BankNifty_Bullish_Intraday

The script uses following mechanism to give a signal of BUY if multiple parameters evaluated are all passed.

ENTRY-

1. 5 min MACD should be more than its previous tick

2. 15 min MACD should be more than its previous tick

3. 60 min MACD should be more than its previous tick

4. ADX should be more than 12

5. RSI should be more than 60

6. Stochastic %k should have cross over with %d

7. Bollinger band upper band value should be more than previous tick

EXIT

If the 5 min bar price closes below 5 min EMA , it gives an exit signal.

Multitimeframe

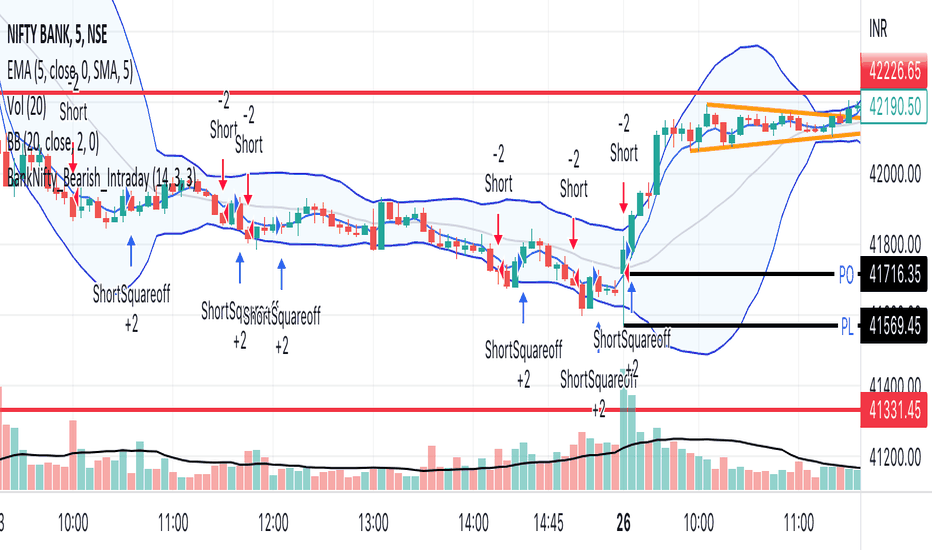

BankNifty_Bearish_Intraday

The script uses following mechanism to give a signal of SELL if multiple parameters evaluated are all passed.

ENTRY-

1. 5 min MACD should be less than its previous tick

2. 15 min MACD should be less than its previous tick

3. 60 min MACD should be less than its previous tick

4. ADX should be more than 12

5. RSI should be less than 40

6. Stochastic %k should have negative cross over with %d

7. Bollinger band lower band value should be less than previous tick

EXIT

If the 5 min bar price closes above 5 min EMA , it gives an exit signal.

rt maax EMA cross strategythis just sample of our strategies we published with open source, to learning our investor the way of trading and analysis, this strategy just for study and learning

in this strategy we use expontial moving avarage 20 , 50 , 200 and the we build this strategy when the price move up ema 200 and ema 20,50 cross up the 200 ema in this conditions the strargey will open long postion

and the oppisit it is true for short postion in this sitation the price should be under ema 200 and the ema 20 , 50 should cross under 200 ema then the strategy will open the short postion

we try this strategy on forex ,crypto and futures and it give us very good result ,, also we try this postion on multi time frame we find the stragey give us good result on 1 hour time frame .

in the end our advice for you before you use any stratgy you should have the knowledg of the indecators how it is work and also you should have information about the market you trade and the last news for this market beacuse it effect so much on the price moving .

so we hope this strategy give you brefing of the way we work and build our strategy

SuperTrend Multi Time Frame Long and Short Trading Strategy

Hello All

This is non-repainting Supertrend Multi Time Frame script, I got so many request on Supertrend with Multi Time Frame. This is for all of them ..I am making it open for all so you can change its coding according to your need.

How the Basic Indicator works

SuperTrend is one of the most common ATR based trailing stop indicators.

In this version you can change the ATR calculation method from the settings. Default method is RMA.

The indicator is easy to use and gives an accurate reading about an ongoing trend. It is constructed with two parameters, namely period and multiplier. The default values used while constructing a Supertrend indicator are 10 for average true range or trading period and three for its multiplier.

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility .

The buy and sell signals are generated when the indicator starts plotting either on top of the closing price or below the closing price. A buy signal is generated when the ‘Supertrend’ closes above the price and a sell signal is generated when it closes below the closing price.

