ASX 200 Bulls Take the Reins as Trade Hopes BuildThe signal from last week’s bullish engulfing candle on ASX 200 SPI futures has proven reliable so far, with the price rocketing above 7900 on Monday, providing a platform to establish long positions around.

With optimism building over trade deals between the United States and major partners, inclu

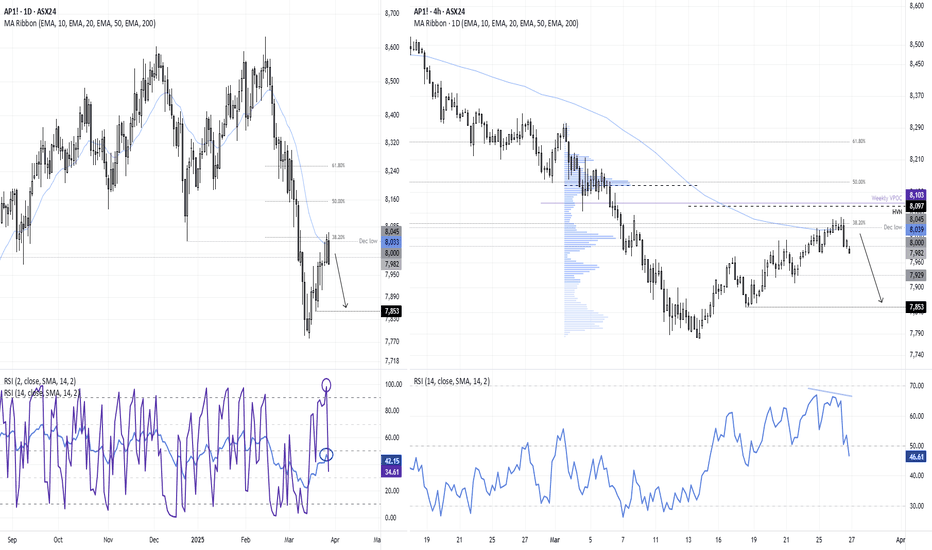

Momentum Turns Against the ASXThe rally of the past two week on the ASX took a turn for the worse on Wednesday, on the warning (and official announcement) of Trump's 25% tariff on non-US cars.

This has seen the ASX get caught in the negative sentiment on Wall Street.

The daily chart shows that momentum has turned lower aroun

ASX 200: Oversold Signals Flash, But Bulls Need ConfirmationASX 200 SPI futures are so oversold on the daily timeframe that you can’t help but notice, especially when looking back over recent years. The only time an RSI reading this low didn’t spark some form of bounce was during the height of the pandemic panic in early 2020.

But being oversold alone isn’t

ASX 200 futures (SPI 200) stablising around 8200The ASX 200 futures market has fallen close to 5% from its all-time high, with 5 of the 7 candles since the top being bearish. However, the daily RSI (2) reached oversold on Friday, a bullish pinbar formed on Monday and a small bullish divergence is now forming on the daily and 1-hour chart. The pin

Sellers in Control as 50DMA Rejection Reinforces Bearish BiasAustralian ASX 200 SPI futures were firmly rejected at the 50-day moving average earlier Friday, reinforcing the message that sellers remain in control following the bearish break of uptrend support flagged earlier this week.

With RSI (14) and MACD both firmly bearish, the near-term bias remains to

ASX 200 SPI Futures Test Key Support as RBA Decision LoomsWith disappointing earnings from major names like Westpac and BHP in recent days, and with more than three rate cuts priced for this year, ASX 200 SPI futures look vulnerable to downside heading into today’s RBA policy decision.

They’re now testing major uptrend support—a level that has attracted b

ASX 200: Why I don't trust today's 'record high'The ASX 200 reached a record high in today's session, but it's not a convincing record high in my books. If anything, it could signal yet another false break. Using the ASX cash and futures market alongside Wall Street indices, I delve into why we need to be on guard for another bull trap before the

ASX 200 SPI: Buying Dips Until the Price Action Says OtherwiseAustralian ASX 200 SPI futures remain a buy-on-dips play until the price action suggests otherwise, bouncing again off channel support on Tuesday, repeating the pattern seen numerous times over the past two months.

Even though momentum indicators don’t look great, with MACD rolling over while RSI (

ASX 200 Futures: Finding a Signal Amid the NoiseWe're sandwiched between an incoming NFP report and the turbulence from Trump's tariffs. That could provide a double dose of 'fickle' price action, which we tend to see leading up to big events such as nonfarm payrolls or Fed meetings. With that in mind, I update my bearish bias on ASX 200 futures,

ASX 200: Why I'm not banking on [an immediate] record highThe ASX 200 cash market is tantalisingly close to retesting its record high set in December. Traders are betting on an RBA cut in February (and 100bp of cuts this year) which is helping to support the market. Yet I doubt the ASX will simply break to a new high without a fresh catalyst. Comparing the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Related futures

Frequently Asked Questions

The current price of ASX SPI 200 Index Futures (May 2025) is 7,817 AUD — it has risen 0.026% in the past 24 hours. Watch ASX SPI 200 Index Futures (May 2025) price in more detail on the chart.

Track more important stats on the ASX SPI 200 Index Futures (May 2025) chart.

The nearest expiration date for ASX SPI 200 Index Futures (May 2025) is May 16, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell ASX SPI 200 Index Futures (May 2025) before May 16, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For ASX SPI 200 Index Futures (May 2025) this number is 78.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for ASX SPI 200 Index Futures (May 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for ASX SPI 200 Index Futures (May 2025). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of ASX SPI 200 Index Futures (May 2025) technicals for a more comprehensive analysis.