vayntraubinator

Premiumgolden pocked abt 50% move on silver dominance vs btc

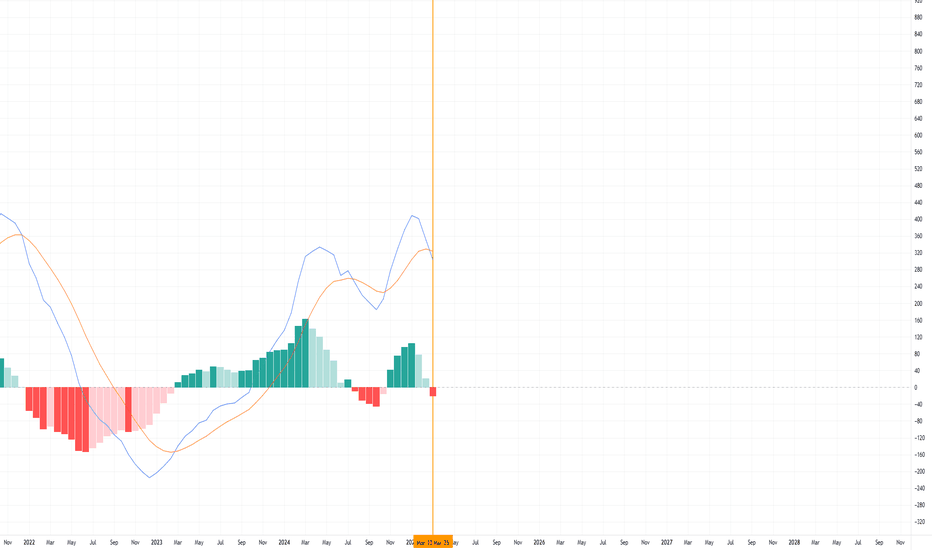

new 3wk MACD cross on silver dominance. should see a favorable silver inflow vs btc now for the next 3 wk closes (3-4 at least) = 3-4 months

abc has completed, ready for wave 2 down. could hit 6$

looks like a market recession results often see bullish divergence and targets above w/ gaps to be filled

overall bearish.... macD is trending neg RSI has more space to drop (overall still above 40 but space to go down) My target is low 1000's Bull target is approximating the next fibo time cluster to correspond to 9000$ (close to red line) Best wishes

see if can turn monthly RSI Above the 50, and the rockets will soar!

more accumulation likely for XRP despite the alt season

Has been accumulating for a while, essentially hit bottom. think based on Bressert we should get final low Jan 2025, mid-term low in august/september. for now in bottom of range good load up area

based on the inverse relationship generally want to start exchanging btc vs eth, or vice versa w these inverted relationships. in the RSI>64 or monthly RSI < 35 zones imo nfa

long-term on log scale AMP has dropped ~ 70%. This is a significant drop and not very promising of continuation as a 2nd wave given it broke the 1st wave of previous degree. I suggest waiting to buy any of this token until it either crosses the RSI resistance trend line on the weekly or it crosses the resistance price trendline on weekly, log scale. if RSI...

odds of progressing to the top of trend channel increase. super bullish stock, NVDA. all pullbacks are buy the dip set-up for now

for now in consolidation for a bit then up since larger time frames weekly 2 week , 3 wk (monthly is pending) appear to be bullish

one more re-test of incline RSI trendline This stock has been developing bullish divergence for quite some time on the mid-term therefore am expecting another re-tracement to touch the supportive RSI incline I think after then that will be a new low and will create sufficient bullish divergence to send the stock up on its final launch on a good long opportunity

TSLA is overvalued compared to other car companies short term bearish, with RSI trending below 50 and price drop and a swing low on the weekly. would touch this stock for another year or so I think

highest probability if down trend breaks with successful re-test. targets above mapped out. gap at 35$. higher probability of reversal after long consolidation/accumulation

ALI USd now outperforming nvda. let's see how strong it can play!

looks like a technical breakdown of long-term suport. will monitor for short

Long the Dollar. clearly the BTC inverted chart is re-testing the downtrend and moving upwards now