GOOGL at a Make-or-Break Zone! Will 165 Hold or Fold? Jun 24🔍 Market Structure:

GOOGL has been in a clear downtrend, printing multiple BOS (Break of Structure) on the 15-min and 1H charts. However, today we’ve seen a CHoCH (Change of Character) after price bounced from the key 162 zone. This signals a potential short-term reversal or at least a relief rally.

Key facts today

Analyst Pierre Ferragu forecasts Alphabet's capital spending on AI infrastructure will soar to $1.7 trillion by 2035, up from $253 billion last year, impacting tech sector growth.

Waymo, Google's subsidiary, raised $5.6 billion last year, reaching a $45 billion valuation. Analysts now project its value could hit $150 billion, with 129% annual growth in bookings.

A UBS report highlights that the US antitrust lawsuit against Google's parent company, Alphabet, over payments to Apple is impacting Apple's interest in acquiring Perplexity AI.

155 ARS

91.68 T ARS

320.31 T ARS

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

ISIN

ARDEUT116159

FIGI

BBG000QND871

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

Googl Technical Analysis for Jun 18GOOGL Hanging by a Thread! Breakdown Below $174.50 Could Trigger a Drop to $171–170 Gamma Zone

🔬 GEX (Options Sentiment) Breakdown:

* Resistance (CALL Walls):

* $177.5 = 2nd CALL Wall

* $180.00 = Highest Positive NET GEX (Gamma Wall)

* $182.5+ = Outer GEX resistance cluster (low odds ne

Google MUST hold this critical level!NASDAQ:GOOG local analysis update

📈 𝙇𝙤𝙣𝙜 𝙩𝙚𝙧𝙢 Further decline below the daily 200EMA, High Volume Node (HVN) and pivot point which it closed below on Friday could see google price fall back below $140.

📉 𝙎𝙝𝙤𝙧𝙩 𝙩𝙚𝙧𝙢 the bullish run has ended with Fridays bearish engulfing, first support below the

GOOGL at a Turning Point! Gamma Levels. CALLs Might Be LoadingGEX Insight (Options Sentiment):

* GOOGL has strong positive GEX zones between 170–175, showing Gamma resistance walls from 2nd and 3rd CALL levels.

* Price is currently trading around 167, close to the highest positive NET GEX / Gamma Wall, meaning market makers are likely to defend this zone.

* Wi

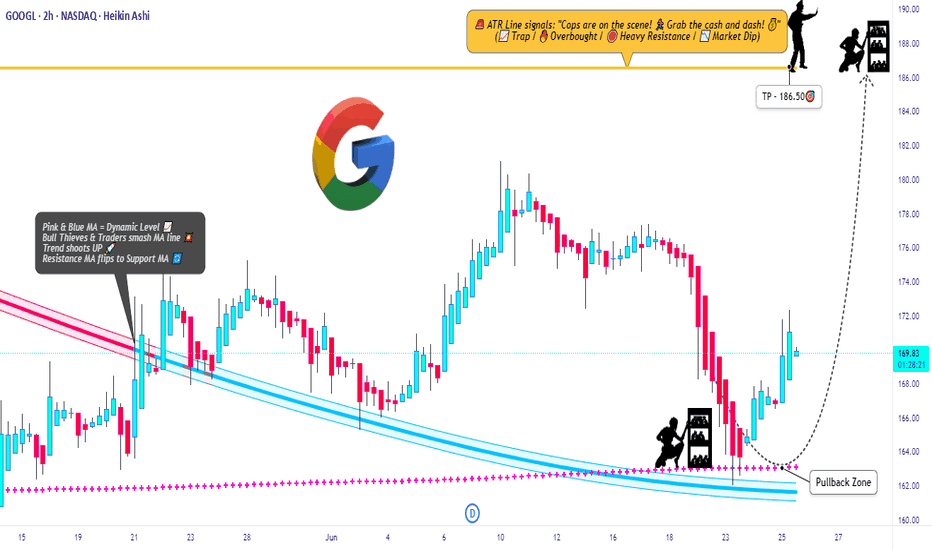

GOOGL Raid Plan: Bulls Set to Hijack the Chart!💎🚨**Operation GOOGL Grab: Robbery in Progress! Swing & Run!**🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Robbers, 🤑💰💸✈️

Get ready for another high-stakes market heist – this time, we’re raiding the vaults of GOOGL (Alphabet Inc.) using the Thief Trading Strategy™. Based

GOOGL – Short Trade Setup!📉

🔍 Pattern: Ascending triangle breakdown (fakeout reversal)

📍 Entry: ~$175.93 (breakdown candle below triangle support)

🎯 Targets:

1st Target: $174.17 (recent support)

2nd Target: $172.36 (major demand zone)

🛑 Stop-loss: $177.33 (above triangle resistance and key rejection zone)

✅ Why this set

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US2079KAF4

ALPHABET 20/50Yield to maturity

7.02%

Maturity date

Aug 15, 2050

US2079KAG2

ALPHABET 20/60Yield to maturity

6.96%

Maturity date

Aug 15, 2060

US2079KAE7

ALPHABET 20/40Yield to maturity

6.25%

Maturity date

Aug 15, 2040

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.56%

Maturity date

May 15, 2065

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.46%

Maturity date

May 15, 2055

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

4.80%

Maturity date

May 15, 2035

GOOG5025299

Alphabet Inc. 0.45% 15-AUG-2025Yield to maturity

4.62%

Maturity date

Aug 15, 2025

US2079KAD9

ALPHABET 20/30Yield to maturity

4.44%

Maturity date

Aug 15, 2030

US2079KAC1

ALPHABET 16/26Yield to maturity

4.15%

Maturity date

Aug 15, 2026

XS306443038

ALPHABET 25/54Yield to maturity

4.13%

Maturity date

May 6, 2054

US2079KAJ6

ALPHABET 20/27Yield to maturity

4.05%

Maturity date

Aug 15, 2027

See all GOOGL bonds

Curated watchlists where GOOGL is featured.