Market analysis from City Index

The RBA held their cash rate at 4.1%, and keep a May cut up in the air without any appetite to commit to one. I highlight my observations on the RBA's statement, before updating my analysis for AUD/USD, AUD/CAD and GBP/AUD. Matt Simpson, Market Analyst at City Index and Forex.com

USD/CAD closed higher for a fourth day on Monday, on the even of Trump's liberation day. It also accelerated away from its 50-day EMA after establishing support around its 100-day EMA last week. This has also seen USD/CAD break trend resistance, and a falling wedge pattern now appears to be in play. This suggests an upside target near the 1.4550 cycle...

I discuss whether the RBA will cut next week and the reasons why, before taking a look at AUD/USD, AUD/CAD, EUR/AUD and GBP/AUD charts. Matt Simpson, Market Analyst at City Index and Forex.com

Trump's tariffs are clearly not going away. In fact, he's upped the ante with a 25% tariff on all non-US cars, vowed to target pharmaceuticals and promised more are to come on April 2nd. Given the dire weakness in consumer sentiment data, I suspect Wall Street indices may have seen a swing high. Matt Simpson, Market Analyst at City Index and Forex.com

Futures traders are net-long GBP/USD futures and net-short AUD/USD futures. So it is quite fitting to see GBP/AUD in a strong uptrend, with traders now eyeing the 2020 high. However, the weekly chart suggests the current upswing may be nearing a cycle peak. A small bearish divergence has also formed on this timeframe. I am therefor seeking evidence of a swing...

The retracement higher for the US dollar is finally underway, which also shows further upside potential. And this is why I am wary of being long EUR/USD over the foreseeable future, even if I suspect it is poised to break to new highs in the coming weeks. Matt Simpson, Market Analyst at City Index and Forex.com

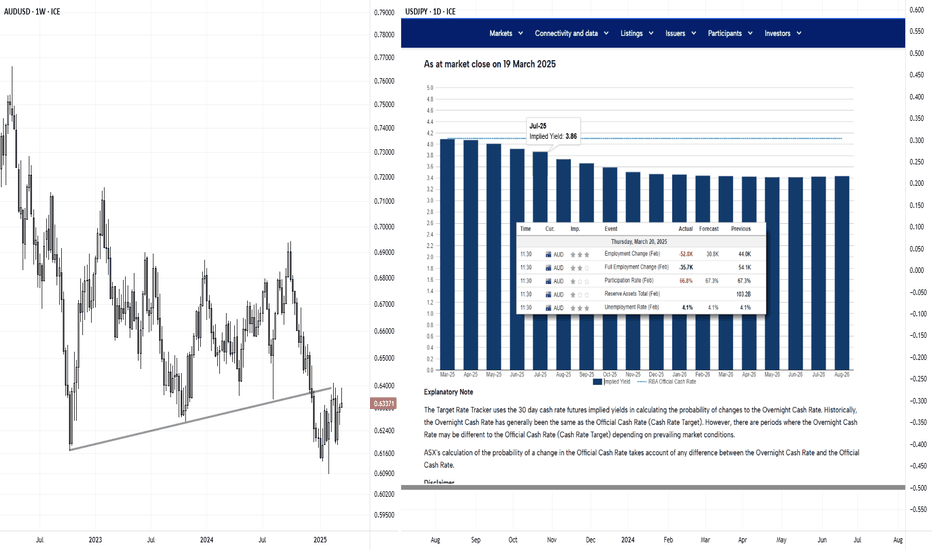

Australia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given. Matt Simpson, Market Analyst at City Index and Forex.com

I take a closer look at the Japanese yen futures market to highlight why I think the Japanese yen has reached an important inflection point. And that could further support the bounce of yen pairs such as AUD/JPY, CAD/JPY and NZD/JPY - alongside USD/JPY should the Fed not be as dovish as many hope. Matt Simpson, Market Analyst at City index and Forex.com

Bitcoin tends to track Wall Street sentiment well, particularly compared to the Nasdaq. Growing concerns that Trump's policies will tip the US (and therefore the global economy) into a recession, which currently has the Nasdaq on the ropes and bitcoin getting dragged along for the ride. And there could be further losses to follow, though a cheeky bounce at a...

A 3-wave move has developed from the January low, that for now appears hesitant to hold above 91c or its 50% retracement level. Twice we have seen false breaks of the 91c level on the daily chart, and Monday presented a bearish pinbar which closed below the 200-day SMA. Bearish divergences have also formed on the weekly and daily RSI (14) and daily RSI (2)....

The US dollar index is on track for its worst week in nearly two and a half years. It is also nearly 6% off from the January high, which is similar in depth to the two previous selloffs seen in 2023 and 2024. Yet I do not think we've seen the low just yet, even if there is evidence of a potential bounce on the daily chart. Matt Simpson, Market Analyst at City...

Currently lower for a sixth day, bitcoin futures have just tested the 200-day average for the first time this year. This clearly marks a pivotal moment for bulls and bears over the near term, but we also have to factor in the higher timeframes. Matt Simpson, Market Analyst at City Index and Forex.com

With key levels holding and bullish divergences forming, USD/JPY looks like it may want to retrace higher over the near term before its bearish trend resumes and head for the 146 - 47 area. Matt Simpson, Market Analyst at City Index and Forex.com

USD/CAD has continued higher for a fourth day, but I suspect this is part of a countertrend move around a larger move lower. Market positioning his extreme levels of record short exposure to CAD futures last year, and many of these bears refused to return despite USD/CAD continuing higher. The sharp reversal lower from 1.48 also suggests we have seen a...

After a 3-week rally which stalled around the 64c handle with a shooting star candle, a pullback was almost inevitable. but we have already seen AUD/USD fall for four consecutive days, and recent history shows its bearish streaks tend to max out at five down days. Given support is nearby and the AU-US 2-year yield is rising, I am now seeking a swing low around the...

Even as recently as two weeks ago, the thought of fed cuts were in the distant past. Yet a slew of weak data from the US since Friday including two consumer sentiment reports and a surprise PMI miss has seen markets reconsider a 25bp Fed cut in June. Today I cover bond yields, the US dollar index and futures exposure to update my dollar outlook. Matt Simpson,...

The ASX 200 futures market has fallen close to 5% from its all-time high, with 5 of the 7 candles since the top being bearish. However, the daily RSI (2) reached oversold on Friday, a bullish pinbar formed on Monday and a small bullish divergence is now forming on the daily and 1-hour chart. The pinbar low also found support at a weekly VPOC (volume point of...

This is a bit of a scrappy chart, but I still see the potential for a cheeky bounce. WTI crude oil is trying to snap a 4-week losing streak, by stalling around a 50% retracement level. Last week's candle was an inverted hammer, and the previous two weeks have both closed above the 50% level. A bullish divergence formed on the daily RSI (2) ahead price action...