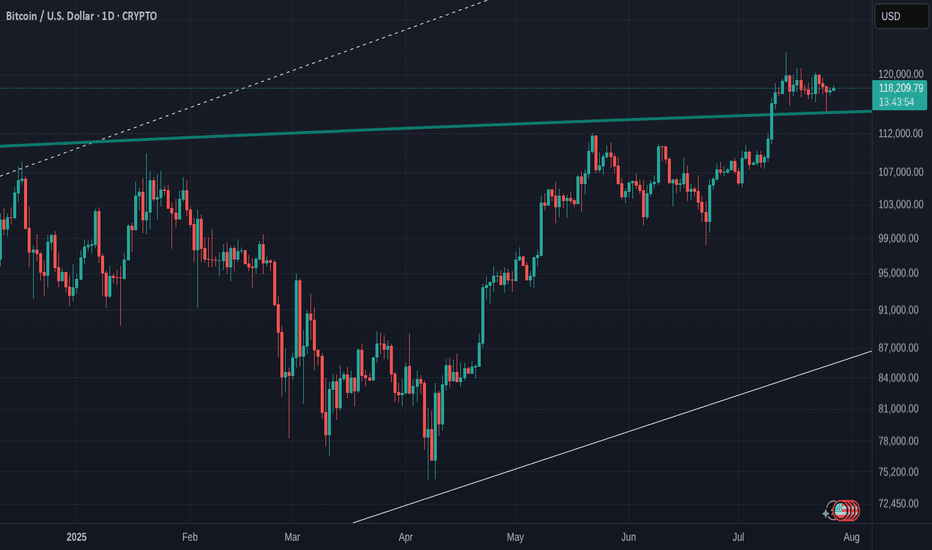

Bitcoin Daily shows us that a HUGE Hurdle has been crossed

The question I will answer in this post is "What is the significance of that Blue line that BTC PA is now sitting on"

On the Daily chart, we can see it has been tested as support and Held.

Previously, it was resistance..

So what ? This has happened many times before.

Lets zoom out and look at the weekly.

So, we see that the Blue line was also the rejection zone in 2021.

Infact, if you look, it has rejected BTC PA 5 times since March 2021 and we have finaly managed to get over it and seem to be comfortable using ot as support now.

This leaves the door open to move higher once PA is ready

But there is WAY MORE to this

Lets look at the monthly chart

So now we see that that same Blue Arc has also been rejecting BTC PA since 2011.

That is nearly the entire life span of Bitcoin and it is certainly the entire life span of its current Bullish momentum since we entered the current channel we are in..

So, in many way, this could be seen as a new beginning, a New cycle.

We do need to remain cautious for now though. As we can see, we did get over this line in 2013 but fell back below......and of course, the possibility for this to happen again exists BUT we now have massive Corporate investment. This could stop that fall.

PA needed to get over this line or fall.

Should this fail to hold for now, we will return to lower lines of support, around 70K- 80K but I would anticipate a massive buying spree should that happen.

The next few months in Bitcoin are absolutely CRUCIAL.

We need to remain above this Arc.

And as I have shown months ago, this Arc is not just a line drawn freehand.

It is actually calculated and is part of a Fibonacci Arc.

The Monthly chart also shows us we are near the ATH Zone on a time span shown under PA on this chart.

We may not see the steep rise we have previously...but the Major Victory is remaining ABOVE this Blue Arc

Fingers Crossed

Bitcoinfutures

Bitcoin: The CME Futures PREMIUM, New All-Time High ConfirmedOk, you got me, I will reveal my secrets to you. I only do this because I love you and I want to give you true value. Great content that you can truly trust because it is based on real market data. Just watch!

» Bitcoin CME Futures price: $104,425 (BOOM!)

» Bitcoin BTCUSDT Spot price: $103,600 (Checkmate)

There is a premium on Bitcoin futures price. This means the market is bullish, plain and simple. You can bet your house, a hotel and your wife on the fact that Bitcoin will soon hit a new All-Time High.

The signals are in.

You can fight me in the comments section or you can simply agree and follow me.

Namaste.

Bitcoin Trajectory for Q1 and Q2 2025Hey everyone, it’s been a while! 👋

Let’s dive straight into the Bitcoin outlook and my vision for the months ahead. 🚀

Key Observations 📊

Patterns : Rounding Top & Bottom.

Rebound Levels:

Alt. 1: $101,000

Alt. 2: $82,000

Moving Averages : EMA50 & EMA188.

Target Area : $135,000+ 🔥

Pro Tip 💡

I'm setting an alert for the EMA188 cross on BTCUSDT to stay ahead of the game.

Stay tuned for more updates and insights! 💬

Bitcoin Cycle Update – Are We Nearing the Peak?Check out this BTCUSDT chart – we’re at GETTEX:92K today, and seems like things are heating up!

▸We’ve seen a Cycle Bottom in late 2022 - early 2023, followed by strong Bull runs in 2023 and 2024.

▸Those Consolidation phases (sideways channels) gave us the perfect setup for massive pumps!

