Institutional Demand Supply IndicatorINTRODUCTION

Institutional demand and supply zones are key areas on a price chart where large institutional traders, such as banks and hedge funds, place significant buy or sell orders. These zones often act as strong support or resistance levels due to the substantial volume of trades executed by institutions.

There are various ways to identify these areas of interest on the charts, but the main goal is to study the price movements, especially significant ones. Large financial entities tend to operate in the same price areas repeatedly. Instead of chasing price movements and risking counter moves, it's better to wait for the price to return to these areas, expecting that these entities will buy or sell there again.

INDICATOR SETTINGS:

1. High Probability Zones (HPZ) - High Probability Zones (HPZ) are demand and supply zones identified using advanced calculations to highlight the most relevant and significant areas. These zones have a higher probability of impacting price movements. Better to keep it turned On.

2. Zone Extension? - Extending zones can be useful for identifying areas that have already been retraced as these zones may continue to influence market dynamics despite the retracement.

3. Zone Type - This option lets you select the zone layout type. 4 options are given which are self explanatory.

4. Directional Candle Count - This option keeps a count of number of consecutive bullish / bearish candle that you would like to set as qualifying parameter for demand / supply zone. For Example - If you keep the number 1, the script will draw a demand or supply zone by just checking if 1 candle has met all the criteria's and calculations.

5. Zone Validity Percentage - You can set the percent change for the number of candles mentioned in point 4 above.

6. HPZ - Keep the number between 6 to 10. As you move the number up, less number of zones will be displayed.

7. Zone Count - You can adjust the number of visible demand and supply zones on the chart. Increase this number if you want to display more zones, or decrease it if the chart becomes too cluttered.

D I S P L A Y

1. Background Color Demand / Supply Zone - This is the background color of demand and supply zone.

2. Channel Color Demand / Supply Zone - This is the color of channel.

3. Channel Line Style - Choose between Solid, dotted or dashed.

4. Background Color Transparency - Choose the transparency of background color

5. Channel Line Width - Choose Channel line width between 1 to 4.

6. Channel Line Transparency - Choose Channel Line Transparency and keep it between 1 to 100.

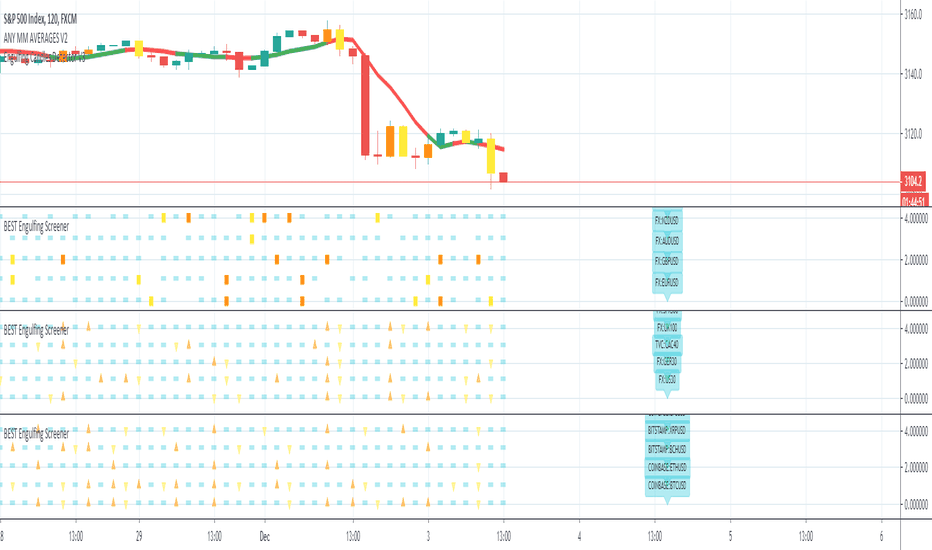

Sometimes, a level may be breached on one timeframe, but that doesn’t mean the indicator is not working. To understand the price action better, switch to a different timeframe to check why that level was breached and why it found support at a different zone on another timeframe. Look at the 2 screenshots below.

Bestindicator

Liquidity Founder The Liquidity Swings indicator aids traders in detecting liquidity swings within the market, providing essential insights for making well-informed trading decisions. Key features include:

How this Indicator work - this indicator search pivot point that is used to determine the levels at which price may face support or resistance. The Pivot Points indicator consists of a pivot point (PP) level and several support (S) and resistance (R) levels. if input number of bar selected 3 than it will look back 3 candle and wait for next 3 candle to make pivot high and low after it identify pivot it draw a line and extend until it no longer intersects with the high or low prices

What is different in my indicator compared to a normal pivot point and what Makes This Indicator Original :

1) Swing High and Low Logic:It avoids marking consecutive pivot highs until a new pivot low is formed, reducing market noise and highlighting significant trend reversals.

2)Volume Integration: By incorporating volume data, the indicator ensures that pivot points are validated with sufficient market activity, enhancing their reliability as support and resistance levels.

3) Multi-Time Frame Analysis:The ability to input and analyze multiple time frames allows the indicator to draw strong support and resistance levels that are relevant across different trading periods, making it versatile for various trading strategies.

🟠 Liquidity Swings indicator

✅Visualization of Liquidity Zones:Accumulation Areas: Identifying regions where liquidity is gathering.liquidity Sweeps: Pinpointing areas where liquidity is being cleared.

✅Pivot and Volume Analysis:Price Pivots: Monitoring significant pivots in price.

Volume Correlation: Linking price pivots with volume to highlight zones of potential support and resistance.

✅Market Dynamics Understanding:Enables traders to visualize and understand market dynamics more effectively.Assists in pinpointing potential support and resistance levels based on liquidity swings.

⭐Example -EurUsd 1 minutes chart developed Potential Support and Resistance Zone

⭐⭐⭐Key Features:

1) Adjustable Time Frame: Allows traders to analyze different periods by modifying the time frame setting.

2) Swing Look back Period: Sets the period for identifying potential price swings, enhancing flexibility in analysis.

🟠 Understanding Strong Support :These are identified by dense clusters of green lines, indicating high concentrations of buy orders that have not yet been executed. These areas suggest strong buying interest which can potentially halt further price declines.

