MA200W buy sell BTC ColoredA script to help you plan your entrances and exits with beautiful colors for BTC. It just helps to better highlight the gap between the start of the week and the end.

It only work on Weekly.

Info :

Blue ... you can wait, enjoy your life

Green is when you buy

Yellow when you enter bull market

Orange is when you begin to take care of next week

Red when you begin to sell low part

White, if while a week you see white you can sell bigs bags, if it end with White you can close majors positions

Warning White may not appear, if second week after first Red week is not White you can sell large position

Good luck and take a breath

Buy-sell

Precise_SignalThis signal combines a portion of Chris Moody's 2014 SlingShot and my 2017 MTF Indicators. Both of our prior scripts over indicated Buy and Sell Points. This signal indicates a buy or sell point much less than our prior scripts did but with absolute precision.

I would say it is 100% accurate, but that is because I am yet to find a timeframe and symbol where the Buy signal failed to see the equity move up or the Sell signal failed to see the equity move down over the next 5 bars. I have tested 2000 charts so far. To be safe, I would rather state this indicator is accurate nearly 100% of the time.

The indicator is made up of 2 main portions and both of them have to agree on a buy or sell in order to indicate such with a vertical green or maroon bar beneath the chart. If there is a failure to agree, nothing is signaled.

Indicator 1 combines a stochastic of a 3 hour chart and a daily chart to determine when the stochastics are in agreement on direction. When there is agreement, both of them MUST cross from a buy state to a sell state and vice versa at exactly the same time. This is difficult to achieve and it is already rare for this occurrence to produce a signal. When a signal is produce it is combine with Chris Moody's 2014 SlingShot Indicator which conservatively determines Buy and Sell signals based on EMAs and market direction. Signals from his SlingShot are infrequent.

BUY Signal

When my MTF signals Buy at the same time that the SlingShot signals a Buy, a vertical green bar will appear in the window containing this script. The vertical bar is based on the close price of the equity and is only final when the close price is final. A BUY signal means the equity will move up potentially as early as the next bar and achieve a higher value from the close price on the signal bar.

SELL Signal

Likewise, a sell signal from the MTF at the same time as a sell signal from the SlingShot will create a maroon bar in the window containing this script. The vertical bar is based on the close price of the equity and is only final when the close price is final. A SELL signal means the equity will move down potentially as early as the next bar and achieve a lower value from the close price on the signal bar.

The default values for this script are hard-coded into this script. You can edit any of the value you would like to play with other timeframes, stochastic, and moving average lengths.

I have played with these values and have hard-coded the ones that are most accurate. Please let me know if you find others that work.

Hopefully this becomes an extra tool in your technical trading toolkit.

RVSI & MACD Confluence BackgroundThis indicator colors the background in vertical (green/red) stripes to indicate if the current trend is possibly bull / bear

A region where the background is not colored indicates that the present trend can not be identified

The algo combines the RVSI (Relative Volume Strength Index {ref fract} ) and the MACD

The Relative Volume Strength Index has been adapted to include 2 moving averages, one fast and one slow

This same fast slow lookback length is applied to the MACD for simplicity

What's interesting is that there is a very strong confluence between the MACD and RVSI, as the MACD is obtained from 'price action only' and the RVSI from the 'volume only'

So a break in confluence of these two might suggest that the current trend is weakening in confidence or can not be clearly identified

Generally, a green background means consider going long ie price trend is rising

A red background means consider going short ie price trend is falling

An absent background color means - consider exiting current trade or wait to get into a new trade

Best Regards, MoonFlag - and a special thanks/mention to 'fract' for the RVSI algo this is derived from

Trend Trader Buy/Sell SignalsTrend Trader

The code is open source, what it uses to print signals is MACD cross and ADX. Bar colors change in relation to where price is according to the 50 day MA. The MA ribbon is used for visualizing trend and using it for dynamic support/resistance. The ribbon is comprised of the 50 day and 100 day MAs.

Main reason to publish this script is because some like to jumble up scripts together slap some moving averages on it to "follow trend" and then label it an algorithm, market it and sell it to people online. No single system will work 100% of the time, do you due diligence in anything you are interested in buying. Plenty of free scripts in the TV library that can do you justice when trading.

Escaping of Rate from Avarage By Mustafa OZVEREscaping of Rate from Average By Mustafa OZVER

This code shows a location of a rate or price (or etc.) from the average, rated by the standard deviation.

To show that, calculates the ema and standard deviation of our data then calculates the distance between ema and the current data by the standard deviation.

In summary, we can say that this value is the current distance by the long term standard deviation.

This value is between +1 and -1 because we expect the absolute value of the standard distance does not get far from the long term standard deviation.