▸Right now, we’re in a Pause Triangle after a big rally – but the Cycle Top could be just around the corner in mid-2025.

▸After that? A potential Bear phase – time to plan your moves!

💡 What’s your strategy? Are you riding this wave to the top, or preparing for the next dip? Let’s discuss 📨

Bitcoin Aligns with the 2017 Cycle ModelThere’s growing speculation that the current Bitcoin cycle mirrors the market behavior seen in 2017.

Intrigued by this, I conducted my own analysis. I overlaid the 2014–2017 cycle pattern onto the current chart for comparison.

The results?

A striking resemblance in both the overall shape and the distinct correction and impulse phases.

It seems history may not repeat itself exactly, but it certainly rhymes. 📊

Behind the Curtain: Bitcoin’s Surprising Macro Triggers1. Introduction

Bitcoin Futures (BTC), once viewed as a niche or speculative product, have now entered the macroeconomic spotlight. Traded on the CME and embraced by institutions through ETF exposure, BTC Futures reflect not only digital asset sentiment—but also evolving reactions to traditional economic forces.

While many traders still associate Bitcoin with crypto-native catalysts, machine learning reveals a different story. Today, BTC responds dynamically to macro indicators like Treasury yields, labor data, and liquidity trends.

In this article, we apply a Random Forest Regressor to historical data to uncover the top economic signals impacting Bitcoin Futures returns across daily, weekly, and monthly timeframes—some of which may surprise even seasoned macro traders.

2. Understanding Bitcoin Futures Contracts

Bitcoin Futures provide institutional-grade access to BTC price movements—with efficient clearing and capital flexibility.

o Standard BTC Futures (BTC):

Tick Size: $5 per tick = $25 per tick per contract

Initial Margin: ≈ $102,000 (subject to volatility)

o Micro Bitcoin Futures (MBT):

Contract Size: 1/50th the BTC size

Tick Size: $5 = $0.50 per tick per contract

Initial Margin: ≈ $2,000

BTC and MBT trade nearly 24 hours per day, five days a week, offering deep liquidity and expanding participation across hedge funds, asset managers, and active retail traders.

3. Daily Timeframe: Short-Term Macro Sensitivity

Bitcoin’s volatility makes it highly reactive to daily data surprises, especially those affecting liquidity and rates.

Velocity of Money (M2): This lesser-watched indicator captures how quickly money circulates. Rising velocity can signal renewed risk-taking, often leading to short-term BTC movements. A declining M2 velocity implies tightening conditions, potentially pressuring BTC as risk appetite contracts.

10-Year Treasury Yield: One of the most sensitive intraday indicators for BTC. Yield spikes make holding non-yielding assets like Bitcoin potentially less attractive. Declining yields could signal easing financial conditions, inviting capital back into crypto.

Labor Force Participation Rate: While not a headline number, sudden shifts in labor force data can affect consumer confidence and policy tone—especially if they suggest a weakening economy. Bitcoin could react positively when data implies future easing.

4. Weekly Timeframe: Labor-Driven Market Reactions

As BTC increasingly correlates with traditional markets, weekly economic data—especially related to labor—has become a mid-term directional driver.

Initial Jobless Claims: Spikes in this metric can indicate rising economic stress. BTC could react defensively to rising claims, but may rally on drops, especially when seen as signs of stability returning.

ISM Manufacturing Employment: This metric reflects hiring strength in the manufacturing sector. Slowing employment growth here could correlate with broader economic softening—something BTC traders can track as part of their risk sentiment gauge.

Continuing Jobless Claims: Tracks the persistence of unemployment. Sustained increases can shake risk markets and pull BTC lower, while ongoing declines suggest an improving outlook, which could help BTC resume upward movement.

5. Monthly Timeframe: Macro Structural Themes

Institutional positioning in Bitcoin increasingly aligns with high-impact monthly data. These indicators help shape longer-term views on liquidity, rate policy, and capital allocation:

Unemployment Rate: A rising unemployment rate could shift market expectations toward a more accommodative monetary policy. Bitcoin, often viewed as a hedge against fiat debasement and monetary easing, can benefit from this shift. In contrast, a low and steady unemployment rate may pressure BTC as it reinforces the case for higher interest rates.

10-Year Treasury Yield (again): On a monthly basis, this repeats and become a cornerstone macro theme.

Initial Jobless Claims (again): Rather than individual weekly prints, the broader trend reveals structural shifts in the labor market.

6. Style-Based Strategy Insights

Bitcoin traders often span a wide range of styles—from short-term volatility hunters to long-duration macro allocators. Aligning indicator focus by style is essential:

o Day Traders

Zero in on M2 velocity and 10-Year Yield to time intraday reversals or continuation setups.

Quick pivots in bond yields or liquidity metrics could coincide with BTC spikes.

o Swing Traders

Use Initial Jobless Claims and ISM Employment trends to track momentum for 3–10 day moves.

Weekly data may help catch directional shifts before they appear in price charts.

o Position Traders

Monitor macro structure via Unemployment Rate, 10Y Yield, and Initial Claims.

