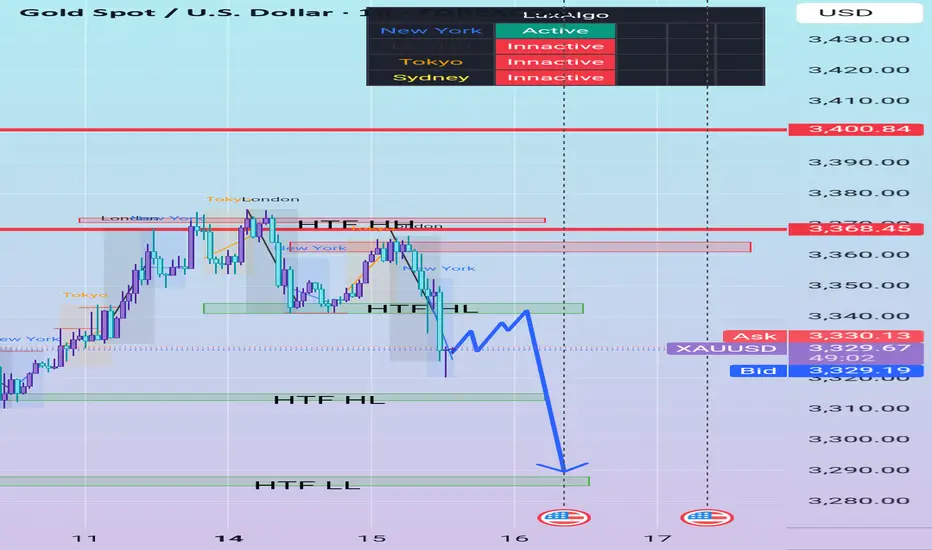

Timeframe: 1H

Session Context: Currently in New York, with London having just closed. Liquidity sweeps from London/NY overlapping zone are in play.

Step 1: Indication

HTF structure broke bullish to bearish with a clear break below a HTF Higher Low (HL) around 3,343–3,345.

This confirms Indication of bearish intent as market structure shifted from bullish → bearish.

The recent Swing High (3,368) was followed by strong selling momentum, showing institutional interest near previous liquidity pools.

Step 2: Correction

Price has retraced to test minor demand around the previous HL zone (green box).

Expecting liquidity collection above this area to trap late buyers and induce sellers.

The market is currently in Correction—a necessary pause after the break in structure to rebalance orders before continuation.

Step 3: Continuation Projection

If price respects the 3,343–3,345 correction zone and fails to reclaim the HTF HL:

Expect a lower high to form.

Entry would be ideal on a 5M–15M confirmation inside this corrective structure (lower timeframe BOS or SMC entry).

Targeting the HTF Lower Low (LL) at ~3,290, with potential for extended move toward 3,275 if NY volatility sustains.

Summary

Bias: Bearish

Reason: Structure Break (Indication), Pullback (Correction), Anticipating Downside Continuation

Confluences:

HTF Structure Break

Previous liquidity sweep from London

NY session volatility

Correction stalling beneath broken HL

Invalidation: A clean 1H close above 3,345–3,348 would invalidate the bearish bias and suggest a deeper retracement or reversal.

Session Context: Currently in New York, with London having just closed. Liquidity sweeps from London/NY overlapping zone are in play.

Step 1: Indication

HTF structure broke bullish to bearish with a clear break below a HTF Higher Low (HL) around 3,343–3,345.

This confirms Indication of bearish intent as market structure shifted from bullish → bearish.

The recent Swing High (3,368) was followed by strong selling momentum, showing institutional interest near previous liquidity pools.

Step 2: Correction

Price has retraced to test minor demand around the previous HL zone (green box).

Expecting liquidity collection above this area to trap late buyers and induce sellers.

The market is currently in Correction—a necessary pause after the break in structure to rebalance orders before continuation.

Step 3: Continuation Projection

If price respects the 3,343–3,345 correction zone and fails to reclaim the HTF HL:

Expect a lower high to form.

Entry would be ideal on a 5M–15M confirmation inside this corrective structure (lower timeframe BOS or SMC entry).

Targeting the HTF Lower Low (LL) at ~3,290, with potential for extended move toward 3,275 if NY volatility sustains.

Summary

Bias: Bearish

Reason: Structure Break (Indication), Pullback (Correction), Anticipating Downside Continuation

Confluences:

HTF Structure Break

Previous liquidity sweep from London

NY session volatility

Correction stalling beneath broken HL

Invalidation: A clean 1H close above 3,345–3,348 would invalidate the bearish bias and suggest a deeper retracement or reversal.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.