Simple Ultimate Oscillator█ OVERVIEW

This indicator as an educational and showcase the usage of user-defined types (UDT) or objects for Ultimate Oscillator.

█ CREDITS

TradingView

█ FEATURES

1. Color of plot is based on contrast color of chart background.

2. Plot fill of overbought and oversold.

3. Support Multi Timeframe.

Ultimate Oscillator (UO)

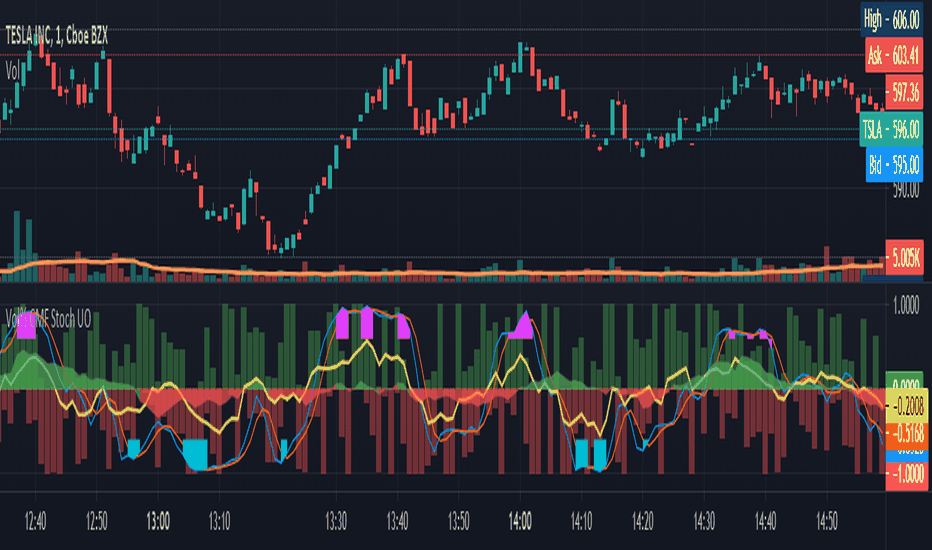

UFO + Realtime Divergences (UO x MFI)UFO + Realtime Divergences (UO x MFI) + Alerts

The UFO is a hybrid of two powerful oscillators - the Ultimate Oscillator (UO) and the Money Flow Index (MFI)

Features of the UFO include:

- Optional divergence lines drawn directly onto the oscillator in realtime.

- Configurable alerts to notify you when divergences occur, as well as centerline crossovers.

- Configurable lookback periods to fine tune the divergences drawn in order to suit different trading styles and timeframes.

- Background colouring option to indicate when the oscillator has crossed its centerline.

- Alternate timeframe feature allows you to configure the oscillator to use data from a different timeframe than the chart it is loaded on.

- 2x MTF triple-timeframe Stochastic RSI overbought and oversold confluence signals painted at the top of the panel for use as a confluence for reversal entry trades.

The core calculations of the UFO+ combine the factory settings of the Ultimate Oscillator and Money Flow Index, taking an average of their combined values for its output eg:

UO_Value + MFI_Value / 2

The result is a powerful oscillator capable of detecting high quality divergences, including on very low timeframes and highly volatile markets, it benefits from the higher weighting of the most recent price action provided by the Ultimate Oscillators calculations, as well as the calculation of the MFI, which incorporates volume data. The UFO and its incorporated 2x triple-timeframe MTF Stoch RSI overbought and oversold signals makes it well adapted for low timeframe scalping and regular divergence trades in particular.

The Ultimate Oscillator (UO)

Tradingview describes the Ultimate Oscillator as follows:

“The Ultimate Oscillator indicator (UO) is a technical analysis tool used to measure momentum across three varying timeframes. The problem with many momentum oscillators is that after a rapid advance or decline in price, they can form false divergence trading signals. For example, after a rapid rise in price, a bearish divergence signal may present itself, however price continues to rise. The Ultimate Oscillator attempts to correct this by using multiple timeframes in its calculation as opposed to just one timeframe which is what is used in most other momentum oscillators.”

You can read more about the UO and its calculations here

The Money Flow Index ( MFI )

Investopedia describes the True Strength Indicator as follows:

“The Money Flow Index ( MFI ) is a technical oscillator that uses price and volume data for identifying overbought or oversold signals in an asset. It can also be used to spot divergences which warn of a trend change in price. The oscillator moves between 0 and 100. Unlike conventional oscillators such as the Relative Strength Index ( RSI ), the Money Flow Index incorporates both price and volume data, as opposed to just price. For this reason, some analysts call MFI the volume-weighted RSI .”