These traders align portfolios based on broader economic trends, often holding exposure through cycles.

7. Risk Management Commentary

Bitcoin Futures demand tactical risk management:

Use Micro BTC Contracts (MBT) to scale in or out of trades precisely.

Expect volatility around macro data releases—set wider stops with volatility-adjusted sizing.

Avoid over-positioning near major Fed meetings, CPI prints, or labor reports.

Unlike legacy markets, BTC can make multi-percent intraday moves. A robust risk plan isn’t optional—it’s survival.

8. Conclusion

Bitcoin has matured into a macro-responsive asset. What once moved on hype now responds to the pulse of the global economy. From M2 liquidity flows and interest rate expectations, to labor market stability, BTC Futures reflect institutional sentiment shaped by data.

BTC’s role in the modern portfolio is still evolving. But one thing is clear: macro matters. And those who understand which indicators truly move Bitcoin can trade with more confidence and precision.

Stay tuned for the next edition of the "Behind the Curtain" series as we decode the economic machinery behind another CME futures product.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Bitcoin, Mind The Gap (85,720) The massive move initiated from Trumps tweet Sunday about the Crypto Strategic Reserve has left a massive gap on the Bitcoin Futures Chart. Gaps tend to get fill sooner rather than later, with a high 90% hit rate on gaps getting filled.

We could see a pullback this week to fill the gap with another run up following back above 90k to save the weekly close ... again.

We see confluence with the golden pocket (0.6128 - 0.65 Fib) here on that retracement and also the most amount of volume (VPVR) being traded there.

A final test of the demand below 90k, which if shown as support, will lead us back into the range of 90k to 110k.

BTCUSD ConsolidationBitcoin is currently in a consolidation phase and gathering momentum to start a new trend, either up or down. The main consolidation range is between the 92,500 and 100,000 levels, and there is now a new consolidation range between 94,800 and 98,500. During this period, trading is not recommended, as it is uncertain which direction the trend will take.

$30,000 drop or $30,000 rise ?!!!This wedge can change the market outcome. If Bitcoin cannot break this wedge from above, we will see a $30k price drop. If the price breaks this wedge from above, we will see a $30k price increase. Now that most traders are disheartened by the crypto market and are selling their assets cheaply, I suspect that the price will go up.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Bitcoin Forecast After 2024 - Why support at 82,000?Bitcoin's price at the close of December, marked by this inverted hammer, clearly indicates that a correction is imminent. However, the overall trend remains upward.

We will discuss the fundamental reasons why Bitcoin may have temporarily peaked in December 2024, as well as the potential support level around 82,000 this year. Let’s explore how we can manage Bitcoin following its peak above 100,000 as we move into 2025.

Micro Bitcoin Futures & Options

Ticker: MBT

Minimum fluctuation:

$5.00 per bitcoin = $0.50 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trade Idea 2024-12-30 and Review of 2024As the year comes to a close, we expect it to be a quiet week. If you haven’t already, now is an excellent time to set your trading goals for the coming year. Where will your focus be? Which markets will you trade actively? What is your risk management plan?

It is also a good time to complete a review for 2024 if you have not already! Keeping a trading journal is essential for tracking progress and learning from your mistakes.

Active trading, like other high-performance activities, requires resilience, focus, and a winning mindset, but even with these attributes, losses are a natural part of the process. Always trade with a clear plan, manage your risks effectively, and never trade with more capital than you can afford to lose.

As we wrap up the year, we are sharing a couple of the most popular charts we reviewed in 2024 and reflecting on the following questions we asked ourselves:

What has the market done?

What is it trying to do?

How good of a job is it doing?

What is likely to happen from here?

Volume profile provides key insights into market auction and interaction of buyers and sellers.

This is how we approach markets although there are many other ways of doing so.

Big Picture ES Futures:

Key Levels:

2024 mid point: 5574.50

2024 VPOC: 5441.75

2024 Value Area High: 5844.25

2024 High: 6184.50

Fib Extensions Target 1: 6388

Fib Extension Target 2: 6514.25

Fib Extension Target 3: 6590.75

Fib Extension Target 4: 6695.50

Big Picture BTC Futures:

Key Levels:

2024 High: 108,960

2024 Mid point: 77,865

2024 VPOC: 69,710

2024 Value Area High: 79,525

Key Support for Bulls: 78,000 - 76,000

Big Picture CL Futures:

Key Levels:

Composite Value Area High: 79.65

2024 Value Area High: 74.90

2024 Mid point: 72.14

2024 VPOC: 69.70

2024 Value Area Low: 66.70

Composite Value Area Low: 63.55

We await the start of the new year to further gauge short term price action, volume and ranges for the upcoming year! Happy trading from EdgeClear! We wish you all a great 2025!

Disclaimer: The views expressed are opinions and should not be interpreted as financial advice. Derivatives involve a substantial risk of loss and are not suitable for all investors.

Decoding the BTC-ES Correlation During FOMC Meetings1. Introduction

The Federal Open Market Committee (FOMC) meetings are pivotal events that significantly impact global financial markets. Traders across asset classes closely monitor these meetings for insights into the Federal Reserve’s stance on monetary policy, interest rates, and economic outlook.

