GARTLEY Harmonic Pattern: How does it work?!GARTLEY Harmonic Pattern: How does it work?!

The "Gartley", as its name suggests, was introduced by Henry Mackinley Gartley.

All other harmonic patterns are modifications of the Gartley.

Its construction consists of 5 waves:

XA: This could be any violent movement on the chart and there are no specific requirements for this movement in order to be a Gartley start

AB: This is opposite to the XA movement and it should be about 61.8% of the XA movement.

BC: This price movement should be opposite to the AB movement and it should be 38.2% or 88.6% of the AB movement.

CD: The last price movement is opposite to BC and it should be 127.2% (extension) of CD if BC is 38.2% of BC. If BC is 88.6% of BC, then CD should be 161.8% (extension) of BC.

AD: The overall price movement between A and D should be 78.6% of XA

How to use it

Point D is where you come in, man! It's your entry signal.

-If it's an M pattern, you buy.

-If it's a W, you sell2.

Where to put your STOP LOSS??

-Below or "X" if you are a BUYER.

-Above "X" if you are a SELLER.

These percentages are based on the famous Fibonacci ratios, as mysterious as the pyramids of Egypt!

Ultimately, the Gartley pattern is like a good Cuban cigar: it requires patience and experience to be appreciated at its true value. But once you master it, it can become a powerful tool in your trading arsenal, as effective as a punch from Rocky Balboa!

Gartley

Comprehensive Analysis of the Gartley Harmonic PatternThe Gartley Harmonic Pattern, a cornerstone of harmonic trading, was first introduced by H.M. Gartley in his 1935 book "Profits in the Stock Market." This pattern leverages Fibonacci retracement levels and geometric price formations to identify potential market reversals, providing traders with a strategic edge.

__________________________The Bullish Gartley Pattern___________________

Structure:

X-A Leg: The initial upward movement.

A-B Leg: A retracement of approximately 61.8% of the X-A leg.

B-C Leg: An upward move retracing between 38.2% and 88.6% of the A-B leg.

C-D Leg: The final downward movement, retracing 78.6% of the X-A leg, marking the pattern completion at point D.

Entry Criteria:

Entry Point: Enter a long (buy) position at point D, where the price is expected to reverse upward. This is typically the 78.6% Fibonacci retracement level of the X-A leg.

Stop-Loss:

Placement: Set a stop-loss order slightly below point X to safeguard against unexpected price movements. This minimizes potential losses if the pattern fails.

Take Profit:

First Target: Place the initial take profit target at point B, the retracement level of the A-B leg.

Second Target: Set the second target at point C, the retracement of the B-C leg.

Extended Targets: For a portion of the position, consider holding to capture further gains if the price continues to rise.

_________________________The Bearish Gartley Pattern_____________________

Structure:

X-A Leg: The initial downward movement.

A-B Leg: A retracement of approximately 61.8% of the X-A leg.

B-C Leg: A downward move retracing between 38.2% and 88.6% of the A-B leg.

C-D Leg: The final upward movement, retracing 78.6% of the X-A leg, completing the pattern at point D.

Entry Criteria:

Entry Point: Enter a short (sell) position at point D, where the price is anticipated to reverse downward. This corresponds to the 78.6% Fibonacci retracement level of the X-A leg.

Stop-Loss:

Placement: Set a stop-loss order slightly above point X to limit potential losses if the pattern does not play out as expected.

Take Profit:

First Target: Place the initial take profit target at point B.

Second Target: Set the second target at point C.

Extended Targets: Consider holding a portion of the position for additional gains if the price continues to decline.

_________________________Key Considerations__________________________

Precision: Accurate measurement of Fibonacci levels is critical. Even slight deviations can invalidate the pattern.

Confirmation: Utilize additional technical indicators or price action signals to confirm the pattern before initiating a trade. This can include moving averages, trend lines, or oscillators.

Risk Management: Adhere to strict risk management practices. This includes setting appropriate stop-loss levels and managing position sizes to protect capital.

____________________________Conclusion______________________________

The Gartley Harmonic Pattern is a sophisticated and reliable tool for identifying potential market reversals. By mastering the intricacies of both the bullish and bearish Gartley patterns, traders can enhance their analytical capabilities and improve trading outcomes. Integrating these patterns with other technical analysis methods and maintaining rigorous risk management protocols is essential for consistent trading success.

Incorporating the Gartley pattern into your trading strategy involves practice and diligence. Ensure that you continuously refine your skills in identifying these patterns and executing trades accordingly, always mindful of market conditions and broader economic factors.

