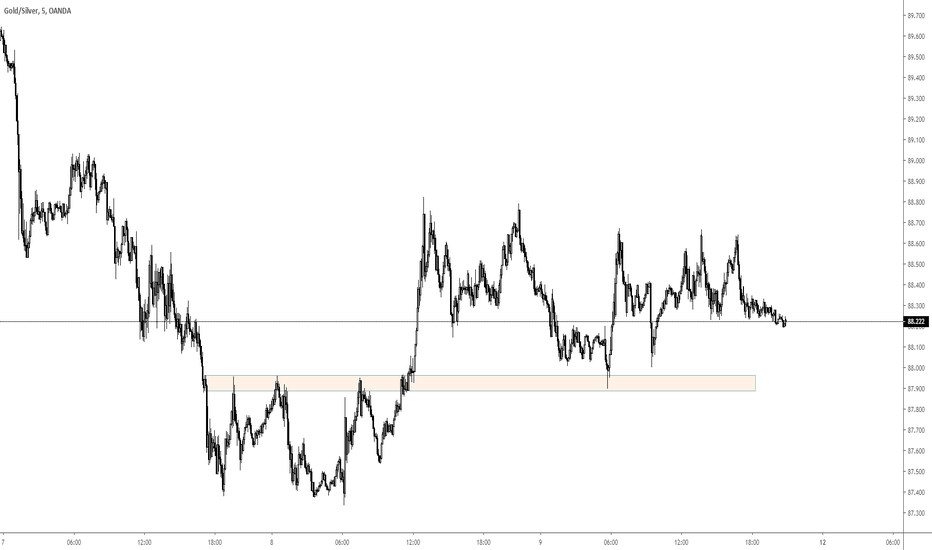

GOLD-SILVER

Understanding Market Bottoms ALTSEASON Is Here #Crypto #ETH #XRPHi I am MartyBoots and I've been trading the markets for 13+ years

This is a video that talks about market bottoms and why we can expect huge moves in the crypto market .... Yes you can can call it an ALT SEASON if you like

In this video I want to show you the exact pattern explaining the bottom

Then over the next few days I will make a video explaining the near term analysis and what exactly to look for .

I also talk about Stocks , Silver companies and Crypto charts

Not to mention HBAR mooning 150% live on camera

ETH has formed a beautiful bottoming pattern , these opportunities don't happen often. Getting in on the lows of coins that have serious potential to move into a bull market is where we make the most money . We need to grab these opportunities with both hands .

Do not miss this video because if this pattern plays out then this is going into large bull market.

The price action and the moving averages are setting up beautifully. On top of that the indicators are also setting up .

DO NOT BE LEFT BEHIND WHEN THIS TRAIN LEAVES THE STATION, GET IN EARLY FOR BETTER RETURNS

Please dont forget to like my content as it helps my work

Thank you

NOW FOCUS ON SILVER MY FRIEND INSTEAD OF THE GOLD

Gold prices are higher in midday trading Monday, but have backed well down from the overnight nearly seven-year high of $1,590.90, basis February Comex gold. Today’s low-range close hints that the gold bulls have run out of gas on a short-term basis and need a rest, or pause. Meantime, silver futures scored a more-than-three-month high of $18.55, basis March Comex futures. High geopolitical tensions are and will likely continue to support the safe-haven metals. February gold futures were last up $13.80 an ounce at 1,566.20. March Comex silver prices were last down $0.016 at $18.14 an ounce.

The U.S. stock indexes coming well up from their overnight lows also encouraged some profit taking in gold from the short-term futures traders, following the recent good gains.

As I reported early this morning, for the very short-term traders of gold (usually futures markets), here’s an important development: History shows that a big spike up in prices amid higher volatility tends to produce near-term market tops sooner rather than later, after that initial spike up. That means in the coming days the gold market could put in a “near-term” top that will last for a moderate period of time.

Global stock markets are still upset on geopolitical fears following the U.S. drone strike late last week that killed Iran’s leading military figure. Asian and European stocks were down overnight.

The key “outside markets” today see crude oil prices near steady after hitting a 22-month high at $64.72 a barrel overnight. Meantime, the U.S. dollar index is weaker amid a five-week-old downtrend in place on the daily bar chart.