In this article, we delve into the correlation between Bitcoin futures (BTC) and E-mini S&P 500 futures (ES) during FOMC meetings. Focusing on the window from one day prior to one day after each meeting, our findings reveal that BTC and ES exhibit a positive correlation 63% of the time. This relationship offers valuable insights for traders navigating these volatile periods.

2. The Significance of Correlations in Market Analysis

Correlation is a vital tool in market analysis, representing the relationship between two assets. A positive correlation indicates that two assets move in the same direction, while a negative correlation implies they move in opposite directions.

BTC and ES are particularly intriguing to study due to their distinct market segments—cryptocurrency and traditional equities. Observing how these two assets interact during FOMC meetings provides a window into macroeconomic forces that affect both markets.

The key finding: BTC and ES are positively correlated 63% of the time around FOMC meetings. This suggests that, despite their differences, both markets often react similarly to macroeconomic developments during these critical periods.

3. Methodology and Data Overview

To analyze the BTC-ES correlation, we focused on a specific timeframe: one day before to one day after each FOMC meeting. Daily closing prices for both assets were used to calculate correlations, providing a clear view of their relationship during these events.

The analysis includes data from multiple FOMC meetings spanning several years. The accompanying charts—such as the correlation heatmap, table of BTC-ES correlations, and line chart—help visualize these findings, highlighting the periods of positive and negative correlation.

Contract Specifications:

o E-mini S&P 500 Futures (ES):

Contract Size: $50 x S&P 500 Index.

Minimum Tick: 0.25 points, equivalent to $12.50.

Initial Margin Requirement: Approximately $15,500 (subject to change).

o Bitcoin Futures (BTC):

Contract Size: 5 Bitcoin.

Minimum Tick: $5 per Bitcoin, equivalent to $25 per tick.

Initial Margin Requirement: Approximately $112,000 (subject to change).

These specifications highlight the differences in notional value and margin requirements, underscoring the distinct characteristics of each contract.

4. Findings: BTC and ES Correlations During FOMC Meetings

The analysis reveals several noteworthy trends:

Positive Correlations (63% of the time): During these periods, BTC and ES tend to move in the same direction, reflecting shared sensitivity to macroeconomic themes such as interest rate adjustments or economic projections.

Negative Correlations: These occur sporadically, suggesting that, in certain scenarios, BTC and ES respond differently to FOMC announcements.

5. Interpretation: Why Do BTC and ES Correlate?

The observed correlation between Bitcoin futures (BTC) and E-mini S&P 500 futures (ES) around FOMC meetings can be attributed to several factors:

Macro Sensitivity: Both BTC and ES are heavily influenced by macroeconomic variables such as interest rate decisions, inflation expectations, and liquidity changes. The FOMC meetings, being central to these narratives, often create synchronized market reactions.

Institutional Adoption: The increasing participation of institutional investors in Bitcoin trading aligns its performance more closely with traditional risk assets like equities. This is evident during FOMC events, where institutional sentiment towards risk assets tends to align.

Market Liquidity: FOMC meetings often drive liquidity shifts across asset classes. This can lead to aligned movement in BTC and ES as traders adjust their portfolios in response to policy announcements.

This correlation provides traders with actionable insights into how these assets might react during future FOMC windows.

6. Forward-Looking Implications

Understanding the historical correlation between BTC and ES during FOMC meetings offers a strategic edge for traders:

Hedging Opportunities: Traders can use the BTC-ES relationship to construct hedging strategies, such as using one asset to offset potential adverse moves in the other.

Volatility Exploitation: Positive correlation periods may signal opportunities for trend-following strategies, while negative correlation phases could favor pairs trading strategies.

Risk-On/Risk-Off Cues: The alignment or divergence of BTC and ES can act as a barometer for market-wide sentiment, aiding decision-making in other correlated assets.

Future FOMC events could present similar dynamics, and traders can leverage this data to refine their approach.

7. Risk Management Considerations

While correlations provide valuable insights, they are not guaranteed to persist. Effective risk management is crucial, particularly during volatile periods like FOMC meetings:

Stop-Loss Orders: Ensure every trade is equipped with a stop-loss to cap potential losses.

Position Sizing: Adjust position sizes based on volatility and margin requirements for BTC and ES.

Diversification: Avoid over-concentration in highly correlated assets to reduce portfolio risk.

Monitoring Correlations: Regularly assess whether the BTC-ES correlation holds true during future events, as changing market conditions could alter these relationships.

A disciplined approach to risk management enhances the probability of navigating FOMC volatility successfully.

8. Conclusion

The correlation between Bitcoin futures (BTC) and E-mini S&P 500 futures (ES) around FOMC meetings highlights the interconnected nature of modern financial markets. With 63% of these events showing positive correlation, traders can glean actionable insights into how these assets react to macroeconomic shifts.

