Candlestick Cheat Sheet You Must To Know➡️ Hi Trader's Whats Up Today ? Am Feel Good With New Education Post Will Inform You Many Details About Candles And Price Action ..

Let,s Start With " Bullish Candle Stick Patterns " ✅⬆️✅

1- Hammer

2- Inverted Hammer

3- Dragon Fly Doji

4- Bullish Spinning Top

5- Bullish Kicker

6- Bullish Engulfing

7- Bullish Harami

8- Tweezer Bottom

9- Morning Star

10 - Morning Doji Star

11 - Three Line Strike

Next Wave Will Be With " Bearish Candle Stick Patterns " ✅⬇️✅

1- Hanging Man

2- Shooting Star

3- Grave Stone Doji

4- Bearish Spinning Top

5- Bearish Kicker

6- Bearish Engulfing

7- Bearish Harami

8- Tweezer Top

9- Bearish Abandoned Baby

10 - Three Black Crows

11- Evening Doji Star

That' All My Friends And Show You In New Post ❤️

Candlestickpattern

Top candlestick Patternshello everyone.

we have the more important candlestick patterns here.

these patterns are powerful when occur in 2 situation together:

1)on top or bottom of a trend

2)when we are at an important support or resistance level.

combination of these patterns with other technical patterns and tools

can be very useful and powerful also.

hope have good trades.

Most Popular Types Of Candles How to Read Candlestick charts?

Candlestick charts were originated in Japan over 100 years before the West had developed the bar charts and point-and-figure charts. In the 1700s, a Japanese man known as Homma discovered that as there was a link between price and the supply and demand of rice, the markets also were strongly influenced by the emotions of traders.

A daily candlestick charts shows the security’s open, high, low, and close price for the day. The candlestick’s wide or rectangle part is called the “real body” which shows the link between opening and closing prices.

This real body shows the price range between the open and close of that day’s trading.

When the real body is filled, black or red then it means that the close is lower than the open and is known as the bearish candle. It shows that the prices opened, the bears pushed the prices down and closed lower than the opening price.

If the real body is empty, white or green then it means that the close was higher than the open known as the bullish candle. It shows that the prices opened, the bulls pushed the prices up and closed higher than the opening price.

The thin vertical lines above and below the real body is knowns as the wicks or shadows which represents the high and low prices of the trading session.

---------------------------------------

1- Hammer Candle

Hammer is a single candlestick pattern that is formed at the end of a downtrend and signals a bullish reversal.

The real body of this candle is small and is located at the top with a lower shadow which should be more than twice the real body. This candlestick chart pattern has no or little upper shadow.

The psychology behind this candle formation is that the prices opened, and sellers pushed down the prices.

Suddenly the buyers came into the market and pushed the prices up and closed the trading session more than the opening price.

This resulted in the formation of bullish pattern and signifies that buyers are back in the market and downtrend may end.

Traders can enter a long position if next day a bullish candle is formed and can place a stop-loss at the low of Hammer.

-----------------------------------------

2- Hanging Man

Hanging Man is a single candlestick pattern which is formed at the end of an uptrend and signals bearish reversal.

The real body of this candle is small and is located at the top with a lower shadow which should be more than the twice of the real body. This candlestick pattern has no or little upper shadow.

The psychology behind this candle formation is that the prices opened and seller pushed down the prices.

Suddenly the buyers came into the market and pushed the prices up but were unsuccessful in doing so as the prices closed below the opening price.

This resulted in the formation of bearish pattern and signifies that seller are back in the market and uptrend may end.

Traders can enter a short position if next day a bearish candle is formed and can place a stop-loss at the high of Hanging Man.

-----------------------------------------

3- Three White Soldiers

The Three White Soldiers is a multiple candlestick pattern that is formed after a downtrend indicating a bullish reversal.

These candlestick charts are made of three long bullish bodies which do not have long shadows and are open within the real body of the previous candle in the pattern.

-----------------------------------------

4- Inverted Hammer

An Inverted Hammer is formed at the end of the downtrend and gives a bullish reversal signal.

In this candlestick, the real body is located at the end and there is a long upper shadow. It is the inverse of the Hammer Candlestick pattern.

This pattern is formed when the opening and closing prices are near to each other and the upper shadow should be more than twice the real body.

----------------------------------------

5- Piercing Pattern

Piercing pattern is a multiple candlestick chart pattern formed after a downtrend indicating a bullish reversal.

Two candles form it, the first candle being a bearish candle which indicates the continuation of the downtrend.

The second candle is a bullish candle which opens the gap down but closes more than 50% of the real body of the previous candle, which shows that the bulls are back in the market and a bullish reversal is going to take place.

Traders can enter a long position if the next day a bullish candle is formed and can place a stop-loss at the low of the second candle.

----------------------------------------

6- White Marubozu

The White Marubozu is a single candlestick pattern that is formed after a downtrend indicating a bullish reversal.

This candlestick has a long bullish body with no upper or lower shadows which shows that the bulls are exerting buying pressure and the markets may turn bullish.

At the formation of this candle, the sellers should be caution and close their shorting position.

Don't Forget To Like And Follow To Next Part

A simple strategy for low timeframesHello, good morning, I want to introduce a simple strategy to those who trade in low frame time.

For example, I'm on the Dow Jones chart for 5 minutes at a time frame

Take a closer look at this backtest

You must first find support and resistance levels

In the next neighbourhood, be patient until the price hits that level

Now wait for the first candle to form relatively independently of that surface

By independent candlestick, I mean to see a candlestick that starts to form without contact with the surface and closes in such a way that it does not come into contact with that surface again.