You can read more about the MFI and its calculations here

The Stochastic RSI (relating to the built-in MTF Stoch RSI feature)

The popular oscillator has been described as follows:

“The Stochastic RSI is an indicator used in technical analysis that ranges between zero and one (or zero and 100 on some charting platforms) and is created by applying the Stochastic oscillator formula to a set of relative strength index ( RSI ) values rather than to standard price data. Using RSI values within the Stochastic formula gives traders an idea of whether the current RSI value is overbought or oversold. The Stochastic RSI oscillator was developed to take advantage of both momentum indicators in order to create a more sensitive indicator that is attuned to a specific security's historical performance rather than a generalized analysis of price change.”

You can read more about the Stochastic RSI and its calculations here

How do traders use overbought and oversold levels in their trading?

The oversold level, that is when the Stochastic RSI is above the 80 level is typically interpreted as being 'overbought', and below the 20 level is typically considered 'oversold'. Traders will often use the Stochastic RSI at an overbought level as a confluence for entry into a short position, and the Stochastic RSI at an oversold level as a confluence for an entry into a long position. These levels do not mean that price will necessarily reverse at those levels in a reliable way, however. This is why this version of the Stoch RSI employs the triple timeframe overbought and oversold confluence, in an attempt to add a more confluence and reliability to this usage of the Stoch RSI .

What are divergences?

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

There are 4 main types of divergence, which are split into 2 categories;

regular divergences and hidden divergences. Regular divergences indicate possible trend reversals, and hidden divergences indicate possible trend continuation.

Regular bullish divergence: An indication of a potential trend reversal, from the current downtrend, to an uptrend.

Regular bearish divergence: An indication of a potential trend reversal, from the current uptrend, to a downtrend.

Hidden bullish divergence: An indication of a potential uptrend continuation.

Hidden bearish divergence: An indication of a potential downtrend continuation.

How do traders use divergences in their trading?

A divergence is considered a leading indicator in technical analysis , meaning it has the ability to indicate a potential price move in the short term future.

Hidden bullish and hidden bearish divergences, which indicate a potential continuation of the current trend are sometimes considered a good place for traders to begin, since trend continuation occurs more frequently than reversals, or trend changes.

When trading regular bullish divergences and regular bearish divergences, which are indications of a trend reversal, the probability of it doing so may increase when these occur at a strong support or resistance level . A common mistake new traders make is to get into a regular divergence trade too early, assuming it will immediately reverse, but these can continue to form for some time before the trend eventually changes, by using forms of support or resistance as an added confluence, such as when price reaches a moving average, the success rate when trading these patterns may increase.

Typically, traders will manually draw lines across the swing highs and swing lows of both the price chart and the oscillator to see whether they appear to present a divergence, this indicator will draw them for you, quickly and clearly, and can notify you when they occur.

Setting alerts.

With this indicator you can set alerts to notify you when any/all of the above types of divergences occur, on any chart timeframe you choose.

Configurable pivot period.

You can adjust the default pivot lookback values to suit your prefered trading style and timeframe. If you like to trade a shorter time frame, lowering the default lookback values will make the divergences drawn more sensitive to short term price action.

Disclaimer: This script includes code from the stock UO and MFI by Tradingview as well as the Divergence for Many Indicators v4 by LonesomeTheBlue.

Ultimate Oscillator + Realtime DivergencesUltimate Oscillator (UO) + Realtime Divergences + Alerts + Lookback periods.

This version of the Ultimate Oscillator adds the following 5 additional features to the stock UO by Tradingview:

- Optional divergence lines drawn directly onto the oscillator in realtime

- Configurable alerts to notify you when divergences occur, as well as centerline crossovers.

- Configurable lookback periods to fine tune the divergences drawn in order to suit different trading styles and timeframes.

- Background colouring option to indicate when the UO has crossed the centerline, or optionally when both the UO and an external oscillator, which can be linked via the settings, have both crossed their centerlines.

- Alternate timeframe feature allows you to configure the oscillator to use data from a different timeframe than the chart it is loaded on.

This indicator adds additional features onto the stock Ultimate Oscillator by Tradingview, whose core calculations remain unchanged. Namely the configurable option to automatically and clearly draw divergence lines onto the oscillator for you as they occur in realtime. It also has the addition of unique alerts, so you can be notified as divergences occur without spending all day watching the charts. Furthermore, this version of the Ultimate Oscillator comes with configurable lookback periods, which can be configured in order to adjust the length of the divergences, in order to suit shorter or higher timeframe trading approaches.

