Long-Term Bullish case being challengedThis is a very long-term chart that goes from 2001-Present.

Every red arrow is a sell, every green arrow is a green.

Trading with this method has proved to be very useful.

The 12EMA (purple line) represents a 1 year exponential moving average. Follow the $SPX below. (black line)

Correction

When the S&P500 catches the fluIn this screencast I look at the S&P500 on the 4H time frame only. I show how I estimate the probable direction (this does not mean prediction).

I give some information on why the markets are reacting to a low grade coronavirus called 2019-nCOV (same family as MERS and SARS).

Disclaimer: This is not trading advice. If you make decisions based on this screencast and lose your money, kindly sue yourself.

How do virus attacks affect Wall Street?This is a very short presentation on how previous virus attacks have affected Wall Street (daily time frame). I go back to 2013, plotting what was seen.

This is relevant in relation to the recent Wuhan coronavirus (WCV). Mainstream media have referred to WCV as a "deadly virus". This is frankly nonsense based on current data.

The case fatality ratio (CFR) is an important measure in assessing lethality of a virus. The CFR for influenza A(H1N1) in 2009 was 0.45%. For ebola virus, it is overall >50%.

For the Wuhan coronavirus (WCV) which may not be one virus strain, the CFR is currently estimated at <3% (I cannot provide references here but people can contact me for links to info).

But hold on - the 3% is not (at this time) for large populations of those infected. The average age group of people who have been killed WCV is currently around 60. Did I say 'average'? Yes - I did (which means I know there are some people who have been around 30). Attribution of WCV has also not been 100% caused by WCV either. The 'average' age group may fall (or increase) with time.

In summary

- ebola is definitely a deadly virus - the markets barely flinched if at all to Ebola.

- estimates of lethality of WCV are currently not robust.

My conclusion -

The media is responsible for selling its news.

The media have been irresponsible in feeding panic, in selling its news.

News and panic are what rules markets more than hard facts and figures.

Will the WCV outbreak be the pin that pricks the bubble? I don't know. It could well be the first of the dominoes to fall, setting off a chain reaction for slow burn down - instead of a serious correction. OR - WCV may well be insignificant. If it is, then expect a raging bull market to rebel! I cannot foresee the future!

Declarations & Disclaimers: I am not a virus expert, nor a financial expert. This post is opinion only based on data fully available in the public domain. Opinions here are not be be relied upon in making financial or trading decisions. If you who reads this makes such decisions, your losses are your own - should you suffer a loss. You sue yourself if you lose money.

XAUUSD on Horizontal Triangle : BUYTriangles are overlapping five wave affairs that subdivide 3-3-3-3-3. They appear to reflect a balance of forces, causing a sideways movement that is usually associated with decreasing volume and volatility. However, it is quite common, particularly in contracting triangles, for wave b to exceed the start of wave a in what may be termed a running triangle

EW Analysis: Bullish Emerging Markets May Push EURUSD HigherHello traders!

Today we will talk about emerging markets(EEM) and EURUSD.

As you can see in the first chart, there's a positive correlation between emerging markets and EURUSD. Of course, there are no tick by tick correlations, but the current wave structure it's telling us that we may see a bigger recovery in the upcoming days/weeks.

Emerging markets can be trading in a three-wave (A)-(B)-(C) recovery up to 61,8% Fibonacci retracement and 46 area, especially after that break out of the corrective channel, so in our opinion EEM may easily stay in the bullish trend.

At the same time we can see strong and impulsive recovery on EURUSD, which is telling us that the temporary bottom can be in place and a bigger three-wave (A)-(B)-(C) correction can be underway up to 1.15 - 1.18 area, mainly because of break out of the wedge pattern (ending diagonal).

Notice that these are daily charts and they may take some time to completely unfold, so don't get confused on the smaller time frame charts. We just want to give you an idea, where the markets can be headed long/mid-term.

Be humble and trade smart!

If you like our analysis, then please give us a like and share it!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

EW Analysis: Wave structure Suggests Limited Downside For BTCHello traders!

After that deeper corrective decline called double zig-zag W-X-Y pattern on Bitcoin , it's time to take a look at potential support levels.

We decided to take a look at Bitcoin dominance ( BTC .D) against the ALT dominance (OTHERS.D), where we clearly see a corrective decline in wave 4 that can find support soon, ideally around previous wave »iv«, 38,2% Fibonacci retracement and 14.00 – 13.50 area. So, seems like BTC Dominance will come back, which can be supportive for Bitcoin , especially if ALTs are looking for the potential support or bottom, but according to dominance, BTC should be still doing it better than ALTs!

