XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Over the past week, gold has been consolidating within a defined range, fluctuating between two key zones.

A break above the marked resistance zone (around $3380-3390) would confirm the start of the next bullish wave, opening the path toward higher

About Gold Spot / U.S. Dollar

Gold price is widely followed in financial markets around the world. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a flat currency system in which paper money doesn't have an implied backing with any physical form of monetization. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world.

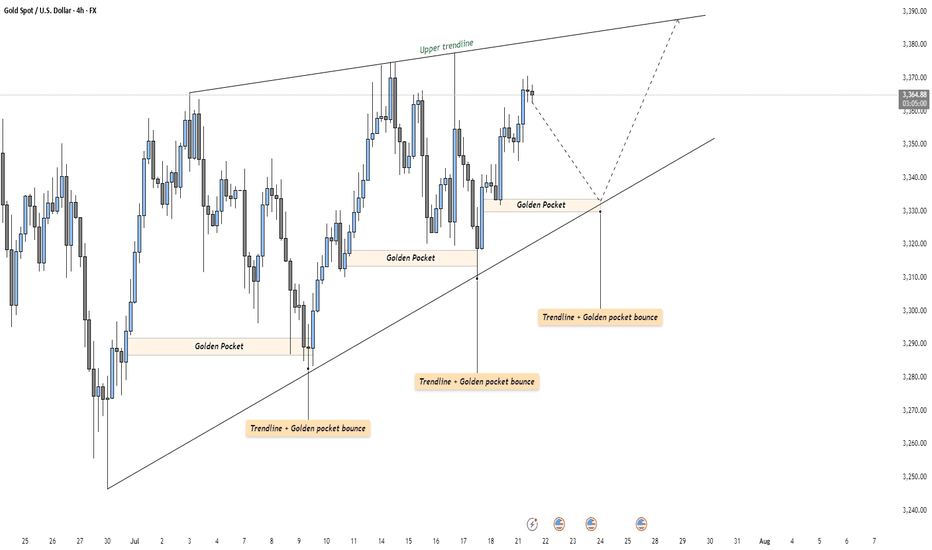

GOLD - Strong Trendline & Golden Pocket ContinuationMarket Context

Gold is currently trading within a rising wedge structure on the 4-hour timeframe. This formation typically represents a tightening market, where buyers continue to push higher — but with decreasing momentum. The confluence of both trendlines and repeated Golden Pocket bounces makes

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

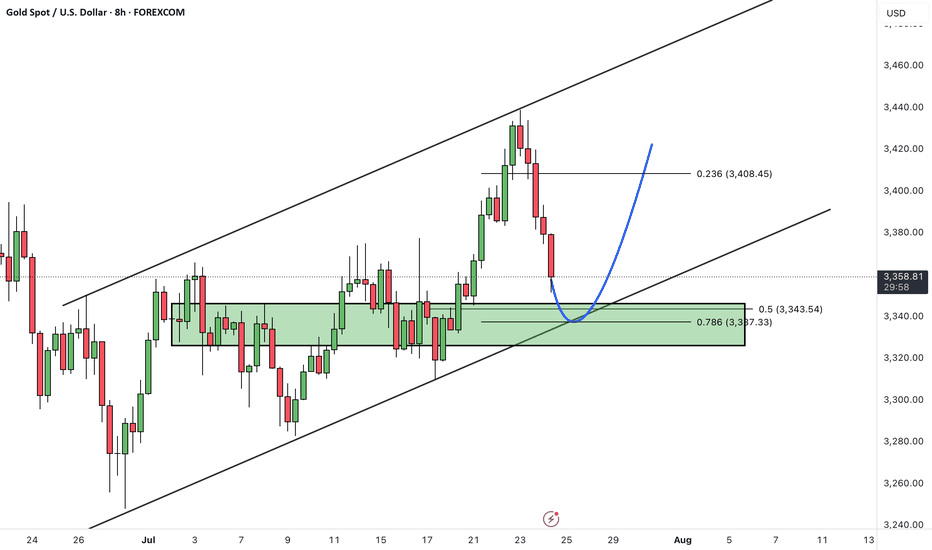

Gold entered a corrective phase after reaching the top of its ascending channel. Price is now approaching the channel bottom, which coincides with a key support zone.