The Ultimate Oscillator

Tradingview describes the Ultimate Oscillator as follows:

“The Ultimate Oscillator indicator (UO) indicator is a technical analysis tool used to measure momentum across three varying timeframes. The problem with many momentum oscillators is that after a rapid advance or decline in price, they can form false divergence trading signals. For example, after a rapid rise in price, a bearish divergence signal may present itself, however price continues to rise. The ultimate Oscillator attempts to correct this by using multiple timeframes in its calculation as opposed to just one timeframe which is what is used in most other momentum oscillators.”

More information on the history, use cases and calculations of the Ultimate Oscillator can be found here: www.tradingview.com

What are divergences?

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

There are 4 main types of divergence, which are split into 2 categories;

regular divergences and hidden divergences. Regular divergences indicate possible trend reversals, and hidden divergences indicate possible trend continuation.

Regular bullish divergence: An indication of a potential trend reversal, from the current downtrend, to an uptrend.

Regular bearish divergence: An indication of a potential trend reversal, from the current uptrend, to a downtrend.

Hidden bullish divergence: An indication of a potential uptrend continuation.

Hidden bearish divergence: An indication of a potential downtrend continuation.

Setting alerts.

With this indicator you can set alerts to notify you when any/all of the above types of divergences occur, on any chart timeframe you choose.

Configurable lookback values.

You can adjust the default lookback values to suit your prefered trading style and timeframe. If you like to trade a shorter time frame, lowering the default lookback values will make the divergences drawn more sensitive to short term price action.

How do traders use divergences in their trading?

A divergence is considered a leading indicator in technical analysis , meaning it has the ability to indicate a potential price move in the short term future.

Hidden bullish and hidden bearish divergences, which indicate a potential continuation of the current trend are sometimes considered a good place for traders to begin, since trend continuation occurs more frequently than reversals, or trend changes.

When trading regular bullish divergences and regular bearish divergences, which are indications of a trend reversal, the probability of it doing so may increase when these occur at a strong support or resistance level . A common mistake new traders make is to get into a regular divergence trade too early, assuming it will immediately reverse, but these can continue to form for some time before the trend eventually changes, by using forms of support or resistance as an added confluence, such as when price reaches a moving average, the success rate when trading these patterns may increase.

Typically, traders will manually draw lines across the swing highs and swing lows of both the price chart and the oscillator to see whether they appear to present a divergence, this indicator will draw them for you, quickly and clearly, and can notify you when they occur.

Disclaimer: This script includes code from the stock UO by Tradingview as well as the Divergence for Many Indicators v4 by LonesomeTheBlue.

Ultimate Oscillator + DivergencesUltimate Oscillator (UO) + Divergences + Alerts + Lookback periods.

This version of the Ultimate Oscillator adds the following 3 additional features to the stock UO by Tradingview:

- Optional divergence lines drawn directly onto the oscillator.

- Configurable alerts to notify you when divergences occur.

- Configurable lookback periods to fine tune the divergences drawn in order to suit different trading styles and timeframes.

This indicator adds additional features onto the stock Ultimate Oscillator by Tradingview, whose core calculations remain unchanged. Namely the configurable option to automatically, quickly and clearly draw divergence lines onto the oscillator for you as they occur, with minimal delay. It also has the addition of unique alerts, so you can be notified when divergences occur without spending all day watching the charts. Furthermore, this version of the Ultimate Oscillator comes with configurable lookback periods, which can be configured in order to adjust the sensitivity of the divergences, in order to suit shorter or higher timeframe trading approaches.

The Ultimate Oscillator

Tradingview describes the Ultimate Oscillator as follows:

“The Ultimate Oscillator indicator (UO) indicator is a technical analysis tool used to measure momentum across three varying timeframes. The problem with many momentum oscillators is that after a rapid advance or decline in price, they can form false divergence trading signals. For example, after a rapid rise in price, a bearish divergence signal may present itself, however price continues to rise. The ultimate Oscillator attempts to correct this by using multiple timeframes in its calculation as opposed to just one timeframe which is what is used in most other momentum oscillators.”

More information on the history, use cases and calculations of the Ultimate Oscillator can be found here: www.tradingview.com

What are divergences?

Divergence is when the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, or is moving contrary to other data. Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

There are 4 main types of divergence, which are split into 2 categories;

regular divergences and hidden divergences . Regular divergences indicate possible trend reversals, and hidden divergences indicate possible trend continuation.

Regular bullish divergence: An indication of a potential trend reversal, from the current downtrend, to an uptrend.