100:50:100 RatioHere at the top, the pattern broadens to R3 (100%)...starting a 100:50:100 (R3:Pivot:S3) algorithm ratio pattern. When the price pulls back from the disjointed window channel, it should bull to a higher R3 because of the ratio signals with the horizontal events. If the price confirms on S3, be long term bullish!

Gartley Pattern (Bearish)With any harmonic pattern you want to let them completely finish before you make a trade at the PRZ (potential reverse zone) area. All harmonic patterns have there own Fib. retracement and extension range percentages, which you need to look up and know to verify that they what you think they are.

This Bearish Gartley pattern stick out very easily, on this EurJpy daily chart, you can trade all harmonic patterns on any time frames, but higher the time frames the easier to recognize them and the easier you will be able to predict their key XABCD points, and PRZ areas to set up trades. They are fun to do on your charts, but harder to do in live/real times when scalping and/or day trading on smaller time frames.

Do not only relay on harmonic patterns, but other confirming indicators, like RSI, angle trend lines, round psychological numbers and/or quarter numbers on chart you are trading on (.000, .250, .500 and/or .750).

Big deal on charts is for the best Risk Reward set ups, always trade when the PRZ (potential reversal zone) is hit and you see Engulfing, Harami and/or Pinbars candlestick patterns reversing in the other way then the bullish CD leg, so look for bearish trading and/or bearish CD leg, so look for bullish trading.

Wish all the best in forex trading and life. Always control risk management on all trades you do (lot sizes, stops, entry, exits/targets) you can do it.

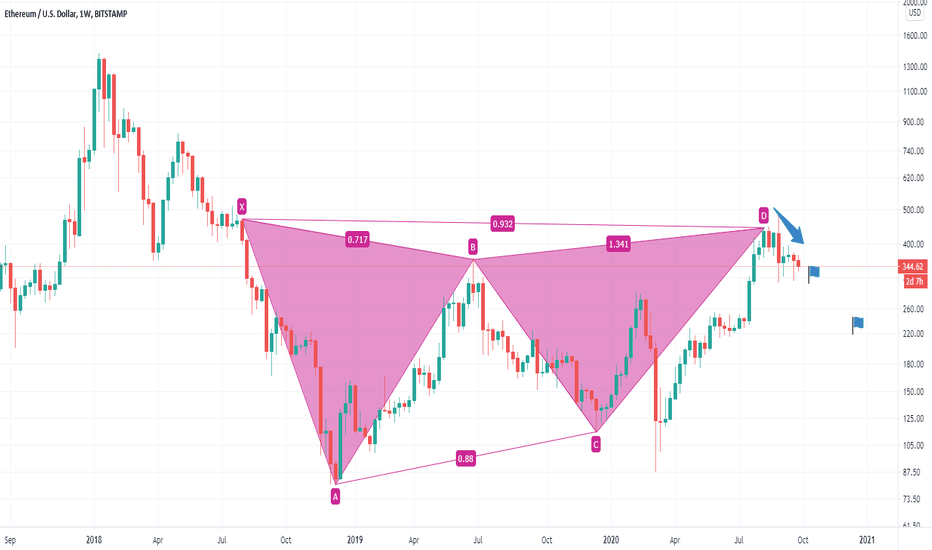

Wyckoff accumulation + gartley pattern We can notice an accumulation phase in the market. Pay attention at the spring, if you zoom in the chart you can see that the low of the spring has broken the low of selling climax and that is a perfect liquidity grab used by istitutionals to open their big long positions.

Then you can see the gartley pattern that worked perfectly, now I expect a retracment and a continuation of the new uptrend

Bullish Gartley patternBullish Gartley Pattern:

It starts with a bullish XA move. AB is then bearish. BC is bullish, and CD is bearish again.

XA: This can be any price activity on the chart. There is no specific price movement in Gartley chart formation.

AB: The AB move should be approximately 61.8 % Fibonacci of XA and should not cross the starting point X. If it crosses X then the pattern becomes invalid.

BC: The BC move should finish between 38.2% and 88.6% Fibonacci of XA and should no cross point A. If it crosses point A then the pattern becomes invalid.

CD: The CD move will be the final and important part of the pattern and to place a long trade when CD is 78.6% of XA. Ideally point D should represent 127% to 161.8% Fibonacci of BC. Look for entry at point D once you see the trend reversal. Note point D cannot be cross the starting point X. If it crosses then the pattern becomes invalid.

