GOLDEN TRADE OF THE YEAR on XAU GOLDGold at the best position right now to take trades. There are two valid scenarios which gives us the confidence to take either buys or sells accordingly to how the news will affect the market tomorrow. Be willing to lose some pip momentum when placing these entries. Our goal isn't the most earliest entry (bc they can be premature and go the other way, before going back to intended trend)

If Gold BREAK ABOVE 1509 --> 1520 (Buy, Long)

If Gold BREAK BELOW 1492 --> 1444 (Sell, Short)

Trade Easy, Trade Safe. Save the recklessness for when you're spending your pips caught

F-XAU

Short term Trade setup on XAU (GOLD) Macro trend:

- Yearly/Monthly: Bullish, just broken out of consolidation with higher lows

- Weekly: Bullish, Just broken out of 6 week consolidation

2 ways to get in on a trend:

- Wait for the retracement and buy the retest

- Buy near the bottom of the consolidation

Key levels outlined:

1) Last week Range High

2) H4 consolidation (Mark the top and bottom)

3) H1 Demand zone

Confluence for trade:

- Trade idea aligns with Macro trend

- H1 Demand zone + Bottom of consolidation (Both same area - My first entry)

Invalidation: H1 close below Demand zone

Adding position: H4 close above Last week High, Buy a retest near top of consolidation

TOP 5. 11.08.2019I will eventually start posting weekly videos with the outlook on my 5 favorite trading instruments on which I place around 90% of the deals.

These include: SPX, Gold, Crude Oil, EURUSD pair and the Emerging markets via USDRUB.

If you like what you see, please fell free to hit the Like bottom and leave your comments.

Disclaimer:

By viewing this video you fully accept and agree that it offers general advice only and that trading the financial markets is a high risk activity and that you understand that past performance does not indicate future performance and that the value of investments and income from them may go up as well as down, and are not guaranteed.

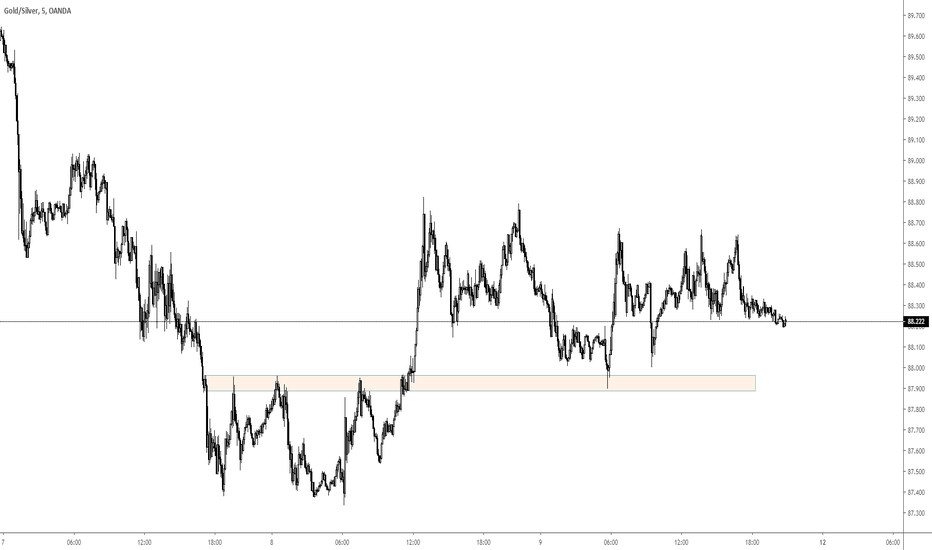

Multiple Setups in XAU / XAG - Flags, Support and Resistance- The setups shown in this video are all in Hindsight. I did not take all the setups detailed in the video.

- Learn to train yourself to see these examples by going through Price Action from the past and you will be able to see these form in real time and react accordingly.

Common names people give to thses setups: Supply and Demand, Support and Resistance, Pivot

*All those refer to the same thing. They are all areas where Price is MOST LIKELY TO REACT from since it has react from the area PREVIOUSLY.

Since Price previously has react from an area before, That area will become our area of interest where we look to do business. Upon a retest, we expect Price to react in a similar fashion as the last time.