Regular bearish divergence: An indication of a potential trend reversal, from the current uptrend, to a downtrend.

Hidden bullish divergence: An indication of a potential uptrend continuation.

Hidden bearish divergence: An indication of a potential downtrend continuation.

Setting alerts.

With this indicator you can set alerts to notify you when any/all of the above types of divergences occur, on any chart timeframe you choose.

Configurable lookback values.

You can adjust the default lookback values to suit your prefered trading style and timeframe. If you like to trade a shorter time frame, lowering the default lookback values will make the divergences drawn more sensitive to short term price action.

How do traders use divergences in their trading?

A divergence is considered a leading indicator in technical analysis, meaning it has the ability to indicate a potential price move in the short term future.

Hidden bullish and hidden bearish divergences, which indicate a potential continuation of the current trend are sometimes considered a good place for traders to begin, since trend continuation occurs more frequently than reversals, or trend changes.

When trading regular bullish divergences and regular bearish divergences, which are indications of a trend reversal, the probability of it doing so may increase when these occur at a strong support or resistance level. A common mistake new traders make is to get into a regular divergence trade too early, assuming it will immediately reverse, but these can continue to form for some time before the trend eventually changes, by using forms of support or resistance as an added confluence, such as when price reaches a moving average, the success rate when trading these patterns may increase.

Typically, traders will manually draw lines across the swing highs and swing lows of both the price chart and the oscillator to see whether they appear to present a divergence, this indicator will draw them for you, quickly and clearly, and can notify you when they occur.

Disclaimer : This script includes code from the stock UO by Tradingview as well as the RSI divergence indicator.

Bogdan Ciocoiu - LitigatorDescription

The Litigator is an indicator that encapsulates the value delivered by the Relative Strength Index, Ultimate Oscillator, Stochastic and Money Flow Index algorithms to produce signals enabling users to enter positions in ideal market conditions. The Litigator integrates the value delivered by the above four algorithms into one script.

This indicator is handy when trading continuation/reversal divergence strategies in conjunction with price action.

Uniqueness

The Litigator's uniqueness stands from integrating the above algorithms into the same visual area and leveraging preconfigured parameters suitable for short term scalping (1-5 minutes).

In addition, the Litigator allows configuring the above four algorithms in such a way to coordinate signals by colour-coding or shape thickness to aid the user with identifying any emerging patterns quicker.

Furthermore, Moonshot's uniqueness is also reflected in the way it has standardised the outputs of each algorithm to look and feel the same, and in doing so, enabling users to plug them in/out as needed. This also includes ensuring the ratios of the shapes are similar (applicable to the same scale).

Open-source

The indicator uses the following open-source scripts/algorithms:

www.tradingview.com

www.tradingview.com

www.tradingview.com

www.tradingview.com

FTL - Range Filter X2 + EMA + UOThjs script combines two range filters, an EMA and the Ultimate oscillator.

This is an indicator type of script with alerts that is ideal for one minute scalping and was developed initially for NAS100 but has been used successfully with other symbols.

The two range filters are used to detect when the short and mid term trends are in the same direction.

The EMA indicates the longer term trend and the UO is used to determine if an asset is overbought or oversold.

This indicator pairs well with divergence indicators to add confluence to a change in direction.

Additional features of this indicator:

- Configure whether to show buy and sell labels only when asset is not overbought or oversold

- Select whether to show buys only when price is above the EMA , or sells only below the EMA

- Indicate a bar where a trend crosses the EMA and select if the crossover or cross under should be shown only in a counter trend.

- Pullbacks within a trend can be identified. This may indicate trend continuation.

- Alerts can be created for pullbacks, EMA crossing and for buy or sell signals

KINSKI Multi Trend OscillatorThe Multi Trend Oscillator is a tool that combines the ratings of several indicators to facilitate the search for profitable trades. I was inspired by the excellent indicator "Technical Ratings" from Team TradingView to create an alternative with a technically new approach. Therefore, it is not a modified copy of the original, but newly conceived and implemented.

The recommendations of the indicator are based on the calculated ratings from the different indicators included in it. The special thing here is that all settings for the individual indicators can be changed according to your own needs and displayed as a histogram and MA line. This provides an excellent visual control of your own settings. Alarms are also triggered.

