yasser81

XAUUSD (Gold) Weekly - Wave Analysis Chart is Language Regards

ImmunityBio, Inc (Wave Analysis) Weekly - Update We are in downtrend wave E from Triangle corrective wave. maybe we are in last wave c or we still in diagonal wave a. So, there are 2 Scenarios. please see the chart. Regards,

ImmunityBio, Inc (Wave Analysis) Weekly We are in downtrend E wave in Triangle wave. See the Chart. Regards,

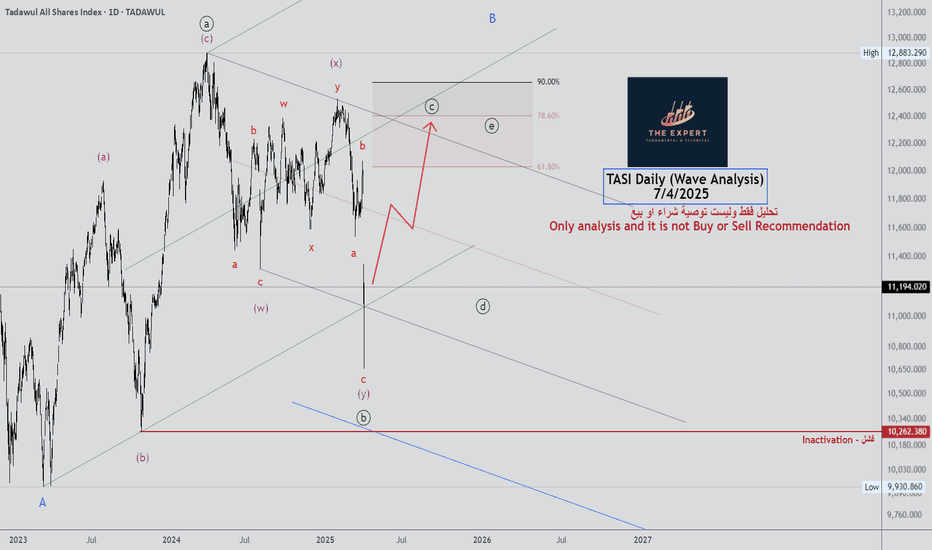

TASI Daily (Wave Analysis) as you see in chart Regards,

TASI Index W1 Scenario 1 We have 2 Scenarios both of them have same direction. Regards.

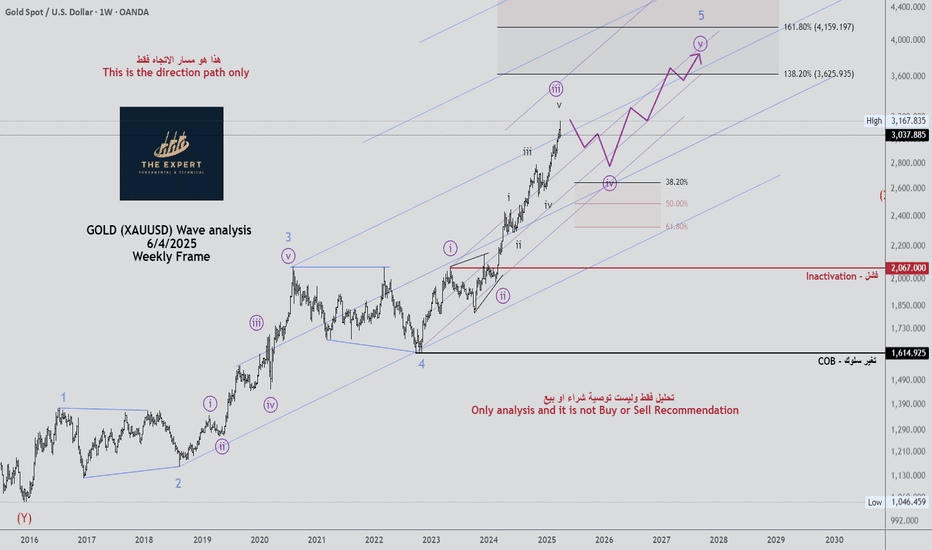

GOLD (XAUUSD) Wave analysis - Weekly Frame chart is language This is the direction path only

Bitcoin (Wave Analysis) Daily still we are in correction wave Regards,

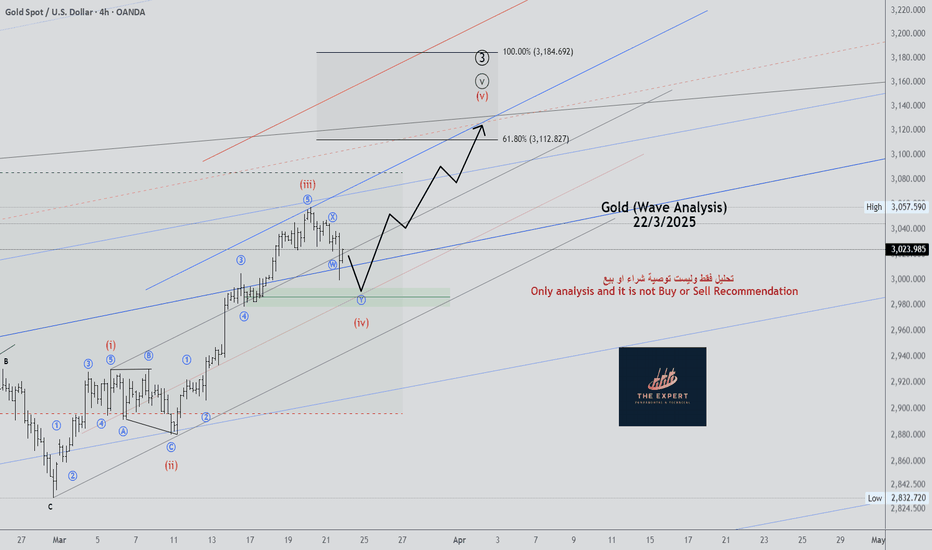

Gold (Wave Analysis) - Update we are in corrective wave and we will go to another impulse wave. Regards

Bitcoin (Wave Analysis) Daily wave 5 is start Regards,

Gold (Wave Analysis) We are in wave corrective wave regards,

TASI Daily (Wave Analysis) please see the weekly analysis wave and volume in my profile regards,

Bitcoin H4 (Wave Analysis) - Update we are in impulse wave which is c from d in triangle wave 4 Regards,

MOVE Crypto Market H1 (Wave Analysis) As shown in chart. Regards,

Lucid Inc. - H4 (Wave Analysis) NASDAQ we are in uptrend impulse wave. Regards,

AUDUSD Daily (Wave analysis) As shown in chart, 5 downtrend waves is finished and we will go to uptrend. Regards,

Bitcoin H4 (Wave Analysis - Update As shown in chart, wave 4 almost look like triangle wave and we are in wave d Regrads,

Gold D1 (Wave Analysis) As Shown in Chart, one more uptrend wave then corrective wave.

Pfizer, Inc (Wave analysis) - Daily As shown in the chart, we are in downtrend wave 5 from A or 1 Regards.