tomstewy

Loving this cash and carry trade, anticipating that kiwi yen stays on the up & up. Stop set below the 61% retracement, if price comes back down there its game over. Lovely overnight interest to offset commission costs!

Yesterday closed bearish, and there is a trendline break pattern suggesting a bears to enter the market. Watching the recent two days low, if we can make a break below 83K then it should be clear sailing to the 80K mark. Alternatively, a break above yesterdays high would signal further buying. Watch this space!

Price has broken to the upside of the Friday high. Looking to trade with existing momentum to the upside, with a tight stop above the recent 1h swing low.

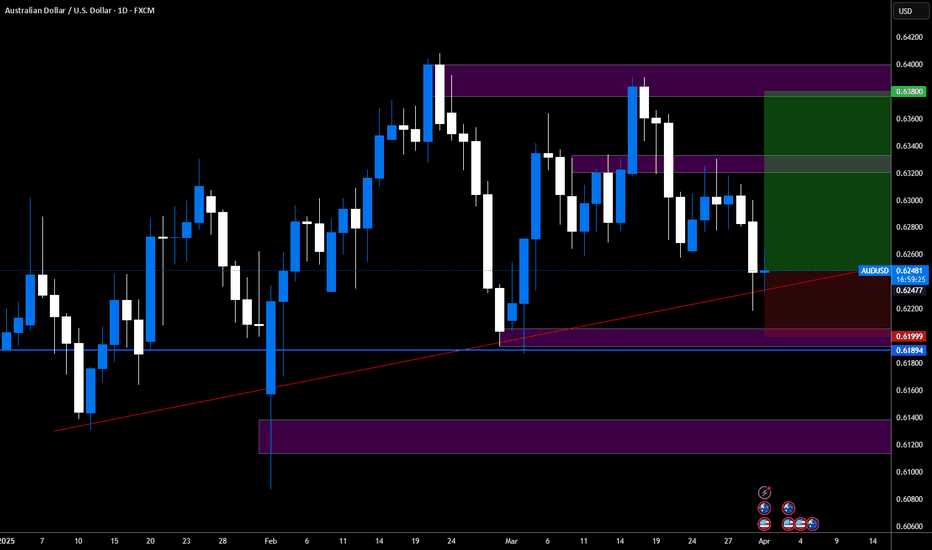

Hi Traders, today i'm looking for the first signs of a AUDUSD failed rally. I'm watching on the lower timeframes to see the AUD run out of upside steam, make a break to the downside and then continue downside direction. Technically; the last few days printed a solid bottom, but downside is likely to be retried towards the 61 cent big figure, and potentially to...

Recently I called gold long. I know this contradicts it, but a nice setup here. Maybe continuation of the gold bear rally as we have certainty over tariff situation at present?

The aussie has been bearish so far this year, and rightly so! We must consider that whilst the US Reserve Bank has talked about cutting rates they have just had a Jobless Claims print lower than the last few decades, signaling that the US economy is going well. In addition, we must consider tensions in Red Sea and the middle east are disrupting trade, and when...

5 & 10 ema for the 15 minute chart have done a bearish cross out of the resistance zone. We'll be following price with a trailing stop should this move in our favour.

Markets sentiment is massively risk off at the moment, and shorting cryptocurrencies (other than btc) seem like a good choice. Dot has broker the rising trendline and looking to sell into range support.

First and foremost, I am bearish Australian equities, but will continue to buy until there is signs of a failed rally at which point I'll short the market. For now, seeing the general trend as bullish. Proceed with caution.

This is basically built on the premise that the EUR has more upside, and has now run stoplosses for retail. Great R/R potential, lets see if it plays out.

Well, a fake out of the recent range bottom, combined with several chart patterns which typically suggest upside, and we have this great risk to reward trade. Price makign a short bounce, and we will see if it is sustained :)

Lots of fundamentals are changing at the moment, so trading on a technical basis is very difficult - latest update is Elon Musk talking about a Free Trade zone between EU & US. Sticking to basics, NFP last week delivered very strong figures for US jobs, and looking to play some EUR downside on the back of that. Recent structure as entry point, 1.1010 level. Stop...

Price is at trendline support. If the AUDUSD can rally from here we'll target upside. YTD the Aussie has been in a steadily ranging upside trend.

Trading oil with current momentum. Stop at 1.5x daily ATR, targeting 1.21 fibo extension.

Price is forming a wedge pattern in the last 3 months. I imagine price is not yet to break the pattern, and we will see downside for the remainder of March. Technically, looking for a trend switch on the 15 minute chart (moving averages bearish cross) out of these resistance levels. Thanks for reading!

I'm selling WTI contracts today, a few technical reasons, and generally trading with the current momentum. Stop will trail. Lets see how we go!

The view from fund managers is still very bullish USD, and this Aussie rally gives a great opportunity to sell the Aussie dollar at a relatively high price to recent trading. This trade has a potentially fantastic risk to reward. We're looking to trail the stop, and secure 50% of the position at a 1:1 risk reward. Please note that using a trailing stop loss has...

AIR NZ Is a lock. Come on, 1. Strategic Market Position Air New Zealand holds a dominant position in the domestic market, serving 20 main centers and regions across New Zealand. Internationally, the airline focuses on the Pacific Rim, leveraging alliances to enhance its network and competitive advantage. AIR NEW ZEALAND 2. Financial Performance In the fiscal...