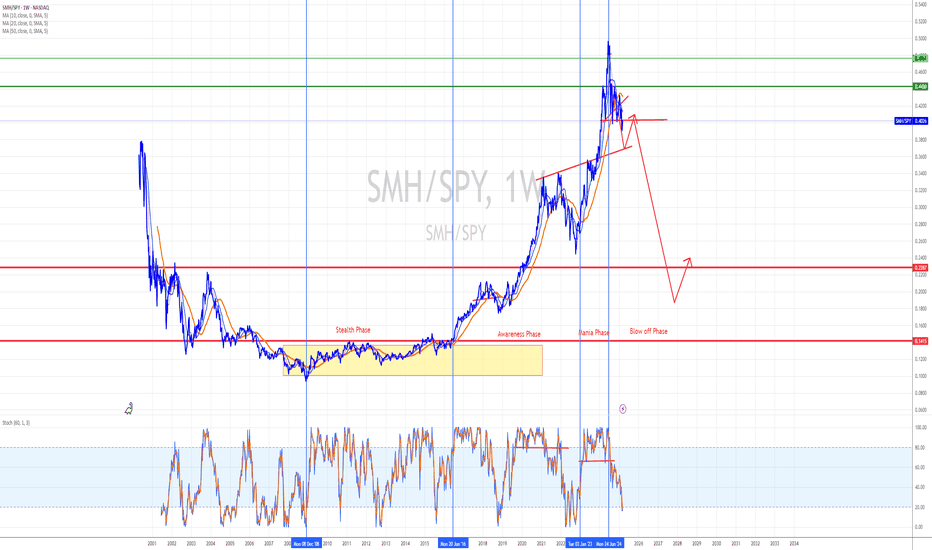

Semiconductor vs SPY seems to be following the Jean-Paul Rodrigue Model perfectly.

Gold appears to be close or has completed wave 3 up, and should consolidate for a few months before the next big rally.

RSP equal weighted SP500 broke above downtrend line and has been consolidating bullishly. Market breadth is expanding, which is good for long term, however, mega caps may be under performing going forward.

HYG/IEI, high yield bond vs 3-7 year treasury. Still near new high, no significant credit risk yet. Until we start to see this indictor turning down and break support line, Small caps should be holding up.

Small cap vs SP500 is in an interesting spot. This can be seen as a back test of the breakout. I am expecting more chops going forward for a period of time, similar to 2nd half of 2020.