A candle that has no contact with the desired surface either at the beginning or at the endpoint.

We can now expect the price to move with the size of the independent candlestick length.

simply

To better understand, watch the image or ask a question after watching it.

I should mention that i always consider one unit of profit and one and a half units of loss

Dark Pool Buy Zones™Some traders try to watch Level 2 data to discern when the large-lot orders come through to get an idea of when the big institutions are accumulating in the Dark Pools, but you really don’t need that. Plus, whether that’s accurate is questionable since Dark Pool transactions are reported way after they were transacted.

“Dark Pool buy zones” is a term I coined because Dark Pools use precise controlled orders that trigger automatically over extended periods of time. Since the Buy Side Institutions using the Dark Pools are primarily buying for the long term, price can sometimes drop down before moving up, creating a range in the price action, what I call “the buy zone.”

When you learn to recognize the Dark Pool Candlestick and Indicator Patterns, you can be ready for the bottom to develop and look for Dark Pool accumulation patterns to plan your trading.

Below is an example. Ford is still falling, but the Dark Pool buy zone support is close. I’ll be waiting to see how the bottom develops around that level before making my decision to trade.

Happy TechniTrading!

Please like and follow if you found this interesting.

How to Read a Candlestick | Beginners Guide 🕯

Hey traders,

If you follow me for quite a while you probably noticed that I apply a candlestick chart for the market analysis.

In this post, we will discuss how to read an individual candlestick and we will outline its important elements.

🔰The candlestick reflects the price movement for a selected period of time.

An hourly candle will show you a price action within an hour and a daily candle within a day.

🔰The candlestick pattern has a very specific shape:

it is composed of a body and a wick.

The wick of the candle indicates the range of the price action within the candle. Its upper wick will show you the highest price during that time period and its lower wick will show the lowest price, while the body of the candle indicates its opening and closing price.

🔰From the color of the body of the candle, we identify its direction.

Green signifies a bullish candle while red signifies a bearish one.

🔰The lower boundary of a body of a bullish candle will show its opening price and its upper boundary its closing price.

🔰The upper boundary of a body of a bearish candle indicates its opening price and its lower boundary its closing price level.

With so many elements within a single candlestick, one can derive a lot of valuable information.

Some candlesticks have a very specific form and are called candlestick patterns. They are applied for predicted the future market behavior.

A proper reading of a candlestick chart may unveil a lot of insights about the market so it is very important for you to learn to work with that.

❤️Please, support this idea with like and comment!❤️

Quantification of Candlestick Patterns !!!█ DISCLAIMER

Are you looking for an answer for Best Quantification of Candlestick Patterns? you are not going to get here. It's just my thoughts about an indicator built on this concept that will be published next month (because I can only post two public indicators per month). Felt to discuss this with the community before head because I am excited to know your view on this. To make it better.

█ OVERVIEW

Thirty-seven different Candlestick Patterns are available in All Patterns Tradingview Indicator + The Boring Candle indicator totalling 38.

█ QUESTIONS FOR THE READERS

How many of you know about them and how to trade them?

Do you feel Candlestick Patterns are reliable?

If reliable, why do traders attach some trend rules to trade? If they already built based on trends? (In the above indicator, also we have the option of "Detection trend based on" option you can observe)

Do you feel other candles not labelled in the above indicator are not telling any story about the price movement? If not, why are we not naming new names?

I am not answering the above questions. There are so many posts with mixed opinions on the above questions.

Yes, I know I am questioning an idea that has existed for more than one century. I respect the knowledge passed down to us to improve the work is our responsibility. That is a crucial role of the researcher.

█ QUANTIFICATION OF CANDLESTICK PATTERNS?

Here, quantification means mapping a candlestick pattern to a number or ratio specks about the trend. A basic example of Quantification is the Probability of a Bull Market i.e.

Bull (Green Candle) → 1

Neutral (Boring Candle) → 0.5

Bear (Red Candle) → 0

Here 0, 0.5 and 1 are quantification based on Candles to tell the Probability of a Bull Market.

Yes, these are not Candlestick patterns we are taking, but I feel you understand my proposal to deal with candlestick patterns.

Let's talk about another example using Heiken Ashi Candles , and the same Quantification is the Probability of a Bull Market .

Strong Bull (Green Candle with only upper wick) → 1

Weak Bull (Green Candle with both wicks and not Neutral) → 0.75

Neutral (Doji or spinning top candles) → 0.5

Soft Bear (Red Candle with both wicks and not Neutral) → 0.25

Strong Bear (Red Candle with only lower wick) → 0

I hope you understand the meaning of quantification better now.

Now my idea is why can't we build a quantification system for general candlestick patterns based on position, volume, and other parameters (Your limit is your imagination !!!). Instead of using the same knowledge from the century, why can't we transform it into some oscillator and put the learning into actual work in trading.

This is my attempt to brush some pine scripters to work on this. I share my work too soon.

█ BENEFITS

Since we are talking about candlestick patterns, there is a delay in picking trends, maybe two candles if you are looking at two bar play. which is significantly less when compared to conventional indicators like MACD, RSI, Moving Average etc.,

With the above discussed "Probability of a Bull Market" with some higher timeframe averages using Rolling OHLC and Rolling Heikin Ashi candles I published, I build a clean indicator that looks similar to RSI but is efficient in finding Over Bought and Over Sold Regions. Creating an oscillator based on candlestick patterns with more sensitive quantification than the proposed simple methods may lead to better trade trends than existing indicators. We can use volume, Price and candlestick patterns to obtain more trend related oscillators.

