trad_corn

Short Selling GAIL Futures involves betting on a decline in the price of GAIL (Gas Authority of India Limited) futures contracts. Traders borrow and sell GAIL futures at the current price, aiming to buy them back at a lower price later to profit from the difference. However, short selling carries high risks, including unlimited loss potential if prices rise,...

Short selling is a trading strategy used by investors to profit from the decline in the price of a stock or other financial asset. Here’s how it works: Borrowing Shares: An investor borrows shares of a stock they believe will decrease in value, typically from a broker. Selling the Shares: The borrowed shares are sold in the market at the current price. Waiting...

In trading, a demand zone is a price area where buying pressure is expected to be strong, potentially causing the price to reverse or bounce higher. For Natural Gas, identifying demand zones can help traders anticipate potential buying opportunities.

The NIFTY 50 is a benchmark stock market index in India, representing the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange (NSE). A "supply zone" in technical analysis refers to a price level or area where selling pressure is expected to be strong, potentially causing the price to reverse or stall.

A Natural Gas Supply Zone refers to a designated area or region where natural gas is extracted, processed, and distributed to meet energy demands. These zones are critical hubs in the energy supply chain, encompassing production facilities, pipelines, storage units, and distribution networks. They play a vital role in ensuring a stable and reliable supply of...

Explore key supply zones for Larsen and Toubro (L&T) with detailed technical analysis. These zones act as potential resistance levels where price reversals or pullbacks are likely, providing strategic entry and exit points for traders. Perfect for swing trading, breakout strategies, and risk management.

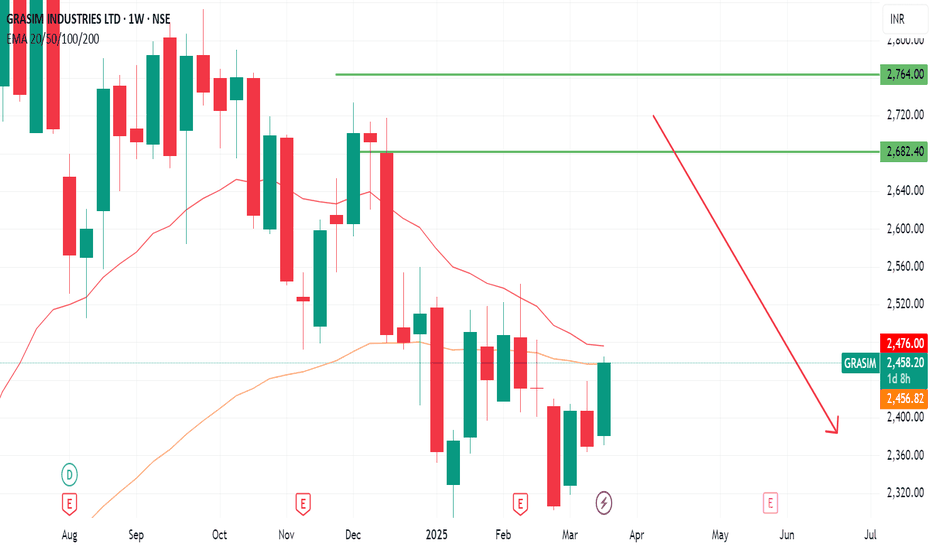

Identify critical supply zones for GRASIM INDUSTRIES using advanced technical analysis. These zones highlight potential resistance areas where price reversals or pullbacks may occur, offering strategic opportunities for traders. Ideal for swing traders, breakout traders, and those focusing on risk management.

Discover key supply zones for UNOMINDA with detailed price action analysis. Ideal for identifying potential reversal points, resistance levels, and strategic entry/exit points. Perfect for traders focusing on demand and supply!

