and engineering consulting firm serving a diverse range of industries—including consumer products, energy, life sciences, environment, and health—with nearly 90 technical disciplines Strengths Robust financial health and profitability High ROE and stable dividend payments Risks Modest growth vs peers High payout ratio limits...

NU given flag break out and also retested channel breakout hope it will make new highs in future Nu Holdings Ltd. (NYSE: NU), the parent company of Nubank, is a leading digital banking platform in Latin America, operating primarily in Brazil, Mexico, and Colombia. As of May 22, 2025, the stock trades at $12.25, with a market capitalization of approximately $58...

BYRN given flag breakout in chart looking very strong in charts

SYM formed Double bottom pattern Company Profile Name: Symbotic Inc. Ticker: SYM Exchange: NASDAQ Sector: Technology Industry: Robotics / AI / Supply Chain Automation Headquarters: Wilmington, Massachusetts, USA Business Model: Provides AI-enabled robotics systems that automate warehouse operations. 💰 Key Financials (as of recent filings) Market Cap:...