Market Review

Spot gold bottomed out and rebounded in the early Asian session. Affected by the US-EU trade agreement, the safe-haven demand weakened at the beginning of the session. The gold price once fell to the $3,320 mark, and then bargain hunting intervened to promote the rebound. It is now trading around $3,335/ounce. This week, the market focuses on risk events such as the Fed's interest rate decision, US PCE data and geopolitical situation.

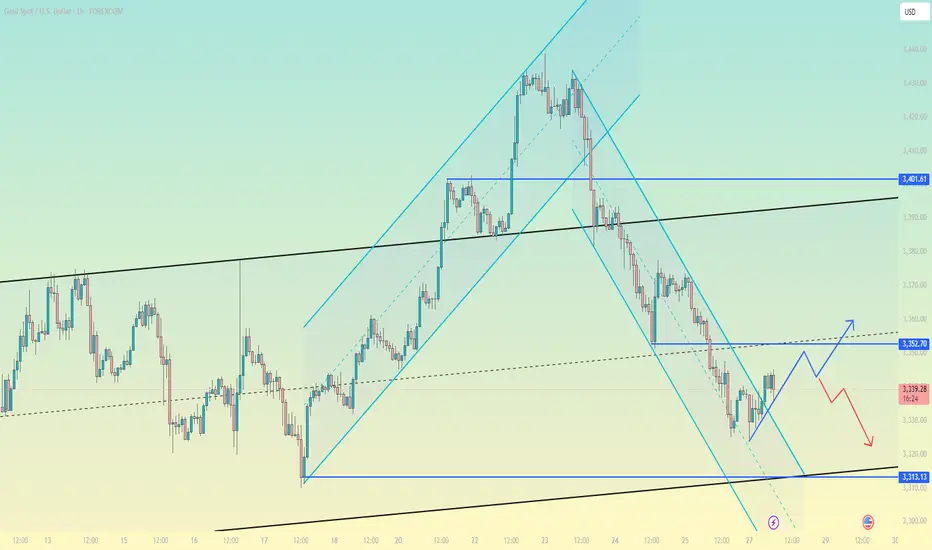

Technical Analysis

Trend Structure

Weekly level: The overall bullish trend has not changed, and the key strength and weakness dividing point is at $3,355. After breaking through, it can look up to $3,380-3,400, or even $3,430; if under pressure, it will maintain low fluctuations.

Daily level: Long and short tug-of-war is obvious, and it fluctuates in the range of 3440-3320. The Bollinger Bands are not open, indicating that the trend is pending. The key support below is $3,285, and the upper resistance is $3,400.

Short-term key position

4-hour chart: rebounded from the bottom in the morning. If the market closes higher, the bottom may be confirmed at the beginning of the week; if it breaks 3320, the support of 3285 will be seen. Pay attention to the breakthrough of the support area of 3310-3300 and the resistance of 3355 during the day.

Operation strategy

Bull opportunity: light long position when it falls back to 3325-3327, stop loss 3319, target 3340-3345.

Short opportunity: short near the rebound of 3350, stop loss 3357, target 3340-3330.

Risk warning: The market may diverge before and after the non-agricultural data this week. The technical side will be the main factor at the beginning of the week, and the data shock should be guarded in the second half of the week.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.