The weekend saw more saber-rattling from the U.S. and Iran. President Trump tweeted that the U.S. has 52 Iranian sites set for attack if Iran retaliates against the U.S. for the killing of its general. Meantime, Iraqi’s government voted to expel U.S. troops from Iraq, which prompted a response from Trump that the U.S. would impose economic sanctions on Iraq if such occurred. Nations around the globe issued proclamations urging restraint on the matter from both the U.S. and Iran. This is arguably the most serious geopolitical development in many years, and whose repercussions will play out for a long time to come. That will likely keep trader and investor risk aversion elevated for some time to come. That’s bullish for safe-haven assets like precious metals and U.S. Treasuries.

GOLD AND SILVER SHORT OPPORTUNITIESThe commitment of trader reports is showing large commercial short positioning on Gold and Silver.

Gold in particular shows short contracts at all-time highs, this is significant for us to sell Gold on any rallies.

Looking at the Gold chart price is re-testing the double top neckline where we can look for short opportunities.

On Silver, we need to see the price for a lower high on the daily timeframe to give us a clear opportunity.

Multiple Setups in XAU / XAG - Flags, Support and Resistance- The setups shown in this video are all in Hindsight. I did not take all the setups detailed in the video.

- Learn to train yourself to see these examples by going through Price Action from the past and you will be able to see these form in real time and react accordingly.

Common names people give to thses setups: Supply and Demand, Support and Resistance, Pivot

*All those refer to the same thing. They are all areas where Price is MOST LIKELY TO REACT from since it has react from the area PREVIOUSLY.

Since Price previously has react from an area before, That area will become our area of interest where we look to do business. Upon a retest, we expect Price to react in a similar fashion as the last time.

DXY - Bearish pattern forming off of key resistance levelA large bearish pinbar is currently forming off of a key resistance level. Keep in mind that there are a few hours left in the market so this pattern will not be confirmed until it has fully formed as a bearish pinbar and today's candle has officially closed. If the candle does close the day as a bearish pinbar then we could see price rotate lower over the next few weeks. If the candle closes as a bullish candlestick, there is still opportunity for a new bearish pattern to form but we could see price rotate even higher towards the 97 range. How today's candlestick finishes forming will tell us a lot.

Dollar Analysis - How to know if the trend is changing?After the FED interest hike yesterday and the hint to expect further hikes over the next year the dollar has reacted by pushing up. Is this a pullback within the short correction or the end of the correction. Here we discuss what to look for over the next few days and how to trade it.

This is not investment advice.

Steve Nixon

Trainer and Mentor

UPDATE: Everyone is calling for Gold $1,200, is the low in?Hi guys, thank you for the support! I will have this analysis out each weekend as well as daily updates throughout the week, if you guys like what I'm doing hit the "follow" button and you will get a notification each time I post a video or chart!

Have a great day everyone!

UPDATE: Real rates suggest Gold rallies to $1,550 big pictureHi guys, thank you for the support! I will have this analysis out each weekend as well as daily updates throughout the week, if you guys like what I'm doing hit the "follow" button and you will get a notification each time I post a video or chart!

Have a great day everyone!

UPDATE: Expect a double bottom in Gold Hi guys, thank you for the support! I will have this analysis out each weekend as well as daily updates throughout the week, if you guys like what I'm doing hit the "follow" button and you will get a notification each time I post a video or chart!

Have a great day everyone!

WEEKEND REVIEW: Why is Gold not shooting for the stars?Hi guys, thank you for the support! I will have this analysis out each weekend as well as daily updates throughout the week, if you guys like what I'm doing hit the "follow" button and you will get a notification each time I post a video or chart!

Have a great day everyone!

UPDATE: Low is in on AUDUSDHi guys, thank you for the support! I will have this analysis out each weekend as well as daily updates throughout the week, if you guys like what I'm doing hit the "follow" button and you will get a notification each time I post a video or chart!

Have a great day everyone!

GOLD clear risk/reward setting up LONGHi guys, I'm Rob from Macro Insights. Today I have a piece on Gold outlining why from a probabilistic outcome Gold is a fantastic opportunity on the long side. I believe you have to look at each asset and analyze 1) the macro top-down picture, 2) a fundamental bottom-up analysis of the asset, 3) what is the positioning/sentiments & 4) you gatekeeping, technical analysis.

I would love to hear your perspective in the comments below relating to Gold, please do your own research this is an asset we have spent a lot of time following and analyzing and we understand our risk to reward parameters for the trade.

Have a great weekend everyone!