⭐ Example -below chart image BtcUsd 5 minutes 2 line are still not touched by price

⭐⭐⭐Reasons for Strong Support:

✅Untouched Liquidity Lines: These green lines represent pending buy orders, indicating robust buying interest at these levels.

✅Accumulation of Orders: Many buy orders are aggregated in these zones, capable of preventing further price drops when approached.

✅ Historical Performance: These areas have previously prevented price declines, establishing them as reliable support zones.

✅ Market Confidence: Close clustering of green lines signifies widespread trader belief in favorable buying conditions, reinforcing support strength.

🟠 Understanding Strong Resistance :Highlighted by dense clusters of red lines, denoting substantial sell orders that did not executed. These zones signify significant selling interest which can impede further price increases.

⭐ Example -below chart image Btcusd 3 minutes 3 line did touched by price previously .price touched that area and retraced because of unfilled liquidity

⭐⭐⭐ Reasons for Strong Support:

✅ Untouched Liquidity Lines: These green lines represent pending buy orders, indicating robust buying interest at these levels.

✅ Accumulation of Orders: Many buy orders are aggregated in these zones, capable of preventing further price drops when approached.

✅ Historical Performance: These areas have previously prevented price declines, establishing them as reliable support zones.

✅ Market Confidence: Close clustering of green lines signifies widespread trader belief in favorable buying conditions, reinforcing support strength.

⭐⭐⭐ Usage of the Liquidity Founder Indicator ⭐⭐⭐

👍 Identifying Liquidity Zones: Pinpoints areas with dense clusters of pending buy (green) or sell (red) orders, providing initial entry points where significant buying or selling interest is concentrated.

👍 Avoiding Market Traps: Helps traders steer clear of market fluctuations or false breakouts by focusing on stable liquidity zones.

How to Use this indicator for Maximum benefit -

1) When the price approaches a cluster of resistance levels, traders should look for a candle showing rejection (e.g., a bearish reversal candle) to enter a short trade.

2)When the price approaches a cluster of support levels, traders should look for a candle showing rejection (e.g., a bullish reversal candle) to enter a long trade.

3) The identified liquidity levels offer a clear understanding of significant support and resistance areas, helping traders make more informed trading decisions.

4) Fake breakouts above resistance or below support clusters. If the price breaks above resistance and then falls back below, it can be a signal to enter a short trade vice versa if price break support cluster and back again above support cluster it can be a long trade

Daily Range + Asia Liquidity + FVG + silver Bullet sessionIndicator Description :

This indicator combines several trading concepts to provide an overall view of intraday selling opportunities. It includes the following elements:

Daily Range:

Measures the daily price range between the highest and lowest points of the day.

Helps understand daily volatility and identify potential support and resistance levels.

Asia Liquidity:

Analyzes price movements and volumes during the Asian session (usually from 00:00 to 08:00 GMT).

Identifies liquidity levels where the price has reacted during this period, providing clues on where significant orders are concentrated.

FVG (Fair Value Gap):

A trading concept that identifies areas where the price has moved quickly, creating a "gap" or empty space on the chart.

These areas are often revisited by the price, which can provide potential entry or exit points.

Silver Bullet Session:

Refers to a specific period of the day where a particular strategy or setup is expected to occur. For example, this could be a period where price movements are historically more predictable or volatile.

This session particularly targets price movements that attract sellers.

Using the Indicator

Identifying Selling Levels:

Combine the daily range levels with the liquidity zones identified during the Asian session to spot levels where sellers might be interested.

Use the fair value gaps (FVG) to identify areas where the price might return, providing entry or exit points for selling positions.

Silver Bullet Session:

Focus on this period to observe price movements and reactions to the levels identified earlier.

Look for selling signals (e.g., bearish reversal candlesticks or continuation patterns) during this session to maximize selling opportunities.

Objective :

The objective of this indicator is to provide a systematic approach to identifying selling opportunities based on multiple technical and temporal elements. By combining daily volatility, liquidity levels, value gaps, and specific trading periods, this indicator helps traders pinpoint potential selling points with greater accuracy.

Dynamic Volume Oscillator [CryptoScripts]The Dynamic Volume Oscillator uses a combination of volume and momentum to nail whenever a reversal is likely to happen. I've also included divergences (both regular and hidden) that you can toggle on/off and adjust the settings to fit your trading style.

Colors - The green wave indicates an uptrend while the purple wave indicates a downtrend.

Overbought/Oversold - Green backgrounds indicate the DVO is oversold and a reversal to the upside is likely to happen within the next few candles. Red backgrounds indicate the DVO is overbought and a reversal to the downside is likely to happen within the next few candles. You can adjust the levels to trigger when the signal flashes. Experiment with different timeframes/altcoins to see which settings work best. Some coins are more volatile than others and lower timeframes tend to reach higher levels vs higher timeframes.

Divergences - The settings of 1 and 3 for the lookbacks are so the divergence signal appears only 1 candle before the actual divergence happens (on the replay tool) vs 4-5 candles from other indicators. This means your entry on a divergence signal is 2 candles after it prints (for backtesting purposes).

Alerts - I also added alerts for Overbought, Oversold, Regular and Hidden Bearish/Bullish Divergences.

Let me know if you have any questions! Enjoy :)

TAS Market Profile Map [TASMarketProfile]TAS Market Profile Map (aka “ TAS Market Map ”) displays volume accumulation at price using our attractive color-coded sideways histogram overlaid onto the price data pane. Hunt for high reward-to-risk opportunities with our favorite “Alligator Jaws” chart pattern setup that reveals significant volume gaps and actionable signals. TAS Market Map can paint up to 5 Maps simultaneously across time windows customized by the user.

TAS Market Map has 4 distinct colored lines:

RED ZONE – Designates an area where there are many market participants willing to transact. This zone of red lines grouped together is known as the “value area” and contains approximately 70% of the volume transacted in that particular section of the price map within the overall Market Map.

YELLOW LINE – Each TAS Market Map will contain at least one yellow horizontal line. This line is called the “Point of Control” (POC) and it represents the price where the most executions have occurred. In the case of multiple yellow POC lines, the one that extends closest to the price axis is considered the “Master Point of Control.”

PURPLE ZONE – Represents an area where there are less people willing to transact and is referred to as being “outside of value.”

BLUE ZONE – Designates areas where there is little interest on the part of commercial or institutional professionals to transact. When these areas occur on the perimeters of the TAS Market Map, they are referred to as “runaway gaps” or “rejection tails.”

