I could wait until the end of May to publish this but I still felt it was worth updating. I felt it was worth updating since the daily chart can't seem to get going despite a very bullish daily pattern revealing accumulation. The monthly downtrend is very weak because it hasn't reached the downside targets and there is no follow through or range expansion on the...

Corn is at a very interesting place here on the chart. You can buy with a 362 1/2 stop and look for a move to 379-380 in the near term. I'm curious to see if the sellers re-emerge since you can see that the last level of oversold reading of 11-day CCI is now breached, that maybe the shorts get squeezed a little. The sellers have been in control for a long time...

The falling volume through the rally coupled with the rising, converging trend lines could be a sign that XLE is going to re-test the lows and potentially drop far under the lows. In order to enter this trade though, I'd like to see XLE fall under the wall of volume at the 80 level and breach 79.5 before going short. You can sell on weakness below 79.5 and on...

After building a mode, as shown, for 14 days, the EURUSD has gone on a rally which has now extended 14 days. The advance has also equaled the range of the accumulation around the mode. If you are long, this is where you exit. You can stay in with trailing stops and even REVERSE and go short with close stops. Cheers. Tim 3:18PM EST Wednesday, May 13,...

Now that the earnings are out and TWTR got hammered back down to old levels, we can see the trail of sell orders that have hit the stock which has followed a pattern you normally see after blow-outs on the downside. Typically you will see either 3 days of selling or 3 waves of selling. The last move down from last Friday to Monday didn't even show a rise in...

From my last post in BTCUSD where I highlighted an 11-day rally pattern, the time expired and during that rally a NEW 11-day rally pattern emerged. At the end of today, May 11, 2015, yet another 11-day pattern will form but will only trigger once another daily range is entirely above current levels. Don't count that until it confirms, but just making you aware...

This chart speaks for itself. Any additional thoughts? Tim 32.60 1:23PM EST

I've been doing this analysis by hand since April 28, 2015 in a spreadsheet at Google. 4/28/2015 1:30 PM 46.70% 53.30% 18111 17960 4/29/2015 9:44 AM 40.00% 60.00% 18083 17975 PFE, MRK reported 4/29/2015 2:26 PM 46.70% 53.30% 18055 17975 4/30/2015 9:55 AM 46.70% 53.30% 17968 17970 4/30/2015 10:47 AM 43.30% 56.70% 17930 17977 4/30/2015 3:54...

Bitcoin BTCUSD Bitstamp - Time is accumulating up here above the 11-day mode at 223-222 where the uptrend launched from. Look at April 29th when the range expanded as it jumped up strongly away from the accumulation under 223-222. For starters, the mid-point of the launch date was support "noted with the + sign" and the "exit" just over the previous highs...

16.53 last 18.00 target 16.125 stop Reasons: 1. Cluster of 5 days where the high is very similar = explosion pattern. 2. Range expansion "UP-bars" on the daily chart highlighted with blue triangles. 3. Range expansion "UP-bar" on the weekly chart 4. Volume building at the 16.50-16.60 level appears to be a breakout level if breached could lead to a...

For the big picture of gold, look at the monthly time frame. What is the story that the monthly chart is telling us? It is showing us that Gold has FAILED to make a new low after bottoming back in November at 109.67: December, January, February, March, April all failed to push new price lows and that is a sign that the sellers are not only extremely patient,...

The "Time at Mode Methodology" is a trend-following and range-trading technique which is allowing a low-risk trade setup at the 113-114 area for entry. I chose 1.13211 for entry based on more than 20 days of supply at that level from the decline in the 1st quarter. It is entirely possible the trade doesn't allow us to enter since I think there are so many...

The range expansion rally on Thursday is a sign that Bitcoin is in an uptrend here. There are 11-days at the 222-223 level, so that is our timing device. The pullback to the middle of the range expansion day is a perfect, low-risk entry level. Targeting 252 in the next 10-days. Buy pullbacks and risk a drop of one average range (11-day average range). Tim ...

Given all of the attention on German Bunds in the past two days, I thought I would graph an overlay of the US Bond market over the German Bund market. They both peaked almost simultaneously on January 30 and the US Bonds have been backing off since that time while German Bunds went back up to test those highs before rolling over. The last two days were quite...

I'm having a little fun making this chart, but perhaps I've spent too much time in front of the charts this week! Either way, what you can see is that the market is rather balanced over the last year and here we are turning over from overbought. We are at the "Sell in May and GO AWAY" time frame that makes people think twice about lightening up on equities after...

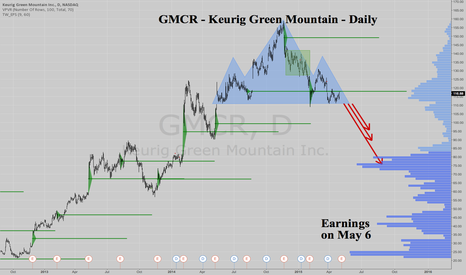

Sometimes a picture is worth a thousand words - Target: Various Levels - Red Arrows Earnings due May 6: Use options to manage risk. Tim 1:03PM EST Thursday, April 30, 2015

In order to see what is going on in the stock market, you might want to know how many stocks are above important levels in their own respective chart. What I have found important is to look at the level of any stock around the dates that earnings are reported and if it is above that level, clearly that is bullish. If it is below the "earnings" price level, then...

Note the various levels on the chart. Tim 9:30AM Wednesday, April 29, 2015