wilsonkfx

Mapped out a few options to look out where buys are probably more likely given the bullish price since the open. A change of structure to the downside would be a stronger indication for me that maybe sells could be a inplay this morning. I am not super keen on options within my Asian range on the first day of the week so I will be patient No actual trades taken...

Swing idea on Oil using trend lines as a way of managing downside and trailing stop in profit 4h time frame only

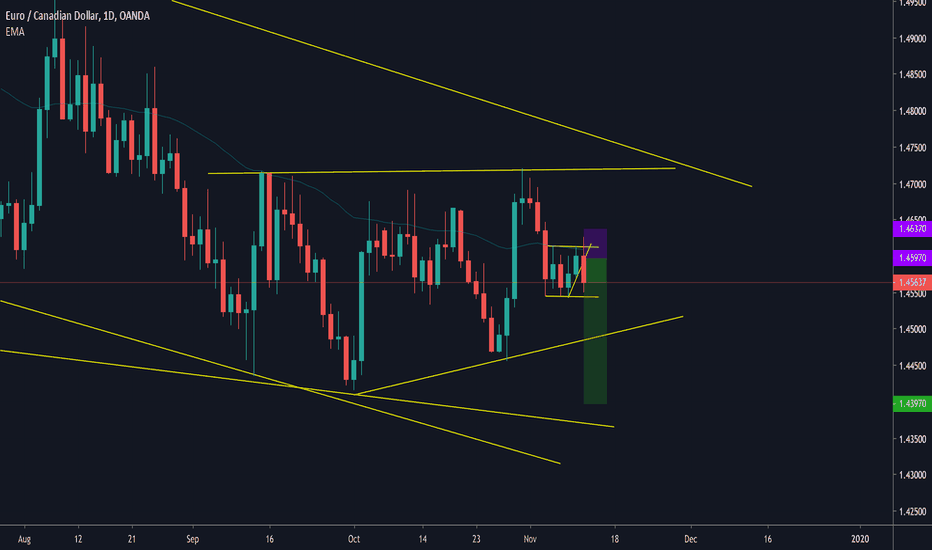

Higher supports forming across multiple time frames and the trend is to the upside Buys make more sense in this situation

Price has been moving down on the 30m and 4h chart creating lower highs and lower lows but this morning price broke the most recent resistance indicating a possible change in structure. This was confirmed with a higher support on the 30m chart which means trading this time frame alone I would be looking for buying opportunities. It is nice confluence to see this...

GBP/JPY - Longer term idea - 60 minute chart Idea is based on remaining within this hourly zone to test the top of the range with potential continuation up and out of this zone. If price does leave the zone closing below the support I would be looking for a higher support to form and price to then close back inside the zone Management areas would be the hourly support

Higher timeframe bullish trend Higher timeframe MA support Impulse, correction in form of flag, buy the continuation Breakout and retest of descending channel on the hourly with MA support Target outer structure

Weekly looks very bearish - Coming from an impulse, correction, continuation in the form of an impulse, i can see this pair now start to come lower - Very bearish week so far after being stuck in a range - Looks like price may come and retest the 1.73250/ Daily MA - Target area is bottom of channel however the weekly suggests we may come a lot lower

- Impulse, correction, continuation - Higher time frame down trend - MA respected on the daily, break and retest to the MA which is very obvious - 4 hour correction, 2 bottoms, 2 highs, corrective nature to the high Main interest on this trade was the respect price was giving the MA after an impulsive break below, unable to close above in 4/5 days and a valid...