wallstreetloser001

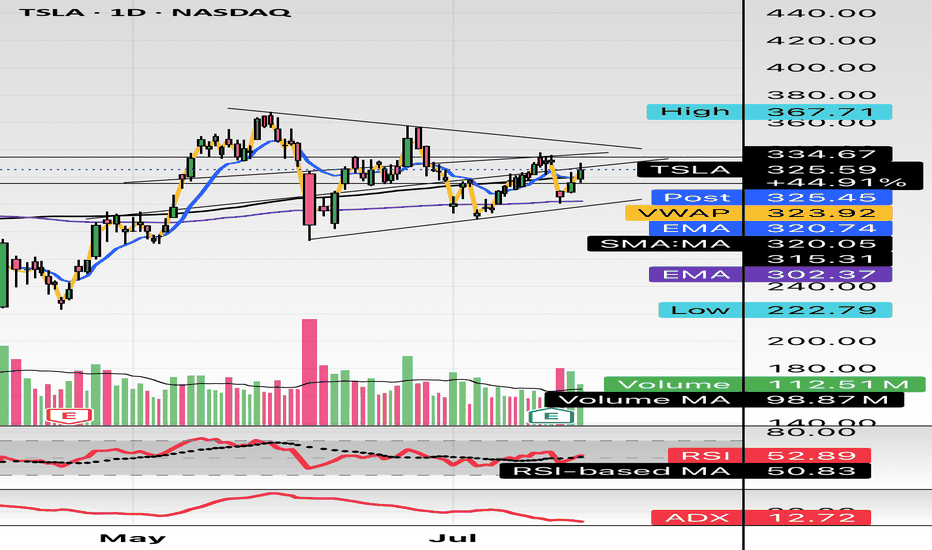

PremiumHello, Just some browsing, NASDAQ:TSLA hasn’t had any major moves prior to early May - June IMO. This is on my watch for a short swing setup. This is bull flagging but I see a short here. I’m conflicted. I do see the higher low but we are in a pitchfork and this has been consolidating in this $290-$340 area for about a month and half. There’s also a lower...

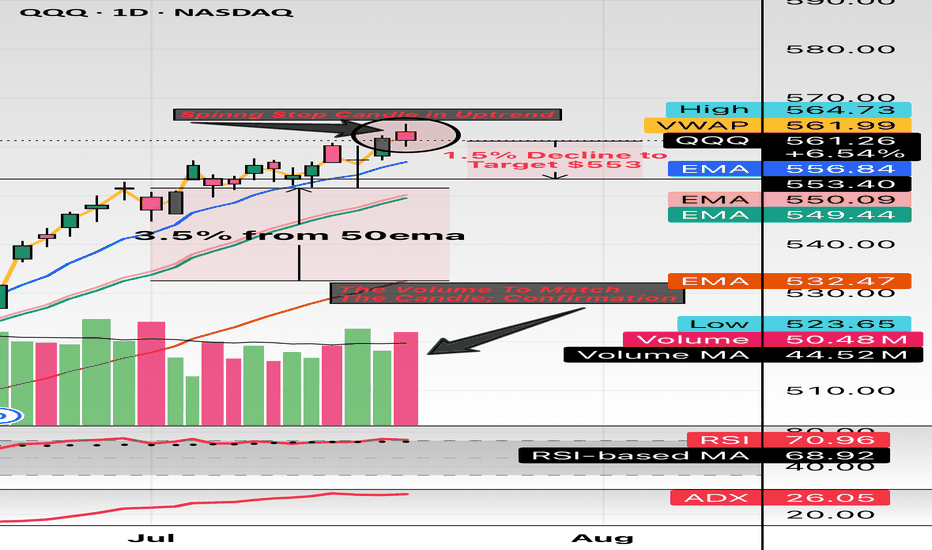

Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY. Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop candle and has volume to match. These candles usually take place...

Called this out at $105 in minds. This Monthly declining volume, support at $100, and uptrend pattern. China will boom into the end of Q3 and early 2026. Target is $180 and $200. WSL.

Hello, extensive chart here: Daily and Weekly. Looking at this name I like the setup here. The Daily and Weekly chart shows strength in this area, $8 to $9 with heavy accumulation and support. The Weekly chart shows about 13 weeks of this bottoming area with tons of buying from previous years as well. NYSE:SNAP has earnings July 25th and I will be looking to...