It also suggests that the trend is shifting from descending mode to ascending mode. Contrary to this, when a ‘Supertrend’ closes above the price, it generates a sell signal as the colour of the indicator changes into red.

A ‘Supertrend’ indicator can be used on spot, futures, options or forex, or even crypto markets and also on daily, weekly and hourly charts as well, but generally, it fails in a sideways-moving market.

How the Strategy works

This is developed based on SuperTrend.

Use two time frame for confirm all entry signals.

Two time frame SuperTrend works as Trailing stop for both long and short positions.

More securely execute orders, because it is wait until confine two time frames(example : daily and 30min)

Each time frame developed as customisable for user to any timeframe.

User can choose trading position side from Long, Short, and Both.

Custom Stop Loss level, user can enter Stop Loss percentage based on timeframe using.

Multiple Take Profit levels with customisable TP price percentage and position size.

Back-testing with custom time frame.

This strategy is develop for specially for automation purpose.

The strategy includes:

Entry for Long and Short.

Take Profit.

Stop Loss.

Trailing Stop Loss.

Position Size.

Exit Signal.

Risk Management Feature.

Backtesting.

Trading Alerts.

Use the strategy with alerts

This strategy is alert-ready. All you have to do is:

Go on a pair you would like to trade

Create an alert

Select the strategy as a Trigger

Wait for new orders to be sent to you

This is develop for specially for automating trading on any exchange, if you need to get that automating service for this strategy or any Tradingview strategy or indicator please contact me I am have 8 year experience on that field.

I hope you enjoy it!

Thanks,

Ranga

Triple RSI strategyThis strategy is commonly used both in forex and stock markets for reversal trading. when the rsi line reaches and crosses simultaneously at 3 rsi setups i.e at 7, 14, and 21, a signal is generated.

This strategy works best in 1-hour timeframe. It provides over 60 to 80 percent accuracy in 1-hour timeframe.

In the stock market, this strategy provides an excellent entry point, if one is seeking small profits.

One can expect to make around 10 to 50 pips in the forex market easily. However, I advise seeking support from price action from the lower timeframe in the forex market.

I hope you like it.

Follow for more strategies and scripts like this.

R19 STRATEGYHello again.

Let me introduce you R19 Strategy I wrote for mostly BTC long/short signals

This is an upgrated version of STRATEGY R18 F BTC strategy.

I checked this strategy on different timeframes and different assest and found it very usefull for BTC 1 Hour and 5 minutes chart.

Strategy is basically takes BTC/USDT as a main indicator, so you can apply this strategy to all cryptocurrencies as they mostly acts accordingly with BTC itself (Of course you can change main indicator to different assets if you think that there is a positive corelation with. i.e. for BTC signals you can sellect DXY index for main indicator to act for BTC long/short signals)

Default variables of the inticator is calibrated to BTC/USDT 5 minute chart. I gained above %77 success.

Strategy simply uses, ADX, MACD, SMA, Fibo, RSI combination and opens positions accordingly. Timeframe variable is very important that, strategy decides according the timeframe you've sellected but acts within the timeframe in the chart. For example, if you're on the 5 minutes chart, but you've selected 1 hour for the time frame variable, strategy looks for 1 hour MACD crossover for opening a position, but this happens in 5 minutes candle, It acts quickly and opens the position.

Strategy also uses a trailing stop loss feature. You can determine max stoploss, at which point trailing starts and at which distance trailing follows. The green and red lines will show your stoploss levels according to the position strategy enters (green for long, red for short stop loss levels). When price exceeds to the certaing levels of success, stop loss goes with the profitable price (this means, when strategy opens a position, you can put your stop loss to the green/red line in actual trading)

You can fine tune strategy to all assets.

Please write down your comments if you get more successfull about different time zones and different assets. And please tell me your fine tuning levels of this strategy as well.

See you all.

Swing Failure Reversal StrategyThis strategy is using Swing Failure Patterns as a reversion indicator.

The strategy automatically adapts itself to the timeframe of the current chart.

Swing Failure Pattern occurs when the price trend fails to set new highs in uptrend or meet new lows in a downtrend. This pattern helps traders decide when to enter and exit the market. Usually, traders enter in the downtrend i.e. lower price highs and lower price lows, and exit in the uptrend situation i.e. higher price highs and higher price lows. Thus, traders go against the current trend. This helps the traders take advantage of early trend reversal indicators.

Types of Failure Swing :

Failure Swing Top: This occurs when the stock price goes higher whereas the RSI fails to make a higher high and falls below the recent fail point. The Fail Point is where the RSI line is below the recent swing low. This Failure Swing indicates a short position.

