INVITE-ONLY SCRIPT

Crack_Heiken_Open_Ver_1.0.0

Hello dear traders from all over the world!

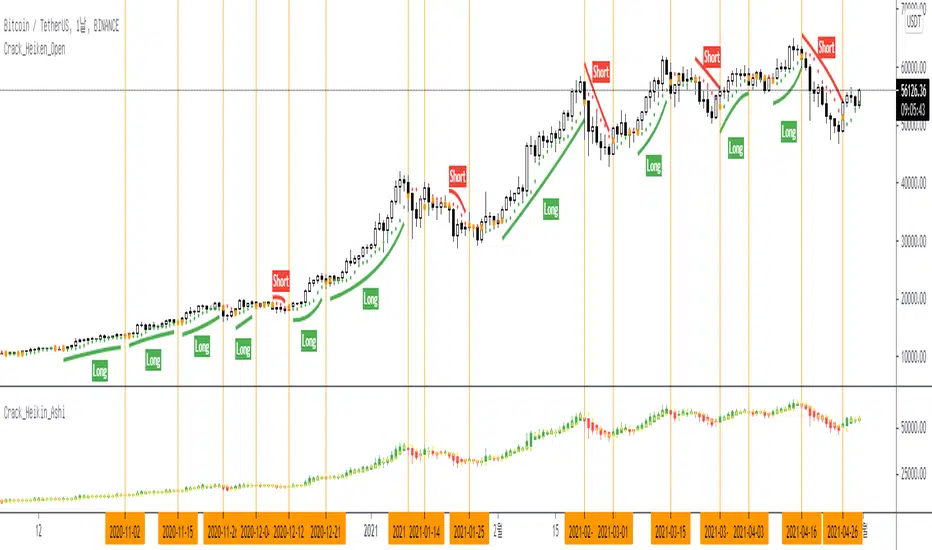

Our team recently have explored deeply in Heikin-Ashi Candlestick techniques and some of the benefits utilizing it. After multiple test phases figuring out the pros and cons, we derived some of the insightful strategies and developed it into an technical indicator that visualizes some of the major pivot levels deducted from Heikin-Ashi.

Unlike the common and conventional candlestick chart used widely by many traders these days, Heikin-Ashi candle chart applies different equations for computing the candle body (gap between open and close price). In fact, the close price is determined considering the open, high, low, and close prices of the original candlestick. This very method smooths out the price momentum by averaging out significant prices forming a candlestick. Many suggest one of the advantages of using Heikin-Ashi for traders as an efficient tool to filter out market noises during a liquidation.

These are the default formulas for Heikin-Ashi candlestick formation, where CO, CH, CL, and CC denote open, high, low and close price of the conventional candlestick, respectively. Similarly, HO, HH, HL, and HC denotes open, high, low and close price of the Heikin-Ashi candlestick.

HO = (Previous_HC + Previous_HO) / 2

HC = (CO + CH + CL + CC) / 4

HH = CH

HL = CL

Similar to the common technical chart, the Heikin-Ashi candlesticks are also to be observed and precepted as a complex structure, rather than a simple dimensional price movement. While this very methodology enables traders to objectively identify the strength of the market trends and trend reversal signals, it is yet quite weak during consolidation or accumulation phases. In other words, it is not so reliable when the market shows sideway moves usually before a big trend appears. Furthermore, the market noises in these days (especially in the post-COVID era) are not exactly like those in years ago. Unlike the old days, the liquidation cycle often happens so fast with wider range which led to certain unconventional phenomenon such as long candle wicks, whipsaws, stoploss hunting, and V-shaped patterns, etc. Therefore, we strongly recommend retail traders to not entirely depend only on the Heikin-Ashi when trading, but rather to consider it as one of the technical indicators that function as a side-aid to comprehend the trends.

This directly leads to introduction of the core logic of our new indicator that are assembled extracting useful strategies. This state-of-the-art mechanism shows multiple integral signals from the Heikin-Ashi. The color and the open price of the Heikin-Ashi candlesticks appear as dots on the regular chart. For those who are familiar using Heikin-Ashi will definitely find this useful

One of the important factors in Heikin-Ashi technique is to observe if the colors of the candle appear consecutively. Appearance of an opposite candle that breaks the continuity can be interpreted that the current trend is being weakened. Our indicator shows whether the Heikin-Ashi candles are formed as bullish or bearish and thus the traders can refer the trend signals given by the Heikin-Ashi candles. Series of consecutive colors means the trend is still progressing, until an opposite color appears. The default color for emergence of an opposite candle is orange. Hence, if an orange dot appears after series of the same color of dots, it can be signaled as a trend reversal.