∟ THE ALLIGATOR JAWS CHART PATTERN:

A popular chart pattern utilizing TAS Market Map is called the “Alligator Jaws” setup. Due to its unmistakable appearance similar to the side profile of an alligator with its mouth open, this chart pattern seeks to exploit when there are two significant Points of Control (yellow lines) with a large volume gap in between. Enter the trade as the market breaks outside of the value area (red zone) in the direction of the volume gap (inside the open jaws), place a stop loss on the other side of the Point of Control and preferably also across the value area (red zone). Seek to take profits at either 50% of the way through the volume gap or a more optimistic target just ahead of entering the opposing jawline (red zone value area). This trading technique can be applied to both long and short side entries.

Below you will find a couple examples of this chart pattern.

∟ INPUT SETTINGS:

By default, three TAS Market Maps will appear. You can activate the 4th and 5th Market Maps easily by checking the boxes in the Input settings. TAS Market Map updates automatically at the close of each bar after it has calculated all of the volume from the closed bar in addition to the completed OHLC data (Open, High, Low, Close). This happens in a matter of seconds at each bar close. The analysis is not static, but rather a rolling period of analysis at each bar close.

THERE ARE 3 SETTINGS FOR EACH MARKET MAP :

>>> # of Lines – This represents how many horizontal lines you want to comprise the Market Map so it generates a transparency customization. The default is 50 lines. If you increase the number to, for example 100, then the Market Map will appear more prominent and less transparent on the chart. Similarly, a lower input setting would remove lines and make it more transparent.

>>> BarStart – This setting dictates the starting point for that particular Market Map analysis based on the number of bars from the current bar. The default is 50 bars so this means the start of the 1st Market Map begins 50 bars from the present. At the close of each new bar, the analysis rolls to the most recent 50 bars automatically. Therefore a setting of 100 would start the analysis based on the most recent rolling 100 most recent bars.

>>> BarStop – This setting dictates the end point for the analysis of that particular Market Map. By default, the 1st Market Map will have a 0 which means it runs analysis through to the most recent bar.

OTHER NOTES ABOUT SETTINGS:

You’ll notice that by default the input settings for BarStart and BarStop for all 5 of the Market Maps are set to 50 bar increments and don’t overlap. For example the StopBar of Market Map #2 is 51, whereas the StartBar for Market Map #1 begins at 50. It is best practice to have consistency regarding the number of bars from the start and stop of the analysis.

Although not as popular, if you want to flip the orientation of the Market Map to paint from right to left instead of the default left to right, simply change the StartBar to 0 and StopBar to 50 and you’ll achieve this preference.

∟ INTERPRETATION AND RULES:

When the market is inside the red zone “value area” of the Market Map, it tends to move sideways within the range of the zone. Therefore you can look to enter trades near the top and bottom of the red zones with potential exits near the POC (yellow line) or opposing side of the red zone value area.

When price does break and close outside the value area zone, then the value area zone becomes new support or resistance and this can be leveraged for trailing stops. The most aggressive trailing stop would be after the market has penetrated into open space away from the value area, moving the stop to just back inside the value area. This would significantly reduce the trade risk.

The use of multiple Market Maps allows the trader to anticipate upcoming areas of support and resistance when the market moves beyond the scope of the current 1st Market Map. Historical Market Maps provide valuable information regarding where commercial interest existed in the past and likely to revisit in the future.

When multiple Market Maps form and the value areas align or overlap across their respective different time windows, these tend to be significant attraction zones for the market and a trader can expect sideway trading within the red value areas zones. Prudent trading is to observe the market conditions present and you the trader must adapt your trading mode to match, or not trade at all. In other words, you must trade the range during times when the market is in the value area zones and trade breakout when confirmed moves occur outside the value area zones.

In the case of a Market Map that develops “multiple distribution” areas (i.e. multiple developed value areas within Market Map), we anticipate a trending move

with price continuing in the direction the value areas are forming in relation to one another and in relation to the direction multiple Market Maps are forming.

Example of multiple Market Maps forming lower and revealing the bearish market trend:

Trade Well My Friends,

Wave Strength Oscillator By CryptoScriptsThe Wave Strength Oscillator uses a combination of wave strength and momentum to help catch the best entries for reversals and does so using a few methods. I'm currently using the 1h timeframe for BTC but feel free to experiment on different timeframes to see what works best for you. In the description below, I'll go over each signal, how it's derived, and how to use them!

Oversold (Green shaded area) - The oversold indication appears whenever both oscillators are oversold and is usually a good indicator that a reversal to the upside is around the corner (at least for a short period). Be advised these are the weakest of the three signals so I recommend using this signal with other indicators.

Overbought (Red shaded area) - The overbought indication appears whenever both oscillators are overbought and is usually a good indicator that a reversal to the downside is around the corner (at least for a short period). Be advised these are the weakest of the three signals so I recommend using this signal with other indicators.

Green Diamond - The green diamonds indicate whenever one or both of the oscillators are oversold AND they are both outside of the bollinger bands which is great for catching reversals to the upside (as seen in the chart). These may come two or three at a time so it may be best to wait until they have all printed before entering.

Red Diamond - The red diamonds indicate whenever one or both of the oscillators are overbought AND they are both outside of the bollinger bands which is great for catching reversals to the downside (as seen in the chart). These may come two or three at a time so it may be best to wait until they have all printed before entering.

Rocket - The rocket symbol occurs whenever BOTH oscillators are oversold and BOTH oscillators are outside of the bollinger bands. This is great for catching reversals to the upside but may come two or three at a time so it may be best to wait until they have all printed before entering.

Red Alarm - The red alarm symbol occurs whenever BOTH oscillators are oversold and BOTH oscillators are outside of the bollinger bands. This is great for catching reversals to the downside but may come two or three at a time so it may be best to wait until they have all printed before entering.

Input Options

Show Histogram - I also included a Histogram in the indicator to help gauge the level of buys/sell strength but kept it hidden for the default levels (i.e a green diamond with a red histogram bar is usually a good sign a reversal is about to happen to the upside whereas a green diamond with a green histogram bar may indicate a false reversal and there's still more room to the downside until a red bar appears. Always backtest this!)

