vicariuzchrist

EssentialHello guys... i wish you have a good trading days so far. I will give you my analysis for GOLD in current condition. I need you to see my analysis before so you have complete understanding about GOLD movement. Fundamental Factor that Moves GOLD 1. As we all know, last weekend there is a conflict between Hamas and Israel after 2 month's ceasefire. It's not a...

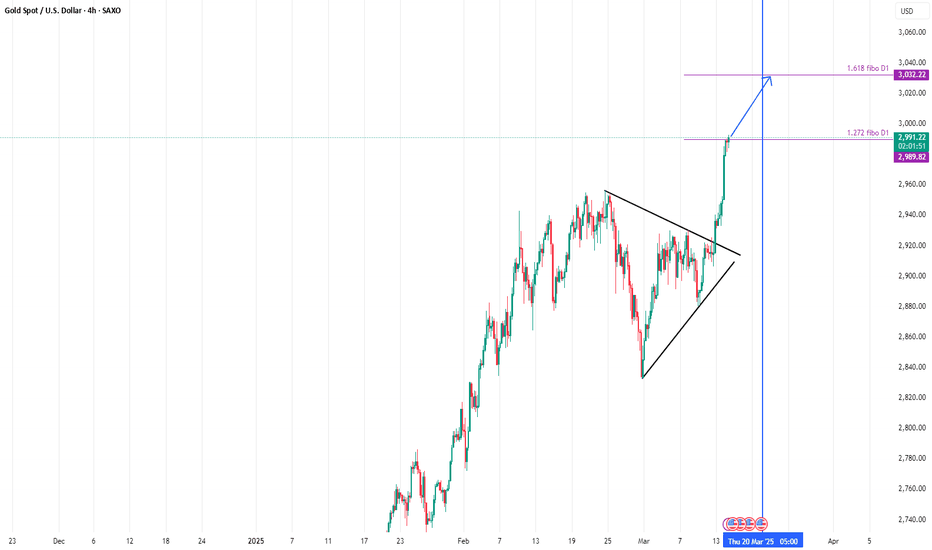

GOLD currently trade at $2987 when i write this idea. GOLD bullish momentum started when CPI data released followed by PPI data. Both of data show inflation slowdown. Last Tuesday, job opening data also showed us a neutral level and we can conclude that the labor market is still in slow pace. A week ago NFP also showed us weak data and slow down in labor market....

Dollar seems on hold in it's 2.618 fibonacci support after NFP data released. Will it go higher next week? I see dollar still waiting next data release. I mention JOLTS Job Opening & CPI which both of them crucial in current context of US macro-economy. Strong job opening & CPI means investor and retail trader must be no worries about US macro-economic despite...

GOLD now seen climbs to it's last ATH. Technically, GOLD just made a minor wave and stopped just at 38.2 fibonacci TF H1. I see GOLD still high chance to reach it's last ATH and still have rooms to make a new ATH again. Current geopolitical and trade war sentiment just boost gold. Traders also can check dollar index which move lower amid strong inflation data....

A week ago BOE just cut it's rate by 25 bps and still have possibility to continue it's normalization cycle. Yesterday we saw GDP m/m actual data higher than expected and it's good for currency. YoY inflation rate also still in control and it's also good for currency. Technically, the bullish momentum just paused by trendline resistance and classical resistance....

GOLD sees last All Time High as Trump speech last night. He said that inflation must be in cooling condition. Now the sentiments are positives for this non-yielding assets and buyers still in control. Next big moment that traders should care is FOMC in the end of January. If FED still hold it's decision in last FOMC and keep high rates, GOLD price could be...

As you can see in the chart, GOLD still climbs higher and higher. Now, i see 2753-2757 as resistance for safe haven commodities. I think gold price now just overbought and have some potential correction movement to 2732.xx Traders and investor may look at the end of January when the FED give speeches about their outlook. If the say they wouldn't cut interest rate...

GOLD currently move higher in the first day of 2025, continuing the uptrend momentum from the end of last year and now traded at 2634. Fundamentally, CME FED Watch Tools still eyeing for two cut rate this year and this could boost GOLD a little bit higher or make a wide-range sideways movement. Technically, i see GOLD still in a sideways condition now with smaller...

US DOLLAR potentially continue it's strong bullish movement as several economic data released last week show us strong labor and inflation is still under control. This week we will face FED Meeting on 18 Dec and FED FUND FUTURES gives 96% number of lower rates (425-450 bps). In general, interest rate cut will give a weak movement for dollar. But, as a good...

Don't forget to check my previous analysis. Afer gold edges up to 2,05% since break out from wide sideways range, finally it's close to resistance area in 2719-2722. Technically, i see classical resistance which it's a LH from D1 chart. It's a invalid seller to hold short position for a longer time. Seller must be exit from market if this level broke up. I also...

SAXO:XAUUSD moves higher from Asian to Europe session and seems continue to catch 2670. As middle east tension continue spark, investor and trader likely hunt the safe haven assets especially GOLD. Another fundamental reason is FED Cut Rate cycle probability which now on 80% 0.25bps cut this month. On the technical analysis side, GOLD now testing the sideways...

SAXO:XAUUSD Technical Analysis gives us clue for GOLD to move higher and higher. We can see in M30 chart that bullish pennant already made and GOLD continue to make a breakout movement. In H4 chart we can see a trendline resistance also already tested. Now GOLD just test a fibbo daily resistance at 2675-2677. Confirm BUY if it's body in H4 already break it. As...

AUDUSD currently traded in the downtrend movement. As we see in the weekly chart, the downshift movement starts from October as USD move stronger belong to strong economic data followed by investor's optimism of second Trump Presidential era. Tomorrow, 10/12/24 RBA would give us signal about it's interest rate. Consensus is 4,35% and we may anticipate the...

TVC:DXY currently traded higher after strong economic data last Friday. NFP data told us that US labor market remain strong. We also can see at Tuesday Job Opening data which showed us "higher than expected - higher than previous month" and finally drives the price up. At the last speech, Powell also said that FED isn't in a rush condition to reduce the interest...