Overweight $XYZ ; Raising Price Target to $140+- BOATS:XYZ has been included to S&P 500 . It's a big news for BOATS:XYZ , this was one of the undervalued stock, treated like a dog but this company is always innovating and has strong talented employees.

- On top of that now BOATS:XYZ will get passive funds which is massive and bullish for

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.49 AUD

4.39 B AUD

36.57 B AUD

About Block, Inc.

Sector

CEO

Jack Patrick Dorsey

Website

Headquarters

Oakland

Founded

2021

ISIN

AU0000380420

FIGI

BBG013GPHLH6

Block, Inc. engages in creating ecosystems for distinct customer audiences. It operates through the Square and Cash App segments. The Square segment provides payment services, software solutions, hardware, and financial services to sellers. The Cash App segment includes the financial tools available to individuals within the mobile Cash App, including peer-to-peer payments, bitcoin and stock investments. It also includes Cash App Card, which is linked to customer stored balances that customers can use to pay for purchases or withdraw funds from an ATM. The company was founded by Jack Patrick Dorsey and James Morgan McKelvey in February 2009 and is headquartered in Oakland, CA.

Related stocks

Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout🧠 Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout 📈

WaverVanir VolanX Protocol | Long-Term Thesis | Smart Money Structure

🗓️ Chart as of July 19, 2025 | 1D Timeframe | DSS Score: High Conviction Long

📍 Technical Analysis – VolanX SMC Layer

Block Inc (SQ) is forming a macro reversal bas

A BNPL Bubble Is Actually Why I'm Bullish, For NowBNPL is growing and inflating at an increasing rate. From concert tickets to burritos, everyone is using buy now pay later. The global market is projected to hit 560 billion dollars in 2025, up from around 492 billion in 2024, and climb to 912 billion by 2030 at a compounding growth rate of 10.2%. J

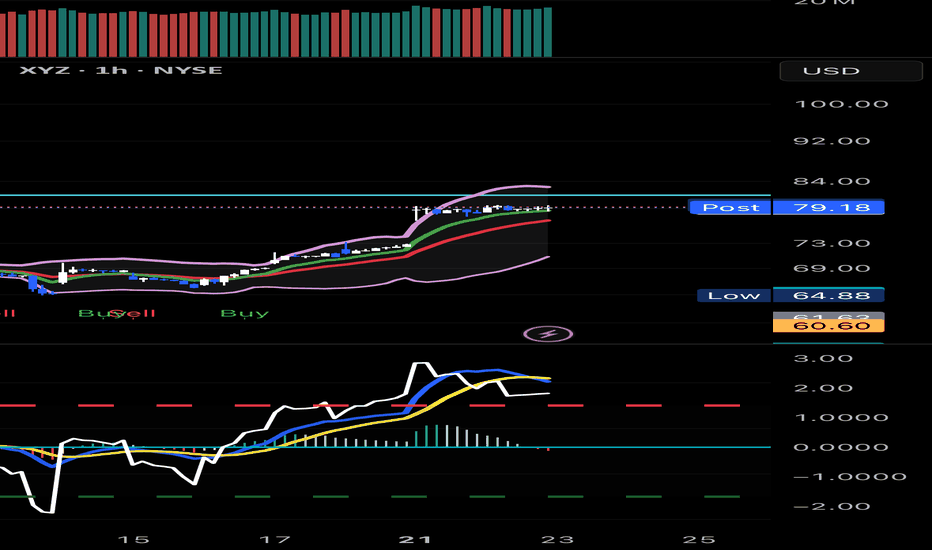

Block | XYZ | Long at $64.84Block's NYSE:XYZ revenue is anticipated to grow from $24 billion in FY2024 to $32 billion in FY2027. With a current price-to-earnings ratio of 13.8x, debt-to-equity ratio of 0.36x, and rising cash flow in the billions, it's a decent value stock at its current price. Understandably, there is some h

"Breakout Eagle: Soaring Past Resistance XYZ!"Breakout Eagle: Soaring Past Resistance!"

📝 Trade Breakdown:

🚀 Setup:

XYZ just blasted past a key resistance zone with strong bullish momentum. The breakout is confirmed with a clean retest on both the trendline and horizontal support — a textbook long setup!

📍 Entry: $65.84 (on breakout retest)

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SQ5307444

Block, Inc. 0.0% 01-MAY-2026Yield to maturity

5.39%

Maturity date

May 1, 2026

SQ5449301

Block, Inc. 2.75% 01-JUN-2026Yield to maturity

5.24%

Maturity date

Jun 1, 2026

SQ5449300

Block, Inc. 3.5% 01-JUN-2031Yield to maturity

5.22%

Maturity date

Jun 1, 2031

SQ5307445

Block, Inc. 0.25% 01-NOV-2027Yield to maturity

4.70%

Maturity date

Nov 1, 2027

See all XYZ bonds