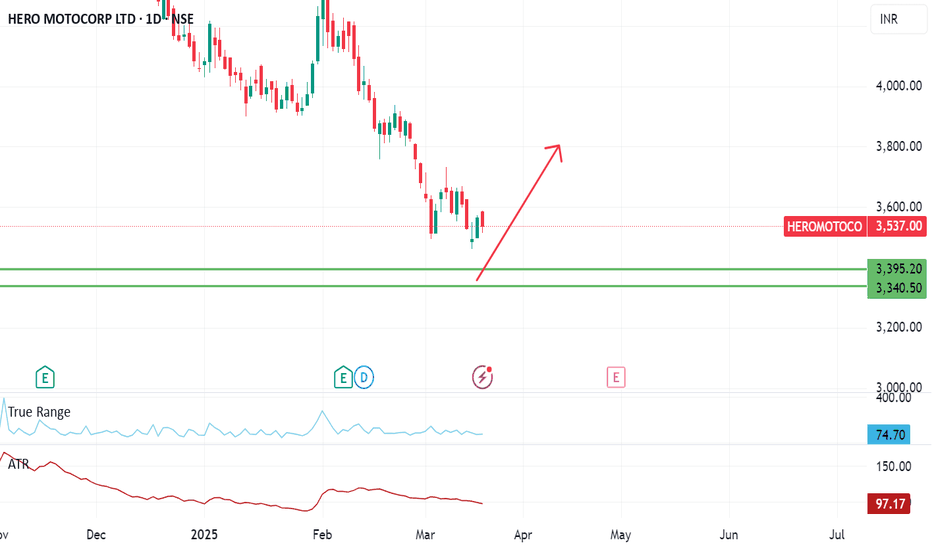

A demand zone at 3395 indicates a potential area of buying pressure, where price may reverse or bounce upward. Traders can consider going long on price rejection at this zone, with a stop loss below 3395.

A supply zone at 5923 indicates a potential area of selling pressure, where price may reverse or stall. Traders can consider shorting on price rejection at this zone, with a stop loss above 5923 (e.g., 5950) and a target at the next support level (e.g., 5750).

In technical analysis, a Supply Zone is an area on a price chart where selling pressure is expected to be strong, causing the price to potentially reverse or stall. This concept is often used in trading strategies to identify potential areas where price might decline.

TATA Steel is approaching a significant supply zone, indicating a potential resistance area where selling pressure may increase. Swing traders can watch for bearish reversal signals (e.g., bearish candlestick patterns, rejection at the zone, or declining volume) to capitalize on a potential downward move. This zone represents a key level where the stock has...

SBI Life Insurance is currently trading near a strong demand zone, indicating a potential reversal or bounce opportunity for swing traders. This zone represents an area where buying interest has historically been strong, making it a key level to watch for entry.

TATA Consumer Products (NSE: TATACONSUM) is currently showing a strong demand zone on the daily/weekly chart, indicating a potential reversal area where buyers are likely to step in. The demand zone is identified between ₹910 and ₹875. Traders can look for long opportunities near the demand zone with a stop-loss below the zone. A break below the demand zone,...

Today will be a gap up opening in NIFTY 50. whether the NIFTY 50 will have a gap-up or gap-down opening is highly speculative and depends on a variety of factors, including global market trends, economic data, geopolitical events, and corporate earnings reports.

A Demand Zone for Hindustan Petroleum (HPCL) refers to a specific price level on the stock's chart where buying pressure has historically been strong, causing the price to reverse or bounce upward. These zones are identified by areas where the price consolidated before making a sharp upward move, indicating a concentration of buying interest. In the context of...

A LT Supply Zone (Long-Term Supply Zone) in trading refers to a significant price level on a chart where sellers have previously overwhelmed buyers, leading to a strong downward price movement. These zones are identified by areas where price has made a sharp drop after a period of consolidation, indicating a concentration of selling pressure. Traders often watch...

ZINC futures are financial contracts that allow traders to buy or sell zinc at a predetermined price and date in the future. These contracts are traded on commodity exchanges and are used by investors to hedge against price fluctuations or to speculate on the price movements of zinc.

![[INTRADAY] NIFTY PE & CE Levels(18/03/2025) NIFTY: [INTRADAY] NIFTY PE & CE Levels(18/03/2025)](https://s3.tradingview.com/5/5L3R5HsS_mid.png)