█ MY FINAL THOUGHTS

Maybe I am overthinking (I am a PhD Statistics Research Scholar. This is my bad habit). Ignore the idea if you feel this observation is not realistic. Wait till next month to get to know what I am talking about.

I am bad at referring to books and indicators. If there is already any concept like this, please enlighten me. I am happy to acknowledge their thoughts. If you have built any indicators already, please share them in the comments section.

If I am the first person talking about this, Kudos to me...

█ REFERENCES

All thoughts are from my head, so there are no references for this post.

Stay Tuned...

If you have any recommendations or alternative ideas, then please drop a comment under the script ;)

Happy Trading

[Candlestick Patterns] Just need to know these three!#Candlestick #CandlePattern #Tocademy #Tutorial

Hello traders from all over the world, this is Tommy =)

I was unexpectedly surprised by many of you who liked and supported my last post about the basic concept of TA(Technical Analysis). Today I prepared a brief lecture about the Candlestick Pattern, one of the most fundamental phenomenon and behaviors that traders must be well-informed. In fact, we should be very familiar with these textbook contents and interpret it in a glimpse on the technical chart unconsciously. Just like we don't pay direct attention about each breathes when breathing, like we don't care each and all of the alphabets when we speak, or like we don’t perceive location of each keyboards every moment as we type, this very technique should be performed automatically and quickly by observing dominant formations of candlestick bars.

As a matter of fact, comprehending market trends and price actions only by referring to the candlesticks is yet too spurious. It should be used in such a way to weight on certain scenarios in a macroscopic view, rather than deriving precise and specific PRZ(Potential Reversal Zone)s and distinguish the accurate market trend. It’s never like ‘The price must go up because this pattern just appeared’. Furthermore, I strongly believe that the reliability of the candlestick pattern strategy is declining especially in recent financial market, where we encounter countless non-traditional and abnormal situations that were not very common in the past. Hence among the existing ‘Textbook’ candlestick pattern strategies that can easily be found on Google, there are particular patterns that are still very reliable on current market and there are ones that are not as reliable as it used to be. So here, I will organize everything very clearly for you guys.

The technical chart is well known as sort of a map tracing the mob-psychology of all the stakeholders in the market. Investors’ sentiments such as FUD(Fear, Uncertainty, and Doubt) and FOMO(Fear of Missing Out) that often cause panic buy/sell are visualized as data. Those with a clear understanding of the fundamental nature of how candlesticks are being formed, don’t even need to memorize these patterns one by one. As I emphasized at my previous post, candlesticks should be interpreted as a whole structure, unlike the line chart expressed in one-dimensional. Candlesticks are newly formed in each time interval and we can choose the timeframe for the chart that we are about to analyze. For instance, each candlestick in a daily chart is formed every day while each candlestick in a 5minute chart is formed every 5 minutes. Higher the timeframe of the chart is, longer-term the scope within the chart is. It is important as a TA analyst to start from macro-perspective with higher timeframe first, then go deeper to lower timeframe and find short-term factors.

There are four independent prices composing a candlestick: open, high, low and close price. Open price indicates the starting point while close price indicates the ending point of a candlestick. Just like the wording, high/low prices are formed at the highest/lowest price during the time period of candlestick being formed. A bullish candlestick is when the closing price is above the opening price (i.e., when the price rises), while a bearish candle is when the closing price is below the opening price (i.e., when the price is falling), and the two are expressed in different colors (green & red or red & blue). The thick part between the opening and closing price is called the ‘Body’, and the thin part is called the ‘Tail’ (Wick or Shadow).

Typically, the length of the body implies the strength of an ongoing trend. We learned from the textbook that the candlesticks with a longer body means stronger trend and those with shorter tails mean clearer trend. Back in the days, there was time when we could detect if whales are involved and deduct impulsiveness of ongoing trend when distinctly long bodied candlesticks with relatively high trading volumes take places. I am afraid to tell you that it is better to erase that memory. First of all, it is too obvious and cliché to announce that the long candlesticks with high volumes mean strong market trend. This criterion itself is quite vague and not 100% reliable to identify future trends or find insightful signals. Moreover, in recent days (especially in Crypto), whales like to deceive retail traders with a strong faith of trading volumes and since the future markets are becoming bigger, giving too much weight on trading volume paired to each candlestick is not as effective as it was when textbook used to work very well. I am not saying textbook is wrong. It just needs slight updates since the market we are dealing with keeps changing over time.

