tricor2000

Based on wave count, momentum and fib price and time extensions, I'm thinking we can expect NASDAQ:ICLN to go down over the short term. Possibly to $28.66. But... I have a hard time making this call because the uptrend seems so strong. What do YOU think?

ENTERING A LONG POSISITION BASED ON ELLIOT WAVE PRIMARY COMPLETION POSSIBLE AT 32.7K. ATTEMPTING TO RIDE WAVE 3 UP TO 38K. 20X LEVERAGE. WE'LL BE ALRIGHT IF THAT WIND CATCHES OUR SAIL!!!!

Weekly momentum remains bearish while daily momentum is bullish. Wave Pattern shows possible wave 3 completion on 1/25/21. When daily momentum flips bearish to align with weekly momentum, we will look for the next entry signal (red down arrow on the daily price chart). Our price target is the .618 and the 20 day ema. The bot is set to immediately execute...

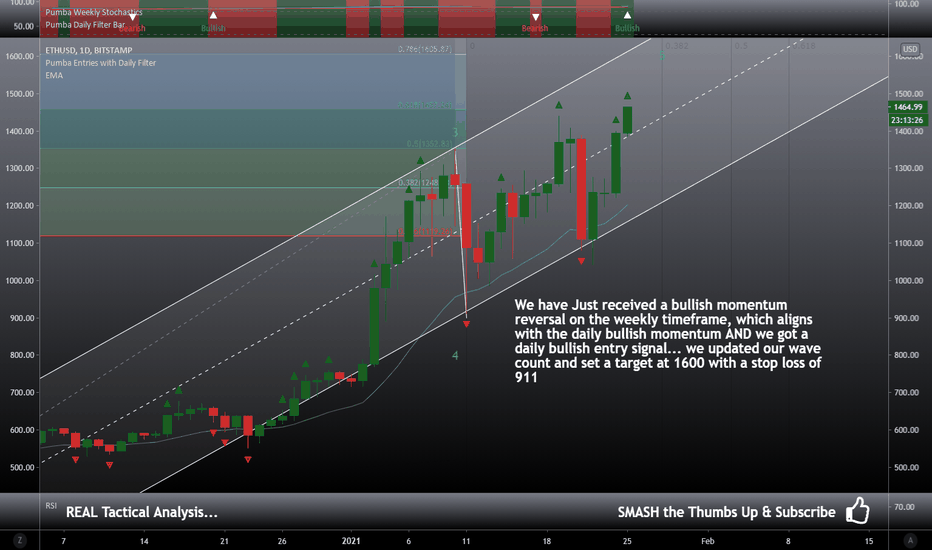

Hey all, I was tracking a ZigZag looking for Wave C Down with a target below 1,000.00. With the weekly close this week turning bullish, and the price action invalidating that wave count we are now ENTERING a long BITSTAMP:ETHUSD new trade with a profit target at 1,600 as we now have bullish weekly momentum, daily momentum and a new daily entry signal all in...

If this is wave 3 up of a descending diagonal, we can expect a drop of 25% to 282 with a risk of less than 1% at 385. Weekly momentum is bearish with daily bullish momentum. Be on the lookout for daily bearish momentum to take the next daily bearish entry signal! AMEX:SPY

Weekly and Daily Momentum in Bearish Alignment for OANDA:XAUUSD Looking for the next daily short entry signal as our wave count appears to be a wave 3 down of a descending diagonal at the minor degree Profit Target is the .618 Fib Extension

Wave Analysis: Although Wave B is not confirmed, it appears we are in Wave C down of a ZigZag. ZigZag's are correction waves labeled ABC. We can expect price action to stay within the elliot wave channel if our AB wave count is correct. Our first price target will be the bottom of wave a, and the second target the .382 retracement level. BITSTAMP:BTCUSD ...

Wave Explanation: ZigZags are corrective waves labeled ABC. It appears the ATH of 42,000 marks wave 5 at the minor degree and possibly marks wave 3 at the intermediate degree. Channel Explanation: We can draw a channel from wave A to wave B and expect price action to stay contained within the channel. !!!-CAUTION-!!! wave B is not 100% confirmed. Wave /...

As you probably know, BTC and ETH are correlated which can be seen in the CC indicator below. Based on the drop in the BTC line on the chart, we will start tracking ETH for a short opportunity.

Our last trade for Wave C Down hit our profit target of 15%. We could see short term price action go up to 33k to 34.6k ish but we would not enter any long position at that small of a wave degree pattern. We are still looking for Wave C Down and would take the appropriate PUMBA signals when they all are in alignment. Looking at the time extension, however, it...

Based on our updated wave count we appear to be in wave 5 up of an ascending impulse at the minor degree. Although we have daily buy signals that align with our daily bullish momentum, we have not entered a trade because our weekly momentum is still bearish. We hope to enter the trade soon when all 3 are in alignment. A riskier trade setup would be to start...

We are updating our wave count to the start of a Wave 5 up of an ascending impulse... previously we were looking for a wave 5 completion. Price retraced to the .236 fib retracement and bounced perfectly. Our daily momentum is bullish. We received buy signals from our indicator.... but we have entered no trade. For our trading plan, the weekly PUMBA momentum...

While I recently received a buy signal that aligned with our daily and weekly momentum indicators, I passed on the trade as the target for Wave 5 was already reached. However, the intermediate and primary waves appear to be in wave 3, so our longer forecast is bullish. Will keep following EUR/USD for another signal that aligns with a new wave count.

Starting with the wave analysis: We are looking at the recent high of 42,000 USD as the completion of wave 5 on the minor degree and possibly wave 3 of the intermediate degree. We appear to be Wave E in a contracting triangle on the minor degree. This would be invalidated with a close greater than the close of 37,449 as Wave E should not "take out" Wave D. ...

In less than 24hours of our last post our price target was reached for a 15% profit on both of our trade entries. Consider a trailing 1D bar high (noted on the chart as the green line) for the new stop loss to lock in some profit. Our eyes are now focused on the .382 retracement level. Our weekly and daily momentum indicators are still bearish, however, we are...

Background: Triangles are sideways price action and a contracting triangle can be described as the top line (B to D) is declining and the bottom line (A to C to E) is rising. The corrective structure is labeled as ABCDE. Commentary: Yesterday, we posted that we appeared to be in Wave E of a contracting triangle on the minor degree, which would be...

Background: We have been watching recent price action to see if a contracting triangle completes. While the price action met expectations to go lower and hit target levels, the price action invalidated the contracting triangle and appears to be a ZigZag. ZigZags are marked by ABC. Commentary: For our trading style, we look to enter trades when a signal...