** The year ahead ** On the above 6 day chart price action has corrected over 50% since December 2023. A number of reasons now favour a long position, they include: 1. Price action and RSI resistance breakouts. 2. Support on past resistance. 3. Double bottom on price action (yellow arrows) 4. Falling wedge breakout confirmation with forecast to $300 area 5. The...

The Nasdaq 100 index is seriously oversold as market participants are gripped by fear. Understandable… however, markets do not crash in fear. Instead the opposite happens, counterintuitive as that sounds. The Index shall continue display volatility until sellers are exhausted, which is around April 30th when the bottom shall print. So yeah, this week is probably...

On the above monthly chart price action has seen a nice 25% rise since November 2023. A number or reasons now exist to be bearish. Incidentally, with all the recently published ideas on Tradingview, Without Worries appears to be the only one who is bearish. The reasons? 1) Broken market structure confirmation. 2) Active price action resistance. 3) Rising...

Last night (April 13th) the Mantra (OM) project saw its market capital drop from $6.11B to $419m! ============================================ From the team ============================================ JP Mullin (CEO of @MANTRA_Chain) remarks at BTCON RWA Summit today on CRYPTOCAP:OM price action overnight • No exploit or hack • No active selling from MM...

It is no secret.... Without Worries maintains a negative outlook on underdeveloped legacy crypto projects. Legacy refers to projects that have been around since 2017 with little to no development since that time. And yet they all continue to attract a significant number of long ideas. To name a few from 2017 price action to present day: Dash $108 versus $23 EOS....

Despite the chaos with Credit Suisse European banks in General are printing some excellent setups. What is the reason for this? No idea. On the above 2-month chart: 1) A strong buy signal (not shown) prints with price action breakout from resistance that has been active since 2007. 2) Regular bullish divergence. No less than eight oscillators this time. Four to...

No doubt everyone has heard a variation of the phrase: “Sell in May, return another day.” In Wikipedia it is written: “Sell in May and go away is an investment strategy for stocks based on a theory (sometimes known as the Halloween indicator) that the period from November to April inclusive has significantly stronger stock market growth on average than the...

On the month of August 2023 at a price of $4 Without Worries published “Bounce Token (Auction) to $40” (see below / green triangle on chart above). Price action went 10x over the next 120 days. Almost worth getting out of bed for. Then the idea “Auction to $16” (see below / red triangle) was published at $45 on December 2023. Price action corrected to $7. Overall...

The recent completion of a Cup and Handle pattern on Gold price action leaves an open question about the historical performance after such a technical formation plays out. While Cup and Handle patterns are generally considered bullish, there are legitimate historical reasons to question maintaining a long position after the pattern completes. Pattern completion...

On the above 5 day chart price action has corrected almost 70% since the year began. A number of reasons now suggest a reversal in trend, they include: 1. Price action and RSI resistance breakouts. 2. A significant confirmation that legacy downtrend breakout now acts as support. 3. Price action confirmation horizontal support. 4. Forecast to broken market...

** short term analysis, the days ahead ** Short version: Very positive. Long version: The Death Cross prints tomorrow, April 7th, 2025. For many retail traders who use moving averages the read will be highly negative. However history tells us that is rarely true. What is a death cross? 1. The 50 day SMA (Simple Moving Average - blue line) crosses down the...

Short answer: Bitcoin By the year end Bitcoin shall enjoy stronger gains. That is despite the 2-week Gravestone DOJI candle now currently printing on Bitcoin, which makes you wonder… what heinous price action awaits gold bugs? On the above 3-day chart a ratio of Gold/Bitcoin is shown. If this ratio is downtrending (it is), Bitcoin will be worth more than Gold...

Currently Without Worries has a higher timeframe “short” opened on Ethereum since $3800. It was not popular. (see idea below - By the way, 32 likes 2.7k views? You want me to keep posting or not?! Like to let me know otherwise off I go!) Corrections in price action are never in a straight line, just as within a bull market. At this moment in time on the above 8...

** The months ahead ** After decades of semiconductor dominance, Intel faces unprecedented threats to its business model. AI computing revolution, manufacturing missteps, and relentless competition from AMD and NVIDIA have created what some analysts call "a potential death spiral" for the tech giant. The floor could be much lower than anyone realises, especially...

On the above 4-day chart price action has corrected 96% since November 2021. A recession is coming, everyone is talking about it… that can only mean one thing, sellers are ready drop the price action the remaining 4% to $0 But what if…. What if price action prints a 6000% upward move instead? Based on the technical chart for MANA/USDT (where the volume is...

The charts are suggesting caution. On the above 10-day chart: 1) Double top in price. 2) Regular bearish divergence. The higher the timeframe you look the more ugly this divergence is. Laterally I’m wondering if the small banking crisis that hit the US is now venturing to other parts of the world. OmaSp does not appear to be in isolation. There were some...

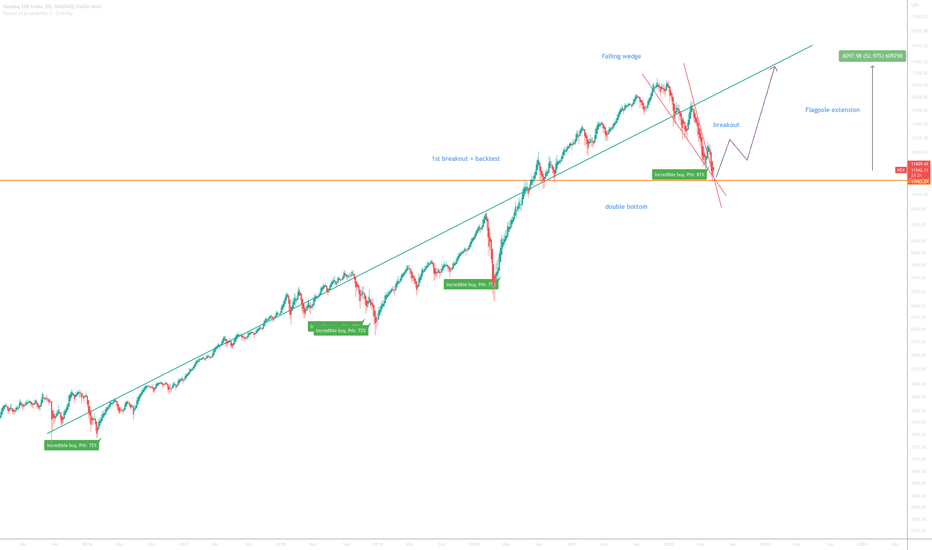

On the above 3-day chart price action has corrected 33% since late December. A number of reasons now exist to be bullish, including: 1) The ‘incredible buy’ signal has printed. Look left. 2) The buy signal is coming in at 81% probability. The previous were 75%, 72@, & 72% percent, respectively. Look at the strength of if a 75% recovery, what do you think a 81%...

On the above 2 week chart Gold price action has completed the much anticipated Cup and Handle forecast to $2700, which was where Without Worries dabbled with a “short” position and was promptly stopped out much to the bugs delight. Price action has rallied 180% since the 2016 lows, amazing. The increased Money supply / Money printing is the reason I’m often given...