Criteria for determining the rating

Relative Strength Index (RSI)

Buy - Crossover oversold level and indicator < oversold level and rising

Sell - Crossunder oversold level and indicator >= oversold level and falling

Neutral - neither Buy nor Sell

Relative Strength Index (RSI) Laguerre

Buy - Crossover Oversold Level and Indicator < Oversold Level and rising

Sell - Crossunder oversold level and indicator >= oversold level and falling

Neutral - neither Buy nor Sell

Noise free Relative Strength Index (RSX)

Buy - Crossover Oversold Level and Indicator < Oversold Level and rising

Sell - Crossunder oversold level and indicator >= oversold level and falling

Neutral - neither Buy nor Sell

Money Flow Index (MFI)

Buy - Crossover Oversold Level and Indicator < Oversold Level and rising

Sell - Crossunder oversold level and indicator >= oversold level and falling

Neutral - neither Buy nor Sell

Commodity Channel Index (CCI)

Buy - Crossover Oversold Level and Indicator < Oversold Level and rising

Sell - Crossunder oversold level and indicator >= oversold level and falling

Neutral - neither Buy nor Sell

Moving Average Convergence/Divergence (MACD)

Buy - values of the main line > values of the signal line and rising

Sell - values of the main line < values of the signal line and falling

Neutral - neither Buy nor Sell

Klinger

Buy - indicator >= 0 and rising

Sell - indicator < 0 and falling

Neutral - neither Buy nor Sell

Average Directional Index (ADX)

Buy - indicator > 20 and +DI line crosses over the -DI line and rising

Sell - indicator > 20 and +DI line crosses below the -DI line and falling

Neutral - neither Buy nor Sell

Awesome Oscillator

Buy - Crossover 0 and values are greater than 0, or exceed the zero line

Sell - Crossunder 0 and values are lower than 0, or fall below the zero line

Neutral - neither Buy nor Sell

Ultimate Oscillator

Buy - Crossover oversold level and indicator < oversold level and rising

Sell - Crossunder oversold level and indicator >= oversold level and falling

Neutral - neither Buy nor Sell

Williams Percent Range

Buy - Crossover Oversold Level and Indicator < Oversold Level and rising

Sell - Crossunder Oversold Level and Indicator >= Oversold Level and falling

Neutral - neither Buy nor Sell

Momentum

Buy - Crossover 0 and indicator levels rising

Sell - Crossunder 0 and indicator values falling

Neutral - neither Buy nor Sell

Total Ratings

The numerical value of the rating "Sell" is 0, "Neutral" is 0 and "Buy" is 1. The total rating is calculated as the average of the ratings of the individual indicators and are determined according to the following criteria:

MaxCount = 12 (depending on whether other oscillators are added).

CompareSellStrong = MaxCount * 0.3

CompareMid = MaxCount * 0.5

CompareBuyStrong = MaxCount * 0.7

value <= CompareSellStrong - Strong Sell

value < CompareMid and value > CompareSellStrong - Sell

value == 6 - Neutral

value > CompareMid and value < CompareBuyStrong - Buy

value >= CompareBuyStrong - Strong Buy

Understanding the results

The Multi Trend Oscillator is designed so that its values fluctuate between 0 and currently 12 (maximum number of integrated indicators). Its values are displayed as a histogram with green, red and gray bars. The bars are gray when the value of the indicator is at half of the number of indicators used, currently 12. Increasingly saturated green bars indicate increasing values above 6, and increasingly saturated red bars indicate increasingly decreasing values below 6.

The table at the end of the histogram shows details (can be activated in the settings) about the overall rating and the individual indicators. Its color is determined by the rating value: gray for neutral, green for buy or strong buy, red for sell or strong sell.

The following alarms are triggered:

Multi Trend Oscillator: Sell

Multi Trend Oscillator: Strong Sell

Multi Trend Oscillator: Buy

Multi Trend Oscillator: Strong Buy

3Commas TA Start Conditions Indicator v1.0Introduction

The indicator attempts to implement the "Technical Analysis Starting Conditions" found in the 3Commas DCA trading bot settings.

How is it original and useful and how does it compare to other scripts in the Public Library?

This indicator is unique in that it's the only one (as of the initial publications) that can handle 5 signal indicator types at the same time as well as output the signal values either to the chart or the data window. The indicator supports all of the following 3Commas built-in indicators on the 3 minute, 5 minute, 15 minute, 30 minute, 1 hour, 2 hour, and 4 hour time frames:

RSI-7

ULT-7-14-2

BB-20-1-LB (Long)

BB-20-2-LB (Long)

MFI-14 crosses 40 (Long)

MFI-14 crosses 20 (Long)

CCI-40 crosses -200 (Long)

BB-20-1-UB (Short)

BB-20-2-UB (Short)

MFI-14 crosses 65 (Short)

CCI-40 crosses 0 (Short)

CCI-40 crosses 100 (Short)

What does it do and how does it do it?