Another efficient strategy is to search for the ‘Shaved Head(Bearish candle with no wick on top)’ and ‘Shaved Bottom(Bullish candle with no wick on bottom)’ patterns. Series of the shaved bottom candles indicates that the trend is bearish while that of shaved head indicates vice versa. In order for the candles to become shaved, the open price should not be broken (below for bullish candles and above for the bearish candles) during the formation of that very candle. This implies that the open price of the Heikin-Ashi candle (the middle of the previous candle body) acts as an important support or resistance.

Some of the decent strategies are summarized as below.

1. When the same color appears consecutively in a series, it means that the trend has started and the distances between the following dots represent the strength of the trend.

2. Similar to Parabolic SAR, the dots work as support and resistance. If the price breaks the dot, in other word if the dot fails to support or reject, be alerted as a weak signal for a trend reversal. (This implies that the Heikin-Ashi candle has failed to construct a shaved head or bottom)

3. If the orange dot appears after a clear and distinctive trend, interpret it as a medium signal for trend reversal. (This implies that the Heikin-Ashi candle has changed the color during on-going trend)

Weight more if one of these signals appear during a longer maintained trend. As mentioned, reliability highly drops when the market is in contraction and consolidation zone, when price is relatively moving sideways without a clear trend.

If you are interested in trying this indicator out, please comment or send direct message to this account.

안녕하세요. 트레이더 여러분 =)

예전과는 성향이 많이 변한 현대 금융 시장에서 하이킨 아시 차트의 적합성, 실용성, 그리고 응용성을 연구 및 고찰하던 저희 팀이 아주 유용한 지표를 개발했습니다. 하이킨 아시 캔들 차트를 보는 방법은 제가 어제 교육 자료로 정리해서 업로딩 해드렸으니 그 부분은 생략하겠습니다.

링크:

![하이킨 아시 차트 보는 법 [All About Heikin-Ashi]](https://s3.tradingview.com/n/NksMKzRF_mid.png)

간략하게 정리를 해드리자면 하이킨 아시 차트는 진행중인 추세의 강도를 파악하거나 변곡점을 더 명확하게 보여주지만 횡보장에서는 신뢰성이 떨어진다는 치명적인 단점이 있습니다. 따라서 해당 차트를 일반 차트에서 효율적으로 참고할 수 있도록 저희가 하이킨 아시 기법을 활용해 도출한 주요 피봇 레벨들을 차트에 시각화해주는 지표를 개발했습니다.

지표를 매매전략에 활용할 수 있는 전략들은 다음과 같이 간추려볼 수 있겠습니다.

1. 동일한 색의 지표(점)들이 연속으로 형성이 된다면 (양봉 -> 양봉, 음봉 -> 음봉), 어느정도 추세가 시작되었다는 의미로 해석할 수 있고 각 점들 사이의 거리가 추세의 강도를 나타냅니다.

2. Parabolic SAR 지표와 유사하게 해당 지표는 지지와 저항의 역할을 합니다. 가격이 점을 돌파 및 이탈하면, 즉 지표가 가격을 지지/저항을 실패해 뚫리면 추세 변곡의 출현 여부를 처음으로 의심해볼 수 있는 시그널입니다. (점이 뚫렸다는 건 하이킨 아시 차트에서 캔들이 Shaved Candle을 형성하지 못했음을 뜻합니다.)

3. 명확한 추세가 어느정도 진행된 이후 주황색 점이 뜨면 추세 반전에 신호로 볼 수 있습니다. (하이킨 아시 캔들 색깔이 바뀐 상황입니다.)

더 오랜 기간 동안 유지되어온 추세일수록 중간에 위 시그널이 나타날 때 더 큰 의미를 부여할 수 있습니다. 앞서 언급했듯이 횡보장일 때, 명확한 추세가 나오지 않거나 횡보 변동폭이 크면 클수록 신뢰성이 크게 떨어질 수 있다는 점 항상 명심하세요.

해당 지표를 사용해보고 싶으신 분들은 댓글 혹은 메시지 보내주시면 되겠습니다~

다들 감사합니다. 성투하세요 =)

Invite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact Tommy_Trader for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Want to use this script on a chart?

Warning: please read before requesting access.

토미 라이브 차트 보기: litt.ly/tommytradingtv

Youtube: bit.ly/Tommy_TV

Telegram: bit.ly/Tommy_Main

트레이딩 MBTI 테스트하기: tradingmbti.waveon.io/

Youtube: bit.ly/Tommy_TV

Telegram: bit.ly/Tommy_Main

트레이딩 MBTI 테스트하기: tradingmbti.waveon.io/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.