Boeing to $300 - Falling wedge** The year ahead **

On the above 6 day chart price action has corrected over 50% since December 2023. A number of reasons now favour a long position, they include:

1. Price action and RSI resistance breakouts.

2. Support on past resistance.

3. Double bottom on price action (yellow arrows)

4. Fall

Key facts today

Recent discussions between U.S. and Chinese officials may lead to potential purchases of Boeing planes as part of broader trade negotiations, focusing on tariffs and trade relations.

An investigation into the Jeju Air crash involving a Boeing 737-800 revealed the left engine was operational post-bird strike, while the right engine was damaged but functional.

−700 ARS

−10.82 T ARS

60.91 T ARS

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

ISIN

ARDEUT110061

FIGI

BBG000FSR2N2

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems. It operates through the following segments: Commercial Airplanes (BCA), Defense, Space and Security (BDS), Global Services (BGS), and Boeing Capital (BCC). The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems, global mobility, including tanker, rotorcraft and tilt-rotor aircraft, and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The Boeing Capital segment seeks to ensure that Boeing customers have the financing they need to buy and take delivery of their Boeing product and manages overall financing exposure. The company was founded by William Edward Boeing on July 15, 1916 and is headquartered in Arlington, VA.

Related stocks

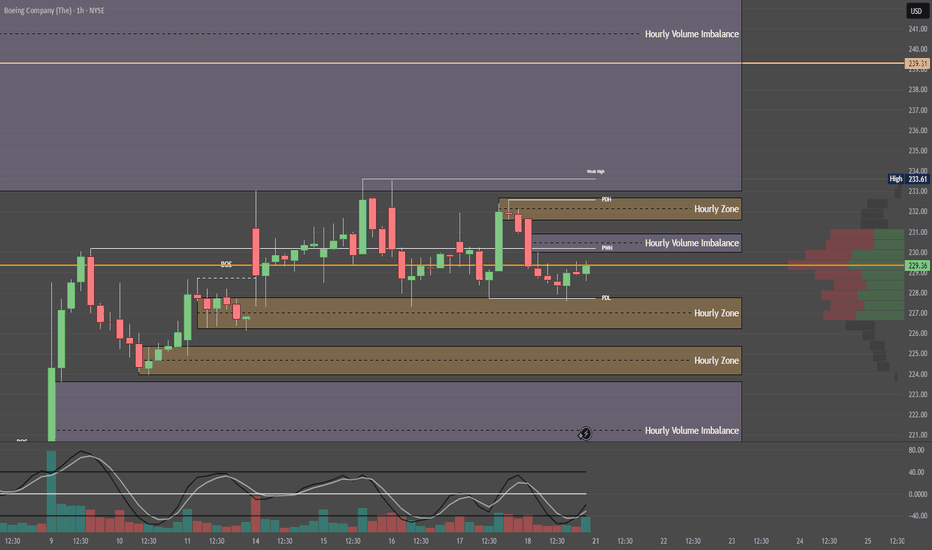

Long Opportunity: Boeing Could Take Flight Next WeekCurrent Price: $226.84

Direction: LONG

Targets:

- T1 = $233.00

- T2 = $238.00

Stop Levels:

- S1 = $223.00

- S2 = $218.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to i

Quantum's BA Weekly Outlook 7/19/25🚀 G.O.D. Flow Certified Trade Blueprint – Boeing (BA)

1. 🧩 Summary Overview

Ticker: BA

Current Price: $229.34

Trade Type: Day Trade / 0–2 Day Swing

System: G.O.D. Flow (Gamma, Orderflow, Dealer Positioning)

2. 🔬 Flow Breakdown

🔵 GEX (Gamma Exposure):

Highest negative GEX at $230 = possible resistan

BA heads up into $230: Strong fib zone might cause a serious dipBA has been flying (lol) from its last crash caused crash.

About to test a signrificant resistance at $229.82-230.73

Expect at least some "orbits" or a pullback from this zone.

.

Previous analysis that caught THE BOTTOM:

==================================================

.

BOEING COMPANY STOCK ENTER INTO BULLISH TREND Boeing Company Stock Enters Bullish Trend on 1-Day Time Frame

The Boeing Company (BA) stock has entered a bullish trend on the 1-day timeframe, signaling potential upward momentum. A key development in this trend is the recent breakout above the critical resistance level of $189.00, which now acts

Boeing: Potential Pullback Ahead, But Long-Term Growth IntactCurrent Price: $215.92

Direction: LONG

Targets:

- T1 = $222.00

- T2 = $227.00

Stop Levels:

- S1 = $209.00

- S2 = $193.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ide

Boeing - Eyeing a recovery soon?NYSE:BA is back to the upside and has been trending upwards since early April 2025. Price action saw the stock is back into action after filling up the bearish breakaway gap. Now it is waiting to break the key resistance above 220.00 to further confirmed the upside.

Meanwhile, Ichimoku is showing

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US97023BS3

BOEING CO. 16/46Yield to maturity

7.63%

Maturity date

Jun 15, 2046

BA4602171

Boeing Company 3.625% 01-MAR-2048Yield to maturity

7.52%

Maturity date

Mar 1, 2048

US97023BV6

BOEING CO. 17/47Yield to maturity

7.49%

Maturity date

Mar 1, 2047

BCOC

BOEING CO. 15/45Yield to maturity

7.48%

Maturity date

Mar 1, 2045

BA4762315

Boeing Company 3.85% 01-NOV-2048Yield to maturity

7.17%

Maturity date

Nov 1, 2048

BA4798350

Boeing Company 3.825% 01-MAR-2059Yield to maturity

7.16%

Maturity date

Mar 1, 2059

BA4866210

Boeing Company 3.95% 01-AUG-2059Yield to maturity

7.11%

Maturity date

Aug 1, 2059

BA4866209

Boeing Company 3.75% 01-FEB-2050Yield to maturity

7.10%

Maturity date

Feb 1, 2050

BA4829131

Boeing Company 3.9% 01-MAY-2049Yield to maturity

7.06%

Maturity date

May 1, 2049

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.86%

Maturity date

May 1, 2064

BA4798349

Boeing Company 3.5% 01-MAR-2039Yield to maturity

6.54%

Maturity date

Mar 1, 2039

See all BA bonds

Curated watchlists where BA is featured.