IBM Stock Forecast and Technical OutlookIBM Stock Forecast and Technical Outlook.

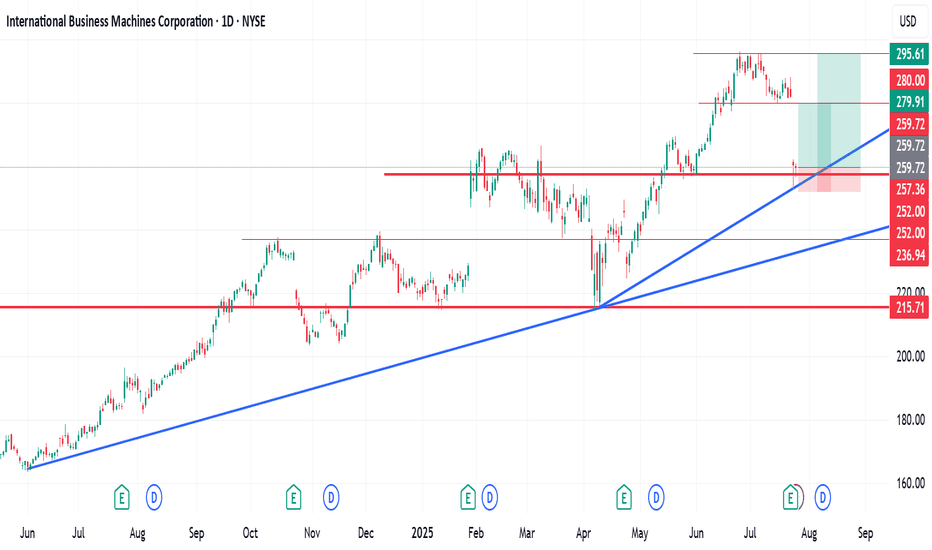

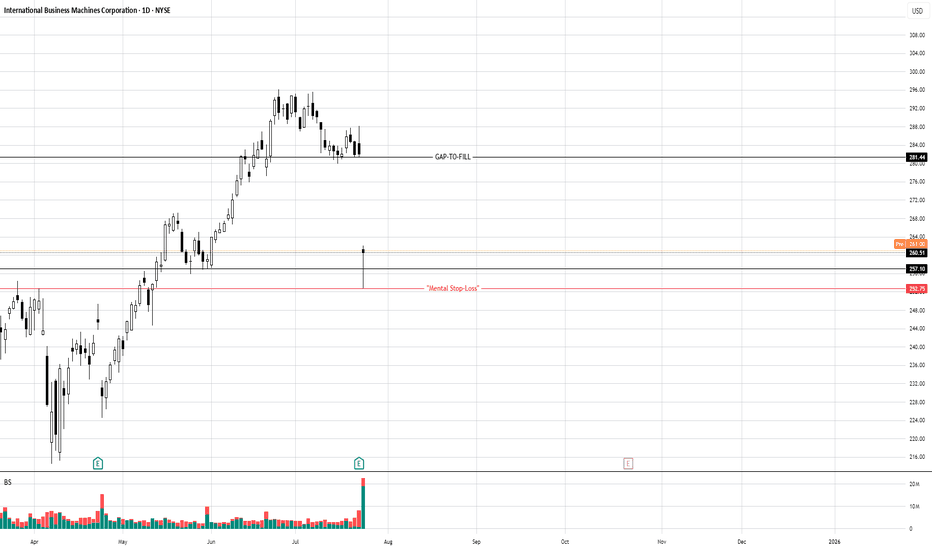

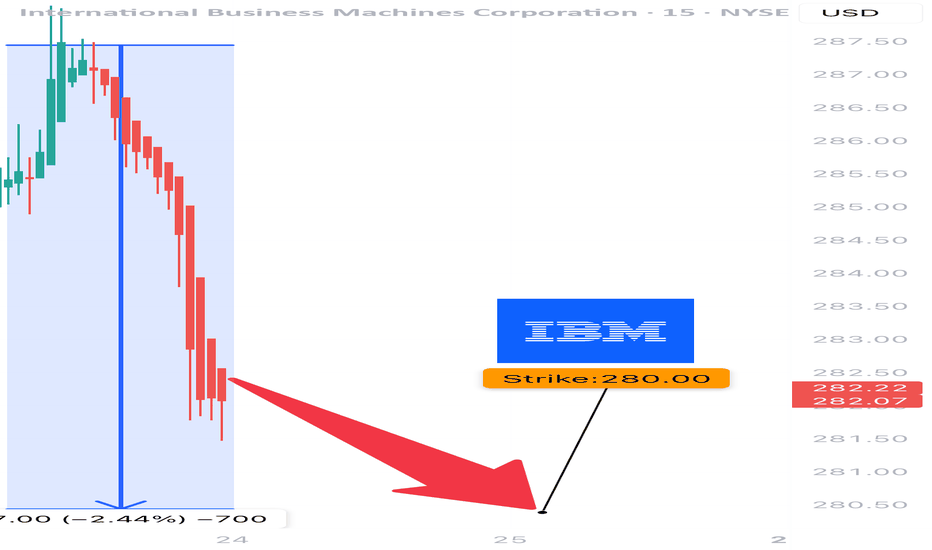

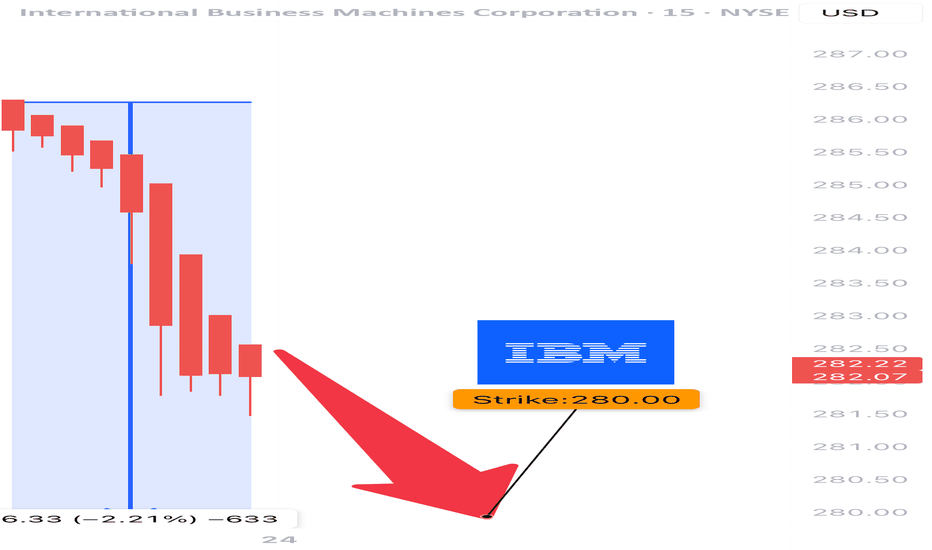

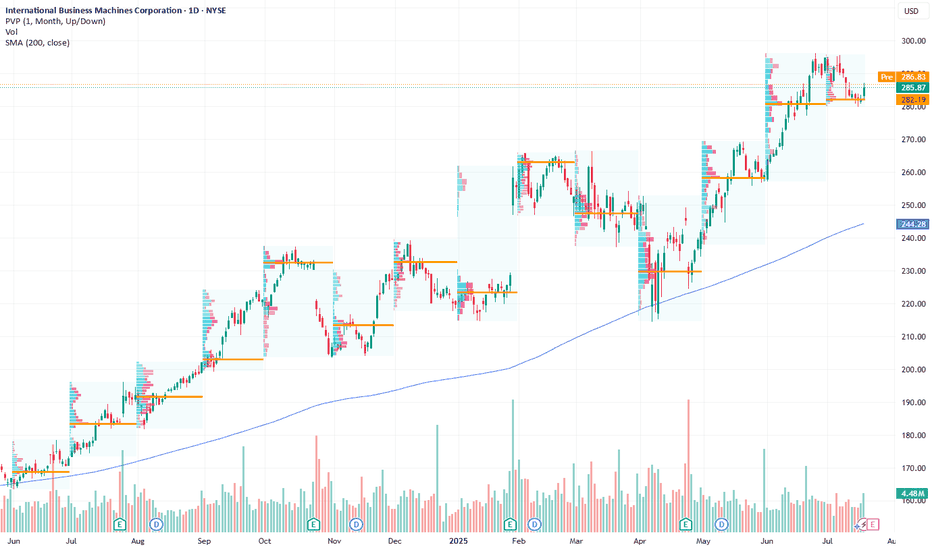

International Business Machines Corporation (IBM) reached a recent peak in June 2025 before experiencing a gradual decline. On July 24th, the stock saw a significant drop of over 10%, likely triggered by investor reaction to recent company news or broader m

0.35 USD

5.35 B USD

55.74 B USD

About International Business Machines Corporation

Sector

Industry

CEO

Arvind Krishna

Website