Show Overbought/Oversold Levels - This is if you want to ignore all of the green/red shaded areas and only focus on the diamonds and rocket/alarm signals

Wave Overbought/Oversold Levels - Free free to change to value of the overbought/oversold levels to change where the green/red shades areas print

Momentum Overbought/Oversold Levels - Free free to change to value of the overbought/oversold levels to change where the green/red shades areas print

Histogram Length - This will not change anything with the signals but I included it so you can change the visuals if it helps you

Momentum Length - This will change where the signals plot

Momentum Signal - This only changes the yellow signal line and nothing else. It's not incorporated into any equation

Average Length - This will change where the signals plot

Alerts

I've set alerts on this indicator for each icon (Oversold, Overbought, Green Diamond, Red Diamond, Rocket, Red Alarm). I HIGHLY recommend setting the alerts for Candle Close so that you can be sure the signal is confirmed.

You may notice that the indicator can give multiple signals back-to-back or be overbought/oversold for multiple candles. When this happens, it's best to look at other indicators such as the RSI , MFI Pro, etc to nail the best entry and have confluence with your decision. With that said, having multiple signals back-to-back can also be an indication that the move is close to happening. This indicator works with crypto and stocks as well.

If you have any questions or would like to purchase this indicator, please comment below or PM me. I also made a video tutorial for the indicator on my Youtube channel (link is next to my profile pic)

Be advised past performance is not indicative of future returns. Backtest EVERY timeframe and NEVER blindly take signals! Also, never invest more than you can afford to lose.

Enjoy :)

Abdul Rehman Trading StrategyBest Buy & Sell Indicator for Crypto, Forex and stocks. This indicator is based on Volume, RSI and current support and resistance.

Best Time Frame:

5 Minutes, 15 minutes

Long Positions:

You will see numbers appearing in Green Colour starting from 7,8 and then you can see the LONG position signal.

Short Position:

You will see numbers appearing in Red Colour starting from 7,8 and then SHORT Position Signal.

Important Note:

If you see the bearish trend in 4 hours time frame then always follow SHORT positions and if you see the bullish trend in 4 Hour time frame then always LONG positions.

Best TradingView Strategy - For NASDAQ and DOW30 and other IndexThe script is totally based on momentum , volume and price. We have used :

1: Bollinger Band Squeezes to know when a breakout might happen.

2: Used Moving Averages(SMA and EMA) to know the direction.

3: The success Rate of this strategy is above 75% and if little price action is added it can easily surpass 90% success mark.

4: Do not worry about drawdowns , we have implemented trailing SL ,so you might see a little extra drawdown but in reality its pretty less.

5: I myself have tested this strategy for 41 days with a 250$ account and right now I have 2700$.

GCOV4 PROTECH GCOV4 PROTECH SYSTEM

This indicator is built specifically for SWING, PULLBACK and BREAKOUT strategy trading in the stocks/equity market. It uses an indicator instrument consisting of ATR TRAILING STOP (ATR), EXPONENTIAL MOVING AVERAGE(EMA), PIVOT POINT and VOLUME ANALYSIS.

The parameters that have been upgraded are to meet the needs of trading strategies whether short or long term trading. In addition, it is built to reduce the risk of trading activities and help traders to adhere to the best trading plan.

This transformation involves 3 trading strategy modes namely SWING PRO, PULL & BOUND and BREAKOUT STRATEGY.

Rebuild of Instrument & Parameter

This indicator is also an upgraded instrument that is sourced from the previous indicator, the GOLDENCO AIE2 INDICATOR.

This R&D of course to make trading activities more effective, dynamic and to increase the confidence of traders in current trading activities. The indicator has been upgraded in terms of parameters as well as additional instruments. Among them are;

1. ATR Trailing Stop

2. Exponential Moving Average – fastMA/slowMA Length

3. Label@Entry Price/Stoploss/Takeprofit line;

>The take profit and stop loss rates are based on percentages. However

traders can change the percentage rate according to their respective

trading plans.

>existing percentage rates have been set(build-in) for standard rate.

So you have to reset based on the type of stock/market cap either penny

stock or blue chip stock.

>The candle/bars have been colored to make it easier for traders to see price

trends whether in bullish or bearish conditions.

Hopefully with the upgrading of these indicators will make traders more successful in trading activities, especially in the equity markets.

DISCLAIMER;

ALL NOTES AND INDICATING TOOLS ARE FOR EDUCATIONAL ONLY AND AS A FACILITATOR AND PREPARATION IN TRADING ACTIVITIES. ADMIN IS NOT RESPONSIBLE FOR ANY RISKS IN YOUR TRADING ACTIVITIES. TAKE AT YOUR OWN RISK.

FunTrader/Aieyee @2022

stratRsi_MiguelThis strategy was created with the aim of trying to predict upper moves and to protect from falling prices. It is intended to out perform going from bottom to top and to bottom again (ex: BTC from 10k to 20k to 10k again and remain with substancial profit from the rise). It will not outperform from bottom to top. It is advised to do not enter short positions with this strategy. Only long and close.

Adjust "Period in minutes" to your time frame. ex: 60 for 1h, 240 for 4h, 1440 for 1D.

This will adjust the lengh of ema (RSI).

Default value is 1440 for 1D time frame.

Long condition is triggered when a FastEma(RSI) is bigger then a MeddiumEma(RSI), the MeddiumRSI is bigger than the SlowerEma(RSI), the FastRSI is larger then the Highest(FastRSI) with a length equal to input "High Length"(default value=6) and ema(close) is rising.

The short Condition is triggered when rsi(close,14) is lower then lowest(FastRSI) with a lenght equal to input "Low Length" (default value=3) and ema(close) is falling.

You can set up the time range to evaluate the strategy from "Start date" (default: year=2018, month=1, day=1) to "End date" (default: year=2050, month=1, day=1). Default commission=0.075%. Default Initial capital = 100 USD

MAFIA CANDLESMafia Candles is a Exhaustion bar count and candle count indicator, Using the Leledc Candles and 1-3 counting candle play gives you a pretty good idea where a so called "top" will be or a so called "bottom" will be!

In this example, getting the transparent round circles ( either lime or red ) would mean that the move will be a good size move!

EXAMPLE=1 You see a down trend and then the Mafia Candles Flashes a Green Dot on the forming new red candle. This is where in theory you might want to consider going long on the market!