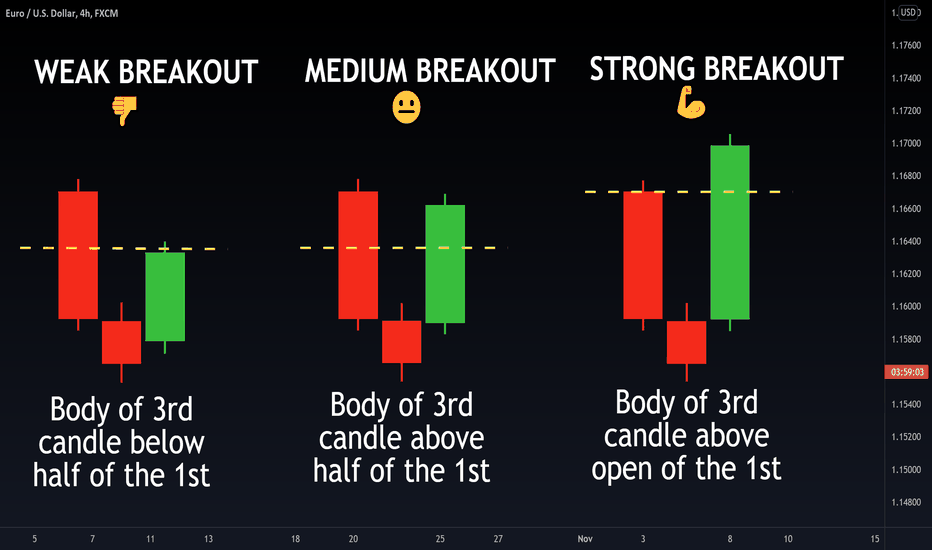

In TA world, closing price of a candlestick carries a great meaning and thus closing prices at higher timeframes should very well be monitored to become a successful trader. Sometimes whales even battle aggressively right before a major closing time often causing a weird ‘scam’ moves with a high volume. As shown below, we usually find the price and time when certain TA variables (such as top/bottom of trendline, channels, pivot levels, and other indicators) are broken, meaning if the price has penetrated those variables successfully, in order to find breakout entries, stoplosses, and target prices, etc. This whole concept of breaking above or below is quite vague, subjective, and relative idea. So, what we traders refer to as a reliable criterion is confirming whether the candle closed above and below the factors. For instance, let’s say that we are seeking and waiting for the breakout of the downward trendline. Well sometimes it’s not as easy as expected to precisely spot and determine whether the price has successfully pierced through the trendline. There are times when price breaks the trendline, but ends up coming back below leading close price of the candlestick to be formed below the trendline like the case 2 below. In this very case, it’s difficult to determine whether the breakout happened successfully or not. Nevertheless, like case 3, when both closing and high prices are formed above the trendline, we can clearly confirm and weight more on the breakout scenario, expecting more bullish rally.

Okay let's get to the point. In recent financial trading market, it's enough to know just these three.

1. Engulfing

2. Doji

3. Long Tailed Candlestick

As mentioned above, there’s nothing hard if you understand the essential concepts and principles of the above patterns and phenomena. The engulfing candlestick is a phenomenon in which the body of the previous candle is consumed by the body of the next candle, that is, a larger body than the previous one comes out. In other words, if a new bullish candle closes higher than the previous open price or if a new bearish candle closes lower than the previous open price, we say ‘the new candlestick engulfed the previous one’. If we look closely, this pattern implies the circumstance where the new candle completely overwhelms the trend of the previous candle and reverses it into a new trend despite closing the price from above or below. However, the appearance of an engulfing candle does not mean that the trend is unconditionally reversed. It is often the case that engulfing candles take place consecutively, with the second candle taking over the body of the first candle, the third’s taking over the second’s, the fourth’s taking over the third’s and so on. As the price fluctuates up and down, it creates a Widening or Broadening pattern also known as expanding sort of shapes, making it difficult for traders to figure out the current trend. In this circumstance, the entry prices, stop loss prices, target prices, or average prices of many participants in the market tend to be located relatively nearby. This price range or region is called a HVP(High Volume Profile or Peak) or an Orderblock and I will cover details about this concept later on another post. Anyway, there are numerous methods to derive Orderblock and one of them is to spot bodies of the consecutive engulfing candlesticks.

The tail(wick) of a candlestick can be interpreted as a sign of the fierce battle between the bulls are bears. Longer tail signifies bigger collision between buying and selling forces. The longer the upper tail, the more the bulls trying to raise the price up but the bears rejecting them eventually sellers ending up being dominant and vice versa for the longer the lower tail. Generally, when the long upper/lower tails are formed at a relative higher/lower part of the wave structure or at a distinctive pullback as a PRZ this can be a possible signal of trend reversal. Due to my personal trading experience, it doesn't matter much in recent TA market whether the long-tailed candlestick is a bullish or bearish. In other words, regardless of the color of Hammer or Shooting star (which are both long-tailed candlestick pattern), it’s better to check if the next following candlesticks are being formed opposite direction of the tail. Personally, I don't think the Inverted Hammer and Hanging Man are not as necessary as it used to be in the old days.

When the length of the candlestick’s body is relatively short meaning if the open and close prices are very close, forming a cross like shape, it’s called a Doji. Since Doji has a short body, the upper and lower tails tend to come out longer and thus can be considered as evidence of a tense confrontation between the bulls and bears that eventually ends up reaching a balance. Similar to the long-tailed candlestick, Doji is also known as a sign of a PRZ depending on the next appearing candlesticks. When Dojis are observed after swing high or low, it can be a possible indicator that the on-going trend is overheated and you might want to anticipate some pullbacks. However, it is too risky to directly assume that the top or bottom is near just because of Doji. Especially in the market these days, Dojis also appear frequently in sideways and sometimes confuses traders searching for a clear trend.

As emphasized above, as with other technical techniques, theories, and indicators, always remember to weight more to the emergence of patterns in higher timeframes and longer-term perspectives. The higher timeframe people globally refer to, the more the reliability the TA will be. Just think about it for a second. Which timeframe do you think that people consider more significantly about the closing price, a 5 minutes chart or a daily chart? I would obviously say that the price signals from the daily cart is relatively more representative and reflect longer-term than those of the 5 minutes chart. Keep in mind is that you also need to understand market trends from a macro perspective before approaching towards short-term perspective. It is always recommended to recognize long-term trends or situations in advance from the candlestick of a higher timeframe, and then look at more detailed and microscopic elements step by step.