For scalping, we can use this value as

buy signal when the value is below -1,

sell signal when the value is above +1,

But only this value can not guarantee good results for trading. BE CAREFUL

MACD Hybrid BSHMACD = Moving Average Convergence and Divergence

Hybrid = Combining the two main MACD signals into one indicator

BSH = Buy Sell Hold

This indicator looks for a crossover of the MACD moving averages (12ema and 26ema) in order to generate a buy/sell signal and a crossover of the MACD line (12ema minus 26ema) and MACD signal line (9ema of MACD line) in order to generate a completely seperate buy/sell signal. The two buy/sell signals are combined into a hybrid buy/sell/hold indicator which looks for one, neither, or both signals to be "buys." If both signals are buys (fast crossed above slow), a "buy" signal is given (green bar color). If only one signal is a buy, a "hold" signal is given (yellow bar color). If neither signal is a buy, a "sell" signal is given (red bar color). Note: MACD moving averages crossing over is the same thing as the MACD line crossing the zero level in the MACD indicator.

It makes sense to have the MACD indicator loaded as a reference when using this but it isn't required. The lines plotted on the chart are the 12ema and a signal line which is the MACD signal line shown relative to the 12ema rather than the MACD line. The 26ema is not plotted on the chart because the chart becomes cluttered, plus the moving averages crossing over is indicated with the MACD indicator.

This indicator should be used with other indicators such as ATR (1), RSI (14), Bollinger bands (20, 2), etc. in order to determine the best course of action when a signal is given. One way to use this as a strict system is to take a neutral cash position when a yellow "hold" signal is given, to go long when a

green "buy" signal is given, and to go short when a red "sell" signal is given. It can be observed that for many tickers and timeframes that green-yellow-green and red-yellow-red sequences are stronger signals than green-yellow-red and red-yellow-green signals.

Note: Chart type must be "bars" in order for the bar colorization to work properly

ATR SL Buy/Sell w/ SMAsFirstly I'd like to state that this script's ATR buy/sell source is from the public script library here:

Additionally with the buy/sell signals from the original script, two more buy/sell conditions were added to give more entries/scaling in or out options. On top of that, two SMA lines were added, a 1 day moving average and a 5 day moving average.

This script is more so designed for scalping/scaling in and out of positions already made.

The SMAs add a level of confidence to the entry order, buy/sell triggers are not based on these SMAs.

For the confirmation on the entry, ideally you want a bullish cross on the SMAs, as well as the color of the SMA to correlate to the buy/sell color.

RSI Chart Bars 8 55 45Dear Traders

This RSI 8 period made for perfect entry for Long and Short for Intraday/Scalping in any time frame, when RSI 8 crossed above 55 the Candle charged to White then you can go for Long/Buy and when crossed below 45 the Candle changed to Yellow so you can go for Short/Sell, it working in any time frame.

Thanks & Regards

Nesan

CCI & EMA_CROSS_PaydarCCI & EMA_CROSS_Paydar

Hello everyone

This indicator is actually a very efficient oscillator,

This system is a unique combination of indicators CCI and EMA, which of course has special settings, these settings are adjusted as much as possible due to signaling.

As you can see in the picture:

CCI: the two colors line, green and red, are actually the same indicator CCI that I set to 20.

*Note that in index CCI I have set the lines +100 and -100 to +75 and -75 for less error and a stronger signal to sell or buy.

EMA: The white line, which is in the form of steps, is in fact the same indicator of EMA, which I have considered as a value of 9.

_________________________________________________________________________________________________________

Instructions

-> areas:

Zone +75 to +200 = positive range or incremental price or bullish

Zone +75 to -75 = Neutral range or almost constant price (no fluctuations or very wet fluctuations)

Zone -75 to -200 = single range or discount price or bearish

->How to use:

Buy = In the bearish range, if line CCI intersects line EMA upwards and goes to the neutral zone.

None = if the index (or index lines) collide in the neutral zone

Sell = In the bullish range, if line CCI intersects line EMA down and goes to the neutral zone.

-> Please comment on this system or if you have a good experience in changing the values of the indicators or it seems to you, please share.

With great respect to:

Who had published the main idea of this system.

Pink panther It is a simple indicator, you can use it with all time frames. So the pink line present the last high potential area that price try to breakout , and to use it you must consider three main things :

1- price on your time frame above Ichimoku cloud.

2- RSI above 50.

3- MACD crossover.

how to execute your order?

when price break the pink line and close 1 minute candle .