While the relationship between BTC and ES may fluctuate, understanding its drivers and implications equips traders with tools to navigate market volatility effectively. By combining historical analysis with proactive risk management, traders can make informed decisions during future FOMC windows.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Bitcoin Futures Confirming 3 Drives of Bearish Divergence

In the recent analysis of futures on the daily timeframe, a technical pattern known as the "3 Drives of Divergence" has been confirmed, signaling a potential trend reversal. This pattern, often associated with strong bearish momentum, has been observed with a divergence in the Relative Strength Index (RSI), further supporting the bearish outlook.

RSI Divergence: The RSI, a momentum oscillator, shows a bearish divergence where the price makes higher highs, but the RSI makes lower highs. This is a classic sign of weakening upward momentum, often preceding a price decline.

Key Levels:

Reversal Pivot: If the price closes below 97K on a daily timeframe. This pivot is critical as it is the last resistance before a potential downtrend.

Target Futures Gap Fill: Historical price action suggests a gap in the futures market that might get filled. This target zone, marked on the chart, could act as a price magnet for Bitcoin if bearish pressures continue.

BTC Futures Expectations: Anticipating the Next Market MovesTwo major macro events are now behind us; the Fed rate decision and more notably, the U.S. Presidential Election. With a clean red sweep, we have begun to see Scenario 1 play out from our previous post. However, given the surge of retail euphoria and excitement, this run towards the 90k mark was not entirely unexpected. November 11, 2024 has now set a crucial range for the weeks ahead.

Big Picture BTC Futures:

Key Levels to Watch:

pATH support: 78,960 - 77,155

Key Bull Zone: 68,100 - 65,500

Yearly Mid: 67,375

Yearly VPOC: 68,100

Scenario 1 — Consolidation While Capped by Weekly High and Monday’s Range

In this scenario, we can expect further consolidation as more participants enter the market.

Based on our current expectations, BTC may consolidate near new ATHs and above key pATHs support. Perhaps we may see another bull flag formation, which may fail at first and test the key pATHs support before another upward move. Here, the key would be shaking out late breakout traders, with a possible dip before another move higher as outlined.

Scenario 2 — Euphoria Turns to Frustration and Shakeout for Late Breakout Traders

In this scenario, we expect a deeper pullback that could be more intense—shifting the euphoria into gloom. A bottom signal will likely emerge as market sentiment turns bearish. BTC futures could dip back to pATHs, followed by a quick V bottom recovery that tests the confluence of yVPOC, key bull support, and yearly midpoint.

Scenario 3 - Sustained Bullish Momentum to 100K

In this scenario, a bullish run continues towards the 100K mark before it starts to cool down and consolidate between 90K and 100K price levels. This is a warning for those trying to time a top in BTC futures. It is better to plan than to step in blindly and fire from the hip.

Considering trading CME BTC futures? You can now access CME MBT Micro Bitcoin futures, 1/10th the size of one bitcoin, and CME BFF, Bitcoin Friday futures, sized at 1/50 of a bitcoin, Bitcoin Friday futures is a short-dated contract that provides an accessible, capital-efficient way to manage your bitcoin trading strategies.

Disclaimer: The views expressed are personal opinions and should not be interpreted as financial advice. NFA does not have regulatory oversight authority over underlying or spot virtual currency products. Derivatives involve a substantial risk of loss and are not suitable for all investors.

Bitcoin | In Satoshi V Trust Gentlemen welcome to BULL MARKET

The price of Bitcoin is $28,280 today with a 24hour trading volume of 45 billion dollars This represents a 4% price increase in the last 24 hours and a 40% price increase in the past 7 days

When iconic US investment bank Lehman Brothers Holdings Inc. filed for bankruptcy in 2008, it shook people’s faith in banks so much that a new class of asset, which did not have the backing of any formal bank, came into being. Bitcoin, the most popular cryptocurrency, first found a mention in November 2008, about two months after the Lehman crisis. A decade later, cryptocurrencies have become one of the most debated financial assets, globally and in India, in terms of risk and returns. now in 2023 Banks fails even bigger and bitcoin is here to shine

Right now all big companies including Amazon, Microsoft, BlackRock, BridgeWater ... got an eye on crypto and buying the dip while the old banking system shows its flaws

all indicators sending bullish signal and be ready for 28500, 28700 and 28900$

Bitcoin is going to the moon! [S3]Signal #3 for my new signal series.

Bitcoin is extremely bullish right now and parabolic, its been bullish for a while now but the momentum remains strong and lots of bull flags remain positive.

----------------------------------------------------------------------------------------------

***ALL ANALYSIS, SIGNALS, AND ANY CONTENT IS FOR EDUCATIONAL PURPOSES

ONLY AND ARE NOT MEANT TO BE PROFITED OFF.***

----------------------------------------------------------------------------------------------

Like I stated in my first signal, I will not be going in big depth on the TA for the signal posts I make, I will make educational posts going more in depth on that soon though.

This post is mainly based on price action, momentum, and some indicators of mine.