When applied to the chart for the first time, the default settings are completely blank, so the only chart element you will see is the "Start Condition Result" line in orange. Once you start applying settings in the "DEAL START CONDITION" section, the indicator will redraw and display the new values for the "Start Condition Result" line. A value of 1 indicates that the results of the condition(s) is "passing". Conversely, a value of 0 indicates that the results of the condition(s) is NOT passing. If you desire to dig deeper into why the indicator is producing the results, you can enable the "Show TA Indicator # Plot" to visually see the values on the price chart or simply open the Data Window panel to see their values as you hover over the candles in the price chart.

This indicator can be used with any indicator in the Public Library that seeks to emulate the 3Commas Technical Analysis Starting Conditions for a signal provider. For example, this indicator can be used our own 3Commas DCA Bot Strategy v1.0 to aid in your backtesting analysis and build confidence that your bot will perform given historical market data that TradingView provides. When you do so, make sure that the "Strategy" input has the same values with the two indicator settings.

Enjoy! 😊👍

How to obtain access to the script?

You have two choices:

Use the "Website" link below to obtain access to this indicator, or

Send us a private message (PM) in TradingView itself.

Crypto RSI Oscillator [marksc]This is my main indicator of pricing trend reversals.

It consists of two main indicators:

1. The green/red oscillator shows a general rising (green) or falling (red) price trend over a smoothed average of a number of periods (length).

2. The yellow "OverUnder Line" shows the Relative Strength Index adjusted price trend in real time.

How to use it:

- You will need to adjust the Overbought and Underbought (green and red) horizontal lines such that the yellow line rarely peaks past them. This will depend on historical data and the time-scale you're using. So if you configure it on a 15minute timescale and then switch to hourly the lines will need-readjusted. This is because the yellow line's movement is "Relative" to a number of periods of time in the timescale.

Predicting Pricing Reversals:

Adjust the Overbought and Underbought lines such that, in the past, the yellow line has rarely peaked over or under them.

When the yellow line peaks over or under one of the Over/Underbought lines again the price will likely make a strong reversal.

(Conversely, if the yellow line is not peaking but staying mostly flat or only slightly angled then the pricing trend is likely to continue.)

Predicting "Pump and Dumps":

If the price makes a sharp reversal while the yellow line was far from the over/underbought lines (ie. the yellow line was near the center), this indicates that a larger purchase or sale than has happened in a long time just happened. In most cases the price will quickly correct back to where it was because this sharp price reversal was was abnormal over the length*period used in the RSI calculation.

Vol Buy/Sell %s, CMF, and Stocahstic Osc & UOPlots % Buy / Sell Volume , Chaikin Money Flow , Stochastic Oscillator, and Ultimate Oscillator on same axis, bound -1 to 1.

Show Volume Percentage, displaying buying as green and positive, selling as red and negative.

Showing the CMF, with green / red fill for positive / negative values.

Modified Stochastic Oscillator, converting bounds to -1 and 1, moving overbought/sold to -0.6 and 0.6, accordingly. Green fill (buy signal) with %D below -0.6 and %K lower than %D. Red fill (sell signal) with %D above 0.6 and %K higher than %D. Fill is between %D and bound, to be more visible.

Modified Ultimate Oscillator, converting bounds to -1 and 1, moving overbought/sold to -0.6 and 0.6, accordingly.

Uber Strength OscillatorThis is my Uber Oscillator applied to RSI essentially. So its like an Ultimate Oscillator with more lengths added, but instead of MAs its RSIs. So its a multi-momentum index of sorts. Part of my efforts in realizing the amazing potential of using multiple lengths of an oscillator to get a bigger picture, while also recognizing that simply stacking them on top of eachother is so ugly and hard to read that it can easily result in mistakes if you arent super careful. So this is an attempt to make that clearer.

Uber Oscillator with DivergencesThis is a simple mod of the Uber Oscillator with more periods added to the mix and combined with a the Tradingview Divergence spotter.

Compare it to the standard Ultimate Oscillator and see the difference. Good to even overlay them even.

It basically just adds more detail. You won't always need it but sometimes it can catch big drops/peaks earlier then the standard AO while still retaining relative relaxedness during other periods.