Failure Swing Bottom: This occurs when the stock price gets lower whereas RSI fails to make a lower low and rises over the recent fail point. Fail point is the point where the RSI line is above the recent swing high. This Failure Swing indicates a long position.

Customizable OCC Non Repainting Scalper Bot v7.0bThis strategy is intended to be used on an automated trading platform and should be run on a one minute chart for fastest confirmations and signal relay to crypto automation platform. The strategy has been modded to only go long at this time to focus on profitability for one direction. The open long and close long text fields allow you to use your own webhook message for this purpose.

I have spent quite a bit of time and I figured I would put it out to the community to share the work and also get some feedback.

Ok, so let me say that I have done absolutely everything I can to make the strategy not repaint while still maintaining it's profitability. It has been a challenge so I am publishing this to the community to help test this.

What I have observed: the strategy will not repaint in real time. That is, if you have the chart open and keep it open, the signals are the same as the ones that are sent out by the strategy. In certain cases, when I reload the chart- the signals might be off from what was sent. In some ways, that is repainting, but it is repainting based on losing the real time data and recalculating from a different set of bars- since I am running it on a one minute chart then the start becomes different when you refresh.

To address repainting while keeping the strategy calculating as quickly as possibly I have altered the logic in the following ways:

I have made an assumption which might not work for everyone- at the first tick of the next bar, you can almost safefly assume in crypto that if you are looking at the previous bar for information, the open of the current bar was the close of the previous bar. This for the most part holds true in crypto with good liquidity. If you are trading a pair that jumps around due to low volume- this might not be the strategy to use. I might publish a different version with a different logic.

I have altered the security repaint to use isbarconfirmed, so at the very end of the bar (as soon as the bar is confirmed), we recalculate to the higher time frames. So as soon as the data is available, it is at that point that we can then safely calculate higher time frames. This is unique and experimental, but seems to do well at creating good signals for entry.

I have employed my own intervals by utilizing the resolution as an integer (used by the previous authors)- but in this case, I use the interval to take a snapshot of the higher time frame. With open close cross, the different moving averages can cause the repainting as they change to show the exact point of the cross. The interval feature I created minimizes this by utilizing the previous bar info until the interval is closed and then we recalculate the variants. You can use the interval offset feature to denote which minute is the one that starts and ends the interval. So for instance, Trading View uses minue 1 and minute 31 for 30 minute intervals. If you offset your 30 minute interval would start on minute 16 and do its calculations based on the last 30 minutes,

As with most of my scripts, I have started using filters and a "show data" feature that will give you the ability to see the values of indicators that you cannot plot in the overlay. This allows you to figure out how to filter losing trades or market conditions.

I have also added a trailing stop and created a fixed stop loss as seems to perform better than the original occ strategy. The original one seemed to repaint enough that it would close too quickly and not give the posiition enough time to become profitable. In certain cases where there was a large move, it would perform well, but for the most part the trades would not close profitably even though the backtest said that it did - probably due to the delay in execution and pinescript not having a confirmation on what the actual position price was.

This is still in beta mode, so please forward test first and use at your own risk.

If you spot repaint issues, please send me a message and try to explain the situation.

Booz StrategyBooz Backtesting : Booz Backtesting is a method for analyzing the performance of your current trading strategy . Booz Backtesting aims to help you generate results and evaluate risk and return without risking real capital.

The Booz Backtesting is the Booz Super Swing Indicator equivalent but gives you the ability to backtest data on different charts.

This is an Indicator created for the purpose of identifying trends in Multiple Markets, it is based on Moving Average Crossover and extra features.

Swing Trading: This function allows you to navigate the entire trend until it is not strong enough, so you can compare it with fixed parameters such as Take Profit and Stop Loss.

Take Profit and Stop Loss function: With this function you will be able to choose the most optimal parameters and see in real time the results in order to choose the best combination of parameters.

Leverage : We have this function for the futures markets where you can check which is the most appropriate leverage for your operation.

Trend Filter: allows you to take multiple entries in the same direction of the market.

If the market crosses below the 200 moving average, it will take only short entries.

If the market crosses above the 200 moving average, it will take only long entries.

Timeframes

Charting from 1 Hour, 4 Hour, Daily, Weekly, Weekly

Markets :Booz Backtesting can be tested in Cryptocurrency, Stocks and Futures markets.

Background Color : at a glance, you can see what cycle the market is in.

Green background : Shows that the market is in a bullish cycle.

Red background: Shows that the market is in a bearish cycle.

