theeOperator90

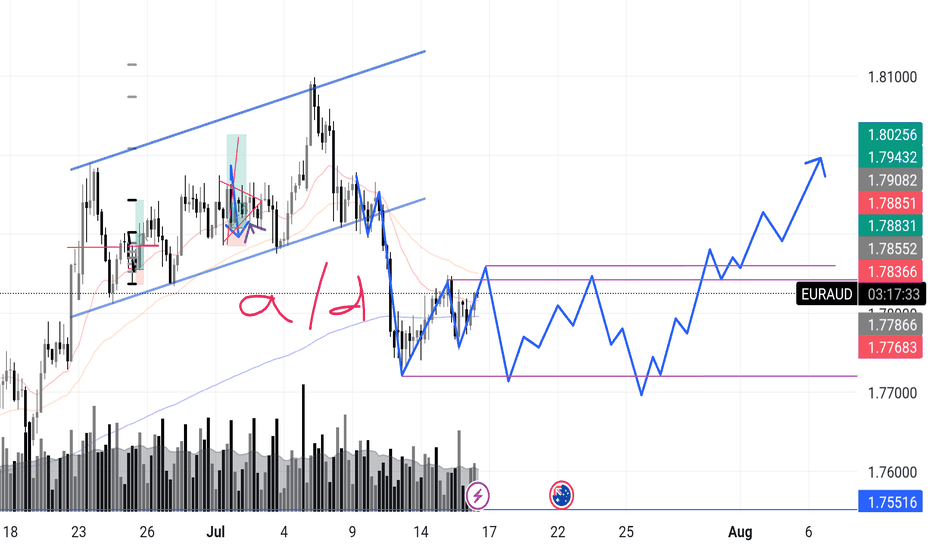

Chart Context: EURAUD recently completed a sharp markdown after a textbook rising channel break. What’s interesting now is that price has entered what looks like a potential box range between 1.7768 and 1.7885. I'm anticipating a possible upthrust move into the 1.788x zone — and what follows will reveal the true intent. Here’s the internal debate: Are we...

Description > Gold – Long Setup Breakdown After a clean break to a new Higher High, price pulled back aggressively on volume. A lot of traders will label that red spike as bearish — but let’s unpack what’s really happening. 1. Structure Held Despite the drop, the move respected the previous demand zone — a classic smart money move to test liquidity before...

GBPCAD 4H Spring 💡 | Smart Money Accumulation Before Expansion Watching a textbook Wyckoff spring unfold here on the 4H. After a multi-day rally, price retraced, and liquidity built up just above 1.8713. What happened next? 🔻 We got a liquidity sweep, tagging below 1.8687 — then a sharp rejection wick back into the range. That’s the spring. 🧠 Why this...

US30 – Wyckoff Spring Setup for NY Session | Intraday Execution Play Price rallied in the London session with rising volume and structure breaks — Now we’re anticipating a classic Wyckoff spring scenario just ahead of NY open. 📍 Key Expectations: Sweep of intraday support around 43,482 Strong buyer reaction (spring confirmation) Expansion into the 43,600+...

BTCUSDT – Spring + S&R Rejection | 15min Power Entry 📅 June 26, 2025 Price swept support and printed a clean spring pattern on the 15-minute — Rejection off key structure + volume surge confirms buyers are back in control. ✅ Demand stepped in hard ✅ Strong wick below consolidation ✅ Protected by the rising 200 EMA ✅ Entry aligns with a Fibonacci 1.618...

GBPUSD – I Got Clipped. Now I’m Coming Back With Intent. 📅 Monday | June 23, 2025 Yes — I got stopped out. That’s execution, not failure. Clean sweep of Asia’s high. Textbook. Liquidity taken. Weak hands shaken. Now the real move can begin. 🔁 This 1H close is my greenlight for re-entry. I don’t hesitate when the market gives me the same setup twice — It’s...

Classic Wyckoff upthrust, this is A+ We’ve got a clear AB=CD completion at C, tagging previous support-turned-resistance, while the volume on the climb is drying up (classic clue of passive buyers getting trapped). The channel top + Fibonacci confluence + previous swing zone adds weight. 🔻 Trade Idea: Entry: 1.3477 Stop: 1.3521 (above wick highs and...

Price swept below support around 1.1473, grabbing liquidity and quickly bouncing back — this is a classic Wyckoff spring setup. 📌 Key Levels Entry: Around 1.1500 Stop Loss: Below 1.1424 (spring low) Target 1: 1.1567 (range high) Target 2: 1.1614 (measured move) 🔍 Why I like this setup: Fake breakdown (spring) and quick recovery Buyers showed up right...

What's going on? USDJPY – Reload Zone Marked. If They Take Me Out, I’ll Be Waiting Lower. Discipline means you don’t chase. You wait where the market must return. Currently in 2 buys, one is an added position, then I moved my stop in from the purple line— but if those get wicked out, I’m hunting the next key demand zone just beneath 144.10. Where we'll have a...

Cause > Effect. Behavior > Breakouts. We just printed a classic Spring + Test setup. Here’s how the puzzle came together: 🔍 Accumulation Context: Market ranged quietly for hours – demand building below the surface. Spike down into previous demand zone with climax volume – the shakeout. Quick reclaim of the zone with bullish absorption signals the...

The Setup: 1. A-B: Strong impulsive drop on increasing volume → clear evidence of real selling pressure. 2. B-C: Pullback forms on decreasing volume → classic corrective behavior, not buyer aggression. 3. C-D: Entry just below point C as new volume confirms sellers stepping back in. 4. Targeting >3R with stop tucked above C — logical structure, clean...

Description : USDCAD is setting up for a potential short — I’m watching closely for an upthrust into the highlighted zone to initiate the position. Here’s my current read: 🔍 Technical Breakdown: 1. Trendline Break Previous bullish trendline broken with conviction. Market structure now vulnerable to bearish continuation. 2. Volume Spike with Selling...

US500 is setting up for a classic Wyckoff spring. This is a high probability set up with high risk to reward (5R+) Here is what needs to happen For situations 1 and 2, a. price should break blue support (traps sellers and shakes out weak hands) b. price should then close above any of the 2 blue supports with high volume c. enter at the close of that bar or...

This is a Wyckoff upthrust text book set up for sell. Any questions please leave a comment!

Everyone talks about edge, but few talk about identity. These are the thoughts I rehearse every day. Not to hype myself up, but to root myself deeper in who I must become. These beliefs don’t just sharpen my trading — they shield my mind from chaos. Welcome to The Part 2 1. Money is not important It’s fuel, not the fire. I don’t chase paper — I chase...

> Price just swept the recent highs near 1.9145 with an upthrust pattern and is showing rejection. This looks like a classic liquidity trap, where breakout buyers may be caught. I'm preparing for a short entry based on Wyckoff principles, focusing on two key options: 1. Aggressive Entry (Candle Close Confirmation): > If the current 4H candle closes with strong...

While most are zoomed into noise, I’m zoomed into structure. After a sharp selloff into a key demand zone (look left), price is now showing signs of absorption below a major support line (3,166.805). This is a textbook example of a Spring : Stop Hunt + Structural Reclaim + Demand Holding I’m watching for a 4H bullish break + retest within this compression...

> Every trader comes to the charts with a story. Mine is one of obsession, resilience, and belief. This is what I tell myself every single day before I take a trade — my inner code. 1. Money can be made in markets I’ve seen the charts. I’ve seen the proof. Every day, money moves — and the ones with eyes to see take their slice. Markets aren’t random. They...