Gold: Bulls Need To Hold $1,430!Hello dear precious metals friends, hope you're doing well guys! ;)

In the last analysis we were looking for higher Lows, which we got eventually, albeit little bit lower/breaking the previous trend line. This gives us now a nice equilibrium range between $1,410-$1,430:

The bulls are currently in breaking of that crucial resistance yet again. If they can manage to uphold the range & make it to support, we could go at least to the previous fake-out highs at $1,450.

Also I'm gonna tell you about Edgy's current mentorship program. Have fun watching! ;)

If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my analyses! I wish you a good trading! :)

Edgy is providing online education only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

Gold and Bitcoin have IDENTICAL market cycles! Well, looks like my viral chart was stolen and reposted without getting credited. If anyone has marketing experience shoot me a message. It's nice to know that my ideas can get big on their own merit, I'd like to see what happens when I have a significant following to boot.

300% GAIN FOR BITCOIN IN 8 MONTHS! 48,000 INCOMING!

Bitcoin on the two day and gold on the monthly are following essentially identical market cycles with the same pattern of expansion compression. The similarities are uncanny and the widespread bias is currently bearish, the sentiment of "this is a sucker's rally" can be found on a vast majority top posts throughout the tradingview ideas section. Hopefully this idea can make its way to the very top!

This is the perfect time to buy in with minimal risk!

We just saw the bullish Daily CCI roll on Bitcoin which has been our ideal trend reentry signal for the past month. If we break a lower low, we will simply reenter bullishly on the next 14 period CCI roll. You can set this up your self by loading up the default Tradingview CCI and setting it to the 14 period. When the line goes below the -100 and crosses back up above, that will be your buy signal if this current trade fails.

As long as the upward trend is defined, you can take this signal as many times as you like.

Always use good risk management and godspeed! Make sure to like this idea if you found my thoughts particularly revealing. This may very well be the lowest bitcoin ever goes for the next two years. If we make a lower low, I'll wait for the CCI roll and say it again! It's ok to risk 5% when your upside is 300%.

Gold Breakout Coming!Hello dear precious metals friends, hope you're doing well guys! ;) Our last 2 analyses perfectly played out with Gold further tightening inside the Equilibrium. But now it's time for a nice breakout! ;) We'll talk about the potential patterns inside the EQ currently, and where we could go to as a target zone. Have fun watching! ;)

If you had some value from my analysis, give it a thumbs-up & comment it, because the mechanism shows my analysis to other people then. Make also sure to follow me so you get notified on my analyses! I wish you a good trading! :)

Edgy is providing online mentorship & trading metrics only. We are not a financial advisor, nor do we hold any formal qualifications in this area. You're trading at your own risk. No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

GOLD AND BITCOIN BULL RUNS ARE IDENTICAL! 300% GAIN INCOMING!Quite the revelation today, these charts follow the meme market cycle just about perfectly.

May I present to you, "This is a sucker's rally"

7bitcoins.com

What a great day to buy bitcoin. There's an active mean reversion condition though I'm certainly inclined to bet against it with how strong macro level trend is.

Green circles for the super obvious "we are here" emphasis.

Gold / XAUUSD / GC - Ascending triangle breakout imminent I made an about face on my bias of gold yesterday where I flipped from bearish to bullish. This doesn't mean I am indecisive or have multiple personalities, rather it was due to watching what price was telling me. Don't ever be afraid to change your opinion of a setup on a dime. Price action and the "price story" is always changing, and thus our bias' of that instrument could change as well.

The setup we are looking at is a bullish ascending triangle reversal pattern. I entered long yesterday evening (perhaps a little prematurely) but price has continued to show buying strength on each test of the lower portion of the ascending triangle which is what we want to see. Given how price aggressively recovered above the #1 ascending triangle, I think a bullish breakout is likely. Remember folks, likely doesn't = 100%. Never bet the farm! To trade we need capital, so capital preservation needs to be a top priority. We preserve our capital by not over risking on individual trades.

If you are in this trade or eventually enter on a future buy signal, the nearest term resistance is in the 1355-1360 range. I will personally be dynamically managing my trades and may get out before that level is reached or stay in after price breaks through(assuming this is how it plays out!), but that level is a nice, common sense level for those of you who are more mechanical.