As long as the channel support holds, we expect a bullish reaction from this area

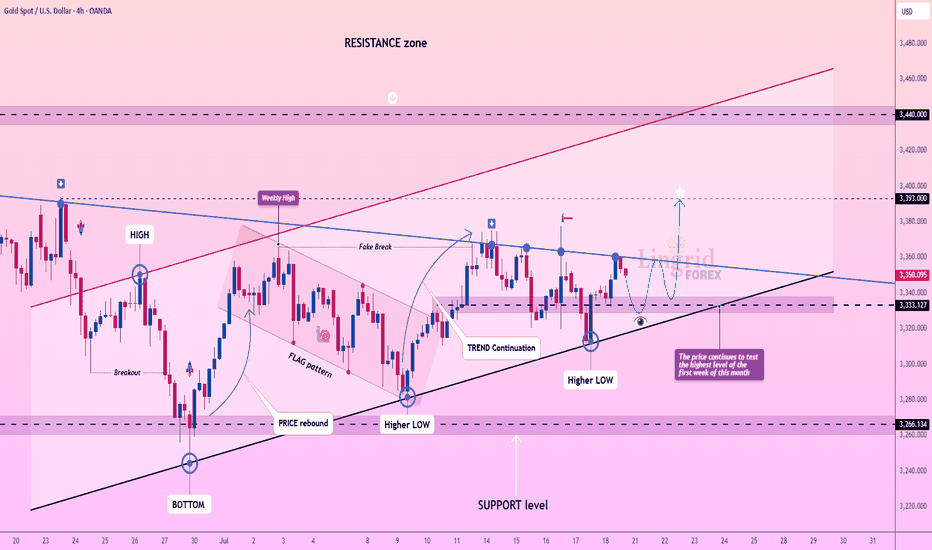

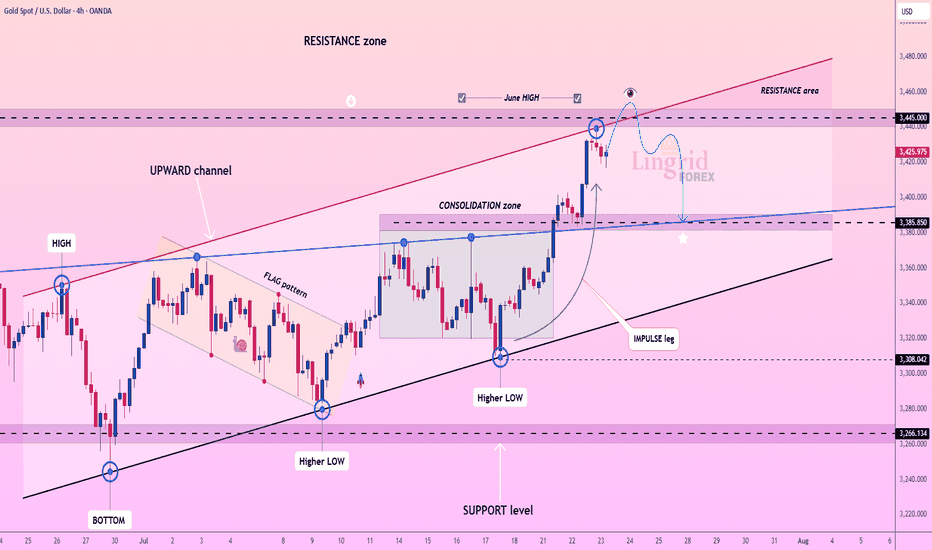

Lingrid | GOLD Weekly Analysis: Testing Resistance ZoneOANDA:XAUUSD markets are showing renewed strength as prices continue to test the highest levels reached in the first week of this month, demonstrating persistent bullish momentum despite ongoing consolidation. The precious metal is approaching a decisive technical juncture that could determine the

GOLD Reawakened: Corrects firmly but conditions remain bullishFrom a technical perspective Gold is climbing in a parallel channel, clearly bullish with a rhythm that’s hard to ignore. Price just bounced off the resistance with force, a classic overextension flush.

And the market is now approaching the lower boundary of this projected channel. This confluence

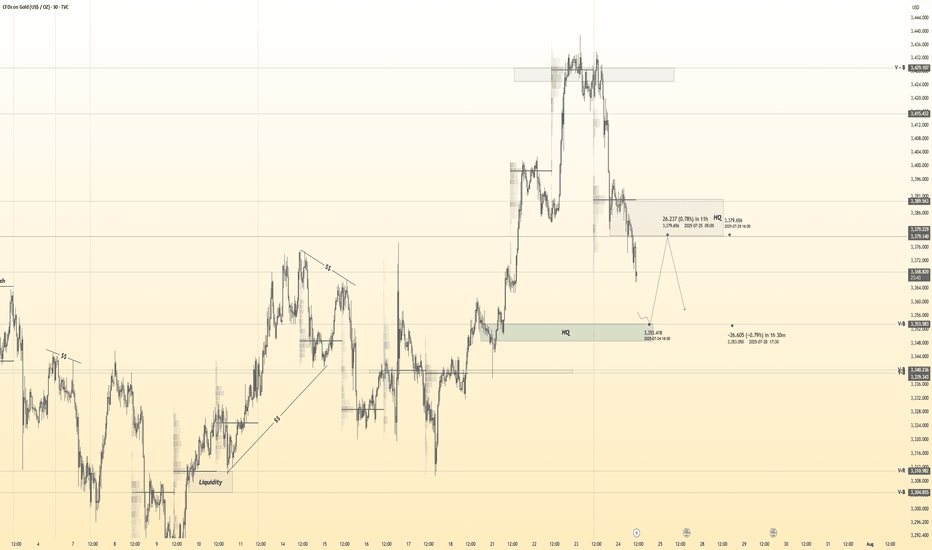

Gold 30Min Engaged ( Bullish & bearish Reversal Entry Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Reversal : 3354

🩸 Bearish Reversal : 3378

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3356 and a gap below at 3331. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see le

Japanese Candlestick Cheat Sheet – Part OneSingle-Candle Formations That Speak

Before you dream of profits, learn the one language that never lies: price.

