The S&P 500 and the Nasdaq are basically moving in lockstep right now — their structures look almost identical. Starting with the S&P 500: We’re currently trading into a 4-hour Fair Value Gap between $5,546 and $5,634, Sitting just under a 4-hour Order Block that could trigger a short-term reaction. At the moment, though, it doesn’t really look like we’re...

We've seen a very solid reaction here — similar to Bitcoin, but still with its own flavor. The Previous Monthly Low was swept and then reclaimed, which is always a strong bullish signal. On top of that, the Monthly Open was reclaimed and successfully retested, flipping market structure back to bullish. No doubt: the trend right now leans upward. The big...

Ethereum is following Bitcoin—but with way worse performance. While BTC is still holding up relatively well, ETH has dropped all the way back to March 2023 levels, wiping out the entire rally. Since its top, Ethereum is down over 63%. 😮💨 Still—or maybe because of that—I’m beginning to slowly scale into spot positions here. Yes, we could fall further. I’ve got...

Once again, there’s blood in the streets—and from this point on I start scaling into spot positions again, slowly but deliberately. All of these are spot entries with soft stop-losses—not hard exits, but areas I’ll react to if needed. So why now? For one, we’re sitting right above the 38,2% Fibonacci level for the ending of the wave A. At the same time, we’re...

Compared to Bitcoin, Ethereum is honestly still moving at a snail’s pace — and the performance is almost embarrassing at this point. There’s still barely any strength showing on the CRYPTOCAP:ETH chart. Yes, ETH has finally reclaimed the Previous Monthly Low, and it’s holding it — which is a positive step. But let’s be real: We’re still 83% below the Yearly...

When you zoom out to the 12-hour chart , Bitcoin actually looks really clean right now. Since my entry at $75,800, we’ve seen a solid 25% rally that’s clearly shifted the momentum back to bullish. - But even with that move, I’m not fully convinced yet that we’re on our way straight to a new all-time high. There’s still a lot of work to be done before that...

It’s good to see Gold OANDA:XAUUSD getting the attention it deserves again. But honestly, the performance it’s putting in right now is just insane. If you zoom into the 4-hour chart, you’ll spot a clear Demand Continuation Pattern: Rally → Base → Rally. In simple terms: strong move up, sideways consolidation, strong move up again. The first rally...

Chevron is starting to look very interesting again — but let’s be clear from the start: Chevron, like every oil giant, lives and dies by the price of oil. If oil rips higher or collapses due to global politics, supply shocks, or economic chaos, Chevron NYSE:CVX follows. No exceptions. That said, what we’re seeing on the chart right now is increasingly...

One of the most talked-about stocks right now — Tesla NASDAQ:TSLA . And for good reason. Between the constant media buzz around Elon Musk and the recent surge in vandalism against Tesla vehicles, it’s been getting plenty of attention. But I’m not here to talk politics or headlines — I’m here for the chart. And honestly? It’s looking better than you’d think....

Apple’s NASDAQ:AAPL chart right now? Honestly, it’s a mess. It’s one of those setups where you can’t confidently say much with conviction , but one thing feels clear to me: it should go lower before it gets better. Zooming out to the 3-day timeframe , you can spot something interesting: the downtrend from 2022 to 2023 looks almost identical to the one...

Looking closely at Nvidia NASDAQ:NVDA , we can see that since March, the price has gravitated back to the Point of Control (POC) on the volume profile. From there, we’ve seen a solid reaction — up around 33%, after Nvidia had previously taken a sharp hit from its recent top. In my view, it’s very possible that Wave 4 is now complete. It’s been a very complex,...

Looking at Gold again, I’m going a bit out on a limb and saying: There’s a good chance we’ve just seen a local top — at least for the coming weeks. Last time I was pretty spot on with my target after being wrong about the top. I wanted to see $2,955, and Gold ended up reaching $2,956.5 — missing my level by just $1.50. Totally fine, especially considering the...

Let’s be real: What’s happening with the S&P 500 right now is rare. This is only the fourth time in history that the index has dropped more than 10% in two days (technically three, including today’s Monday session). The other times? October 1987, November 2008 during the financial crisis, and March 2020 during the pandemic crash. And now? We’re seeing a...

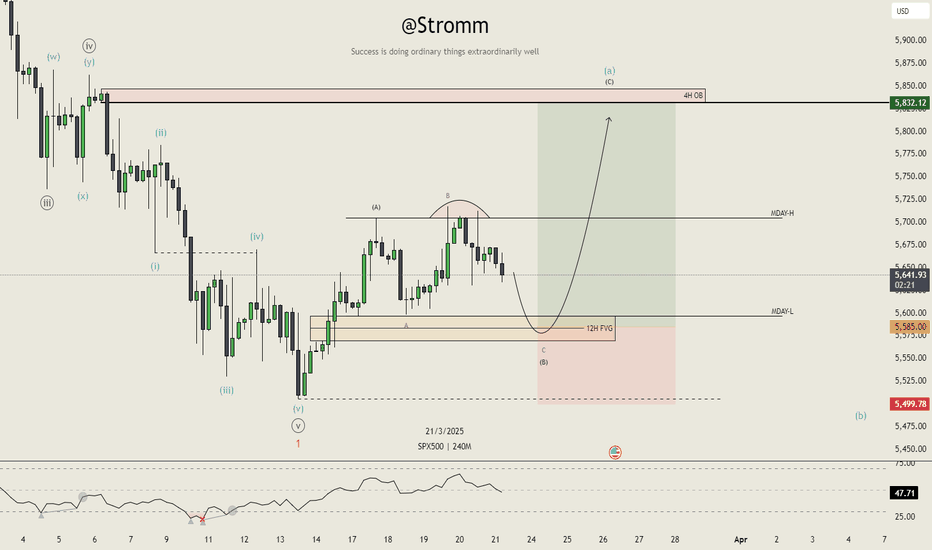

As I’ve said before, the FOREXCOM:SPX500 is a key reference for my crypto trading . That’s why I sat down and took a closer look at the chart – and I’m now ready to place a limit order , based on what I’m seeing. I believe we’re still in a correction phase , and it’s far from over . However, I think it’s realistic that we’ll see a move toward $5,832 next...

Google NASDAQ:GOOG NASDAQ:GOOGL is shaping up to look bullish in the short term, and I believe that in the next few weeks to months, we could see a solid upside move - before things could turn ugly again later on. Let me explain why. Big picture: we’re currently in a Wave (2) corrective structure, which is playing out as a complex WXY correction (marked in...

The Nasdaq is starting to look really interesting here. In my view, we've completed Wave ((a)) to the downside—a clean (abc) correction. Why do I think it's done? Because we've just tapped into a Fair Value Gap (FVG) and saw a strong reaction, just above last year’s VWAP, which I always consider a key reference point on the higher time frame. Ideally, I would...

Gold has seen a strong rally over the past week – technically impressive, but from a Risk-On perspective, it’s more of a warning sign. As I mentioned in my Nvidia market report, I don’t think the Risk-Off phase will last forever. But for now, I believe we’re not quite done with it yet. From where I stand, Gold could push a bit higher. My next target is the 161.8%...

I’ve just entered a position in PayPal, and the reason is that several overlapping factors are lining up in a way that suggests a potential bottom may be in. First, it looks very likely that Wave (2) is complete. The stock tapped the 61.8% Fibonacci retracement level with precision and has held that level over the past few days – all while the RSI has been...