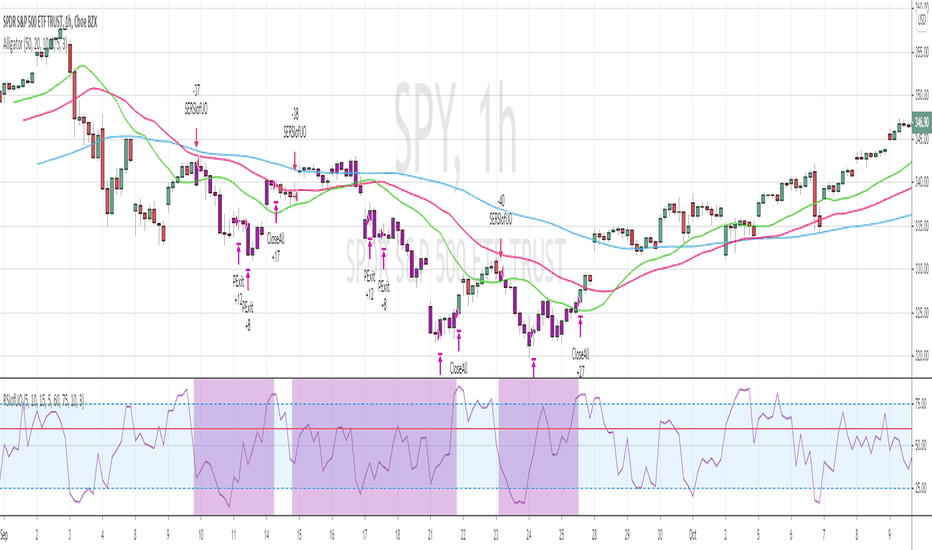

RSI of Ultimate Oscillator [SHORT Selling] StrategyThis is SHORT selling strategy with Ultimate Oscillator. Instead of drectly using the UO oscillator , I have used RSI on UO (as I did in my previous strategies )

Ultimator Oscillator settings are 5, 10 and 15

RSI of UO setting is 5

Short Sell

==========

I have used moving averages from WilliamAlligator indicator --- settings are 10(Lips), 20(teeth) and 50 (Jaw)

when Lips , Teeth and Jaw are aligned to downtrend (that means Lips < Teeth < Jaw )

Look for RSIofUO dropping below 60 ( setting parameter is Sell Line )

Partial Exit

==========

When RSIofUO crossing up Oversold line i.e 30

Cover Short / Exit

=================

When RSIofUO crosisng above overbought line i.e 70

StopLoss

========

StopLoss defaulted to 3 % , Though it is mentioned in settings , it has not been not used to calcuate and StopLoss Exit... Reason is, when RSIofUO already crossed 60 line (for SHORTING) , then it would take more efforts go up beynd 60. There is saying price takes stairs to climb up but it takes elevator to go down. I have not purely depend on this to exit stop loss, however noticed the trades in this stratgey did not get out with loss higher than when RSIofUO reaching 70 level.

Note

======

Williams Alligator is not drawn from the script. It is manually added to chart for illustration purpose. Please add it when you are using this strategy , whch woould give an idea how the strategy is taking Short Trades.

This is tested on Hourly chart for SPY

Bar color changes to purple when the strategy is in SHORT trade

Warning

========

For the eductional purposes only

UO StrategyStrategy is based on UO and its derivatives.

Quite fast to price changes and flexible to different time frames considering risk management.

I had many versions of UO strategy, but so far this one is the safest.

UO CrossThis particular UO Cross is evolved into far more flexible and visually intuitive oscillator than previous versions.

After thorough experiments with the code of indicator, I came to new deductions on how to use it properly for random TF and made it simpler.

How to read a chart using UOX:

Before uptrend takes place, we see the both indicator levels moving towards green dotted line (40).

When green UO index passes below 40, it's an alert that the market is about to interact to new demand levels, coloring it blue for a potential reversal.

Once green UO index is moving up and crossing above green dotted line - the second signal of uptrend established.

Another strong sign of uptrend is when green UO index passes above red UO index, coloring the space in between 2 indicators greenish.

At this point of time, we can be more confident that the general movement of the price is headed upwards, although we might see some small corrections there.

During uptrend Green UO index will fluctuate above red UO index.

Both indices will rise, getting closer and closer to red dotted line, which psychologically would be the first signs of the reversal of the uptrend.

When you see green UO index passing above red dotted line 60, coloring orangish, that's a serious alert for upcoming reversal.

I'll once more remind you that at this point of time both UO indices are at overbought levels, def above 50.

You know the situation is serious when you witness red UO index being very close to red dotted line!

To confirm the signals for downtrend, you must see green UO index go down and passing below red dotted line.

Second confirmation of downtrend is when green UO index crosses below red UO index, and colors the space in between indices red.