EXAMPLE=2 If you see a RED $ symbol, after a uptrend, this means in theory, there might be room for a short play or room for a small pullback in the price!

THE CIRCLES(RED OR LIME COLORED) ARE INDICATING BIGGER MOVES!

THE $ SYMBOLS (RED OR LIME COLORED) ARE INDICATING SMALLER PULLBACKS OR SMALLER PUMPS IN PRICE!

RED IS CONSIDERED TO BE A SELL!

LIME COLOR IS CONSIDERED TO BE A BUY!

AS MUCH IS BASED OF THE 1-3 CANDLE COUNT AND THE LEDLEC CANDLE DEVIATION STRATEGY, LET ME EXPLAIN THE THEORY ON BOTH THE 1-3 CANDLE COUNT AND THE LELEDC STRATEGY I COMBINE TO BRING YOU THIS ADDITION OF THE INDICATOR....

LELEDC THEORY USAGE...

An Exhaustion Bar is a bar which signals

the exhaustion of the trend in the current direction. In other words an

exhaustion bar is “A bar of last seller” in case of a downtrend and “A bar of

last buyer”in case of an uptrend.

Having said that when a party cannot take the price further in their direction,naturally the other party comes in , takes charge and reverses the direction of the trend.

TO EASIER UNDERSTAND I GIVE YOU A EASY EXAMPLE OF WHAT AN LELEDC EXHAUSTION BAR IS...

1. A wide range bar ( a bar with

long body!!!).

2. A long wick at the bottom of

the bar and no or negligible wick at the top of the bar in case of “Bear exhaustion bar” and

a long wick at the top and no or

negligible wick at the bottom of the bar in case of

“Bull exhuation bar”!!!

3. Extreme volume and.....

4. Bar forming at a key support or resistance

area including a Round Number (RN) and Big Round Number ( BRN ).THE PSYCHOLOGY BEHIND THIS!!!

Now let's assume that we have a group

of people,say 100 people who decides to go for a casual running. After running for few KM's few of

them will say “I am exhausted. I cannot run further”. They will quit running.

After running further, another bunch of runners will say “I am exhausted. I can’t run

further” and they also will quit running.

This goes on and on and then there will be a stage where only few will be left in the running. Now a stage will come where the last person left in the running will say “I

am exhausted” and he stops running. That means no one is left now in the

running.This means all are exhausted in the running.

The same way an exhaustion bar works and if we can figure out that

exhaustion bar with all the tools available on hand, we will be in a big trade

for sure!!.The reason is an exhaustion bar is formed at exact tops and bottoms most of the times.In forex with wide variety of pairs available at the counter ,one can trade this technique to make lifetime gains.

NOW LET ME EXPLAIN THE 1-3 CANDLE CORRECTION COUNT THEORY WHICH IS USED TO GET THE SUM UP SIGNALS FROM THIS INDICATOR FROM ITS INPUT LEVELS!!!

1-3 CANDLES....

The 1-3 Candlestick pattern is basically like sequential, aka a candle counting system!

1-3 CANDLE COUNT means you count the number of bullish=green candles or the bearish=red candles!

3 BULL/GREEN CANDLES in a row, each closing its close higher than the previous one before it is the 1-3 candle top count idea!

lets say you get 3 red bear candles, each candle after the first closes its body below the previous red candle before it, then you see 3 red candles with each closing lower bodies lower than the previous candle, THATS A POSSIBLE SIGN OF BEARISH EXHAUSTION, AND YOU MIGHT HAVE SOME BULLS STEP IN TO TAKE THE PRICE UP AFTER THE IMMEDIATE DOWNFALL OF THOSE 3 RED CANDLES!!

PLEASE IF ANYONE HAS QUESTIONS OR NEEDS ANY FURTHER EXPLANATION, DONT HESISITATE TO MESSAGE ME! CHALRES KNIGHT IS THE ORIGINAL AUTHOR OF THE 1-3 CANDLE COUNT AND THE LELEDC EXHAUSTION BAR INDICATOR ON METE-TRADER! R.IP CHARLES F KNIGHT!!! WE LOVE YOU AND MISS YOU BROTHER!

CHARLES KNIGHT PASSED DOWN ALL OF HIS INDICATORS AND SCRIPTS IN ORIGINAL CODE TO MYSELF WHEN HE PASSED AWAY AND I WILL CONTINUE TO HONOR HIS MEMORY BY ENHANCING HIS ORIGINAL SOURCE CODED SCRIPTS TO ENHANCE THE LIFE FOR ALL TRADERS!

CHARLIE LOVED WHEN I WOULD PUT MY OWN SWING ON HIS INDICATORS! HE TAUGHT ME EVERYTHING I KNOW AND I KNOW ONE DAY I WILL SEE HIM AGAIN!

TRADE IN PARADISE CHARLIE!!!

THE BEST TRADER IN THE WORLD!!!

Make Profit Club Main ScalpThe main scalping indicator.

We use this indicator to trade for a short time in a TF of 5-15 minutes.

We have created takeprofit zones for you so that you can understand where we can get to and take your profit. these points are mostly very helpful.

There are basic settings that allow you to adjust the indicator individually for each situation; because of this, this indicator can be used for any exchange and any currency pair.

For Scalp trading, we use 3 different strategies available to our clients. If you enter them correctly, you can never see the minus sign.

Use the link below to obtain access to this indicator.

CPR with Pivot LevelsWe recommend some preconditions for Intraday Trading Strategy with CPR (Central Pivot Range)

Rules For BUY Setup with CPR

1) Today's Pivot Level Should be higher than Previous Day's Pivot Level

2) The previous day's close should be near day high.

Rules For SELL Setup with CPR

1) Today's Pivot Level Should be lower than Previous Day's Pivot Level

2) The previous day's close should be near day low.

CPR or central pivot range is the best tool available for the trader to see the price base indicator. You can use this tool i.e CPR (central pivot range) to check the price indicator in the stock market. You know the price of shares sometimes goes up or sometimes goes down in the stock market. So it will be best to stay updated and know it before the time the share market/stock market fall or rises.

Squeeze MTF HeatmapHere is a multi-timeframe heat map using one of the most apreciated indicators in Tradingview: Squeeze Momentum Indicator by LazyBear.

Study shall be added to 15min chart.

