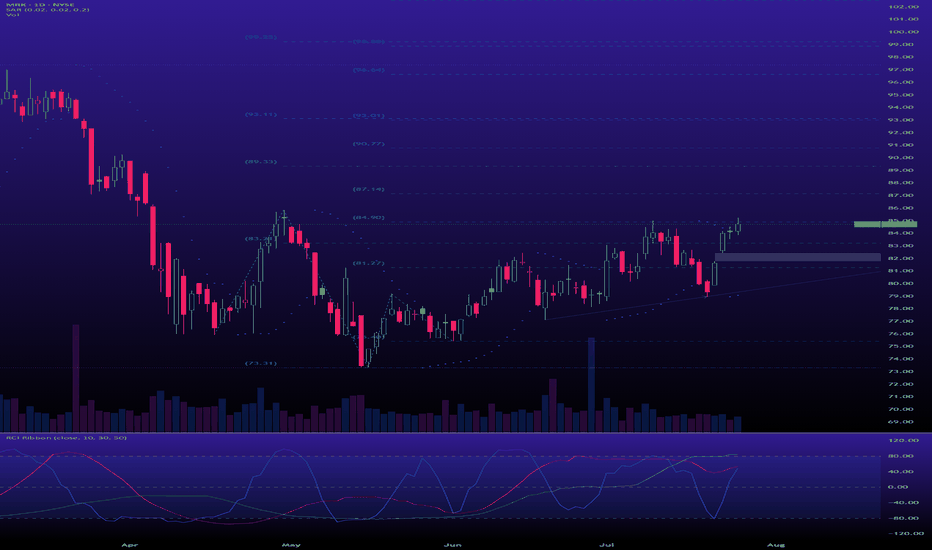

MRK potentially enters the Wyckoff accumulation phase this week.The weekly chart points strongly towards a stock emerging from a prolonged Markdown Phase and potentially entering Accumulation (Phase C), with signs of strength appearing.

Merck is basically yelling 'buy me' across all timeframes, so I'm jumping into a long call

15.20 B USD

56.82 B USD

About Merck & Company, Inc.

Sector

Industry

CEO

Robert M. Davis

Website

Headquarters

Rahway

Founded

1891

ISIN

ARDEUT110277

FIGI

BBG000FT0R36

Merck & Co., Inc. is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products. The Animal Health segment discovers, develops, manufactures, and markets animal health products, such as pharmaceutical and vaccine products, for the prevention, treatment and control of disease in livestock, and companion animal species. The Other segment consists of sales for the non-reportable segments of healthcare services. The company was founded in 1891 and is headquartered in Rahway, NJ.

Related stocks

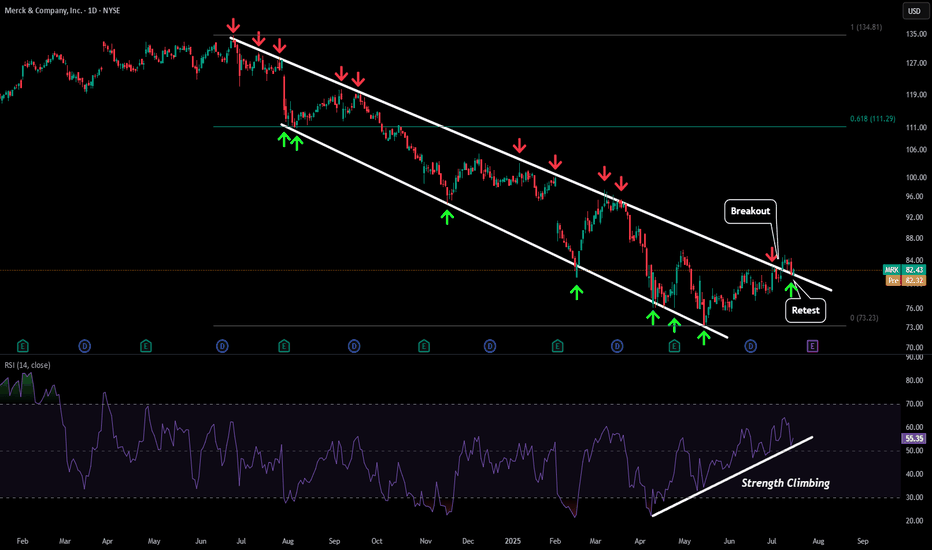

MRK - Retesting BreakoutAfter being in a downtrend for almost a year things finally look like they are starting to turn around for MRK.

Recently price broke the downwards sloping resistance and has retested that level as a new support level. We have also seen strength increasing on our daily RSI bringing some life back i

MRK Wave Analysis – 14 July 2025- MRK reversed from the support zone

- Likely to rise to resistance level 85.00

MRK recently reversed up from the support zone surrounding the long-term support level 73.45 (which has been reversing the price from the start of 2020, as can be seen from the weekly MRK chart below).

The upward rever

MRK Buying Opportunity!MRK is currently undervalued. The stock price dropped approximately 45% from June 25th of last year to May 15th of this year. At present, the price has bounced off a long-term weekly trendline that has been respected since 2009, indicating a strong rejection zone.

Additionally, on the daily timefra

AAA - Setup from the bottomInverse head and shoulders pattern on the daily timeframe and if you were to break it down further to 12hr it should be also clear.

Monthly rsi sharply bounced back below an RSI of 30, weekly rsi has been below 30 rsi for multile touches

rsi line and rsi moving average crossover indicating change i

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MRK5002693

Merck & Co., Inc. 2.45% 24-JUN-2050Yield to maturity

7.12%

Maturity date

Jun 24, 2050

MRK5319197

Merck & Co., Inc. 2.9% 10-DEC-2061Yield to maturity

7.07%

Maturity date

Dec 10, 2061

US58933YBF1

MERCK & CO. 21/51Yield to maturity

6.95%

Maturity date

Dec 10, 2051

US58933YBA2

MERCK & CO. 20/40Yield to maturity

6.38%

Maturity date

Jun 24, 2040

MRK3900816

Merck & Co., Inc. 3.6% 15-SEP-2042Yield to maturity

6.20%

Maturity date

Sep 15, 2042

US58933YAT2

MERCK CO. 2045Yield to maturity

6.16%

Maturity date

Feb 10, 2045

MRK4806294

Merck & Co., Inc. 4.0% 07-MAR-2049Yield to maturity

6.12%

Maturity date

Mar 7, 2049

US58933YAJ4

MERCK CO. 13/43Yield to maturity

5.95%

Maturity date

May 18, 2043

MRK5584756

Merck & Co., Inc. 5.15% 17-MAY-2063Yield to maturity

5.84%

Maturity date

May 17, 2063

MRK5584755

Merck & Co., Inc. 5.0% 17-MAY-2053Yield to maturity

5.83%

Maturity date

May 17, 2053

MRK.GF

Merck & Co., Inc. 5.76% 03-MAY-2037Yield to maturity

5.70%

Maturity date

May 3, 2037

See all MRKD bonds