tbuckle

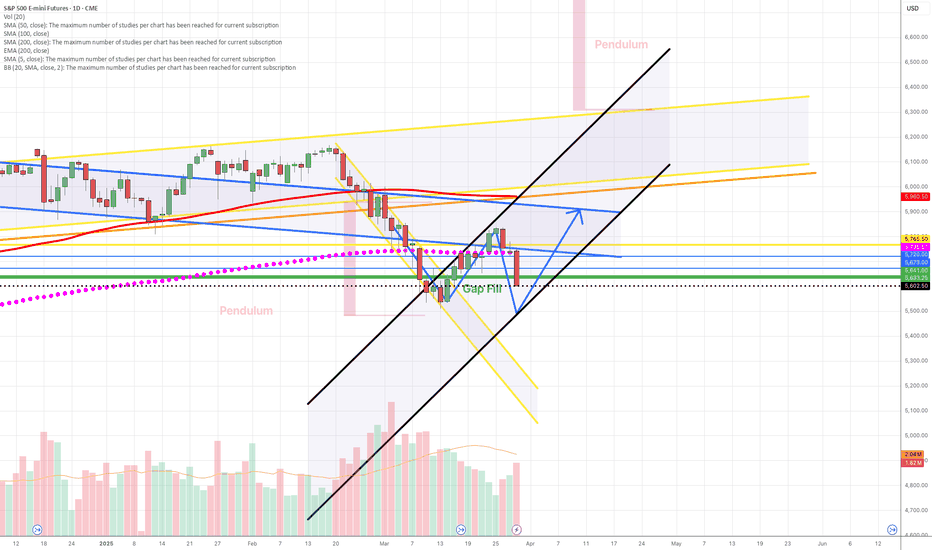

The George W Bush pattern still seems to be forming...taking the longer larger and more powerful form. Will the right lower part of the W take place above the lower left side, dead even or below. Certainly sentiment would lead us to believe it will be well below the left side. However, today failed to make a lower low. Selling may resume Sunday night/Monday...

As per usually channel lines are nice but common price action includes big pushes past them and then reclaiming them. This provides great opportunities for big money to run the stops, scoop of the shares, paint a big wick and keep trucking. It's how the game is played and provides no real ability as to where to count on a bottom or to put stops. Non the less the...

Latest outlook analysis. Possible paths. (two main ones in my view) See how it has exited the channel? This could be good to free itself and produce upward movement out of the W pattern. Or of course it could paint a larger W even with a big exhaustion push down stopping out all the bottom pickers and scooping up all their shares before ripping higher. Of...

A thousand scenarios could unfold with price action. But if were to guess (which is exactly what I am doing (from experience), ES/SPY will take the longest and most torturous and yet most powerful route to form a bottom and pave the way for the big yearly move up...forming a W pattern. (no good old genius George has nothing to do with it). None the less the W...

Alternative and more likely scenario to previous ES/SPY bottoming ideas: #1 ES/SPY has been traveling in downward channel. Seems as if it has made 3 - 4 top of channel/bottom of channel trips and potentially may be missing completion of this last rotation down, which ignites the move up or may exit the channel with sideways move which would provide idea number...

Daily wick looks to indicate a bottom is in. This would be consistent with past bottoms. Big wick after mainly days of bearish movement. Sentiment is bearish. The tariffs are in, people are scared, the bulls have unwound. Retails is bloodied. Now big money comes in and buys low and squeezes the bears who think it will just keep falling. Remember T.I.N.A. too!

The up and down motion is a clear precursor for a big move and while the current price action is up....but as yet with out big strong price movement up. As of yet we keep bouncing and moving up and yet not yet breaking any new big territory. A ceiling? Distribution and the load up of shorts for the big rug pull downward to fill the gap? Or consolidation and...

Spy has room on the upside in the long term channel, but big pull pack on the weekly candle and to the bottom of the channel is expected.

So obvious what the oil chart pattern is saying. It's the time tested clear "smile signal" for oil