It indicates squeeze and momentum at: 15 min, 30 min, 60 min, 240 min and 1 Day.

Thanks to © azimuthdynamics for inspiration and portion of code

Thanks to Lazy Bear for coding Squeeze Momentum Indicator

BEST MA Cross/MACD ScreenerHello traders

Continuing deeper and stronger with the screeners' educational serie one more time

I - Concept

This is the first flexible screener I'm releasing. Screener detecting a convergence whenever the MACD and MM cross are giving a signal in the same direction.

Those who know me from TradingView ... are aware that I'm big on convergences. I totally think that 1 indicator isn't enough - whatever the timeframe.

But building my own convergence detection systems has been fruitful for me

II - How did I set the screener

The visual signals are as follow:

- square: MACD + MA cross convergence.

- diamond: Only MACD is selected

- circle: Only MA cross is selected

Then the colors are:

- green when bullish

- red when bearish

Example

Below, I highlighted why we see diamonds on the top screener panel. This is because I only selected the MACD filter

Cool Hacks

Don't forget that you can add the same indicator multiple times on your chart :)

Wishing you all the BEST trading

Dave

BEST Ultimate Engulfing ScreenerHello traders

Continuing deeper and stronger with the screeners serie. I keep getting requests private messages and requests saying that screeners aren't possible with TradingView.

My answer is always... "Reallyyy ??" (I never find a better answer than that...)

I'll publish a few screeners just for everyone to understand what can be done with Pinescript. We don't have to wait for TradingView to allow screener based on custom indicator - we can build our own ^^

I - What is an engulfing pattern

Let's start with a screener to check for a very famous candlestick pattern called engulfing

Engulfing candles tend to signal a reversal of the current trend in the market. This specific pattern involves two candles with the latter candle ‘engulfing’ the entire body of the candle before it.

The engulfing candle can be bullish or bearish depending on where it forms in relation to the existing trend

Source and more info here

These engulfing candles indicate a strong shift in direction, and when combined with observation of the price-trending direction that precedes it, this shift creates the opportunity for a trading strategy.

II - How did I set the screener

I added an optional filter being Price vs SMA. The idea is to select only the engulfing whenever the price also breaks an SMA - this usually translates a stronger move - but could sometimes give the signal too late (#meh #trading #ain't #easy)

The visual signals are as follow:

- square: whenever the engine detects an engulfing and an SMA breakout

- triangle: the engine only detects an engulfing

- dash: none of the above

Then the colors are:

- orange when bullish

- yellow when bearish

- aqua/dash when none of the above

Cool Hacks

"But sir... what can we do with only 5 instruments for a screener?" I agree not much but...

even if I allow only 5 instruments per indicator - nothing prevents you from adding multiple times the same indicator and changing the selected instruments for each. I also show why the SPX500 gave a yellow triangle (bearish engulfing) and how to match it with the screener.

=> imgur.com

Wishing you all the BEST trading

Dave

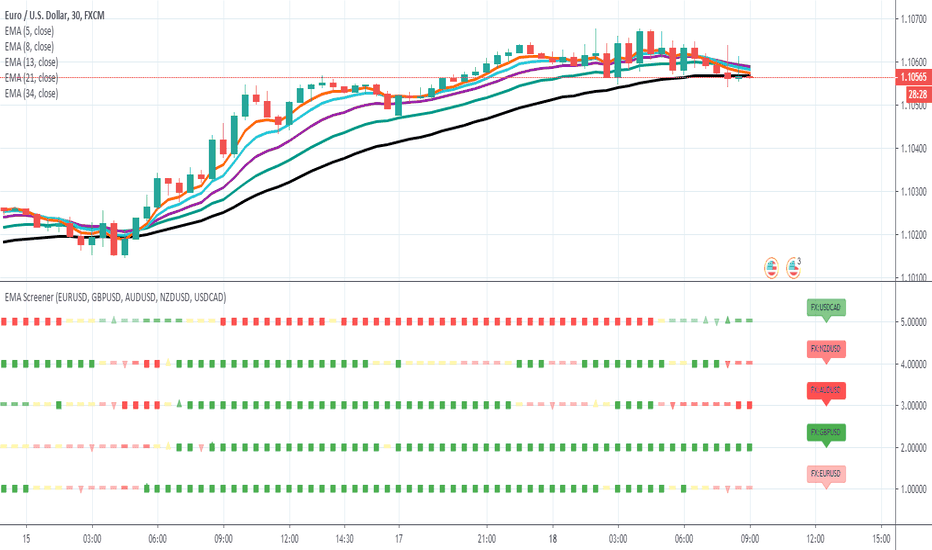

Ultimate EMA ScreenerHello traders

Very busy preparing a few stuff for Black Friday but wanted to remind that I still know Pinescript and how to step up my game :)

My master @RicardoSantos once again showed me how to push the pinescript limits one step/dimension further. Kudo also to my client (Judy) for this amazing idea.

I inspired myself from his script () to display multiple assets in the same panel - without breaking the chart scaling.

In that case, I'm comparing 5 EMAs relatively to each other and display:

- a square if they're stacked properly

- a triangle if two of them are stacked properly

- a dash otherwise

For those interested, the conditions are in the f_securitys function.

I posted in the past a few screeners using labels but we're limited to 50 labels per script. There isn't such limitation when using the plotshape function - giving us more complete screeners. #uhuuuu

I'll post a few more examples this week with different trading strategies/combinations. The possibilities here are (close to) limitless.

I'm using the security built-in function to call external assets (here different forex pairs) and we're limited to 40 security calls per script.

But nothing preventing us from duplicating the same script a few times and calling different assets each time :) If you'd like to display 10 forex pairs, you only need to add that script on your chart twice and select 5 pairs for the first panel, 5 other pairs for the second panel.

You're welcome <3

All the BEST

Dave

Algorithm Builder - Multiple TrendsHello traders

I. SCRIPTS ACCESS AND TRIALS

1. For the trial request access, they have to be done through my website .

2. My website URL is in this script signature at the very bottom (you'll have to scroll down a bit and going past the long description) and in my profile status available here : Daveatt

Due to the new scripts publishing house rules, I won't mention the URL here directly. As I value my partnership with TradingView very much, I prefer showing you the way for finding them :)

3. You may also contact me directly for more information

II. Algorithm Builder - Multiple Trends

2.1 Forewords

This indicator is available only to our PREMIUM users. Our PREMIUM indicators offer more trading analysis capabilities and opportunities.