Entry:

$79,200-$80,000

Targets:

TP1: $82,742

TP2: $85,132

TP3: $82,742

Stop Loss:

$74,305

----------------------------------------------------------------------------------------------

***ALL ANALYSIS, SIGNALS, AND ANY CONTENT IS FOR EDUCATIONAL PURPOSES

ONLY AND ARE NOT MEANT TO BE PROFITED OFF.***

----------------------------------------------------------------------------------------------

BTC IN UP MOVEMENT + TRADE PLANTrend Identification:

Descending Channel: Bitcoin is currently in a descending parallel channel after an uptrend, indicating a potential bullish continuation if it breaks out of this channel.

Previous Uptrend: The price came from an uptrend, and descending channels often serve as continuation patterns, suggesting a higher probability of an upward breakout.

Key Support and Resistance Levels:

Support Levels:

$68,556.87: Major support near the recent low in the channel.

$66,333.98: Secondary support zone that could act as a cushion in case of a downside move.

$64,591.15: Historical support level providing a safety net if the price dips further.

Resistance Levels:

$72,198.87: Immediate resistance that BTC needs to overcome for a continued uptrend.

$73,655.67: Key resistance area that, if broken, could trigger a strong bullish move.

Indicators Analysis:

RSI (Relative Strength Index): The RSI is close to the midpoint, indicating a neutral zone. However, an upward movement in RSI could signal increasing bullish momentum.

Stochastic RSI: Currently near the overbought zone. It indicates potential upward pressure, but caution is needed as it may signal short-term exhaustion.

Volume: Noticeable increase in volume around the support levels, indicating buying interest. Volume confirmation on breakout above the resistance line would strengthen the bullish case.

Moving Averages:

HMA (Hull Moving Average): Showing a slight upward trend, aligning with the potential breakout from the descending channel.

Trading Plan

Entry Strategy:

Aggressive Entry: Enter a long position upon the breakout of the descending channel, ideally with a confirmed volume increase above $72,198.87. This would signal a possible continuation of the previous uptrend.

Conservative Entry: Wait for a confirmed breakout and retest of the $72,198.87 level. If the price holds above this level after retesting, it indicates stronger bullish confirmation.

Stop Loss:

Place a stop loss slightly below $68,556.87 to limit downside risk. This area aligns with recent support, and a drop below it may indicate invalidation of the breakout pattern.

Take Profit Levels:

Primary Target: $73,655.67 (first resistance level). Partial profits can be taken here to lock in gains.

Secondary Target: $76,000, if Bitcoin gains strong momentum after breaking through the primary target. This level could be achieved in a continued bullish scenario.

Final Target: $80,000 as a psychological target, if there is sustained bullish momentum and no major resistance above.

Risk Management:

Position Size: Limit the position size to manage risk exposure, especially with the potential volatility in cryptocurrency markets.

Trailing Stop: Consider using a trailing stop after reaching the first target to lock in profits while allowing for potential upside.

Monitoring Indicators:

Volume: Continuously monitor the volume as the price approaches resistance zones. Higher-than-average volume would support the breakout, whereas weak volume could lead to a false breakout.

RSI and Stochastic: Keep an eye on these momentum indicators. If the RSI and Stochastic enter overbought territory and start to diverge, it could signal a potential reversal.

Timeframe:

This setup appears on a 4-hour chart, suggesting a medium-term trading perspective. Reassess positions if the breakout fails to materialize within the next few days.

BITCOIN is the KING and upward movement is highly expected!Technical analysis and trade plan by Blaž Fabjan

Support and Resistance Levels:

Resistance Levels:

72,198.87 USDT

68,556.87 USDT

64,591.15 USDT

Support Levels:

66,333.98 USDT

61,758.48 USDT

60,301.68 USDT

56,902.49 USDT

The key levels indicate potential areas where price action could face resistance or find support, which might serve as entry or exit points.

Indicators:

Wave Cipher Divergences:

Wave Cipher shows divergences suggesting a possible upward momentum. Positive divergences with green dots could imply bullish continuation.

Relative Strength Index (RSI):

RSI currently reads 55.19, indicating a neutral zone, leaning slightly bullish if it moves towards 60. This suggests Bitcoin isn't overbought or oversold and could continue a gradual trend.

Stochastic Oscillator:

The Stochastic shows a value around 70.52, close to the overbought region (above 80). If it breaks further upward, it may signal an overbought state, potentially leading to a correction.

Hull Moving Average (HMA):

HMA appears to trend slightly downwards, showing a bearish trend in the short term. The value of -6.58 indicates a bearish momentum, which may warn of a potential short-term pullback before any significant uptrend resumes.

Price Action:

The chart shows a potential breakout attempt around the 66,333.98 USDT level, where price action previously tested and retraced. A consolidation near this level could suggest that bulls are preparing for an upward push, especially if price breaks above 68,556.87 USDT.

Volume Analysis:

Volume shows a steady, moderate increase, supporting the upward trend. This moderate volume increase without large spikes could imply gradual accumulation rather than distribution.

Trading Plan

Long Position (Bullish Scenario)

Entry: Consider entering a long position if the price breaks and holds above the 68,556.87 USDT resistance level with volume confirmation.

Stop Loss: Set a stop loss slightly below the 66,333.98 USDT support level to mitigate risk in case of a false breakout.

