Wait for entry. Previous price action at 1600. 0.04 lots risk, trade up to mid 1600's. Wait for a pin bar or bullish close on daily. If a bearish close on daily happens , do not enter. A second candle for confirmation (such as engulfing) may be too late with the volatility that gold has been having.

Since early September this market seems to make a series of higher lows and higher highs, a bullish trending market sitting at each of the quarters levels. We are now at the (4) section of the remaining (4)-(5) leg of the Elliot Impulse Wave. Observe how the (2)-(3) leg did not push above the 200 Day EMA. As we gain bullish price accumulation in the short term, I...

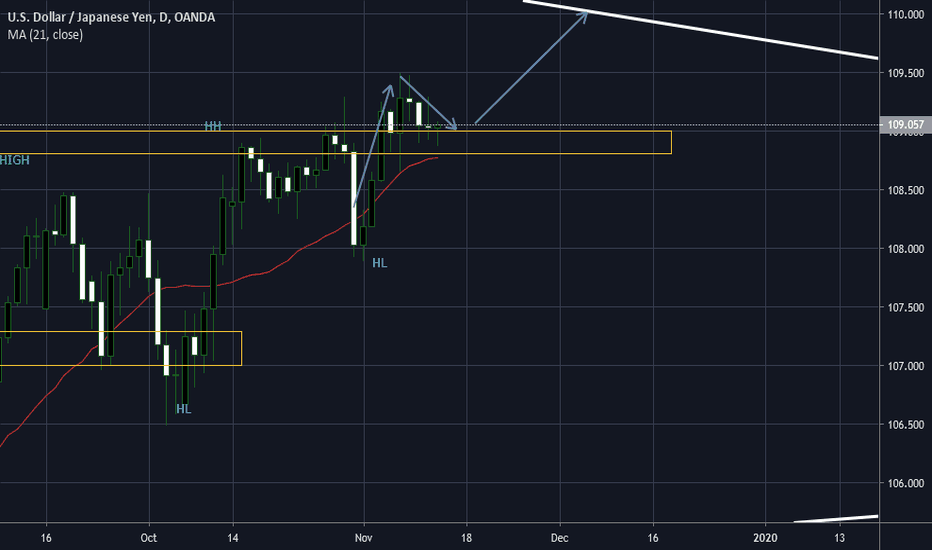

The 109.50 is a major level for USDJPY and price is currently breaking out of this zone. 190.50 has been a major level of resistance dating back to june of this year. Observe the daily timeframe on the pair, the previous 2 candlesticks mark indecision, so now there is a place for the market to make it's move. Given sustained momentum past even 110.00 I would like...

A second-phase deal could not be reached yesterday, and uncertainty in the US-China Trade Deal persisted. So overall, investors were looking to take on less risk with the uncertainty. We see AUDUSD continuing it's bearish momentum and will likely stay below the 0.6800 handle. Australian Dollar denominated assets are considered slightly risky, so this is where the...

USDJPY has been consolidated for the past few days between 108.60 and 109.00 . Still appearing to use the 200 EMA as a place of resistance and not breaking above. There has not been enough significant US Data to drive price lower. I am still in the short position with entry at 108.60 with stop loss at 108.80 and take profit at 108.00

Observe the major swing low in mid-July, that began from the top of the trend line of resistance. AUDUSD appears to be making a bullish trending market with the beginning series of Higher High's and Higher Low's . I do not currently believe we will hit another Higher High unless that trendline of resistance is broken, that would be a big push. I am bullish on...

USDJPY appears to be in the midst of a trending market, with a series of higher lows and higher highs. USDJPY has just hit a key resistance level of 109.00 . This level of resistance was confirmed running from May 2019-July2019. As we usually see in markets, we may see an S/R flip, where this resistance now becomes a new support. The market looks like it has...

Previous idea indicated that Gold could break through the 1450's and continue bearish momentum. This momentum has seemed to stall as we are now trading in this key support zone (look at the news headlines) . A bullish pin bar seems to be forming on the daily time frame, Gold could reject off this zone and shift momentum back to the upside. Stay patient, do not...

Observe the area of previous resistance (and now support) of 1444-1462 . If we break below this , the next zone Gold could trade at the previous zone (1365-1440). Michigan consumer Sentiment is to be released very shortly. If we have a positive reading, the price of Gold will be expected to fall as USD strengthens. If we have a negative reading, the price of...

Consider the trendline on the weekly timeframe, it is a very strong area of resistance which began in November of last year. Right now we are at the 0.6920 level. Consider AUDUSD on the daily timeframe. Seeing some nice resistance after last Friday's Positive NFP. I forecast this pair to move to the downside, I have a stop loss of 40 pips, and a take profit of...

Observe the strong movement to the upside in early August. We are now in a formation where price has not driven up to despite some USD weakness. (Refer to economic calendar, unemployment). For the past few weeks we have stayed the neighborhood around $1500. For the past 62 days, Gold has exhibited a descending triangle. We know that descending triangles formed...

Technical buying on Aussie. Potential level of resistance to hit on USDJPY and a large correction on Gold. Watch the video for the full Analysis.

Observe the triangle on the weekly time frame. A break above would indicate a buy signal, a break below would indicate a sell signal. As this is on a higher timeframe, I do not see a breakout happening for the next few weeks. Currently I am in a buy position with a target around 108.90 . It is in this area that the 109 whole level (quarters theory) has seen...

We can see that USDJPY has broke the trendline of resistance in yesterday's session, as The Fed's rate decision rallied the U.S. Dollar. The price action so far in today's session is looking to come back below the trendline. In tomorrow's session I would look for a pin bar, with the wick reaching below the trendline. A bullish engulfing candle unlikely as the...

Observe that gold has hit a support at around the 1500 mark. The Fed's Rate decision rallied the metal yesterday, U.S. Equities open today may point toward the upside. Gold Futures are overall bullish.

Examining the channel of EURUSD, how pin bars can be combined with stochastic, and basic ranging markets.

Observe the trendline of resistance which seems to begin in December 2018. The average move to the downside off the trendline is 301 pips. There is huge selling potential here.

AUDUSD is about to make the (final) 4-5 leg 0.6850 is a big place of resistance for 2 reasons: It's a quarter level, and prices tend to make moves off of these levels. The 61.8 % Fibonacci retracement from the 2-3 leg on the 1H timeframe (prices 0.6837-0.6873) hits exactly 0.6850. So there is a high probability the Elliot Wave completes and ends up around...