A few words of caution: the Algorithm Builders - Multiple Trends are more advanced and as such, would require slightly more time to be mastered.

They're not that much difficult, but we understand that designing a trading system with 2 trends might be slightly more complicated - however, there is nothing to be scared of :).

The time spent to learn how to use our PREMIUM tools might be rewarded handsomely.

2.2 Concept

The Algorithm Builder - Multiple Trends is made to detect the convergence of many unrelated indicators and give a BUY or SELL signal whenever all the selected sub-indicators are converging in the same direction.

This is an upgrade of the PRO package giving access to the Algorithm Builder - Single Trend - designed to show 1 unique entry per trend - whereas the Multiple Trends offers re-entries in the same direction of the trend if the indicator detects good convergences to accumulate more positions.

III. Multiple Trends versus Single Trend

3.1 Multiple Trends benefits

A friend asked us recently Why using the Multiple Trends if we can use the Single Trend in a smaller timeframe, and get more entries that way?

We thought this was an excellent question, but the answer is obvious.

Using a Single Trend on a smaller timeframe to solely getting more entries will reduce the security of the given trades.

We designed the Algorithm Builders to take a trade in an identified trend but reducing the timeframe too much will mostly increase your risk - and might lead to capital loss.

By the way, this is a universal rule valid also for a big majority of indicators.

We're absolutely not saying that the Single Trend won't work on small timeframes because actually it really does. But, if you find out a great configuration for your Single Trend, and want to get more signals without increasing your risk - then the Multiple Trends would be a very viable option.

3.2 Main signal versus secondary signals

For the main and secondary trends, the color green symbolizes any identified "BUY" trend. And the color red symbolizes any identified "SELL" trend.

-The MAIN trend symbol is unique and symbolized by a triangle.

- The SECONDARY (could also be called re-entries) trends are multiple and symbolized by a diamond.

In the Algorithm Builder indicator settings, they're identified with the Additional keyword.

3.3 How the convergences are calculated

Extremely important: The diamonds (or re-entries) are displayed, as long as a triangle (or main/primary signal) is displayed.

For a trend change (buy to sell or sell to buy), the system waits for ALL selected re-entries sub-indicators , to give a convergence/confluence in the opposite direction.

For example, let's assume a BUY/green convergence based on 3 indicators. One or Two of them going turning red, won't be enough for a trend change.

But, if all of them turn red, then we'll see a red triangle - signaling the beginning of a new downtrend.

3.4 Why multiple entries?

Here are a few use cases :

1. The main use case why we made those Multiple Trends indicators: A trader got invalidated or stopped out on a trade, but wants a system to let hin/her jump back in with a minimum of security. (security depending on the configuration of the Algorithm Builder as a whole).

This is very frustrating to get in a trade, being stopped out, and finally, see the trade going in the expected direction.

Even more frustrating to jump back in at the end of a trend, and get stopped out again - we all agree on this.

2. You want to add more positions on your main trade as your Algo Builder identified a solid trend - this is a nice way to possibly maximize your gains.

Once again, we don't/won't guarantee any performance result (not because we don't believe in our tools, but for legal reason), all depends on the time spent reading our documentation and playing with the Algo Builder - as explained on our Tutorials.

More info available on our website. URL available in this script signature and on my profile status.

IV. Why the Algorithm Builder Multiple Trends may help you

I worked with many traders during my career, and their feedback about trading is often pretty similar.

They all tried a lot of complicated indicators, losing their capital, and finally getting back to the basics (even to the basic indicators if I might say)

The art is finding a good combination of indicators and setting strict money/risk management rules.

Easy in concept, but more than 90+% of traders lose money on the markets... which teach us that trading is not only about drawing trendlines, or using cool indicators but finding ways to ease our psychology while trading.

4.1 The Algorithm Builder trading framework

The sub-indicators (full list on our website) weren't chosen randomly. They're based on a trading method we've developed over the last 6 years - while working with traders and other trading quants.

The Algo Builders are made to detect a convergence - and as such, will give a signal once a trend has been identified.

They're not made to detect reversal but have been designed to give a signal when all sub-indicators are either ALL bullish (green) or ALL bearish (red).

We provide a framework based on indicators we selected because they:

1. make sense to be used altogether

2. work on asset classes like INDEX, CRYPTO, STOCK OPTIONS, FOREX, COMMODITIES

3. it may expand your knowledge about what detecting a convergence with pre-selected indicator really means

4.2 Supports and Resistances

The indicator displays the main algorithmic supports and resistances according to our trading method.

I think they're relevant for all asset classes, but you're absolutely free to use any different supports/resistances logic if you want to.

I'm not against it because I know that pivots, Fibonacci levels, etc. may work very well also.

4.6 Hard Exits

Our trading method is known for the hard exits, also called invalidation.

The Single Trend+ includes a hard exit based on a MACD - settings are flexible and you may update them.

Having a stop-loss protecting your trade is a best practice - Protecting your stop-loss also from getting hit is incredible.

We prefer invalidate a few positions, even if sometimes we don't want to. Rather than the market hard exiting on us, and leaving with our hard-working money.

4.7 Alerts

Alerts are enabled for:

- BUY/SELL MAIN triangles signals

- BUY/SELL SECONDARY diamond signals

- Hard Exits

V. Pain points that we're trying to solve with our Algorithm Builders

Issue #1 There are many informations / indicators / strategies / backtests / noise. Finding the right ones is not a simple task.

Solution #1 A reliable system that removes the external noise is much needed in trading to stay "in the game".

Issue #2 Trading could be quite stressful - The majority doesn't lose in trading because technical analysis is hard, but because managing our psychology is one of the hardest things a human can do.

Solution #2 Some ways to reduce the "trading stress" could be: getting better quality signals and trading like a "machine". Forgetting about Twitter and trusting the system you designed.

Issue #3 Trading without strict rules and only based on what we feel, or what we think the market should do is the fastest way to kiss our money goodbye.

Only 1 indicator generally is not enough. Traders generally use a combination of several indicators but they're monitoring them individually.

It's normal then to feel exhausted at the end of the day ^^ (to say the least)... and exhaustion leads to mistakes which leads to..... (I'm sure you got it) ... capital loss.