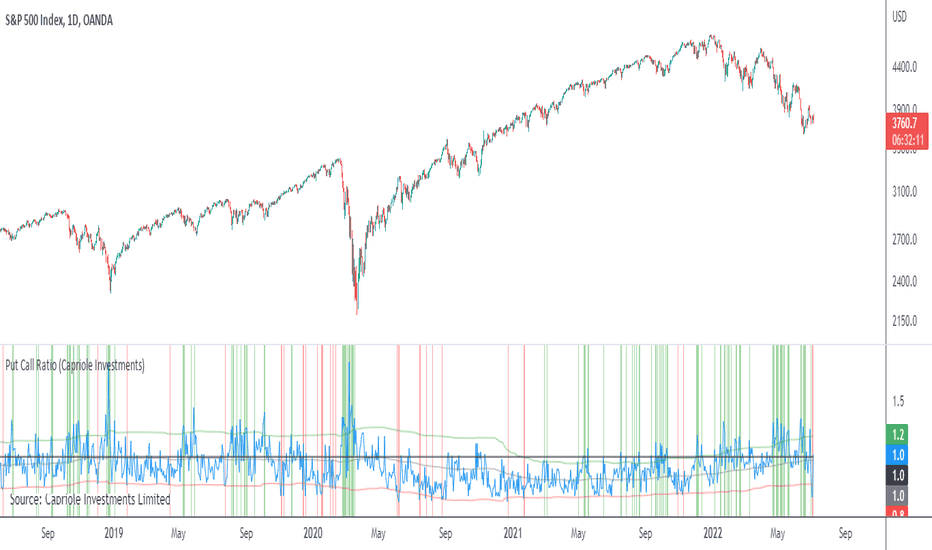

Put Call RatioPlots the CBOE Put Call Ratio and marks up locations of extremities.

Useful as a factor of confluence in identifying extremities in the market.

Scalpin 30Pips

Indicator signs

-Buying or selling signal on screen

-RSI in overbought or oversold

-Stoch overbought or oversold

"Risk adjustment"

The expected profit is 30pips positive. Adjust risk by 30pips

indicator consisting of

Stoch 14, 6, 6

Rsi 14

Dmi 20, 5

Follow Line IndicatorThe FollowLine indicator is a trend following indicator. The blue/red lines are activated when the price closes above the upper Bollinger band or below the lower one.

Once the trigger of the trend direction is made, the FollowLine will be placed at High or Low (depending of the trend).

An ATR filter can be selected to place the line at a more distance level than the normal mode settled at candles Highs/Lows.

Alerts Added

RSI Buy & Sell IndicatorColor coded RSI indicator showing green columns during a BUY opportunity and red columns during a SELL opportunity

Trend TrailingAndrew Abraham

It can be used as:

- stop loss indicator

- indicator of support and resistance

- buy and sell signals

Simple Reversal PointThis indicator finds possible points of reversion, you can use it to stack positions and get a good average price for when the price changes direction, it is the trader responsibility to manage the position and make a profit.

-Added alerts

Normalized Smoothed MACDMACD normalized with its highest and lowest values over the last “Normalization period”

- includes alerts

KDJ Indicator The KDJ indicator is derived from the Stochastic with the one difference being the addition of the J line. This implies that the KDJ indicator has a total of three lines; %K%D%J. The %J is simply put, the difference between the %K and the %D lines, which is similar to the MACD.

The difference between the %J and that of the MACD is that it is plotted as a histogram and the second being that the value are weighted and as such delivers more emphasis on the shorter term %K line.

What we now have is a line that moves quite slowly and has the knack to move beyond the range of a normal stochastic indicator.

Market ModeThe Market Mode indicator seeks to identify trends and rebounds by identifying “phases” according to the principles of John Ehlers.

- When the oscillator passes above the top line, the market is in an uptrend.

- When the oscillator goes below the bottom line, the market is in a downtrend.

- Between these two levels, the market is calmer and could rebound in the direction of the initial trend and / or phase of trend change.

Quadratic SemaphoreThe quadratic semaphore indicator is an indicator that find confirmed market u-turn with the help of 2 quadratic regression calculated with Highs and Lows over the last “length” periods.

- “p” setting is candlesticks quantity to confirmed the quadratic regression has formed a High or Low parabola, such as Fractals. Consecutive same signals can happen due to the use of different price values for upper and lower semaphore.

- Adjust the settings to your instrument and time frame.

- Alerts included.

Success with your trade¡¡

Long Tail Candle by Oliver VelezThis script detects an event created by Oliver Velez, it is a wide-range candle with a small body and a long tail (hammer-type candle), its range is noticeably larger than previous candles, as a rule it can be taken that the body should be maximum of 30% of the total range of the candle with a long tail. The stop goes under the tail and the signal is given when the next candle followed by the long tail candle exceeds its body, do not program this condition so that the alert indicates that a long tail candle was generated and the trader has some Time to visualize the graph and wait for the signal.

The default configuration is very basic, each trader must adjust to their needs.

- Trend filters can be activated.

- Alerts available.

Thumbs up

Dynamic RSIThe Dynamic RSI indicator is a kind of exponential RSI. The overbought and oversold levels (respectively HiLine and LoLine) are calculated according to the recent highest and lowest values of the Dynamic RSI line.

TMMS OscillatorThe TMMS oscillator (aka “Trading Made More Simpler”) is an indicator made of conditions based on both 2 separated Stochastic and 1 RSI.

Bullish zone is green and bearish one is red. When the histogram is grey, no signals is available at that time.

The indicator has an option to show the current trend of an Hull moving average (ascending or descending curve). When the trend is up, green dots are plotted on the zero line. When the trend is down, the dots are coloured in red.

Greetings, success with your trade!!!