toateotihuacan

Essential🔥 BTCUSD vs. M2 Supply 💸📈 – It’s HOT Right Now! 🔥 Everybody has been posting M2/btc charts. Here's mine: I roughly averaged the trends for PRE and POST-lockdowns MARCH 2020 for both global M2 and bitcoin. Bitcoin is on a log trend so that it can keep up with how absurd the money printing is. Even so, M2 is currently out-pacing bitcoin's trend, so something has...

The panic could be severe, given market conditions are creating job losses at an accelerated pace. Expect overcorrection and place stink bids. But fair market value for bitcoin remains at a floor of ~85k per: en.macromicro.me/charts/29435/bitcoin-production-total-cost So anything below 85 is pure discount. Good luck.

Using log fibs, we can find a target for gold for this breakout. Inflation is more severe than the government is reporting--based on M2 and hidden spending--so perhaps gold will finally have its moment of glory. Buy gold, keep it in hand, and be prepared to defend it.

Jumping across the creek would confirm wyckoff-reaccumulation and trigger an all-in scenario, causing disruption in financial markets everywhere. Housing market is cooked, and people will begin to sell their homes in exchange for a fraction of a coin, leading to inflationary pressures that the US Administration was never equipped to handle. Evidence of their...

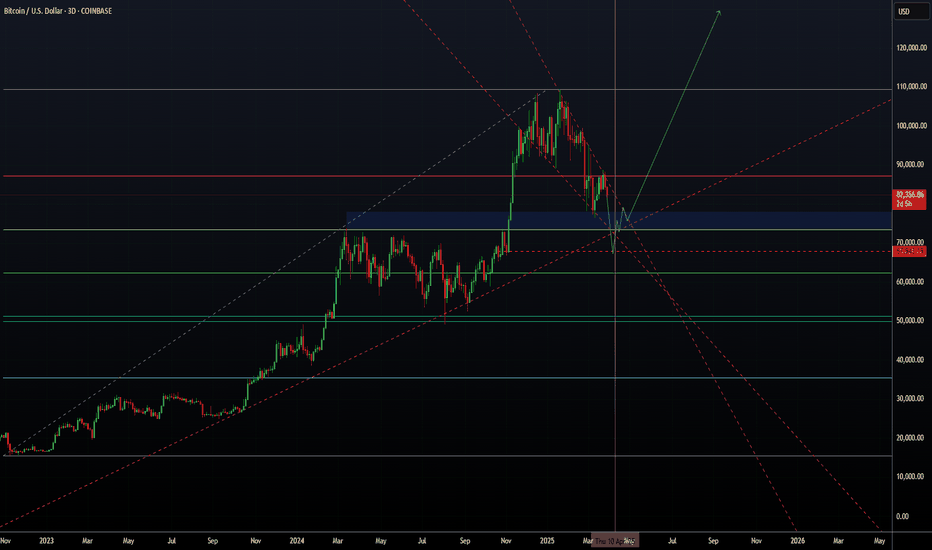

Bitcoin facing resistance at 106K. Will complete rising broadening wedge, flash crash to scare noobs, and continue up to 280K. Good luck.

Using ghost candles from the 2021 bull-run we have replicated a similar scenario. Targets based on cup and handle pattern, followed by fibs. Good luck, traders.

Major trendline linear support (currently) @37K. .50 fib at 44K. Could be months to resolve.

This looks like a giant bullflag to me--call me crazy. 55K holding and retesting 69K was evidence of the health of the bitcoin market, but we still need a bit more momentum to make new highs. Let's swing to the next fib and continue from there, shall we?

Someone just requested a litecoin chart and this is all that matters. I wouldn't buy any alts until 2027. Most are trending down vs. BTC. Still no breakout here on log, so it's not a terrible idea to buy some alts, but uh.... I do not recommend it personally.

Join me and become a Fibonacci Maximalist. Thanks be to Leonardo Bonacci and the Italians. All my sells are at 360-400k. All glory to God. Updated version of the related idea below:

Buy bitcoin. Shoutout to @TechDev_52 I wanted to re-create his chart with my thoughts. Please give him a like and follow. Only thing worth noting about these BBands is it uses EMA instead of SMA, and 50 settings instead of default. Still a great way to catch a general trend and pattern. fib target of ~360K

I like the 2-Day chart best for clarity. Stop everyone out at 64K, scare the wall of worry one more time and continue upwards into unknown territory. No breakouts yet as evidenced by the continued decline in volume.

Linear fibs show buy support at 51K, but the halving will shock the supply such that the price will be forced to double shortly thereafter. Current cost to mine one bitcoin is ~50K so a fair price for bitcoin should be around 80K after many miners give up their rigs at a loss. Just spit-balling here. Posting chart for retrospective. How's WWIII treating you so far, anon?

Looks like a convincing breakout to the upside, which could provide enough momentum to hit the .786 fib before running the opposite direction, stopping the longs out for maximum pain before the halving. What do you think?

Improved chart from The End of Banking part 1: "The primary weapon the (((oligarchs))) have is the USD and banking. We have seen the breakdown of this weapon every since the divorce of East and West when SWIFT was banned from Russia. Alternatives to the dollar have been suggested, but only BTC remains. I've done the math. When the weakness of the dollar is...

The primary weapon the (((oligarchs))) have is the USD and banking. We have seen the breakdown of this weapon every since the divorce of East and West when SWIFT was banned from Russia. Alternatives to the dollar have been suggested, but only BTC remains. I've done the math. When the weakness of the dollar is fully revealed, bitcoin will reach 8 million dollars...

A Millenial's History of the world using the SP500. The only question left is: who is Likud? Better yet, who is Irgun?

You really think we're headed for hyperinflation? Nah. Powell is serious about raising rates because saving the USD may mean saving the entire world. Bitcoin is a passing fad, built on top of hype, greed and delusion. If it has any staying power, it will find its bottom in 3 years' time. Hold onto your butts.