consolidation breakout - 3 min & 1 hr S2 Break on weekly CPR 3 minute candle daily CPR movement need to confirm the downward moment. 1) if 3 min candle open below S1 and retest then a good movement can be expected. 2) If the 3 minute candle opens above R1 or SMA 200 with good green candle then can see a consolidation or a bounce back the analysis which i...

1) trendline breakout 2) recently Promoter increased buying 3) high volume 4) BB Widening & above 40 EMA Showing bullishness in stocks Target: 1057. or Trail above 15 % sl: previous candle low. rsi is in over bought so a consolidation or support level pullback can expected.

trend line breakout. bought it at 680 sl 10% tar 30% will trail. once it reach 15%. promoters are buying.

intraday trade will only taken if low of today break. 1:1 risk reward (4% approx)

1) sun pharma breaks its trendline support 2) In option chain analysis huge put buildup in 1840 which act as a strong resistance. 3) profit level for postional opption buyer as 1740 (nearby) and sl on 1840

Based on OI insight analysis on stike. money platform. potential buy signal generated.

Stock crossing its downward trend line. Momentum Pick up.

Based on elliott wave analysis starting of 5 th wave on both weekly and daily. RMI Scanner new buy signal generated. Took support at 40 day EMA. RSI not in overbought zone. T: 16% SL: 8% Generate GTT order once yesterday high broke buy order get activated. Any feedback put it in comment.

momentum in IT sector, based on my analysis elliott wave 5th leg started. and also rohit momentum indicator give a buy signal. correct me if am wrong. lets learn and succeed.

while going through fii and client data in strike.money platform its indicating downside fall or a consolidation is possible. some sectors are outperforming the nifty index which are Healthcare, fmcg and pharma. so once nifty get stabilised can look for good entry. Currently I am not taking any new positions. its my personal opinion. do your own research...

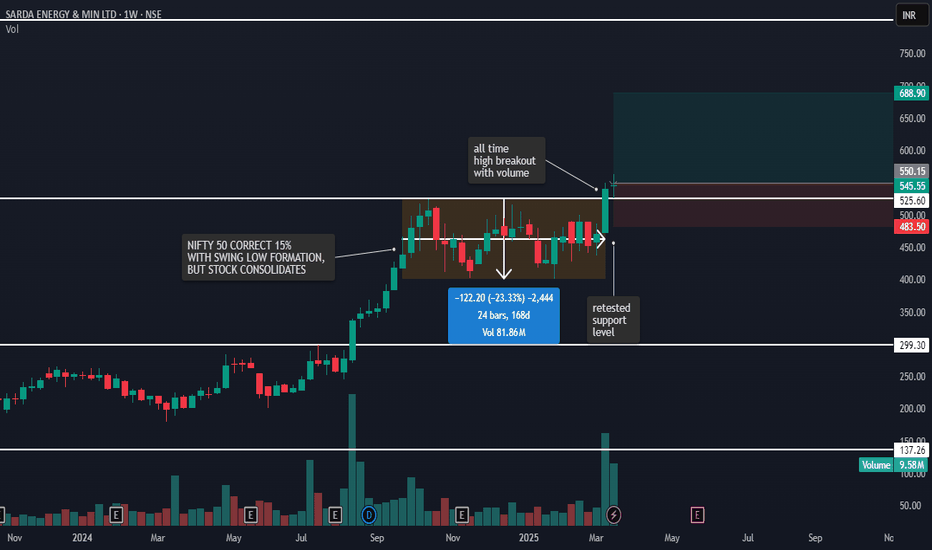

broke 52 week high month consolidation from previous high and break

bullish trend, pattern breakout, 52 week high breakout if high breaks buy entry, sl low of the candle target 1) 1.5x of sl 2) using ema 9, 2 red candle close, low of last red candle sl and if triggered exit.

52 week high breakout uptrend stocks. 10% targets and lo of candle stoploss