Hello, This name is interesting. I will be doing more research and due diligence along with asking some of my peers what they think. This name has seen increasing volume for a while now, daily moves of 5%, 10%, etc. Do you guys have any thoughts? Long term buy and hold? I randomly found this ticker a month ago just browsing.. talk to me in the comments and let me...

Hello. Market is moving up off the “news” of “ceasefire” from Trump. Take what is given I suppose. NASDAQ:NVDA could see a beautiful upside towards the psych level of $150 in just one session (Tuesday, 6/24) which is just a “small” move of 3%. Could break out of its rising wedge. This name has been lackluster as of late (kinda sorta). $150 calls will be entered...

Hello, quick mobile chart posting here. Simple looking bear flagging forming. Bitcoin having some downside action, I imagine Saylor will be buying some Bitcoin soon again as well. This should see $350. Looking for a short. + geopolitical turmoil hits crypto/Bitcoin the hardest and most violent. The 20 and 50 EMA are aligned as well with the Supertrend Downtrend...

Hello, NASDAQ:AMD Advanced Micro Devices, INC looks TASTY. I'm almost salivating. NASDAQ:NVDA may take a backseat and NASDAQ:AMD could start seeing monster upside. Something in my gut is telling me this name wants to GO. I'm looking at $120c for 6/20 and $130c for 6/20. This thing can launch.. it's hanging on an upside trendline, it may break but this $110...

Hello, this seems to be the "BUY THE DIP!" name definitely on the retail side. A guy once told me, if everyone is talking about getting into something, buying something, it might be a good time to sell and get out of that something. Example: I have been buying Bitcoin for five years, the price has risen and now everybody is talking about Bitcoin, that might be a...

Hello, NYSE:FI Fiserv evidently got hammered to the downside the last month and last few months the name is down 30% from it's all time high from March 2025 and last month and change it is down 25% or so after downgrades. I have been watching the name the last week or so and I was looking for a drop into a zone of activity in the $152-$154 but it seems that...

Hello, I have multiple time frames up here: Daily, Weekly, and Monthly. I love Robinhood NASDAQ:HOOD as a broker, product and revolutionary company in the financial space. This is a great long term hold equity wise in my opinion but right now I am looking to short this name for a necessary pullback into $58-$60. It's overbought on the big time frames as you can...

(Sorry for mobile charts/posts) NASDAQ:COST Hello, looking at multiple time frames on Costco I am going to take a stab at a short. This name isn’t unfamiliar with big moves so an 8% to 10% move could take place here on earnings forecast. Granted, they could not divulge any details but I think that wouldn’t be good and amidst the tariff rhetoric which has been...

This name seems to have lost steam. I’m all for Saylor and what he believes in but currently this feels set up for a nasty short. Strategy has had numerous monster days to the downside and upside. This thing had a $150 intraday swing off its $550 high. Tomorrow, 5/23, I am going to enter a possible 5-7% short that expires 5/23. Just a quick idea here as I can’t...

Hello. Not much analysis here besides a monster gut feeling. NYSE:SNOW has earnings May 21. I’m looking to get in $200c for May 16 expiration. For some reason this name can’t scorch $200 and I believe it should. If NASDAQ:CRWD moves the way it does so can $SNOW. I think it’s made a strong support and mental level at $150. I was apart of the latest push to...

NASDAQ:GOOGL You tell me. This looks so ready to go back below $150. My target is $152. I am entering puts right now with a strike price of $150 for 6/20 starting at $1.33 entry. I will add some on a push towards $167-$168. I will give up if it pushes through or holds at $170. This just looks to good TECHNICALLY in my opinion. I will keep you updated. I am...

Little hammer candle on some nicely oversold conditions with my moving average just below the RSI on the Daily. I like this for a $380 test. With a break through you could see $405-$408. Eyeing $380 calls a week or two out. WSL

I'm looking to swing some $34 or $35c 2 weeks out. The volume pattern seems to be more accumulating rather than selling even after an abysmal and confusing earnings. This name loves to pump 7%, 9%, 10%.

Interesting setup here. Looks pretty good IMO. Software is a great name to look at in this market environment. It has a nice support at $20, even at large volume here it’s holding nicely so it shows relative strength. This name is definitely bullish long term. I’m in $21.5c for 2 weeks out, this is a high IV% name. Can run 10% in a day, 20% in a week, etc. We will...