All right. I will wrap up now. Thanks for reading my post.

Your subscriptions, likes, and comments are a huge inspiration for me to write more posts!

Engulfing Candlestick PatternEngulfing candlestick is formed when it completely engulfs the previous more than one candle but be considered an engulfing candlestick pattern because in Engulfing at least one candle must fully engulf.

Types of Engulfing Candlestick Pattern

Bullish Engulfing Pattern

Bearish Engulfing Pattern

#1 Bullish Engulfing Pattern

Bullish Engulfing pattern consists of two candle formations, the first candle is the small body and the second candle is the bigger. The second big candle should be fully engulfed than the previous small candle. This is called the bullish engulfing pattern.

#2 Bearish Engulfing Pattern

Bearish Engulfing pattern consists of two candle formations, the first candle is a small Bullish candle and the second is the bigger bearish Candle than the previous bullish candle. The Second big bearish candle should fully engulf the previous one or more small candles. This is called a bearish engulfing pattern.

Reversal candlestick patterns in crypto you only needHello, everyone!

While Bitcoin is playing out our long signal it’s time for educational content. Today I wanna show you the candlestick formations which predict the reversals in crypto. I know that in the books we can find more formations with different names, but in practice only these patterns does matter in reversals. All these formations play out with the best performance on the 4h+ timeframes.

Bullish Formations

1. This is the strongest bullish formation. When we observe the downtrend and the bullish hammer candle with the increased volume appears at the end, it is almost 100% sign of reversal, the huge bounce or the new uptrend is anticipated when you see this pattern.

2. This formation does not mean that the downtrend is finished, but the big bounce can be anticipated.

3. This formation is the weakest. If it appeared we can wait just for the local bounce.

Bearish Formations

4. The strongest bearish formation which appears at the uptrend end with the increased volume at the bearish hammer candle.

5. The big correction can be anticipated if you see this formation but not the new downtrend.

6. Local correction can play out in case of this bearish formation.

Please, remember that the candlestick formation without conformation can’t be the long or short signal. Exception are 1 and 4 formations. For other patterns we have to see the divergence to confirm the trend reverse.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions at the real market.

Bullish Engulfing PatternsThe bullish engulfing pattern is a two-candle reversal pattern. The second candle completely ‘engulfs’ the real body of the first one, without regard to the length of the tail shadows.

This pattern appears in a downtrend and is a combination of one red candle followed by a larger green candle. On the second day of the pattern, the price opens lower than the previous low, yet buying pressure pushes the price up to a higher level than the previous high, culminating in an obvious win for the buyers.

The Power of DojiA Doji is created when the open and close for a price are virtually the same. Doji tend to look like a cross or plus sign and have small or nonexistent bodies. From an auction theory perspective, Doji represent indecision on the side of both buyers and sellers. Everyone is equally matched, so the price goes nowhere; buyers and sellers are in a standoff.

When it comes in a downtrend it act as a reversal pattern so we know that the bears power is weak, and bulls start to take control thus the price will go up and the trend will be up , when it comes in an uptrend the bull power is weak , bears starts to take control and price will eventually go down . But in technical analysis you cant enter a trade only from one sign so you should know you Support and Resistance area, draw your trend lines, use some indicators, and when you see the Doji know you know its the perfect time to execute the trade.

Candlesticks PatternsMost simply, candlestick charts are used by traders to represent the price evolution of an asset. While candlesticks may be harder to understand initially, they offer far more information than a simple line chart.

How to read a candle?

There are two colors: red and green. When a candle is red, its closing price was lower than the opening price: the price of the asset decreased during that trading period. When a candle turns green, the closing price was higher than the opening price as the asset's price increased.

Beyond color, let's break down the rest of the visual above:

Body: The body indicates the open-to-close range. In other words, it indicates the difference between the closing and the opening price.

Wicks: These are also called tails or shadows. They reveal the highest and lowest price of an asset within the candlestick period. If there is no wick, the opening and closing prices are the lowest/highest price.

Highest Price: The top of the upper wick indicates the highest price traded during the period.

Lowest Price: The lowest price traded during the period is indicated by the bottom of the lower wick.

Opening price: This is the price at which the first trade happened during the new candlestick time period. If the price goes up, the candle turns green and conversely turns red on a price decrease.

Closing price: The closing price is the last price traded during the period of the candle formation. If this price is above the opening price, the candle will be green, otherwise, it will be red.

Types of Candlestick Patterns:

The candlestick patterns can be divided into:

1.Continuation Patterns

2.Bullish Reversal Patterns

3.Bearish Reversal Patterns

We may further divide the above categories into further 35 sub-categories.

1. Hammer: Hammer is a single candlestick pattern that is formed at the end of a downtrend and signals bullish reversal. The psychology behind this candle formation is that the prices opened and sellers pushed down the prices.

2. Piercing Pattern: Piercing pattern is multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal. It is formed by two candles, the first candle being a bearish candle which indicates the continuation of the downtrend.

3. Bullish Engulfing: It is formed by two candles, the second candlestick engulfing the first candlestick. The first candle is a bearish candle that indicates the continuation of the downtrend.

4. The Morning Star: It is made of 3 candlesticks, first being a bearish candle, second a Doji and the third being a bullish candle.

5. Three White Soldiers: These candlestick charts are made of three long bullish bodies which do not have long shadows and are open within the real body of the previous candle in the pattern.

