Lessons about ultimate ignorance, survivor bias, exp. growthHello,

I wanted to write about these 3 subjects, I have alot on my mind but I'll try keeping it compact and clean.

1- Ultimate Ignorance

* People are persuaded the stock market will always go up. Why? They expect to all become rich with absolutely no effort like magical money will just appear in their pockets.

Even a woldwide index isn't completely safe, global markets have dropped and stagnated for more than 100 years in the past and stock markets are only 500 years old. Concerning individual countries there has never been one that lasted forever... So it's pretty irrational as Einstein would say to expect a different outcome this time.

And money doesn't just magically grow on trees forever what are those people thinking...

They are going to learn a harsh lesson.

* Certain people are completely stupid and out of this world. I have no word. The type of person crying because Bernie is not the dem frontrunner.

One of those said, and it seemed it wasn't a troll, that "rich" bloomberg was so rich he could give every single american citizen $1 million which would change the life of most americans. And when people tried explaining how stupid that claim was, that person defended it "bla bla bla the point is he could give 1 million to every one and he wouldn't notice".

The kind of people that watch clown news network every day and believe what they say.

Even in congress alot fail basic maths taught to 6 yos. And of course they think infinite money can be printed and make every one rich. And if need money for free stuff always simple solution "just tax the rich". All of their idiotic ideas are traumatising. And on top of that it has been tried and failed.

I lost all hope for the human race...

Might be living in noisy stressful big towns making people lose their minds. We need to end wageslavery and have an exodus back to rural areas asap, but this is an idea for another post.

* 2 years ago Paul Singer (the Argentina Vulture Capitalist managing a few dozen billions in a fund) had this to say about Bitcoin in a letter sent to investors, unlike Warren Buffet he does not try to look nice and friendly not hurt anyone feelings and just says it how it is:

“This is not just a bubble. It is not just a fraud. It is perhaps the outer limit, the ultimate expression, of the ability of humans to seize upon ether and hope to ride it to the stars...

But is it not glorious that when the equivalent of nothing attracts priests and parishioners who run up the price, the very willingness of the mob to buy it at higher and higher prices is seen as validation of the thing, rather than an indication of the limitless ignorance of swaths of the human race?”

I completely agree. And like this person, I just say it how it is no point sugar coating it, Warren does it and crypto victims are still hating the guy so what is the point?

He admitted there was genius in Bitcoin, when he called it a "Brilliant scam". I completely agree.

Crypto HAS to be the ultimate never seen before super scam, the biggest ponzi in history. They can't ever have been any scam this big. Social security and debt are different so I'd count them separately. Bitcoin is one of the biggest mass delusion the dumbest the peak of human ignorance.

"The outer limit" yes, this must be it, how can it possibly get dumber?

2- Survivor bias

How ignorant are you?

Here is a little test, got this from a recent video on youtube about prediction:

This is an image extracted from the damaged planes the air force has in their hangar (I think it was the RAF but it doesn't matter):

Command wants to armor the plane. Where should they place the armor? (can't full armor the plane makes it heavy and costs money & a nation cannot print or tax itself into wealth)

The red areas represent where the planes took bullets on average.

Well what does this tell us?

It tells us that the planes in the hangars have this composite.

In other words, the planes that made it home.

I know alot of people ("just tax the rich make everything free") that would instantly say "armor the red area" but it is so wrong.

This is why natural selection favors the smartest, and why wars are won by smarter faster thinking commands (cough cough france germany ww2).

The reason why their planes had very little impacts in the mid fuselage engines and cockpit is really obvious... Those ones did not make it home.

So all they get back are the survivors... That didn't get hit in the priority areas.

Understanding survivor bias is important.

In this video it was a class lesson and about half the students gave the wrong answer. Of the other half I am willing to bet they were mostly just afraid to look stupid or sleeping.

3- Exponential Growth

The graph is a classic.

Some examples:

- Bacteria Colonies: the stagnate when food rarefies then just die of hunger/eat each other

- Virusses (Corona...)

- Internet Virusses

- Ponzi Schemes (you know one...)

- Product Life Cycle (the radio was introduced - Lag Phase, grew till every one had one, stagnated at 90% adoption or so, and has been dying with tv the internet smartphones)

- Bubbles ("back to normal" is stagnation)

- And more

What is great about maths is how you learn that everything is correlated and works the same. And add finance which also does that, your brain goes boom.

By the way, in Asia the coronavirus so many nuts are so afraid of, is in the decline phase.

In Europe and NA I think we are at stagnation phase but there has been a spike in case, probably from all the people testing for it.

