2,150 ARS

3.09 T ARS

10.47 T ARS

About Southern Copper Corporation

Sector

Industry

CEO

Oscar González Rocha

Website

Headquarters

Phoenix

Founded

1952

ISIN

ARDEUT116084

FIGI

BBG000GNS3T3

Southern Copper Corp. engages in the development, production, and exploration of copper, molybdenum, zinc, and silver. It operates through the following segments: Peruvian Operations, Mexican Open-Pit Operations, and Mexican Underground Mining Operations. The Peruvian Operations segment focuses on the Toquepala and Cuajone mine complexes and the smelting and refining plants, industrial railroad, and port facilities that service both mines. The Mexican Open-Pit Operations segment comprises the La Caridad and Buenavista mine complexes, the smelting, and refining plants and support facilities, which service both mines. The Mexican Underground Mining Operations segment is involved in the operation of five underground mines, a coal mine, and several industrial processing facilities. The company was founded on December 12, 1952 and is headquartered in Phoenix, AZ.

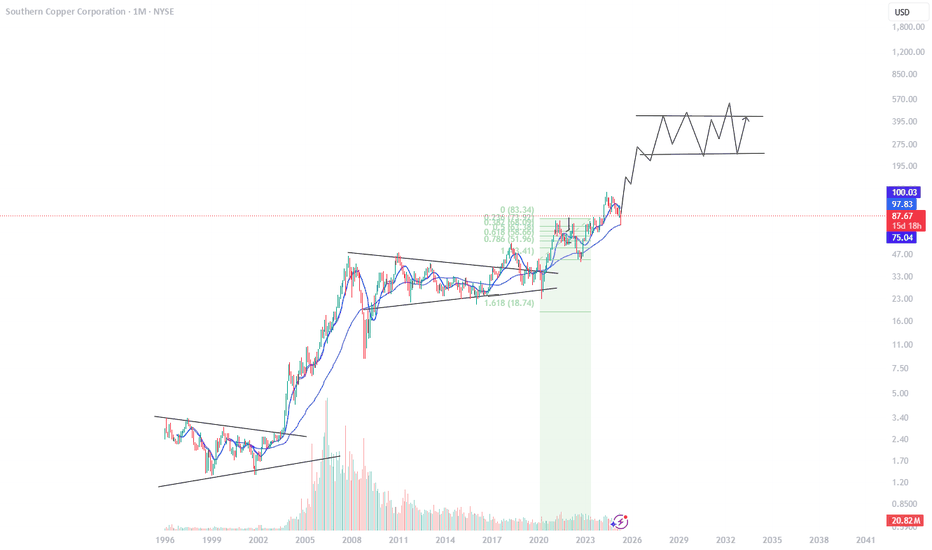

SCCO watch $87.05 above 83.65 below: Key fibs to determine trendSCCO may have bottomed but not yet flying.

Currently fighting Genesis fib above at $87.05

Likely dips need to hold Golden Covid at $83.65

Of course we have the Copper > Econ > China thing,

No way to know effects but the fibs say "look here".

=============================================

Copper Equities Breaking Down, Is tthe economy?Copper is very close to losing criyical support.

If this daily chart trendline breaks, there is a big move down into the next support.

Copper Equity stocks are already teing us aa likely breakdown in the commodity is coming.

Is this base metal signaling weaker economic demand & growth?

SCCO bulls struggle at current highs.SOUTHERN COPPER CORPORATION - 30d expiry - We look to Sell at 77.48 (stop at 81.21)

We are trading at overbought extremes.

Posted a Double Top formation.

Bespoke resistance is located at 78.70.

Resistance could prove difficult to breakdown.

Early optimism is likely to lead to gains although ex

Southern Copper top?Southern Copper Corporation has been on a tear the past 2 weeks since the China reopening news. Eventually within another week or so, copper will hit its top resistance level. Here's a SCCO 1 week chart and HG1! comparison using my TTCATR(beta) indicator set to 9 with my commodity channel index comp

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

M

MNRMF4887148

Minera Mexico, S.A. de C.V. 4.5% 26-JAN-2050Yield to maturity

6.85%

Maturity date

Jan 26, 2050

M

MNRMF5999370

Minera Mexico, S.A. de C.V. 5.625% 12-FEB-2032Yield to maturity

5.42%

Maturity date

Feb 12, 2032

G

GMBX3686196

Grupo Minero Mexico SA de CV 9.25% 01-APR-2028Yield to maturity

5.15%

Maturity date

Apr 1, 2028

M

MNRMF5999369

Minera Mexico, S.A. de C.V. 5.625% 12-FEB-2032Yield to maturity

—

Maturity date

Feb 12, 2032

See all SCCO bonds

Curated watchlists where SCCO is featured.