Gold intraday analysis involves examining the price movements of gold within a single trading day to identify potential trading opportunities. Traders and analysts use various technical tools and indicators such as moving averages, Bollinger Bands, Relative Strength Index (RSI), and candlestick patterns to gauge the market sentiment, momentum, and potential price direction for gold.

This analysis typically includes:

Market Sentiment: Assessing global economic factors, geopolitical tensions, and currency movements, particularly the U.S. dollar, which often inversely affects gold prices. News events and central bank activities are also crucial in shaping intraday price trends.

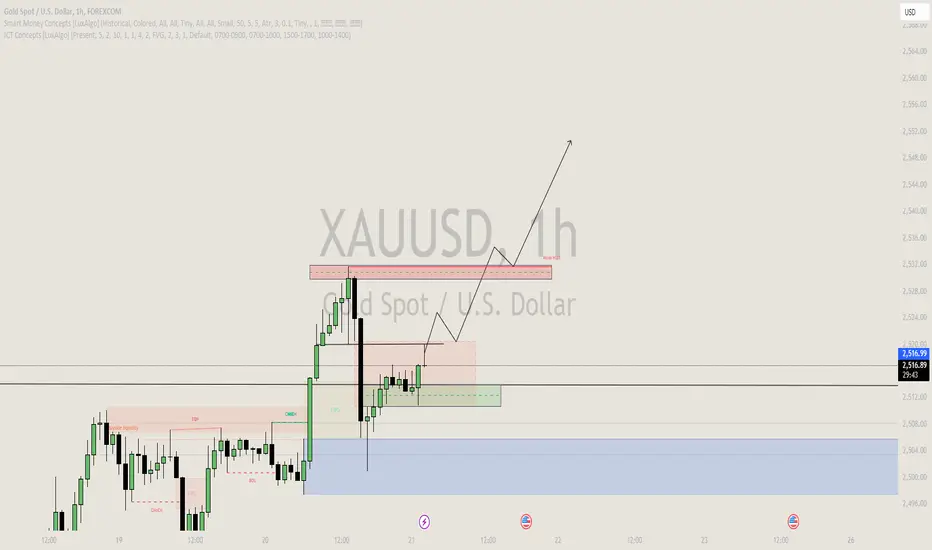

Price Action: Observing gold's price movements on an hourly or even minute-by-minute basis. Analysts look for patterns like breakouts, reversals, and consolidation phases, which provide insights into short-term price behavior.

Volume Analysis: Monitoring trading volumes to confirm price trends or reversals. Higher volumes often signify stronger trends, while lower volumes may indicate potential reversals or weak trends.

Support and Resistance Levels: Identifying key price levels where gold tends to find buying support or selling resistance. These levels help traders set entry and exit points for intraday trades.

Technical Indicators: Utilizing tools like the Moving Average Convergence Divergence (MACD), RSI, and stochastic oscillators to predict potential entry and exit points based on overbought or oversold conditions.

Risk Management: Establishing stop-loss levels and position sizing to manage risk, given the volatility inherent in intraday trading.

This analysis typically includes:

Market Sentiment: Assessing global economic factors, geopolitical tensions, and currency movements, particularly the U.S. dollar, which often inversely affects gold prices. News events and central bank activities are also crucial in shaping intraday price trends.

Price Action: Observing gold's price movements on an hourly or even minute-by-minute basis. Analysts look for patterns like breakouts, reversals, and consolidation phases, which provide insights into short-term price behavior.

Volume Analysis: Monitoring trading volumes to confirm price trends or reversals. Higher volumes often signify stronger trends, while lower volumes may indicate potential reversals or weak trends.

Support and Resistance Levels: Identifying key price levels where gold tends to find buying support or selling resistance. These levels help traders set entry and exit points for intraday trades.

Technical Indicators: Utilizing tools like the Moving Average Convergence Divergence (MACD), RSI, and stochastic oscillators to predict potential entry and exit points based on overbought or oversold conditions.

Risk Management: Establishing stop-loss levels and position sizing to manage risk, given the volatility inherent in intraday trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.