What a joke. Idiocy to the limit "outer limit". Peak ignorance.

People are fighting for toilet paper. I don't even understand.

Some numbers.

Worldwide cases of CoronaHoax: 150,000. Probably a bit more with the infected people that don't even notice it LOL!

H1N1 2009 (swine flu) cases: 700,000,000 to 1,500,000,000. Half a million deaths.

There was like easilly 1 billion cases of H1N1.

It is still good that government try to limit the spread of the virus, to protect their elders.

But all these ignoramus panicking, and whining Trump didn't do enough (Obama did nothing for 1 billion infected H1N1...).

Oh and by the way an analysis was done on 1 billion infected H1N1... It was a smaller deal than the common flu THAT HAPPENS EVERY YEAR.

The pathetic little common cold known as Covid-19 (it is a common cold) is on the decline already :)

Mass hysteria over this... so this is it... Clown world. The exponential spread of idiocy is at max now right? Ah right we keep helping them out rather than let natural selection do its job so the decline won't ever happen.

"You have to be a contrarian to make money". Yup. When the herd panics "CO2" (makes so much sense) "CoronaPoop" (sad) or gets all excited "Bitcoin moon soon" (reptilian brains) you know it is time to consider thinking the opposite.

Interesting how everyone that makes money consistantly, all the big time billionaire financeers, all think the same.

90% are going to have this mob mentality to varying degrees. SHEEP. Illogical irrational ignorant sheep.

Understand how the reptilian herd behaves, profit from it, rince and repeat.

No one ever made money being a sheep (ok there were a few but they got lucky).

Always stay rational. This gets repeated so often via "do not be emotional", but those that repeat this number 1 tip do not always understand it and think it means you should avoid going completely berserk (clearly they don't trade and just repeat something they read), it means BE RATIONAL (as opposed to emotional).

And this is the 1 exception, the 1 free meal. In this case there is a very simple way (well maybe not for everyone, but simple on paper) to make alot of money.

By simply being rational you already beat 90% of the competition. It is magical.

Coronavirus (COVID-19)

Are Markets Really Crashing? (An S&P500 Study) #SnP500Traders, If you have been following the news items on mainstream media or social media, people all over the world seem to be discussing recent fall in indices indicating another market crash and a possible recession. In this study lets look at S&P500 index from almost purely technical point of view.

Hit the like button and subscribe if you enjoyed this study.

Comment below and let me know what you think of this analysis and what is your opinion in this matter? Are you trading S&P500?

Have a great trading week!

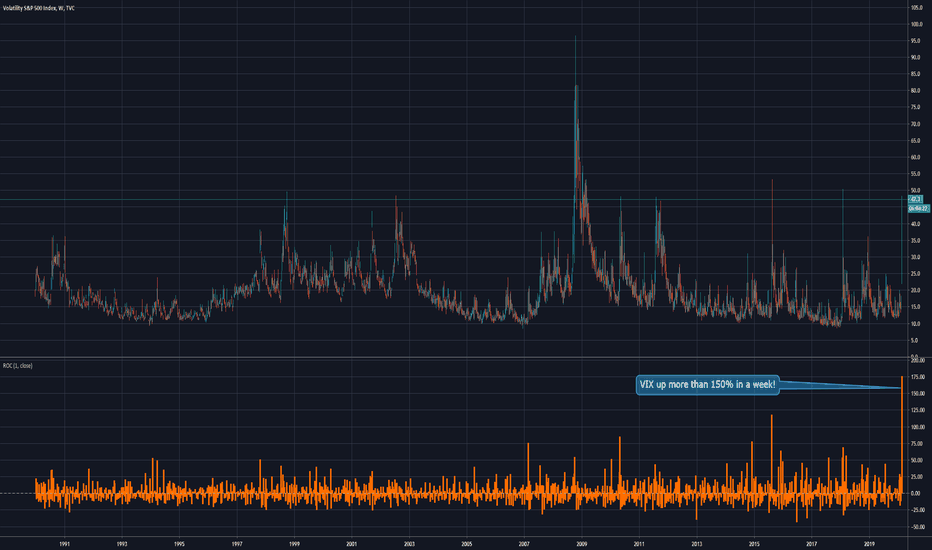

The VIX Has Never Moved Like This!There are a lot of superlatives about the stock market this week. It's the fastest correction ever, with just six sessions between the S&P 500 hitting a new record high and a 10 percent drawdown.

