themoneyman80

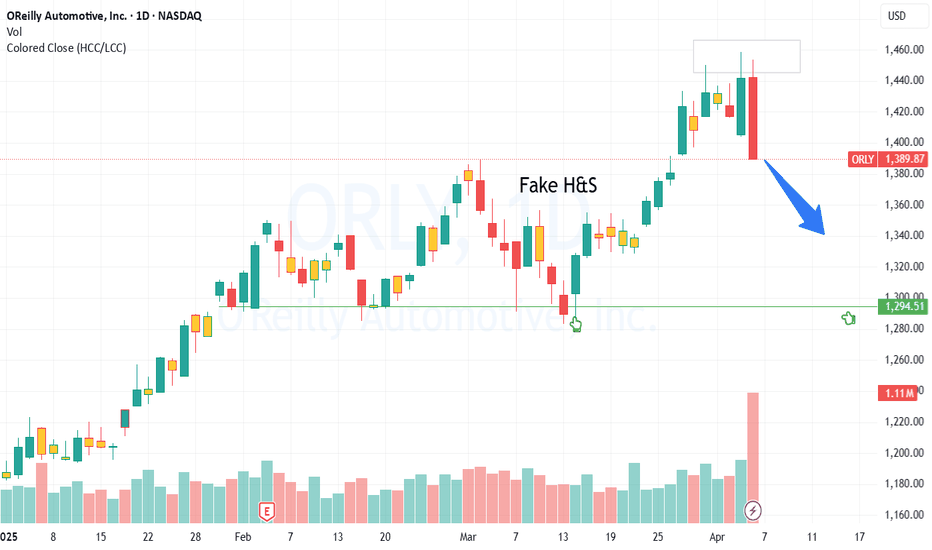

EssentialBreak the candle and move on to the 52-week test. This has been turbulent up and down, and there is no escaping the current path to its momentum unless we see a break in structure.

Like other stocks, this seems to be revitalizing after the recent correction. The only difference between this and others in a similar stretch is the chart pattern, and by design, you can expect things to change dramatically.

With all oscillators still recovering from prefall and the turning indicators, this one still has room, growth, volatility, volume, and strength to continue testing the 52-week. The only thing on the lookout is the previous high; the candle has to close higher to continue to keep this momentum going, which should be determined in the next 1-2 sessions.

With the hard-sought-out area within the red, the stock started to pick up traction; therefore, we are still bullish until the target is complete.

After a turbulent week, as things start to normalize a bit, the oversold areas are continuing to step up further. The one thing that stands out is the last candle beating the previous high, as pointed out on the arrow, but also testing resistance. This shouldn't be a great area of concern for bulls until it breaks through and retests the 52-week high.

Got a few areas but don't see the upside continuation as a solid move right now but it does carry bearish sentiment until a direction is confirm, it looks like a sideway move.

The bounce returns to the resistance to either break and continue on its way up or expect sideways trading and consolidation. The end game is Bulls.

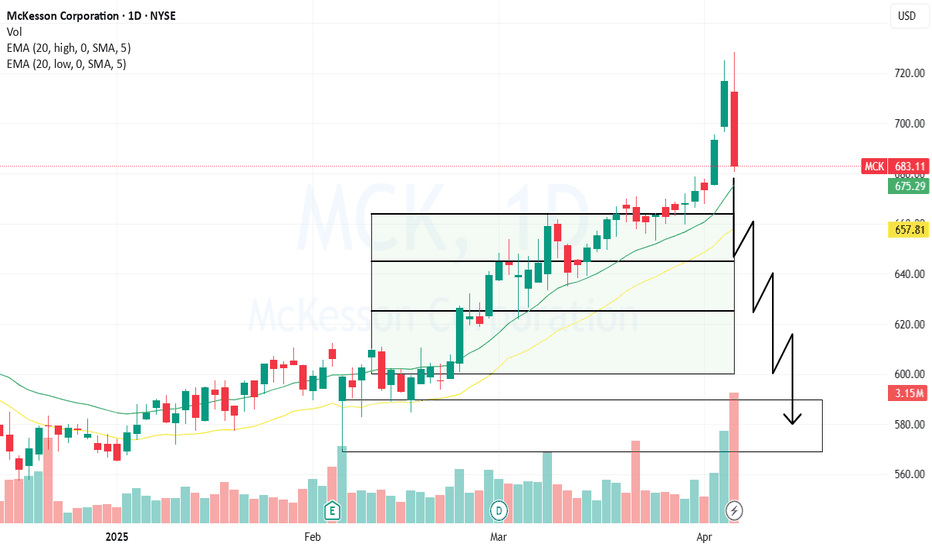

With meaningful data suggesting this is a pivotal moment, even charts can now change course and start a new bit of history, but we're keeping it simple: retest before you break down completely. Also, it may extend the stop loss to maintain confidence.

The Bears are still firmly in control. Also, remember that it hasn't beaten its last high; the LS and BOS oscillators are overbought, and it will find its firm place.

Strength has been the lucky star of the ticker, but with the presence surrounding the world of decision-making finances, this might be the bit before the next lucky star.

The stock swings have been trying to position themselves into an upswing trending faction. However, they have failed to materialize and have LS from making new highs, an early indication that things may need re-evaluation.

This is a high candidate for reversal if there ever was, seeing it come down, maybe diligently per company operations, or panicking if there isn't. Either way, looking for a correction after entering.

The catalyst doesn't lie, but neither does the TA. We have clearly pointed out key elements to the significance of how low this can go. Major turning points sit at sub 600, volume, and volatility. This will continue to sell off, but expect a retrieval at some point closest to the low 600s.

Looks like it could make the green shadow its sanctuary and move back into positive territory, and the higher high acts as the resistance.

With the right angle poised to coincide with oscillators and indicators pointed in the direction of stabilizing at some point, it could be messy and start an entirely new direction in the public's sentiment. However, it could extend further to newer levels when things are in the cool-down phase.

We see a playful insight into the upgrade, continuing fundamentals, cash flow, and catalysts setting up inflow. But we don't see that the oscillators are in severe deterioration, and the magic needs a bit of wondering where it could settle down next. Not only a gap in this area, a major turning point, but also an indicator of strength has been decided. 50 is the...

There is a significant gap to fill at 26. I do see potential, and it has been showing signs of finding its feet. Look forward to a higher mark as to why it's simply by design and concurrent with market conditions and display from others in AI to mark a significant move for themselves. With this being marked so low, ATM could prove vital, statistically as well as...

Sentiment has slowed, but the buying has continued, maybe to average down. TA-wise, the precedent is clear: by retracing, then stabilizing, consolidating, and continuing.