With the Fed's tariff decision approaching, can gold see a turnaround?

Gold Outlook: The Current Bull-Bear Game Amid Three Major Storms

Key Event Drivers

Countdown to US-China Tariff Exemptions (August 1): The negotiation deadlock is difficult to break, but an "extension" could be a temporary respite for both sides. Be wary of Trump-style abrupt shifts that could impact market sentiment.

Federal Reserve Interest Rate Decision (Thursday): A consensus is for holding steady, but if Powell unleashes a hawkish outlook on expectations management, gold could face further pressure—the market currently has little illusion of a dovish Fed.

Non-Farm Payroll Data (Friday): ADP provides a preliminary analysis. If the job market remains hot, the 3,300 mark will face a severe test.

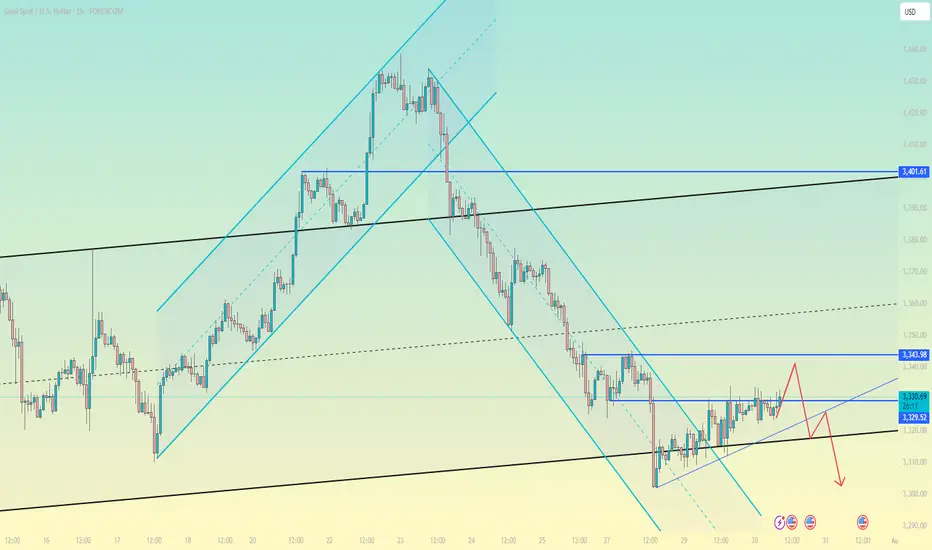

Key Technical Dividing Points

Bull resistance: 3280 (July double bottom neckline) + 3300 (psychological barrier); a break opens up downside potential.

Bear support: 3345 (price point) + 3336 (5-day moving average); a breakout will alleviate the downward trend.

Current scenario: After Monday's breakout above 3320, which induced buying, the market has shifted into a "short on rebound" mode. However, be wary of the Fed's "selling expectations, buying facts" strategy—if gold prices remain above 3300 after the decision, short-covering could be triggered.

Trading Strategy

Keynote: Focus on long positions, bottom fishing requires stringent conditions.

Aggressive short positions: Open a position near 3345, stop-loss at 3355, target 3320 (profit-loss ratio 1:2.5)

Long position on the left: Only try long positions with a small amount after stabilization in the 3280-3300 range, with a strict stop-loss below 3275.

"Gold is currently walking a tightrope, with the Federal Reserve's hawkish stance on one side and the lifeline of geopolitical risks on the other. Before the data dust settles, any chasing orders is a gamble—either wait for a breakout above 3345 and a strong rally, or wait for a long lower shadow at 3280 after a panic sell-off. Otherwise, hold onto the high side and participate in the market."

Gold Outlook: The Current Bull-Bear Game Amid Three Major Storms

Key Event Drivers

Countdown to US-China Tariff Exemptions (August 1): The negotiation deadlock is difficult to break, but an "extension" could be a temporary respite for both sides. Be wary of Trump-style abrupt shifts that could impact market sentiment.

Federal Reserve Interest Rate Decision (Thursday): A consensus is for holding steady, but if Powell unleashes a hawkish outlook on expectations management, gold could face further pressure—the market currently has little illusion of a dovish Fed.

Non-Farm Payroll Data (Friday): ADP provides a preliminary analysis. If the job market remains hot, the 3,300 mark will face a severe test.

Key Technical Dividing Points

Bull resistance: 3280 (July double bottom neckline) + 3300 (psychological barrier); a break opens up downside potential.

Bear support: 3345 (price point) + 3336 (5-day moving average); a breakout will alleviate the downward trend.

Current scenario: After Monday's breakout above 3320, which induced buying, the market has shifted into a "short on rebound" mode. However, be wary of the Fed's "selling expectations, buying facts" strategy—if gold prices remain above 3300 after the decision, short-covering could be triggered.

Trading Strategy

Keynote: Focus on long positions, bottom fishing requires stringent conditions.

Aggressive short positions: Open a position near 3345, stop-loss at 3355, target 3320 (profit-loss ratio 1:2.5)

Long position on the left: Only try long positions with a small amount after stabilization in the 3280-3300 range, with a strict stop-loss below 3275.

"Gold is currently walking a tightrope, with the Federal Reserve's hawkish stance on one side and the lifeline of geopolitical risks on the other. Before the data dust settles, any chasing orders is a gamble—either wait for a breakout above 3345 and a strong rally, or wait for a long lower shadow at 3280 after a panic sell-off. Otherwise, hold onto the high side and participate in the market."

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.