Profit Targets:

The full target price of the pattern is the 161.8% Fibonacci extension of the AD. However, there can be 3 intermediate targets before the final target

which are:

Target 1: point B swing

Target 2: Point C swing

Target 3: Point A swing

Target 4: Point E 161.8% Fibonacci of AD

Note that you can only draw (AD) Fibonacci retracement once the pattern has completed at point D and the price has reversed.

Stop Loss : should be just below X with a support channel.

If you like my TA & ideas!! Want to keep yourself updated with current market action, then please follow my profile for more analysis.

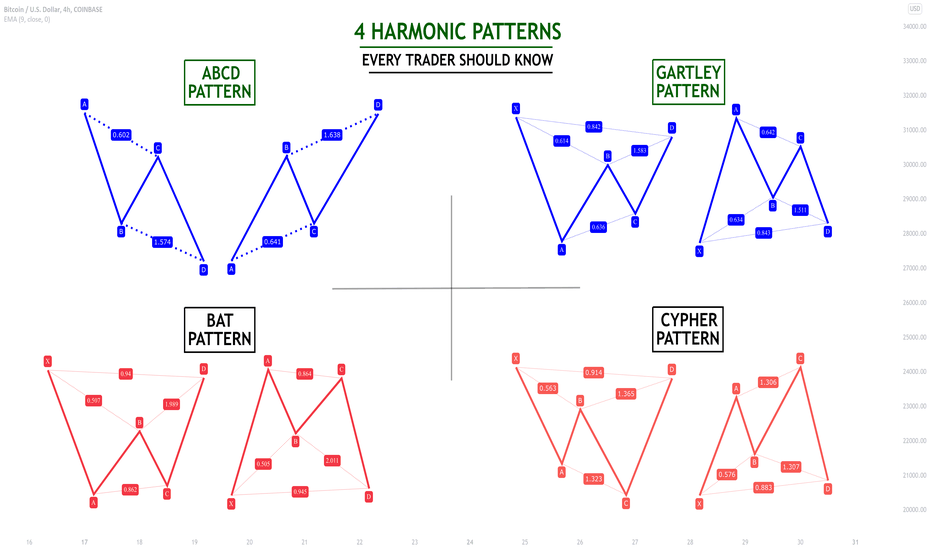

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️

Gartley Pattern Trading Strategy

Gartley patterns are harmonic chart patterns based on Fibonacci numbers.

The first stop-loss point is often positioned at Point X and the take-profit is often set at point Fibonacci retracement numbers.

I normally open 3 small positions or a big position and close partially at 0.618, 0.5 and 0.382 Fibonacci numbers.

Gartley patternHow to Trade when you see the Gartley Pattern?

What to consider to enter the trade?

To enter a Gartley trade you should first take note of the pattern and then confirm if it is valid or not. Outline the four price swings on the chart and check to make sure they respond to their respective Fibonacci levels to draw the Gartley pattern on your chart. Ensure you mark every price action swing with the important letters X, A, B, C, and D. By doing this, you will be able to estimate the overall size of the pattern and get a clear idea about the parameters.

If your chat is a bullish Gartley, open a long trade after noticing these conditions:

CD gets support at 127.2 percent or 161.8 percent Fibonacci level of the BC move.

The price action bounces in a bullish direction from the respective Fibonacci level.

If the Gartley pattern is bearish, then you make use of the same two rules to open a trade. But in this case, your trade will to the short side.

Where to set your stop-loss for a Gartley trade?

It is always recommended that you use a stop loss order regardless of your preferred entry signal. By doing this, you will be protecting yourself from any rapid or unexpected price moves. The stop loss order of a bullish Gartley trade should be found below the D point of the chart pattern. But for a bearish Gartley trade, your stop loss order should be found above the pattern’s D point.

What to aim for your take profit for a Gartley trade?

When you open your Gartley trade and you place your stop loss order, you expect the price to move in your favor, right? And if and when it does, you should know how long you expect to stay in the trade.

It is advisable to enter a full position after the D bounce and then scale out at different levels when trading a Gartley harmonic pattern. If the price momentum continues to show signs of strength, you can opt to keep a small portion of the trade open so as you can catch a large move. Use price action clues such as trend lines, support and resistant techniques, candle patterns and trend lines to find the right final exit point. But generally, if the price action shows no signs of interrupting the new trend, just stay in it for as long as you can.

Gartley Pattern Cheat SheetHello, guys!

Here is a cheat sheet for the very reliable pattern - Gartley. If you are able to find it on a chart the successful trade can be executed. The most important thing for gartley is the proportions which should be approximately like on the chart. There are four most popular Gartley's types:

-Crab

-Butterfly

-Bat

-Classical

Please, write in comments how are your trades with this pattern, it's very interesting to know!