Parabolic SAR Heikin Ashi MTF Candle ScalperThis is scalper strategy designed around parabolic sar indicator, where as an input candle value it uses the heikinashi from a higher timeframe.

This example has been adapted to SPY/SPX chart

In this case ,we are using a 5 min chart, but the calculations are made on a 15 min heikin ashi chart for the PSAR and then on 5 min chart we plot the results.

At the same time we are conditioning the entry to be base on a time/session for daytrading/scalper mentality

In this case we only enter within the first 30 min of SPY opening session , and then we exit after 3-4 hours of staying in the position ( unless we hit a reverse condition).

For long condition we enter when the mtf ha candle close is above the mtf psar and for short condition we enter when the mtf ha candle close is below the mtf psar

This script is made with an educational purpose to show the power of multiple time frame approach compared to a single chart.

If you have any questions, let me know !

Take profit Multi timeframeRepublish:

Take profit Multi timeframe:

In this scipts, I build risk-reward system managemant. You can take profit in two way: percent or at resistant in higher timeframe or both.

Strategy in this scripts, I use Wave trend indicator as example strategy.

MTF RSI & STOCH Strategy by kziThis script is a teaml job with Indicator-Johns.

First he used my script, then i transform his code.

The origine:

The first transformation:

www.tradingview.com

Funny moment together, thanks for that. :)

This sharing is an indicator where you can see the average of different time frames.

The RSI is the blue line

The Stock is the yellow line

You can manage the timeframe in the parameters.

The strategy is to take position when the two lines get overbought or oversold and close when the stoch and RSI goes to the middle.

Strategy LinReg ST@RLStrategy LinReg ST@RL

Strategy LinReg ST@RL is a visual trend following indicator.

It is compiled in PINE Script Version V5 language.

This indicator/strategy, based on Linear Regression Calculation, is intended to help beginners (and also the more experienced ones) to trade in the right direction of the market trend and test strategy. It allows you to avoid the mistakes of always trading against the trend.

Strategy based on an original idea of @KivancOzbilgic (SuperTrend) and DevLucem (@LucemAnb) (Lin Reg ++)

A special credit goes to - KivancOzbilgic and @LucemAnb which inspired me a lot to improve this indicator/Strategy.

This indicator can be configured to your liking,according to your needs or your tastes.

The indicator/Strategy works in multi time frame.

The settings (length, offset, deviation, smoothing) are identical for all time frames if “Conf Auto” is not checked.

In this case the default settings (time frame=H1 settings) apply for all time frames.

The choice of source setting is common for all time frames.

If “Auto Conf” is checked,

then the settings will be optimized for each selected time frame (1m-3m H2 H3 H1 H4 & Daily). Time frames, other than 1m-3m H2 H3 H1 H4 & Daily will be affected with the default settings corresponding to the H1 time frame and will therefore not be optimized! The default setting values of each time frame (1m-3m H2 H3 H1 H4 & Daily) can be configured differently and optimized by you.

REVERSAL mode: Signal Buy=Sell and Signal Sell=Buy.

This option may be better than the regular strategy. Default mode is Reversal option.

Note that only for 1m (1 minute) Time frame, the option REVERSAL is opposite as default choice in configuration. (If reversal option is checked, then option for time frame 1m is not reversal!)

Trend indications (potential sell or buy areas) are displayed as a background color (bullish: green or bearish: red), assume that the market is moving in one direction.

You can tune the input, style and visibility settings to match your own preferences or habits.

Label Info (Simple or Full) gives trend info for each Exit (or current trade)

The choice of indicator colors is suitable for a graph with a "dark" theme, which you will probably need to modify for visual comfort, if you are using a "Light" mode or a custom mode.

This script is an indicator that you can run on standard chart types. It also works on non-standard chart types but the results will be skewed and different.

Non-standard charts are:

• Heikin Ashi (HA)

• Renko

• Kagi

• Point & Figure

• Range

As a reminder: No indicator is capable of providing accurate signals 100% of the time. Every now and then, even the best will fail, leaving you with a losing deal. Whichever indicator you base yourself on, remember to follow the basic rules of risk management and capital allocation.

BINANCE:BTCUSDT

! Français !

Strategy LinReg ST@RL

Stratégie LinReg ST@RL est un indicateur visuel de suivi de tendance.

Il est compilé en langage PINE Script Version V5.

Stratégie basée sur une idée originale de @KivancOzbilgic (SuperTrend) et DevLucem (@LucemAnb) (Lin Reg ++) Un crédit spécial va à - KivancOzbilgic et @LucemAnb qui m'ont beaucoup inspiré pour améliorer cet indicateur/stratégie.