Solution #3 As a trader, I needed a trading framework and a method. I offer our trading method but they're plenty others out there. We cannot claim obviously it's the best ever ....but let's say we're using those exact same

scripts ourselves for our trading. And this what we've been recommending our clients to trade with for the past years. Also, having a tool detecting the convergence of several indicators and giving 1 unique signal

for BUY/SELL position will save you a lot of time/energy, and perhaps might help you out getting better trading performance.

VI. Resolving a complex puzzle and having fun in the process

Trading has to stay a passion and not (only be) a source of intense stress.

The most successful traders I know are "trading geeks" - literally always looking for optimizing, searching for the best possible entries, setups, indicators, tools, etc.

For them, it's not even about the money anymore, but only about beating their previous performance.

Why are they doing this? Because it's fun

Might appears as a bold statement, but I guarantee that looking for setups is fun.

One of our users even told us, that it's like playing with "Legos" and we couldn't possibly agree more.

VII. Designing a system that "makes sense"

Another bold statement now. Brace yourselves ladies and gentlemen

The Algorithm Builders allow to design trading systems quickly. What could takes days/weeks/months to find out... might be now within your reach in less than a few hours.

With a bit of practice, less than an hour might be enough per asset/timeframe to find a system that makes sense to you and adapted to your trading capital and psychology.

Assuming our users read our guides and are fully committed to learning a new way of trading - then we do guarantee you'll be able to design kick-ass trading systems that make sense.

"Making sense" doesn't mean at all it's guaranteed to win, it means you're the one defining the convergence of indicators, using your Algorithm Builder, and observe that most of the time - whenever there is a BUY signal, the candlesticks are going upwards - whenever there is a SELL signal, it's going downwards.

This is a necessary step to make real progress from a trading analyst perspective - and hopefully could lead to profits.

VII. Algorithm Builder versus the main trader enemy(=psychology)

This indicator has the goal to help solving one of the MAIN issues encountered by traders.

Most of traders realize, they can't perform with only 1 indicator (or 1 price pattern or 1 price action) and need a combination of multiple indicators before getting in a trade.

Far from being a magic pill, if it could at least reduce the stress you have while trading, then we'll consider we made a great job - it's a technical "useless noise remover", and needs to be followed strictly.

Such trust in a trading system can only be built by testing your Algorithm Builder configuration on either:

1. a demo account

2. or a live account with small bids. And then, increasing progressively the bids if your capital increases progressively.

Though, you should still use your common sense. (for instance: if we get a BUY signal right on a big timeframe resistance we're hitting for the first time).

I'm aware this is a new way of trading but for many, and while we cannot foresee the future, neither predict performance, we believe it might save you a lot of time to find good signals.

My maximum level of happiness will be reached the day when our users will contact me and showing me setups being mine.

I'm sure that even I can learn from my users and, we can all learn from each other Algorithm Builder configuration

VIII. What is a wrong or bad configuration?

Simply put. If you see that most of your signals react such as described below:

1. a buy triangle predicts, most of the time an upwards move

2. a sell triangle predicts, most of the time a downwards move

3. you estimated yourself the stop-loss needed to give enough room for your trades.

4. take profits based on algorithmic support and resistances or your own take profit method.

So what's a good Algorithm Builder configuration? A configuration you're happy with and makes sense.

A better Algorithm Builder setup is one used in demo or a live account w/ small bids for a few weeks, and you're consistent in your trading performance.

If you have any doubt or question, please hit me up directly or ask in the comments section of this script.

I'll never claim I have the best trading methodology or the best indicators. You only will be the judge, and I'll appreciate all the questions and feedback you're sending my way.

They help me a ton to develop indicators based on all the requests I received.

Kind regards,

Dave

WBCC Scalp StrategyИндикатор для Scalp сделок, использовать рекомендуется исключительно на временных интервалах от 1 часа и ниже.

WBCC Main TrendИспользуется для определения движения основного тренда (Long/Short), а так же успешно может быть применен и на более маленьких временных интервалах.

WBCC Level StrategyКраткое описание настройки:

Trend Period - количество свечей для расчета тренда.

WBCC_Level - уровень влияет на быстроту сигнала, чем меньше уровень тем быстрее сигнал появится, чем выше уровень тем меньше ложных сигналов и стабильней входы в Long и Short (рекомендованные параметры - 0.45-0.65)

Рекомендованное использование на Time Frame графика от 1 часа и выше.

TEDong Price Velocity MotionHi Folg,

TEDong Price Velocity Motion indikator for XBT is based on Physics Newton Law.

It gives a Buy signal when the Line value crosses up its EMA and a Sell signal when it crosses down its EMA .

Cross over markers Directional bgcolor, where RED for bearish (S) and GREEN for bullish (B)

If you include volume analyses in your trading strategy, automating EDong Price Velocity Motion will give buy signals whenever volume and price are rising altogether.

HINT:

Bullish when line/BG is green, bearish when line/BG is red. BUY on first green candle, SELLl on first red candle.

DONATE/TIP

BTC: 13nhMN2H4LoRi4VMcPcyR96jitxrH3uivB

TEDong Velocity/Acceleration: Physics Newton LawHi Folg,

In physics, equations of motion are equations that describe the behavior of a physical system in terms of its motion as a function of time.

Kinematics motion is simpler as it concerns only variables derived from the positions of objects, and time. In circumstances of constant acceleration, these simpler equations of motion are usually referred to as the SUVAT equations, arising from the definitions of kinematic quantities: displacement (s), initial velocity (u), final velocity (v), acceleration (a), and time (t).

A differential equation of motion, usually identified as some physical law and applying definitions of physical quantities, is used to set up an equation for the problem. Solving the differential equation will lead to a general solution with arbitrary constants, the arbitrariness corresponding to a family of solutions. A particular solution can be obtained by setting the initial values, which fixes the values of the constants. To state this formally, in general an equation of motion M is a function of the position r of the object, its velocity (the first time derivative of r, v = dr/dt

), and its acceleration (the second derivative of r, a = d2r/dt2), and time t.

The following indikator is called TEDong Velocity/Acceleration, with alert LONG/BUY and SHORT/Sell.

DONATE/TIP

BTC: 13nhMN2H4LoRi4VMcPcyR96jitxrH3uivB