Depending on the length of time you have been watching markets, you will find that you have a bias towards thinking that gold and interest rates (as measured by US Gov't T-Bill Rates) have some kind of a pattern. But the longer term chart reveals that there is almost zero correlation. I wont even run the "correlation indicator" because you can very easily see...

This pattern was shown to me by Liz Ann Sonders in her publications at Charles Schwab, which are available to all of us via Schwab.com and her posts on Twitter. What you see here is when longer term (3-month) VIX ($VIX3M) drops to a fraction of front-month (1-month) $VIX, it can signal an extreme shift in demand for short term options, which has shown us time...

Here is a plot of the $DJI Dow Jones Industrial Average together with a concept I call "Key Earnings Levels" which plots the sum total of the prices where the stocks in the Dow reported their earnings. It has been a very useful tool to define support and resistance in this sideways, choppy market that has led to low risk entries several times this year. We...

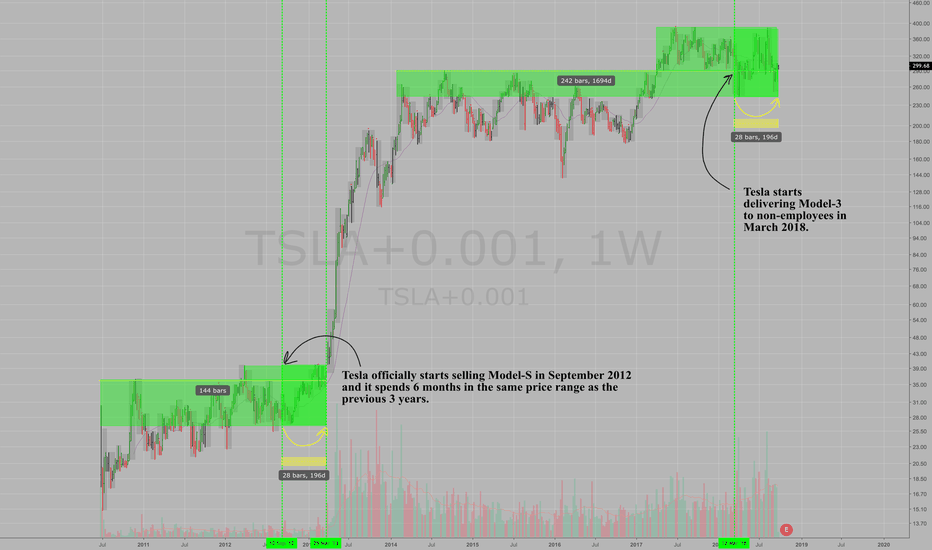

Back in 2012, I was actively researching Tesla, investing in the stock, and charting the patterns here at TradingView. The pattern I found was that people were concerned the Model-S wasn't going to work as planned or they would have production problems. Tesla was still such a new company in 2012 to most and the price point for the Model-S car was much higher...

I grabbed the last four times the crude oil (USOIL) market bottomed and plotted what the S&P500 (SPY) did until crude oil peaked. 1. The first is 1993, December 2. The second is 1998, July 3. The third is 2001, November 4. The fourth is 2009, February I made this chart originally with USOIL divided by the US Dollar and decided to just keep this chart labeled...

I've plotted this relationship over the years here and here is the current update. The concept: When $VIX spikes by 5 points or more and then retraces 75% of that spike, buyers have absorbed the selling from the panicky sellers and provided liquidity to an illiquid market. AFTER these episodes, you can use them for reference and support. See how there have...

Here's a big point... HOPE vs FEAR as shown by Municipal Bond Prices (using the Dreyfus Muni Bond Fund ETF $LEO) Hope is the time when people are selling their "SUPER SAFE MUNI BONDS" to invest in stocks. Fear is when people are buying SuperSafe Muni Bonds It's a general-view, but worth attention. If $LEO turns down, then look for the market to turn up for...

What is the PATTERN of gold price movement on the day that the Fed raises interest rates? Here are the last six (6) rate hikes and the dates. If the triangle is GREEN, then the price moved UP and CLOSED UP on the day. If the triangle is RED, then the price moved DOWN and CLOSED DOWN on the day. On 6/14/2017, the price moved UP initially, then traded DOWN and...

If you consider how the US stock market looks when viewed from the eyes of the collective non-US investor in a "trade-weighted" view, then you would see the US Stock Market in this form. When you own the US stock market, you first own the currency, the US Dollar. But no "one" owns the DXY, rather, it is an approximation of the weighted (by trade) average of the...

2018 - basic outline for the year - as published here in my chatroom - Key Hidden Levels. I see "no gain" for the year as the market chops sideways and then musters strength for a move up next year as the full impact of the new Tax Law kicks into full effect, driving Capex, Buybacks and re-distribution of wealth. Time will tell, but given the extreme calls for...

Do you see the pattern here? If there is a 6 point drop in $USDJPYand a sharp reversal in $USDJPY then the stock market has put in a meaningful bottom with support at the low of the $USDJPY. Once you see a bottom in the $USDJPY, mark a bottom in the $SPX500 and carry it over 3-6 months because that is how long the support level is good for. See for...

Amazon has rallied for 15 weeks into last week's close after accumulating at the mode back this past fall for 15 weeks. In other words: Amazon has "run out of time". Once Amazon blasted off on its previous earnings report back in October, it kicked off a 15 week rally which ran far beyond the rally that was implied by the previous move from $766 (where it...

The current market environment somewhat mimics the 1981 market: Why? The stock market rallied 31% from Nov 1979 to Nov 1980 on the optimism that Reagan would revolutionize the economy. The Reagan Revolution led to the Tax Cuts entitled "Economic Recovery Tax Act of 1981, An act to amend the Internal Revenue Code of 1954 to encourage economic growth through...

When we look at auto sales, do we adjust for the number of people in America? If you see the lower chart, you can see we are just over the trend in Light Vehicle sales. The trend is 16 million and we hit 18 million and backed off to 17 million recently. It sure looks like the number of cars sold "per person" in the USA is down dramatically over the last 40...

A little tongue in cheek here but clearly the end of the year has been a time when people have moved OUT OF short term treasuries and into other assets or durations. The news has been covering how short term rates are at their highest levels in years here. I'm pulling up the chart and with the great indicator "MTPC" for "Multi-Time-Period-Charts" I was able to...

Here is a "pairs strategy" to go long $DIS and short $MAR over the course of the next 3-6 months AFTER earnings are released for $DIS on November 9th. I don't want to put you at risk for the current earnings report, but over the longer term, $DIS tends to correlate very highly to $MAR Marriott. $MAR has been on a straight line rally for many months now while...

Sometimes a picture tells you a powerful story - just like this one. The KEY HIDDEN LEVELS "Earnings Support and Resistance" lines show you in advance where important support and resistance is in a stock. Take a look at $UAL for example: Note how the green line broke to the downside, then retested before heading lower in a cascade of "Range Expansion"...