6. White Marubozu: This candlestick has a long bullish body with no upper or lower shadows which shows that the bulls are exerting buying pressure and the markets may turn bullish. At the formation of this candle, the sellers should be caution and close their shorting position.

7. Three Inside Up: It consists of three candlesticks, the first being a long bearish candle, the second candlestick being a small bullish candle which should be in the range the first candlestick. The third candlestick should be a long bullish candlestick confirming the bullish reversal.

8. Bullish Harami: It consists of two candlestick charts, the first candlestick being a tall bearish candle and second being a small bullish candle which should be in the range of the first candlestick. The first bearish candle shows the continuation of the bearish trend and the second candle shows that the bulls are back in the market.

9. Tweezer Bottom: It consists of two candlesticks, the first one being bearish and the second one being bullish candlestick.

10. Inverted Hammer: In this candlestick, the real body is located at the end and there is a long upper shadow. It is the inverse of the Hammer Candlestick pattern.

11. Three Outside Up: It consists of three candlesticks, the first being a short bearish candle, the second candlestick being a large bullish candle which should cover the first candlestick.

12. On-Neck Pattern: The on neck pattern occurs after a downtrend when a long real bodied bearish candle is followed by a smaller real bodied bullish candle which gaps down on the open but then closes near the prior candle’s close.

13. Bullish Counterattack- This candlestick pattern is a two-bar pattern that appears during a downtrend in the market.

Bearish Candlestick Pattern:

14. Hanging man: The real body of this candle is small and is located at the top with a lower shadow which should be more than the twice of the real body. This candlestick pattern has no or little upper shadow. The psychology behind this candle formation is that the prices opened and seller pushed down the prices.

15. Dark cloud cover: It is formed by two candles, the first candle being a bullish candle which indicates the continuation of the uptrend. The second candle is a bearish candle which opens gap up but closes more than 50% of the real body of the previous candle which shows that the bears are back in the market and bearish reversal is going to take place.

16. Bearish Engulfing: It is formed by two candles, the second candlestick engulfing the first candlestick. The first candle being a bullish candle indicates the continuation of the uptrend. The second candlestick chart is a long bearish candle that completely engulfs the first candle and shows that the bears are back in the market.

17. The Evening Star: It is made of 3 candlesticks, first being a bullish candle, second a doji and third being a bearish candle.

18. Three Black Crows: These candlesticks are made of three long bearish bodies which do not have long shadows and open within the real body of the previous candle in the pattern.

19. Black Marubozu: This candlestick chart has a long bearish body with no upper or lower shadows which shows that the bears are exerting selling pressure and the markets may turn bearish. At the formation of this candle, the buyers should take caution and close their buying position.

20. Three Inside Down: It consists of three candlesticks, the first being a long bullish candle, the second candlestick being a small bearish which should be in the range the first candlestick. The third candlestick chart should be a long bearish candlestick confirming the bearish reversal. The relationship of the first and second candlestick should be of the bearish Harami candlestick pattern.

21. Bearish Harami: It consists of two candlesticks, the first candlestick being a tall bullish candle and second being a small bearish candle which should be in the range of the first candlestick chart.

22. Shooting Star: Shooting Star is formed at the end of the uptrend and gives bearish reversal signal. In this candlestick chart the real body is located at the end and there is long upper shadow. It is the inverse of the Hanging Man Candlestick pattern.

23. Tweezer Top: It consists of two candlesticks, the first one being bullish and the second one being bearish candlestick. Both the tweezer candlestick make almost or the same high. When the Tweezer Top candlestick pattern is formed the prior trend is an uptrend. A bullish candlestick is formed which looks like the continuation of the ongoing uptrend. On the next day, the high of the second day’s bearish candle’s high indicates a resistance level. Bulls seem to raise the price upward, but now they are not willing to buy at higher prices.

24. Three Outside Down: It consists of three candlesticks, the first being a short bullish candle, the second candlestick being a large bearish candle which should cover the first candlestick. The third candlestick should be a long bearish candlestick confirming the bearish reversal.

25. Bearish Counterattack– The bearish counterattack candlestick pattern is a bearish reversal pattern that appears during an uptrend in the market. It predicts that the current uptrend in the market will make and the new downtrend will take over the market.

Continuation Candlestick Patterns:

26. Doji: It is formed when both the bulls and bears are fighting to control prices but nobody succeeds in gaining full control of the prices.

27. Spinning Top: The only difference between spinning top and doji is in their formation, the real body of the spinning is larger as compared to Doji.

28. Falling Three Methods: The “falling three methods” is a bearish, five candle continuation pattern which signals an interruption, but not a reversal, of the ongoing downtrend.

29. Rising Three Methods: The “rising three methods” is a bullish, five candle continuation pattern which signals an interruption, but not a reversal, of the ongoing uptrend.

30. Upside Tasuki Gap: This candlestick pattern consists of three candles, the first candlestick is a long-bodied bullish candlestick, and the second candlestick is also a bullish candlestick chart formed after a gap up. The third candlestick is a bearish candle that closes in the gap formed between these first two bullish candles.

31. Downside Tasuki Gap: This candlestick pattern consists of three candles, the first candlestick is a long-bodied bearish candlestick, and the second candlestick is also a bearish candlestick formed after a gap down. The third candlestick is a bullish candle that closes in the gap formed between these first two bearish candles.

32. Mat-Hold-There can be either bearish or bullish mat hold patterns. A bullish pattern begins with a large bullish candle followed by a gap higher and three smaller candles which move lower.