With this indicator we can understand:

Condition of the market

Early signs and alerts for reversal

Signals of entry

Confirmations of those signals

Visualized mass psychology behind domination of bulls / bears

It would be much better if you combine it with volume-based indicators.

Good luck!

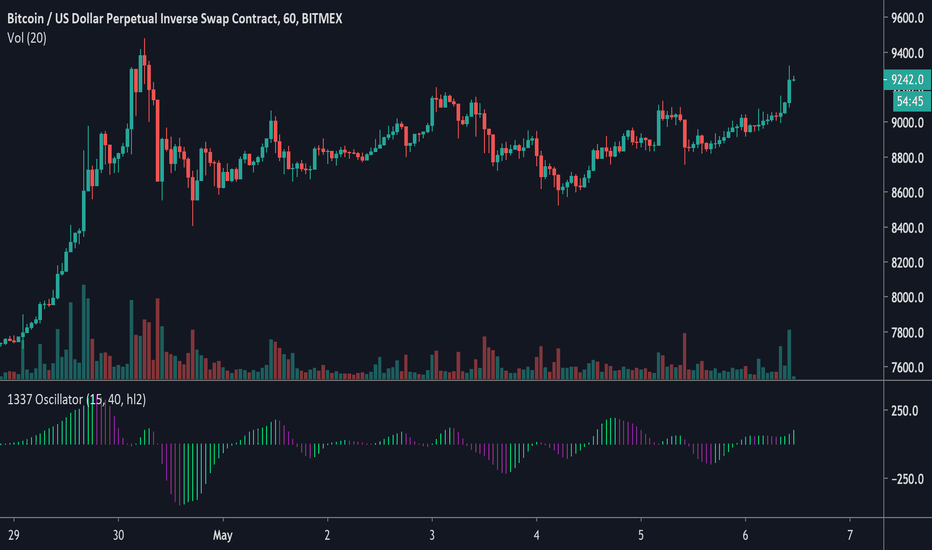

1337 StrategyThis is a WIP strategy based on the 1337 Oscillator. It seems to catch some of the nice trending moves on the 1H but needs work to filter the choppy signals after a move and during consolidation.

Triple Cross UOSensitivity to a price change:

Black UO > Green UO > Red UO

How to reach a chart using UO_3X indicator:

A trend can be considered as stable if Green UO crosses and stays above Red UO. Visually it will look like a green cloud.

During uptrend there is a tendency of Black UO to fluctuate above Green OU and especially above Red UO. Coloring it yellow.

First reversal signal of the uptrend would be if Black UO touches or crosses above Red Band.

Second reversal signal is when Black UO falls below Green UO.

As a result of second reversal signal, Green UO also declines and eventually crosses below Red UO which is the confirmation of upcoming general downtrend, coloring it red.

During a downtrend Black and Green UOs fluctuate below RED UO.

Once black UO crosses below Green Band, coloring it blue, the first signal of upcoming reversal of downtrend is established.

Second signal of reversal of downtrend would be is when Black UO crosses above Green and RED UOs.

Confirmation of uptrend would be if Green UO goes above Red UO coloring it Green.

1337 OscillatorThis script is inspired by the Awesome Oscillator by Bill Williams. The 1337 Oscillator uses a faster and more reactive hull moving average.

Signals could be from the 0 line crosses or rising/falling.

Cross UO v1This is my first script.

I use 2x UO's as a tool to identify the stability and overall condition of a trend.

The UO colored blue is more reactive to price change (candles) than red one, because it takes into account less candles.

The difference in rates of change is a mass mental condition of a market.

The combo might predict the reversals too.

How to read a chart using it?

We'd know the uptrend is stable when Blue UO fluctuates OVER Red UO.

As blue UO reaches red band - it's time for reversal.

To confirm the reversal of an uptrend - Blue UO must cross below Red UO.

During downtrend, the blue and red UOs are reaching green band which would indicate that market is oversold.

Once Blue UO touches green band and crosses above red UO - it's time for downtrend to reverse it's direction.

ck - Ultimate Oscillator & RSI Indicator v1Hi,

This is an indicator that combines the Ultimate Oscillator with RSI.

Currently it displays signals on the screen when the RSI crosses from low to high (to open and close a long) and vice versa for short signals.

Further signals will be developed for Ultimate Oscillator longs/shorts.

Stay tuned!

UO + RSITwo oscillators combined in one to protect each other. RSI and Ultimate Oscillator together shows better results in search of overbought and oversold zones.

Works better for scalping with crypto to USD(t) pairs and short time frames like 3-5-15 mins.