Targets:

Target 1: 72,198.87 USDT — aligns with a strong resistance level and provides a conservative target.

Target 2: 75,553.67 USDT — the next significant resistance level, offering a favorable risk-to-reward ratio.

Short Position (Bearish Scenario)

Entry: Consider shorting if the price fails to hold above 66,333.98 USDT and shows bearish confirmation, such as a breakdown with high volume.

Stop Loss: Set a stop loss above 68,556.87 USDT to avoid risks from potential false breakdowns.

Targets:

Target 1: 61,758.48 USDT — a nearby support level that provides a logical take-profit point.

Target 2: 60,301.68 USDT — serves as a secondary target if the bearish trend strengthens.

Risk Management: Given the proximity to resistance and support levels, using a risk/reward ratio of 1:2 or higher is advisable to maintain favorable trade setups.

Monitor Divergences: Keep an eye on divergences in the Wave Cipher, RSI, and Stochastic Oscillator for potential trend reversals or continuations.

News and Market Sentiment: Be mindful of broader market sentiment and news events, as these can influence Bitcoin's price behavior, particularly near key levels.

This trading plan provides a structured approach to capitalize on potential breakouts or breakdowns, balancing both bullish and bearish scenarios.

BITCOIN ULTIMATE PARABOLIC CURVE CHART | Insane $181,267 Target!🟢 Hello, fellow traders! I’m excited to share an update on Bitcoin price prediction and the potential implications of the Parabolic Curve pattern we witnessing at the moment!

Today, let’s dive into the Parabolic Curve as Bitcoin approached the end point of Base 4. Understanding this pattern can help us evaluate future trading opportunities.

The Parabolic Curve often surfaces near the culmination of major market surges, marking the end result of multiple base formation breaks. This pattern is typically seen in growth assets with innovative technology or visionary leadership — Bitcoin is a prime example.

Last year, at the pivotal point of Base 3 , indicated by the "X" on the chart at $25,700 , Bitcoin doubled in a remarkably short timeframe.

The hallmark of this pattern was its staircase-like formation, where the price created short-term bases before catapulting to new highs, repeating this cycle multiple times during its ascent.

In my analysis using Fibonacci tools and Elliott Waves , I've observed that:

Base 4 in the range between the $72,759 resistance and $55,257 support , with lowest spike at $49,000 .

The anticipated sell zone for the parabolic move was positioned between $149,175 and $181,267 .

This parabolic curve, reminiscent of a rocket's trajectory, has demonstrated significant persistence. However, as we saw, caution is a key as this pattern near completion; rapid upward momentum can conclude abruptly, resulting in price declines that outpace previous gains.

What are your thoughts on Bitcoin's recent movements? Did you spot the Parabolic Curve unfolding as anticipated? Share your insights in the comments below — I’d love to hear your perspective!

Your support means the world to me, so if you found this analysis valuable, please smash that like button and follow for more insights!

Bulltraps aboundIf you were looking for an in-depth analysis, this isn't one.

I'm not offering financial advise, and I 'm only sharing this for entertainment purposes.

I am not a licensed professional and this information shouldn't be misconstrued as any kind of exchange related to professional services. Period.

Extracting Arbitrage Yields In Bitcoin Carry TradeBitcoin is known as digital gold. It is treasured as an investment asset. Much like the famous yellow metal, bitcoin (“BTC”) does not offer income through dividends or interest. This poses a challenge for investors seeking regular cashflows and income.

One strategy that skilled investors use to turn BTC into an income generating asset is the cash and carry trade (“carry trade”).

This paper describes mechanics of carry trade and the attendant risks. It also highlights that the introduction of spot ETFs has created a secure infrastructure for harvesting carry yields using a regulated platforms such as the CME.

INTRODUCTION TO THE CARRY TRADE

The carry trade is an arbitrage strategy that benefits from the differences in futures and spot price of an asset. It is a delta neutral strategy. In other words, the returns are not price dependent once the carry trade is profitably set up.

To illustrate, consider the forward curve of CME Bitcoin futures which shows futures prices at different expiries.

Bitcoin futures with later expiries trade at a premium to near term ones and this type of market structure is referred to as contango.

In a trade that involves simultaneous acquisition of BTC and selling a BTC futures contract expiring later, investors can lock in the price difference as profits. Once established, this trade’s profit is unaffected by price moves enabling investors to harvest carry yield at the futures expiry.

The pay-off from this trade is driven by convergence of futures and spot prices. Convergence is the movement of a futures price closer to spot price at expiry. Once futures and spot price are sufficiently close, the trade can be unwound by simultaneously exiting both positions.

For CME Bitcoin and Micro Bitcoin futures, convergence occurs because the futures contracts settle to a robust price benchmark known as the CF Bitcoin Reference Rate (“BRR”) which includes price quotes from major crypto exchanges.

BTC FUTURES CONTANGO TERM STRUCTURE AND PREVALANCE OF CARRY TRADE

Carry trades can be executed in both contango and backwardation term structures. While the carry trade can technically be executed in backwardation (where later expiries are cheaper), doing so involves high borrowing costs for the short spot leg. Hence, BTC’s contango term structure is beneficial for extracting arbitrage yields from carry trade.

