timwest

WizardWarning: Severe Hindsight Bias Presented. Had you followed this simple (in hindsight) strategy to Sell Gold and Buy Silver whenever the ratio hit 78 (using XAUUSD and XAGUSD) and then turned around and did the opposite when the ratio hit 52 where you sold all of your silver to buy gold, AND if you had started doing this starting in May 1987 when the S&P500 was at...

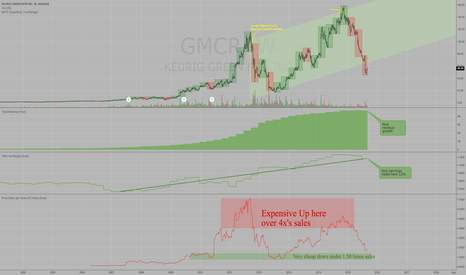

All of the bad news seems to be out for Keurig (Green Mountain Coffee Roasters, GMCR, is the symbol). 1. They created a brewing machine that didn't allow you to use the competitors K-Cups = FAIL. 2. They created a mini-brewing machine that caught fire = FAIL 3. They partnered with Coke (KO) to market a cold-beverage machine = FAIL (my guess). So, the...

Target: 59+, +9% Stop: <53 (approx 52.5), -4% Reason: Oversold to "Key Earnings Level" that has held declines after the last three earnings reports. Risk: Less than half of the upside potential. Reward: Up to the last earnings release level at the 60 level. With the S&P futures up strongly this morning and relief from a Chinese market rally despite terrible...

Here is an overview of the condition of the current trend in Bitcoin using Bitstamp prices. The uptrend in 2013 was well constructed and had 7 months at its mode (see purple boxed in range with mode highlighted). The movement out of the mode/accumulation zone peaked early on and by the 7th month had exhausted itself. 5 months after the highest high was...

I've posted on Kohls before and was able to catch both the back and forth waves in KSS shares and the breakout move to the high this year. Now we are being presented with an opportunity in disguise. The problem is the price is down sharply from the peak and retail has been suffering lately with Walmart getting slammed and Amazon growing its reach with online...

Recession in bricks & mortar businesses! Down with the retail real estate holders like Walmart (WMT), Kohls (KSS), Whole Foods (WFM), Michael Kors (KORS), Coach (COH), and Target (TGT) and UP WITH Amazon (AMZN), Priceline (PCLN), GOOG (Alphabet), Nike (NKE)... and those that don't directly deal with the consumer using retail commercial real estate. This is...

I am demonstrating how to calculate trend using a simple methodology that I call "Time at Mode". It is a simple, bar-by-bar analysis that logically deduces how to calculate the trend in a very mathematical way that can help you in your trading/investing/thinking/understanding about charts. The building blocks of an uptrend is a new high. If you don't see a...

The S&P500 has a pattern that is extremely interesting. I've devised an indicator I call Range-Movement, which I say Range-Move and shorten to RgMov on the chart below. It measures the way the market is moving and compares ranges to ranges, side-by-side. It also gives very interesting indications of TREND and sometimes more importantly it shows the level of...

At some point, everything has a price. Maybe now that GoPro is HALF-OFF, it might entice someone to step up to the plate here. At these prices, maybe a car manufacturer will buy it so they can put one in every vehicle, standard issue. It will lower insurance rates and make our roads safer, especially when everyone knows that their driving habits will be...

Despite the horrendous September for the stock market, INTC is making new 2-month highs. It is also tracing out a pattern that technicians love to see, it is called a Head & Shoulders pattern. The interesting point is that this bottom follows on the heels of a H&S top pattern that completed this past summer. Which one will win? The top pattern or the bottom...

It is in a triangle as it awaits its fate, likely to move up or down 5 points on the release and update on its forecast for the coming holiday season. Nike reported Sep 24 and the stock shot up sharply on strong growth in China. Perhaps UA will do what it seems to do best, follow NKE wherever it goes.... NKE went up so I think UA will go up. Simple...

We are 11 stocks into the 30 stock DJIA Components to report earnings this cycle. The exact KEY level is 17,413, but 174,000 is easier to remember. Since the last earnings reporting cycle, which averaged 17,643, we had the "margin liquidation - stop out" decline to 15,370, which was a 12.89% drop or 2274 points from the KEY EARNINGS LEVEL. What is the KEY...

Mysterious "Island Gap" bottoms in the S&P500 is a odd sign. It is a sign of overnight news driving major price moves. What I want to see is if the market can hold onto the gains since all of these basing patterns. I will be watching for what happens after the same amount of time here in the base expires. I measured 28 bars over 39 days (see the bottom of...

1. Overbought on CCI 2. Trend Indicator is in a downtrend using 2 month low in RgMov 3. Maximum volume level at $36.50 is maximum resistance here. 4. Large distribution zone could be in place if below $36.50 Time will tell. It looks like a good setup here. Sell short if down on the day only and more if below Friday's low. Tim 1:15PM Sunday 10/11/2015

Gold is building for a measured move to $1187 on XAUUSD. Gold "range expanded" out of the recent "mode" at 1135-1130, which triggered the first buy signal of a 10-day long potential rally to 1187. We are in DAY 3 here. The pullback today provides another entry to the mid-point of the "range expansion day" highlighted in "bright blue". The target on this...

Rally back to high volume resistance at 2.05. Also, 2.05 is the price level with the most TIME as well and is nearly a 100% rally from the low at the end of September. The CCI(11) is overbought, of course, since it just rallied 9 days from 1.07 to 2.076, a full 1.00 move. Risk 10% to 2.25 Target -20% to -25% to 1.60-1.50 Tim 10/9/2015 10:15AM EST

October 2015 Update: The magnitude of the decline still isn't that great here, as the trend turned down in September with HYG at a little over 91. It is down to 85.11 (and HYG has paid monthly dividends of roughly 40cents for 12 months now, so they are really at a small 1 point or a 1% loss right here). Still, when risk taking earns you a loss after 12 months,...

Apple has been acting a bit rotten lately. Why? Well, for starters, it didn't act so well on the release of its latest iPhone 6s when it gapped up and then closed down on the day. Technically speaking, that's a sign that buyers were already crowded in the stock and were ready to sell on the good news. That pattern is also called a "key reversal" which is a...