33. Rising Window-The rising window is a candlestick pattern consisting of two bullish candlesticks with a gap between them. The gap is a space between the high and low of two candlesticks that occurs due to high trading volatility. It is a trend continuation candlestick pattern indicating strong strength of buyers in the market.

34. Falling Window-The falling window is a candlestick pattern that consists of two bearish candlesticks with a gap between them. The gap is a space between the high and low of two candlesticks. it occurs due to high trading volatility. It is a trend continuation candlestick pattern and it is an indication of the strong strength of sellers in the market.

35. High Wave-The high wave candlestick pattern is an indecision pattern that shows the market is neither bullish nor bearish. It mostly occurs at support and resistance levels.

ENGULFING CANDLE. Powerful reversal candlestick pattern🕯

✅Candlestick patterns trading is one of the oldest but most effective ways to analyze the foreign exchange market. The trader needs to find certain patterns, and based on them, decide where the price will go. Today we will talk about one of these candlesticks, which is called the "engulfing candle". There are two types of it: bullish and bearish. The appearance of such a model on the chart with a high probability indicates a possible reversal of the trend and is a signal to enter the market.

Types of engulfing and their features

⚠️So, we realized that there are two types of this candle:

🟢Bullish. It indicates that the trend is turning towards an increase in the value of an asset or currency pair. The candle must engulf the range of the previous bearish candle to be valid.

🟢Bearish. The same as with bullish, only the opposite. It indicates that the trend is turning towards a decrease in the value of the asset. In this case, the candle must engulf the range of the previous bullish candle.

✅The formation of the "Bullish engulfing" candle says that buyers have sat on the throne, and "Bearish" - sellers. Let's discuss the theoretical foundations of the pattern. In the case of the "bullish engulfing" pattern, everything will be the same, just the opposite.

Rules for the formation of the "bearish engulfing" pattern:

There should be a bullish trend in the market, and the price should be on a key level.

❗️A long-bodied bullish candle appears (that is, directed towards the trend). The opening of the second candle should be carried out with a gap relative to the closing of the first, and its body should be larger than that of the previous one. It seems to engulf the trend with its dimensions, and therefore it is necessary to sell (a bearish candle indicates the beginning of a downward trend).

❤️ Please, support our work with like & comment! ❤️

BEST CANDLESTICK PATTERNSCombinations confirming the reversal of the "bearish trend"

1. Inverted hammer and combinations of hammers. The hammer has a large shadow under the small green body, and the inverted hammer has a large shadow over the small red body. It appears, like all subsequent combinations, at the base of the downtrend, before the reversal.

2. "Bullish harami" consists of two candles: the first with a long red body, which covers the second with a short green body. A distinctive feature is that this model assumes a price gap. The fact is that "harami" in Japanese means pregnant, so if you look closely at the drawing, you will see that the body of the right candle is, as it were, inside the body of the left candle.

3. Short candles in the "star position". A "star" is a candle with a fairly small body, formed after the break with the closing of the previous candle, usually having a large body. Therefore, in this model, the candle should appear at the bottom of the downtrend, have a short body and open with a break down compared to the previous candle. The third red candle with a short body should close above the first candle.

4. "The morning star in the position of three candles." Here, the first candle should be red, which indicates a strong downward movement, the second has a short body and is formed with a gap relative to the first candle, and the third candle is necessarily green, the price of which has increased to at least a value at the level of half the body of the first candle. Ideally, the morning star should have a gap before and after the second candle, but the gap between the second and third candles is rare.

5. A short candle in the "harami" position. This combination is similar to the "bullish harami" that we described earlier, only in this case the second candle is short and red, but it is also located in the body of the first candle. The third candle is necessarily green.

Combinations confirming the reversal of the "bullish trend"

6. "Bearish harami" is the same as "bullish harami", only a long green body should appear first, and a short red body should appear second, and the body of the right candle is absorbed by the body of the first candle. The next candles go out.

7. "Bearish absorption". Here, the first is a short green candle, and the second is a long red one, and if you look, the body of the left candle is inside the body of the right candle. After that, the price decreases.

8. "Shooting star" is a short candle with a missing lower shadow and a very long upper one.

9. The bear cross "harami" is formed when the first candle is long and green, and the second candle ("child") is a "doji".

10. "A three-line star in thought" or in another way "the repulsed offensive of three white soldiers". This combination reflects a gradual steady increase in prices and consists of three candles, the opening price of each of which is located inside or near the previous green body. The closing price of candles is equal to or approaching the maximum prices. If the second and third candles (or only the third candle) show signs of weakening, that is, their bodies gradually decrease or relatively long upper shadows form, then the "repulsed offensive of three white soldiers" model is formed. This pattern should cause particular alarm if it appears after a long uptrend.

Learn To Trade Technical Analysis Hammer & Shooting StarHey Traders today I wanted to go over what I believe is one of the best ways to trade any market with Japanese Candlesticks using hammers and shooting stars. Normally you want the wick of the candle to be at least twice the size of the body of the candle. Alot of times they can lead to explosive moves in the markets. So lets dive in and see how to use this powerful technique in your trading arsenal.

Enjoy!

Trade Well,

Clifford

Morning Star Candlestick Pattern: Trading strategy!🌟🕯️

✳️The Morning Star candlestick pattern is a candle formation that can often be seen on price action charts. It has a bullish character and can often determine the main minimum of market fluctuations.

✳️Three candles in a figure are one of the mandatory conditions of the pattern. Nevertheless, it is quite easy to find the morning star on the chart. It's easy to make sure of this – just look at the shape and location of the “Morning Star" figure.