Headquarters

Armonk

Founded

1911

ISIN

ARDEUT110202

FIGI

BBG000FSY0C0

International Business Machines Corp. is an information technology company, which engages in the provision of integrated solutions that leverage information technology and knowledge of business processes. It operates through the following segments: Software, Consulting, Infrastructure, Financing, and Other. The Software segment combines hybrid cloud platform and software solutions to help clients become more data-driven, and to automate, secure, and modernize their environments. The Consulting segment focuses on integrating skills on strategy, experience, technology and operations by domain and industry. The Infrastructure segment offers solutions for hybrid cloud and is the foundation of the hybrid cloud stack. Infrastructure is optimized for infusing AI into mission-critical transactions and tightly integrated with IBM Software including Red Hat for accelerated hybrid cloud benefits. The Financing segment refers to the client and commercial financing, facilitating IBM clients’ acquisition of IT systems, software, and services. The company was founded by Charles Ranlett Flint and Thomas J. Watson Sr. on June 16, 1911 and is headquartered in Armonk, NY.

Related stocks

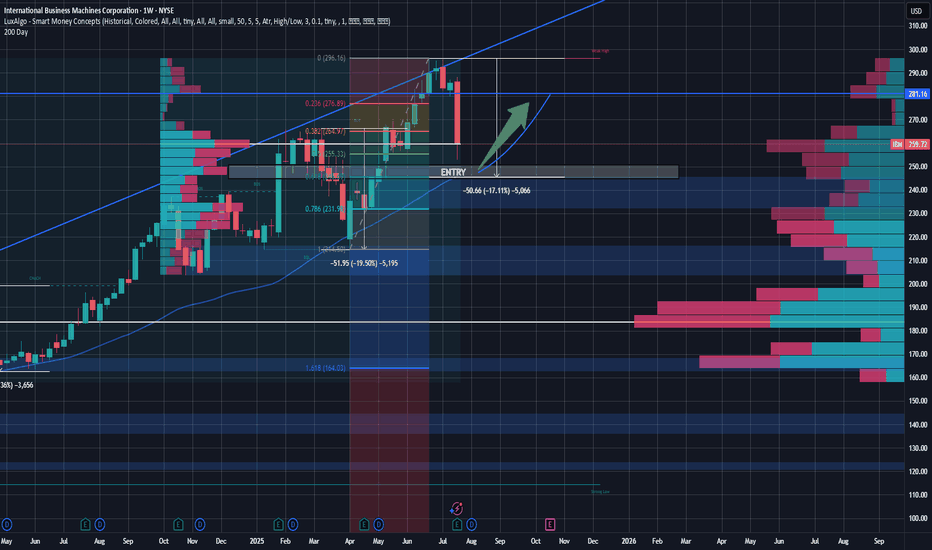

IBM Rebound Trade - Buying the Pullback at Key ConfluenceSetup:

IBM is setting up for a potential high-conviction long entry around the $245 level, a price zone marked by multiple layers of technical confluence and volume-based support. Over the last 18 months, IBM has seen two notable pullbacks—both in the 17–20% range, often around earnings events. The

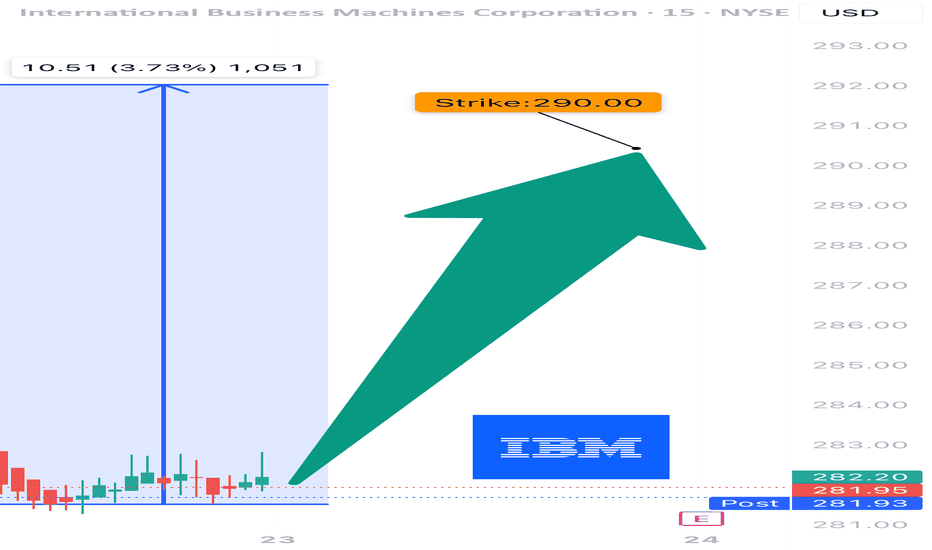

Looking like an immediate buy on IBM! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

IBM Earnings Trade Setup – JULY 22, 2025

📡 IBM Earnings Trade Setup – JULY 22, 2025

💼 IBM: Big Blue’s Rebound or Breakdown? Earnings Play Incoming

⸻

🔍 1. FUNDAMENTALS SNAPSHOT

📊 Revenue Growth: +0.5% YoY — flat in a fast-moving tech landscape

💰 Margins:

• Gross: 57.0%

• Operating: 12.4%

• Net: 8.7%

⚠️ Debt-to-Equity: 247.98 – Very h

IBM Earnings Analysis Summary (2025-07-23)

🧨 IBM Earnings Trade Idea 🧨

Earnings Date: July 24, 2025 (AMC)

🧠 Confidence: 70% Bearish | 🎯 Expected Move: ~5%

⸻

🔍 Snapshot Summary:

• 🐢 Revenue Growth: Flat at +0.5% YoY

• ⚠️ High Debt: D/E ratio at 247.98 — compression risk

• ✅ Beat History: 100% past 8 quarters, but…

• 🤔 Forward EPS Proj

IBM EARNINGS TRADE IDEA — BEARISH SETUP INTO EARNINGS

⚠️ IBM EARNINGS TRADE IDEA — BEARISH SETUP INTO EARNINGS ⚠️

📅 Report Date: July 25, 2025 (AMC)

🔎 Confidence Level: 70% Bearish Bias

🧠 Thesis: Fundamentals weak | Options market hedging | Price below key MA | Guidance risk elevated

⸻

🔍 Quick Breakdown:

• IBM is lagging in growth: TTM revenue up j

IBM's Cloud & Consulting Momentum Presents Bullish Setup Current Price: $285.87

Direction: LONG

Targets:

- T1 = $294.00

- T2 = $305.00

Stop Levels:

- S1 = $279.50

- S2 = $276.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to id

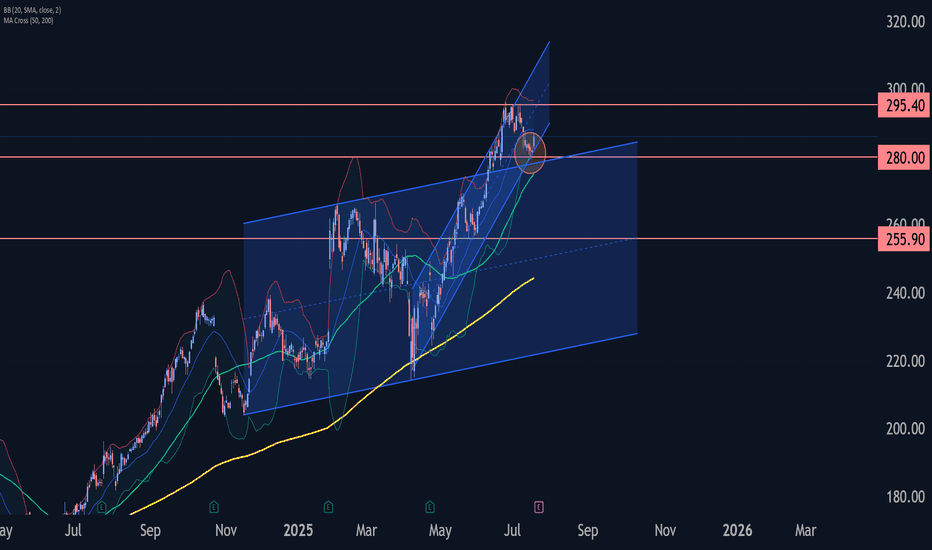

IBM Wave Analysis – 18 July 2025

- IBM reversed from support zone

- Likely to rise to resistance 295.40

IBM recently reversed up from the support zone between the support level 280.00, upper trendline of the recently broken weekly up channel from 2024 and the support trendline of the more recent up channel from April.

This suppo

IBM eyes on $282.88: Golden Genesis fib a Key Support to uptrendIBM has been in a strong uptrend but looking top-ish.

It has pulled back to a Golden Genesis fib at $282.88

Look for a bounce but perhaps after a couple orbits.

.

See "Related Publications" for previous charts like this BOTTOM CALL:

Hit the BOOST and FOLLOW for more such PRECISE and TIMELY chart

IBM: SHA-ttering ExpectationsAs we move through 2024, NYSE:IBM continues to demonstrate its strength as a technology powerhouse, particularly in cloud computing, AI, and cybersecurity. With a legacy rooted in innovation, IBM's deep history in encryption technologies and its forward-looking strategies make it a compelling buy

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

IBM4983326

International Business Machines Corporation 2.95% 15-MAY-2050Yield to maturity

7.08%

Maturity date

May 15, 2050

IBM5354862

International Business Machines Corporation 3.43% 09-FEB-2052Yield to maturity

6.80%

Maturity date

Feb 9, 2052

IBM.GX

International Business Machines Corporation 7.0% 30-OCT-2045Yield to maturity

6.03%

Maturity date

Oct 30, 2045

IBM5449458

International Business Machines Corporation 4.9% 27-JUL-2052Yield to maturity

6.01%

Maturity date

Jul 27, 2052

IBM5534365

International Business Machines Corporation 5.1% 06-FEB-2053Yield to maturity

5.95%

Maturity date

Feb 6, 2053

I

IBM5744047

IBM International Capital Pte. Ltd. 5.3% 05-FEB-2054Yield to maturity

5.94%

Maturity date

Feb 5, 2054

See all IBMD bonds

Curated watchlists where IBMD is featured.