Factors driving BTC contango term structure are multi-faceted. Simply put, during bull runs, investors anticipate higher prices for contracts maturing later. Furthermore, high demand for spot BTC and limited availability on the sell-side can exacerbate forward premiums.

Additional factors resulting in contango include cost of funds, insurance premiums, and custodial charges that are higher for later expiries, and a convenience yield of holding BTC. Convenience yield represents returns from holding BTC through activities such as lending.

BTC futures term structure has shown both contango and backwardation during different periods. Current term structure indicates bullish sentiment fuelled by spot BTC approval in January and the next halving event expected in April.

Term structure shifts can result in outsized returns at times. Notably, the switch from contango to backwardation can offer outsized returns on the carry trade, exceeding the difference between futures and spot price as observed at trade inception.

The carry trade has been a popular strategy, especially during periods of significant volatility and during bull markets when BTC contango structure widens. Even sell-offs provide compelling trading opportunities as the carry trade is directionally neutral. Carry trades have lower risk relative to an outright long position.

For reference , during 2021, LedgerPrime’s quant fund was able to beat BTC returns using, among others, the carry trade during a large selloff.

RISKS OF THE CARRY TRADE

The carry trade neutralises market risk but is still subject to counterparty risks and liquidity risks when spreads diverge and tear.

Largest risk factors associated with the carry trade is the counterparty risk . While CME futures are regulated by the CFTC, spot crypto exchanges are not subject to similar regulations. This poses significant risk for investors if they opt to hold their BTC on such unregulated exchanges.

Such risks arising from trading on unregulated platforms is most exemplified by the collapse of FTX. FTX was a popular exchange for executing carry trades as it offered dated futures, perps, and spot BTC on its platform. The dramatic collapse of FTX highlighted counterparty risk as a major concern.

Self-custody of spot BTC has its own risks including transfer costs and cybersecurity risks.

Another risk factor is early liquidation. As the futures leg of the trade is a short position, where prices rally sharply, the short position may be at risk of liquidation despite a proportional gain on the long leg of the carry trade.

SPOT BTC ETF HELPS REDUCE COUNTERPARTY RISKS

The rollout of spot BTC ETFs reduces counterparty risk. Unlike unregulated crypto exchanges, spot ETFs are regulated by the SEC, listed on regulated exchanges with investor protection.

With both the futures and spot leg now available through regulated platforms, investors have access to secure infrastructure for executing the carry trade.

The table below provides details of approved spot ETFs including AUM, expense ratio, and the benchmark index.

Carry trade using spot ETFs with CME CF Bitcoin Reference Rate (CME BRR) enables greater precision in extracting arbitrage yields. Seven of the eleven approved spot BTC ETFs use the CME BRR.

Still, there are downside to using spot ETFs for long BTC exposure in carry trades. For one, ETFs are only tradeable during market hours (9:30AM to 4:00PM US Eastern Time not including extended trading hours) whereas cryptocurrency exchanges and even CME futures trade for longer hours.

Moreover, expense ratios and premium/discount to NAV for ETFs will erode already thin profits. Spot BTC ETFs are currently offering discounts on expense ratio for a fixed period.

CARRY TRADE ILLUSTRATION

To illustrate a hypothetical carry trade, consider the following setup comprising long BITB ETF and short CME Bitcoin futures (BTCH2024).

BITB references the same CME CF Bitcoin Reference Rate as CME futures and its premium/discount of -0.07% (as of 09/Feb) offers a beneficial entry point for this trade. Moreover, the premium/discount on the ETF has been tight.

Source: Bitwise

The premium for MBTH2024 over spot reference rate as of close on 9/Feb was 2.83%. Taking seven basis point discount to NAV, this results in total return of 2.90% over 48 days resulting in an annualized arbitrage return of 22%.

As the trade is required to be directionally neutral, notional value on both legs needs to be balanced. CME Micro Bitcoin futures (“MBT”) offers exposure to 0.1 BTC.

Notional on short BTCH2024 futures leg: 0.1 BTC

As of close 09/Feb,

BITB market price: USD 25.95

CME CF Benchmark BTC price: USD 47,614

Each share of BITB offers exposure to 0.000545 BTC

184 shares of BITB provide exposure to 0.000545 x 184 = 0.100280 BTC

The payoff from the trade consisting of 184 x long BITB and 1 x short MBTH2024 would be 2.9% of notional value = 2.9% x (0.1 x 47,614 USD/BTC) = USD 138.

The trade requires margin of USD 980 on the short futures leg and notional of USD 4,775 on the long leg for a total capital requirement of USD 5,755 (as of Feb 2023) which translates into ROI of 2.4%.

Still, as mentioned, liquidation risk remains a concern. Hence, it is prudent to maintain higher margin on the short futures leg which would lower the ROI.

Note that timing this trade better can improve the odds and in case Bitcoin’s term structure switches from contango to backwardation, payoff would be higher.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.