⚠️ The shape of the Morning Star pattern

So, the formation consists of three Japanese candlesticks. Each of them must meet certain requirements.

🔵 The first candle is a bearish one with a rather large body and the absence of wicks or their presence with a very small length (no more than 10% of the body);

🔵The second candle is with a small body or completely without it. The candle should be with small wicks. The color of the second candle does not matter;

🔵The third candle is bullish with a large body. The body of the third candle should cover most of the body of the first candle (or engulf the whole body). Also, the candle should be without shadows (ribose) or with very small shadows;

🔵There should be a gap between the central candle and the other two. But, as practice shows, it is not always a prerequisite.

❗ Location of the candle model "Morning Star" ❗

The morning star is a bullish formation. Therefore, it is located at the end of a downtrend. The central candle is the local minimum of the downtrend. After the formation of this Price Action pattern, you should buy an asset.

❗ Signal amplification of the Morning Star model ❗

🔴If the central candle was formed without a body, then the pattern gives almost 100% about the change of the downtrend to an uptrend. This model is also called the "morning star Doji" or "abandoned baby";

🔴The presence of a gap between the central candle and the other two candles strengthens the trading signal;

🔴The bullish central candle is stronger than the bearish one. But the strongest is bodiless;

The third candle completely covers the first candle;

🔴The presence of a small trading volume at the first candle and a large volume at the third candle strengthens the model.

✅ When to enter into a transaction

We enter into the transaction after the closing of the third candle. It is confirmatory in the "Morning Star" pattern. This is a kind of guarantor of the model.

✅ When not to enter into a transaction

Everything is simple here. If the pattern does not satisfy the main conditions, then we do not enter into the transaction. It will no longer be a morning star model, but something else.

❤️Friends, If you want more of these articles, like comment and subscribe❤️

HOW TO READ A CANDLE BODY AND WICKThis basic representation of a candle is useful to newbies starting of in technical analysis. For all the advanced followers we will post our Goldview report this weekend.

Please note time to time we will be making posts like this to help newbies to start reading and understanding the charts and that has to start with a candle!

Please like, comment and follow us to support us!

GoldView

What are candlesticks in trading and how to use them?🕯

✅The price dynamics of an asset are displayed on the chart in different formats, including bars, lines, or candles. The latter format is most popular among traders and is often used in technical market analysis. What are candles and how to work with them?

🟢Candlesticks (Japanese candlesticks) are a graphical way of displaying price dynamics, in which vertical rectangles and lines are used. This method was invented on the rice exchanges of Japan in the 17th century, from where it got its name.

A price candle consists of two main elements:

1️⃣the body is a vertical rectangle that shows the opening and closing levels of trades;

2️⃣wicks (shadows, tails) - vertical lines from above and below the body of the candle, reflecting fluctuations in value in the interval between opening and closing.

❗️The main advantage of a candle over bars and a linear chart is that it allows you to get 4 important indicators for technical analysis at once:

High - the highest price for the period;

Low - the lowest price for the period;

Open - the opening price of the period;

Close - the closing price of the period.

🔴When using a linear graph to get the same information, 4 indicators would have to be displayed on the screen at once, which is inconvenient and complicates the perception of information.

At the same time, candles display the process of cost formation in a specific time interval, so the position and appearance of candles on the hourly and daily periods will differ significantly

Types of candles

⚠️Two main types of candlesticks correspond to market trends:

Bullish candle - formed when the closing price of the period was higher than the opening price. On the chart, such a candle is displayed in green (on b / w - white) and indicates the victory of buyers in this time.

A bearish candle - is formed if the period is closed at a price lower than it was opened. On the chart, bearish candlesticks have a red color (on b / w - black) and they show that sellers are dominating at the moment.

❤️ Please, support our work with like & comment! ❤️

CANDLESTICK PATTERNS BASICS | Engulfing Candle 📚

Hey traders,

In this educational post, I want to discuss with you one of the most accurate REVERSAL candlestick patterns - the engulfing candle.

On EURUSD chart, I spotted for you bullish & bearish examples of this pattern.

The logic behind this pattern is quite simple:

⭐️In a bullish trend, after a strong directional movement, the price reaches some important structure level. Growing steadily and forming a sequence of green bullish candles the price suddenly forms a strong bearish candle.

What is particular about that candle is the fact that its total range (distance from the wick high to wick low) & body range (distance from body open to body close) exceed the ranges of a previous bullish candle.

🔻Such a candle we will call a bearish engulfing candle.

Most of the time it signifies a strong spike in selling volumes and willingness of sellers to push.

With a high probability, such a formation leads to a pullback or even a trend reversal.

⭐️In a bearish trend, after a strong short rally, the price reaches some demand cluster. Instead of breaking that and going lower, the price forms a strong bullish candle.

That candle engulfs the range of the previous bearish candle & its body size exceeds the size of the previous candle.

🟢Such a candle we will call a bullish engulfing candle.

Quite often such a formation leads to a pullback or even a trend reversal.

🔔And there is just one single tip that will dramatically increase your performance trading the engulfing candle:

It is recommended to rely on this pattern ONLY IF it is formed on a key level:

❗️Bullish engulfing candle must strictly form on a strong support.

❗️Bearish engulfing candle must strictly form on a strong resistance.

Forming beyond key levels, the pattern occasionally will give false signals.

⏳Preferable time frames to trade engulfing candles are daily/4h.

Learn to spot this pattern & you will see how efficient it is.

What candlestick patterns do you want to learn in the next posts?

❤️Please, support this post with like and comment!❤️