We also decided to take a look on BTC Futures chart, because it's more accurate than those from exchanges. As said above, we are tracking a double zig-zag W-X-Y corrective pattern, which can be approaching the end soon, ideally once BTC .D/OTHERS.D chart finds support. From technical perspective, previous wave 4 and 61,8% Fibonacci retracement are actually ideal support zone and if we also consider an open GAP from May, which usually acts as a reversal point once it gets filled, then we should be really aware of a potential bounce around 7000 area, specifically 7400 – 6300!

As always, the count always needs to be confirmed, so we will be watching very closely when/if comes into the support zone . And, if BTCUSD is really going to rebound in strong and impulsive manner later, then we will be looking for longs, but until then we have to patiently wait!

Trade smart!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

lesson on wick candlesticks 5/30/2019Im just posting this for personal reference. Sometimes I have doubts when I look at wicks and I want to document the cases where things actually play out as I expect them to. I figured I would share with you all so you can correct me if I am wrong or add something you think I may have unintentionally left out. I am learning more each and every day. Soon I will be a master of the charts :)

Interest Rate Spikes Precede CorrectionsNotice the downward trend in the US10Y since the 80's, while government, corporate and consumer debt has exploded to all time highs. The achilles heel of massive debt levels are high interest rates, which end up causing slowed growth and economic contraction. With ever higher levels of debt, the level of interest required to put the economy in pain falls over time - thus why we see crashes and corrections even as the US10Y spikes to levels far below the historical average (~6.18%).

Last year we popped above the "danger zone" trend line and we saw what happened. Watch out for interest rate spikes, it can save your ass.

Identify Impulse and Corrective MovesMarket moves can generally be categorized as either an IMPULSE move or a CORRECTIVE move.

A fast and strong move is described as an IMPULSE move.

A slow and weak move is described as a CORRECTIVE move.

Practical Exercise

1) Pick any currency pair, any timeframe, and identify the IMPULSE and CORRECTIVE moves on the chart.

2) Draw a line on the IMPULSE move; draw a box on the CORRECTIVE move.

3) Post your chart on the comment section below.

4) Repeat this practice on 2 other currency pairs.

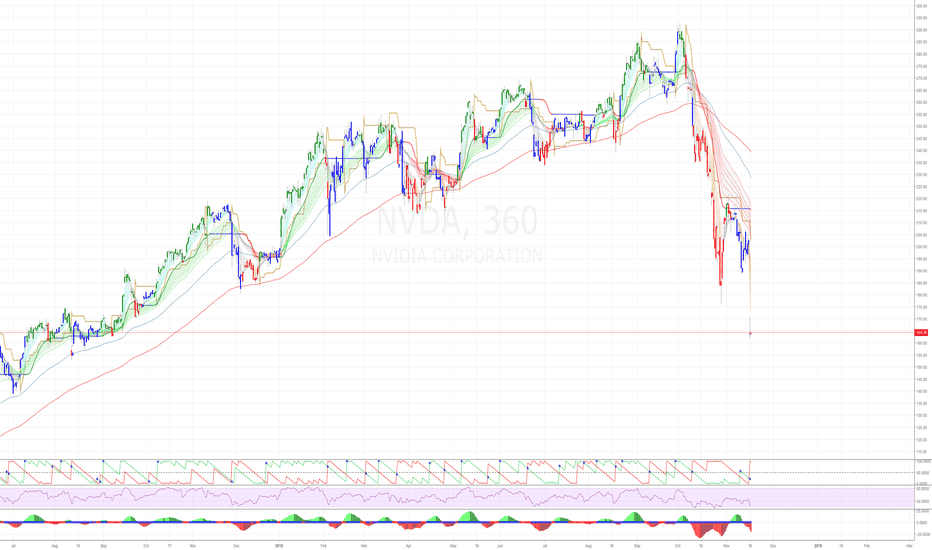

DANGER: Amazon and FANGS could be in trouble. Amazon has just crossed $1 Trillion in market value.

This is without doubt a parabolic expansion. History has shown us that parabolic charts like this suffer a significant correction. Do not expect me to say when - as I have no crystal ball.

Tech stocks have been propping up Wall Streets expansion. But there is a problem. The stock markets in the US and around the world are being eroded in value. Google is your friend. Around the globe there is market contraction due to trade wars and international political tensions.

Reliable research shows that value of stocks below the top 30 is falling in average. This is a danger signal.

The traditional 'news' is not your friend. From day to day we hear different news casts. These people are there to sell their news - that's all. Dig deeper. The world is in trouble!

Amazon cannot fight and win over the whole world. It just ain't that big or powerful.

Tech stocks have been living on borrowed time and feeding frenzies. If Amazon goes south, and the rest of tech goes south, expect to see major corrections on Wall Street.

Those looking to short the stock markets may wish to look for trend changes on the 4H - 6H time frames and with Amazon.