Indicators are just subtitles — price is the voice.

Japanese candlesticks are more than just red and green bars — they reflect emotion, pressure, and intention within the market.

This

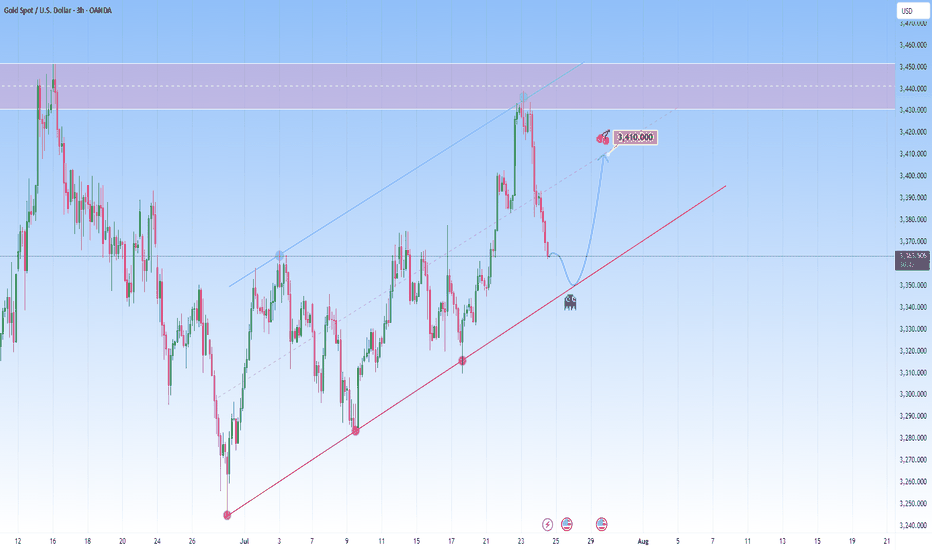

Lingrid | GOLD Key Resistance Zone. Possible Short-Term TradeThe price perfectly fulfilled my last idea . OANDA:XAUUSD has reached the upper boundary of the resistance zone around 3,445 after a strong impulse leg from the support trendline and the breakout of consolidation. Price action shows signs of exhaustion just below the June high, forming a potentia

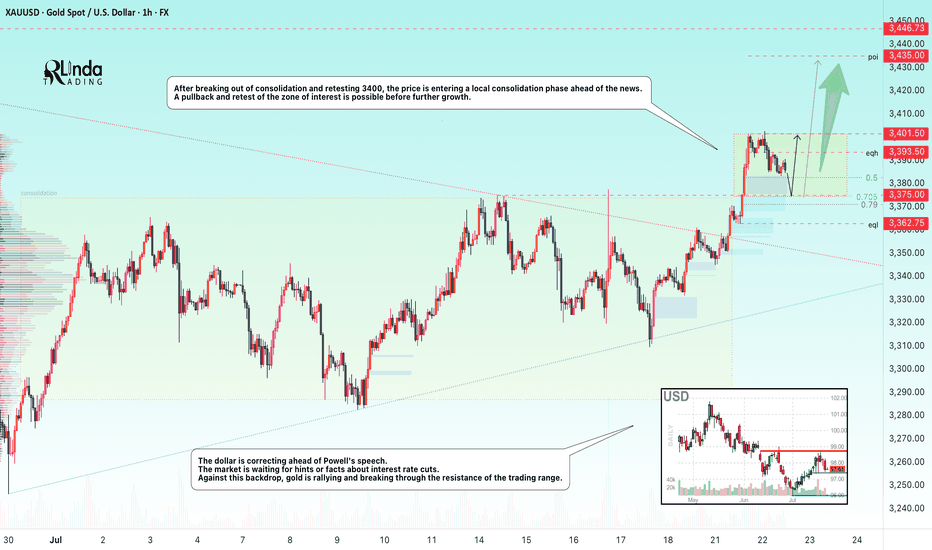

GOLD → Correction before continuing the rally to 3450FX:XAUUSD updates its local maximum to 3401.5 and enters a consolidation phase ahead of news. The dollar correction gives speculators a chance...

The price of gold is correcting from 3400. The reason is profit-taking ahead of Powell's speech at 12:30 GMT and waiting for clarity on US trade neg

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.