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions.

Bearish Gartley Pattern - The Warning SignHello, dear subscribers!

Let's consider the most common bearish sign which can be founded on the market - the bearish Gartley formation.

This pattern takes place when there was a huge dump like from point X to point A. After that we have the small bounce from A to B, but the decline continue from B to C. There is a massive growth almost to the the X point level (see point D) at the end of this price action.

It seems that the downtrend is over and bulls dominate again. We can see two signs of the new uptrend beginning: the higher lows (point C is higher than A) and highs (point D is higher than B).

Here is a big danger now. Until the price is not reached the X point level, the bearish Gartley pattern formation can play. If the Gartley pattern have approximately the same characteristics as numbers on the chart there is the high probability of price dump to the price level between points A and C.

Be very careful when you analyze the trend reverse opportunity, this bearish sign can take place.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions.

eurgbp harmonic patternhello everyone EurGbp is ricing like a rocket right now

we expect to reach resistance line that mentioned in chart

here is that AB=Cd is complete and we expect a gartley pattern as well

notice that its opposite of trend so Enter with at most 3% of your equality

notice that target is based on fibonacci and lowest profit that is available in this case

my strategy is based on

1 : fibonacci

2 : harmonic pattern gartley and Ab=CD

3 : trend line and channel trading

4 ; Rsi h4

notice that in order to enter this trade you should see some confirmations like : candlesticks formation , indicator,s signs (ichimoku , moving average and ... )

then at last wait for break higher low to enter short

Hope you Enjoy

♥ { comment in below and share you opinion with my team } ♥

this is MkyTradingGroup

Bist 100 Ayı Gartley , Bearish GartleyBist 100 ,15 dakikalık grafikte Bearish Gartley formasyonu oluyor gibi gözüküyor,bu çalışmalarda yeniyim,grafik eğitim amaçlıdır,yatırım tavsiyesi değildir.

Eğer tespitim doğru ise ve formasyon normal kanalında devam eder ise 109.200 lere kadar bir çıkış ve sonrasında 100.000 altı bir senaryo olabilir.

Bu teknik analiz tabi ülkemizde olabilecek ani haber akışları ile tamamen değişebilir.Böyle bir durumda formasyon tamamen geçersiz olacaktır

WAVE 3 OF WAVE C OF WAVE B WAVE 3 OF WAVE C OF WAVE B

TECHNICAL SL AND A REDUCED SL, WITH LESS RISK BUT WITH GOOD CHANCE OF NOT BEING TOUCHED. TAKING THE GUIDELINES OF THE TRIDENTS : IF AT THE BEGINNING OF A TRIDENT OF ONE HARMONIC (GARLEY IN THIS CASE) A 5-WAVE IMPULSE BEGINS, THE PRICE HAS 80% CHANCE OF REACHING THE CENTER LINE (DOTTED RED) AND NOT BREAKING THE SIDE LINES.

ONDA 3 DE LA ONDA C DE LA ONDA B

SI EL PRECIO TOCA LA LINEA LATERAL DE TRIDENTE , PROBABLEMENTE TOME OTRA ENTRADA.

SL TECNICO Y UN SL REDUCIDO , CON MENOS RIESGO PERO CON BUENAS PROBABILIDADES DE NO SER TOCADO . TOMANDO LAS GUIAS DE LOS TRIDENTES : SI AL INICIO DE UN TRIDENTE DE UN DE UN ARMONICO (GARLEY EN ESTE CASO) EMPIEZA UN IMPULSO DE 5 ONDAS , EL PRECIO TIENE 80% DE PROBABILIDADES DE LLEGAR A LA LINEA DEL CENTRO (ROJA) Y NO ROMPER LAS LINEAS LATERALES DEL TRIDENTE .

Analysis of EURUSD HarmonicThis is for education purposes analysing a successful harmonic pattern / 61.8.

This was from a Gartley which is a very powerful harmonic pattern.

The price completed a Harmonic pattern with values very close to the desired out come (only a few points)

Price found a level of support from the structure.

There was Divergence evidence in the lower time frame

This is complemented by a trendline breakout

Finally, there was a rejection pin bar from the 61.8 level ( look for the X A Line)

The exit point would have been based on a rejection candle from the one hour time frame at the 50 level. After that, price hovered around there then fell back to the main 61.8 level.

The only point of this trade that would bring doubt is this is a reversal pattern against a strong downward trend however with proper risk reward management this was a successful pattern.