The VIX illustrates this trend clearly. Its overall level around 47 isn't all that high in the big scheme of things. Volatility hit 50 two years ago and in August of 2015. It also saw levels like this in 2010 and 2011. Of course, during October 2008, it went all the way up to 96.

But all of those increases unfolded over weeks and months. Never has the VIX risen this far, this fast.

We can see this clearly on TradingView. This weekly chart simply adds the Rate of Change indicator, with an interval of 1 period. It shows the VIX hasn't risen this quickly in a week since the data set began in the early 1990s.

So, while countless articles and talking heads will speak endlessly about this current move, at TradeStation we like to stick with charts and numbers. In this case, the picture's worth way more than a thousand words.

Long-Term Bullish case being challengedThis is a very long-term chart that goes from 2001-Present.

Every red arrow is a sell, every green arrow is a green.

Trading with this method has proved to be very useful.

The 12EMA (purple line) represents a 1 year exponential moving average. Follow the $SPX below. (black line)

MAN AND MONEY vs VIRUS! WHO WILL WIN?The picture of the 2019-nCOV is rapidly evolving. Globally there have been >14,000 cases and >305 deaths. The trajectory of spread of this virus has exceeded SARS (2003).

In under 20 days there are 14,544 cases. There were less than 20 cases in the same period for SARS.

SARS plateaued off at 8,500 cases after 100 days then fell off. What we're seeing in hard evidence is that nCOV is going rapidly exponential - almost doubling in 20 days what SARS reached in 100 days.

8 countries have effectively quarantined China in various ways. AND NOW - China has told everybody to calm down, that it will maintain financial stability and pump their market with USD$173 Billion from Monday 3rd February 2020. The FED and Australia are considering similar moves.

The global economic disruption in what was a 'risk-off' situation, is gonna be serious and probably last well over a year. This doesn't mean that the markets will tank over the next year. It means expect bearish pressure.

Think also about an 'endpoint'. How will anybody know when it is safe to open borders, trade and travel in China?

If the VIX gets above 53 there is serious trouble!

Declarations & Disclaimers: For the avoidance of doubt, this post is only about potential impact of a virus in financial contexts. I take no comfort at all in people suffering and dying. Whilst I am sorry about the human consequences, I deal with the markets as an instrument - like any other. It is not illegal or immoral to exploit the movement of any market for any cause. As usual this is not trading advice. If you lose your money, kindly sue yourself.

When the S&P500 catches the fluIn this screencast I look at the S&P500 on the 4H time frame only. I show how I estimate the probable direction (this does not mean prediction).

I give some information on why the markets are reacting to a low grade coronavirus called 2019-nCOV (same family as MERS and SARS).

Disclaimer: This is not trading advice. If you make decisions based on this screencast and lose your money, kindly sue yourself.

How do virus attacks affect Wall Street?This is a very short presentation on how previous virus attacks have affected Wall Street (daily time frame). I go back to 2013, plotting what was seen.

This is relevant in relation to the recent Wuhan coronavirus (WCV). Mainstream media have referred to WCV as a "deadly virus". This is frankly nonsense based on current data.

The case fatality ratio (CFR) is an important measure in assessing lethality of a virus. The CFR for influenza A(H1N1) in 2009 was 0.45%. For ebola virus, it is overall >50%.

For the Wuhan coronavirus (WCV) which may not be one virus strain, the CFR is currently estimated at <3% (I cannot provide references here but people can contact me for links to info).

But hold on - the 3% is not (at this time) for large populations of those infected. The average age group of people who have been killed WCV is currently around 60. Did I say 'average'? Yes - I did (which means I know there are some people who have been around 30). Attribution of WCV has also not been 100% caused by WCV either. The 'average' age group may fall (or increase) with time.

In summary

- ebola is definitely a deadly virus - the markets barely flinched if at all to Ebola.

- estimates of lethality of WCV are currently not robust.

My conclusion -

The media is responsible for selling its news.

The media have been irresponsible in feeding panic, in selling its news.

News and panic are what rules markets more than hard facts and figures.

Will the WCV outbreak be the pin that pricks the bubble? I don't know. It could well be the first of the dominoes to fall, setting off a chain reaction for slow burn down - instead of a serious correction. OR - WCV may well be insignificant. If it is, then expect a raging bull market to rebel! I cannot foresee the future!

Declarations & Disclaimers: I am not a virus expert, nor a financial expert. This post is opinion only based on data fully available in the public domain. Opinions here are not be be relied upon in making financial or trading decisions. If you who reads this makes such decisions, your losses are your own - should you suffer a loss. You sue yourself if you lose money.