Definitions: Every type of decline in priceUnderstanding the definitions. Here they are, well this is my own definition, but look into any book it will be quite similar.

I will post examples to show why that makes sense.

First, this applies to anything that has enough participants, and enough market cap. I do not have an exact number, but if something is not public or next to impossible to trade kind of "secret" or "underground" and has a market cap of 25 million, rules do not apply. If something is a NYZE listed company with a market cap of 500 million it applies. Applies to gold, does not apply to granular piss (actually maybe it does as people are really buying this stuff and using it well idk but let's just focus on anything that has lets say a mcap of at least 500 million, the definition could be pushed to anything over 2 billion to be "safe").

The time span for declines is 1 to 2 quarters.

The definition will be different for FX, numbers are smaller, and for crypto, numbers are bigger like 25% for Bitcoin is just a correction.

Here are the different categories - truer definitions would use percent drops compared to average market volatility:

Correction: 10% decline

Bear market: 20% decline

Crash: 35-60% decline

MegaCrash: 60%-80% decline (less than once in a lifetime)

Death: 80% decline

Ponzi: 90% decline

Here is the example of a correction:

Here are examples of a bear market:

Here are examples of market crashes:

Here is a mega crash:

Here is a death:

Here are a few examples of ponzis :):

1- Every single stock Jordan Belfort has ever participated in.

2-

3-

4-

5-

6-

7-

8-

9-

10-

11-

12- Well any stock or crypto you find in a "hot stock" list that is "very cheap" and "a great buy"

Waves 101: Basic wave characteristicsHi all,

I would like you all to have a basic understanding of how waves (Elliot Waves essentially) feel like.

Impulse waves (the 1, 3 and 5 you hear of quite often) are generally easier to "feel". See the chart for example. The fall from 11.7k to 8.3k was pretty easy to detect as a downtrend. There is little scope of confusion during these waves.

Corrective waves on the other hand (the 2 and 4 waves and well, many different forms. Mind it, they are not just simple ABC waves as commonly believed) are pretty complex. They are generally combinations of different types of waves and create confusion of bullish/bearish nature on shorter tf. Here for example, we have been correction the impulse wave down and if you are active on the chat, you will see sentiment swing every few hours owing to the complex nature of the wave.

Note: the impulse wave down can even be a part of corrective wave of a higher degree. Don't get confused here, just want everyone to know how to detect these waves.

A QUICK LESSON ON BEAR FLAGS! Hey guys, just wanted to post this quick educational analysis of what a bear flag looks like and how to calculate the measured move. Pretty straightforward from the chart, but if you have any questions feel free to comment. Also, this bear flag ties in with my other idea that is linked below in case you want to see how it plays along with the current situation.

As always, this is for educational purposes only, please LIKE if this has helped you!

Reverse pattern in EURUSDA beautiful reverse pattern in the EURUSD invites to a short trade.

What are the signs for a short?

perfect evening star formation

CCI turns again below 100

overdue correction

changing monetary policy

How could a trade look like?

There are several possibilities.

Short-term trade: Entry immediately, SL at 1.1979 and TP at 1.1718

Medium to long-term trade: Entry immediately, SL at 1.21 and TP at 1.15

A thread about STRUCTURE!This entire thread will be for STRUCTURE!

In the "idea updates" column I will be posting all types of

corrective and impulsive structures!

When it comes to trading the waves, the 12345ABC we all

love to draw when we first learned about the theory will be

useless (most of the time)

What we should focus on is if we're in correction, and if so

how the heck can we trade the next impulse!

Every instrument I look at i will post here.

As long as there is structure it will be fine to be posted here!

Practical Exercise - Identify 1st Market ScenarioUnderstanding that market moves in an impulse or corrective nature, we can now further categorise market moves into 3 scenarios.

Here we will illustrate the 1st scenario - an impulse move, followed by a corrective move.

Practical Exercise

1) Find an example of such scenario in the market. It can be any currency pair, any timeframe.

2) Record down what's the next move after this scenario.

3) Repeat this practice to gather a total of 10 examples.

*Refer to the first comment below for a sample of this practical exercise.

Practical Exercise - Identify Impulse and Corrective MovesMarket moves can generally be categorised as either an IMPULSE move or a CORRECTIVE move.

A fast and strong move is described as an IMPULSE move.

A slow and weak move is described as a CORRECTIVE move.

Practical Exercise

1) Pick any currency pair, any timeframe, and identify the IMPULSE and CORRECTIVE moves on the chart.

2) Draw a line on the IMPULSE move; draw a box on the CORRECTIVE move.

3) Post your chart on the comment section below.

4) Repeat this practice on 2 other currency pairs.

*Refer to the first comment below for a sample of this practical exercise.