Cet indicateur/strategie, basé sur le calcul de régression linéaire, est destiné à aider les débutants (et aussi les plus expérimentés) à trader dans le bon sens de la tendance du marché et à tester la stratégie. Cela vous permet d'éviter les erreurs de toujours négocier à contre-courant.

Cet indicateur peut être configuré à votre guise, selon vos besoins ou vos goûts.

L'indicateur/Stratégie fonctionne sur plusieurs bases de temps.

Les réglages (longueur, décalage, déviation, lissage) sont identiques pour toutes les bases de temps si

« Conf Auto » n'est pas coché. Dans ce cas, les paramètres par défaut (intervalle de temps=paramètres H1) s'appliquent à toutes les bases de temps.

Le choix du réglage de la source est commun à toutes les bases de temps.

Si "Auto Conf" est coché, alors les paramètres seront optimisés pour chaque base de temps sélectionnée (1m-3m H2 H3 H1 H4 & Daily). Les bases de temps, autres que 1m-3m H2 H3 H1 H4 & Daily seront affectées par les paramètres par défaut correspondant à la base de temps H1 et ne seront donc pas optimisées ! Les valeurs de réglage par défaut de chaque période (1m-3m H2 H3 H1 H4 & Daily) peuvent être configurées différemment et optimisées par vous.

Mode REVERSAL : Signal Achat=Vente et Signal Vente=Achat. Cette option peut être meilleure que la stratégie habituelle. Le mode par défaut est l'option REVERSAL.

Notez que seulement pour la base de temps de 1m (1 minute), l'option REVERSAL est l’opposée du choix par défaut dans la configuration. (Si l'option REVERSAL est cochée, alors l'option pour la base de temps 1 m n'est pas REVERSAL !)

Les indications de tendance (zones potentielles de vente ou d'achat) sont affichées en couleur de fond (haussier : vert ou baissier : rouge), supposons que le marché évolue dans une direction. Vous pouvez ajuster les paramètres d'entrée, de style et de visibilité en fonction de vos propres préférences ou habitudes.

Les informations sur l'étiquette (simples ou complètes) donnent des informations sur de chaque clôture (ou position en cours)

Le choix des couleurs des indicateurs est adapté à un graphique avec un thème "sombre", qu'il vous faudra probablement modifier pour le confort visuel, si vous utilisez un mode "Clair" ou un mode personnalisé.

Ce script est un indicateur que vous pouvez exécuter sur des types de graphiques standard. Cela fonctionne également sur les types de graphiques non standard, mais les résultats seront faussés et différents.

Les graphiques non standard sont :

• Heikin Ashi (HA)

• Renko

• Kagi

• Point & Figure

• Range

Pour rappel : Aucun indicateur n'est capable de fournir des signaux précis 100% du temps. De temps en temps, même les meilleurs échoueront, vous laissant avec une affaire perdante. Quel que soit l'indicateur sur lequel vous vous basez, rappelez-vous de suivre les règles de base de la gestion des risques et de l'allocation du capital.

Multi Supertrend with no-repaint HTF option strategyThis is the strategy version of the multi supertrend indicator.

The RoMDD looks good :)

Checked in ETHUSDT 1hour with auto HTF ON.

Have a look :)

wtfBUYorSELLffsMultiple timeframe Hull moving averages. 1 Hull period, 3 timeframes.

With Info Panel

This strategy is for any pair but the settings are tuned for DOGEUSDT

It is 3 Hull moving averages crossovers.

The first HMA is taken from the timeframe of the chart.

The second and third HMA's have a setting for TIMEFRAME.

For example the user can have the chart on 15m, 2nd HMA on 60m(1H), 3rd HMA on 240m(1H)

A info panel is on chart with the signal from each timeframe.

The binance (where DOGEUSDT can be traded) commission fee of 0.1% is added to the results.

Adjust the commission fee to suit your broker and pair.

Tuned for trading cryptocurrency Elon Musk has constantly been backing – dogecoin.

Multi-TimeFrame MAThere is a youtube channel which ı follow, He shared an educational video and ı want to share it with you.

You can also follow it in Youtube , its name is "Xmaxpro - Kriptocu"

You can see how to develop a multi-time-frame trading strategy and test this MA strategy.

MTF stochastic strategyThis strategy is based on MTF strategy found on Forex Factory forum and published by bobby2 (credits to him).

This is quite simple but need improvement to work properly:

1- it is made for 5 min chart

2- when 15min stochastic cross above 50 and 5min stochastic is rising, buy

3- when 15min stochastic cross below 50 and 5min stochastic is falling, sell