(The following is solely a personal opinion and not investment advice. Please conduct your own analysis before making any decisions.) NVIDIA's earnings report exceeded expectations, yet the market saw a sharp decline on Thursday. The price broke below 20,800, indicating weakening bullish momentum and the potential for further downside. Given the significant drop...

(This is solely a personal opinion, not investment advice. Please conduct your own judgment before making any decisions.) NVIDIA's earnings report exceeded expectations. The market has declined for three consecutive trading days, with multiple support levels below. There is a high probability of a bottoming-out rebound. If going long, the price needs to break...

Disclaimer: This is solely a personal opinion and not investment advice. Please conduct your own assessment before making any decisions. The market performance last week aligned with prior expectations. Price maintaining an upward trend from Monday to Thursday. On Friday, prices saw a noticeable pullback; however, the decline was limited and did not break the...

Last week, both CPI and PPI data came in below expectations, indicating signs of rising inflation. However, the market did not experience a sharp decline; instead, prices held above 21,432, demonstrating strong support. This market reaction suggests that seller were not willing to enter at this stage. The market maintained its uptrend, broke through previous...

(Disclaimer: The following is only a personal opinion, not investment advice. Please make your own judgment before making any decisions.) This week, the price has remained stable above 21,432. Yesterday’s CPI data came in worse than expected, indicating inflation is rising again, which may slow down the rate cut process. Despite this, the market did not break...

(Disclaimer: This is just a personal opinion, not investment advice. Please make your own judgment before making any decisions.) Last week, the market was highly volatile. Monday opened with a significant gap down due to weekend tariff news, but prices quickly rebounded with news support, recovering until Friday morning. However, after the NFP data release on...

After NFP, price continues to break upwards, with two possible scenarios: 1. The market reaches near the PMH level and is unable to break higher. Considering the current breakout consolidation pattern, if the price retraces near 21,972 and fails to break upwards, there is a high probability the price will fall back to around 20,800. If it drops below 20,500,...

Due to the price not breaking below 20,300 on Monday and Tuesday of this week, the price may attempt to break through the previous high. The short-term target is 21,800. After breaking above 21,970, attention should be given to the price movement between 21,970 and 22,136, while also monitoring whether market data and news support a further breakout. Trading...

Considering the sharp decline in the Nasdaq during the Asian session on Monday, my current expectation is that prices should break below or reach around 20,300 before a meaningful rebound occurs, followed by a continued downtrend. This week, it is crucial to closely monitor market performance and adjust strategies accordingly. Based on the price action from...

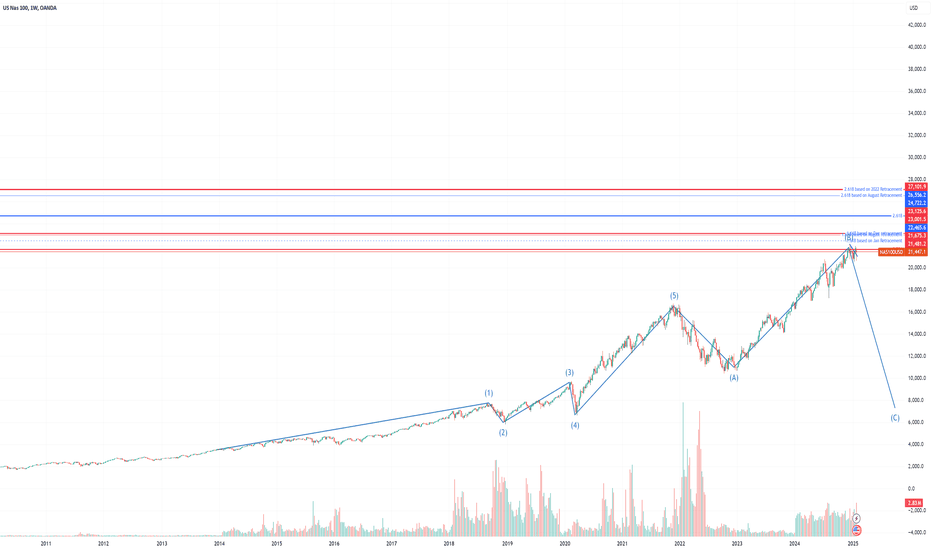

February 3–7, 2025 (The following is solely personal opinion, not investment advice. Please conduct your own assessment before making any decisions.) This is a market context update using Elliott Wave Theory. As shown in the chart, considering the Nasdaq bull market from the 2008 bottom to the present, there is a high probability that we are currently in a B Wave...